A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

North Carolina Condominium Withholding

Description

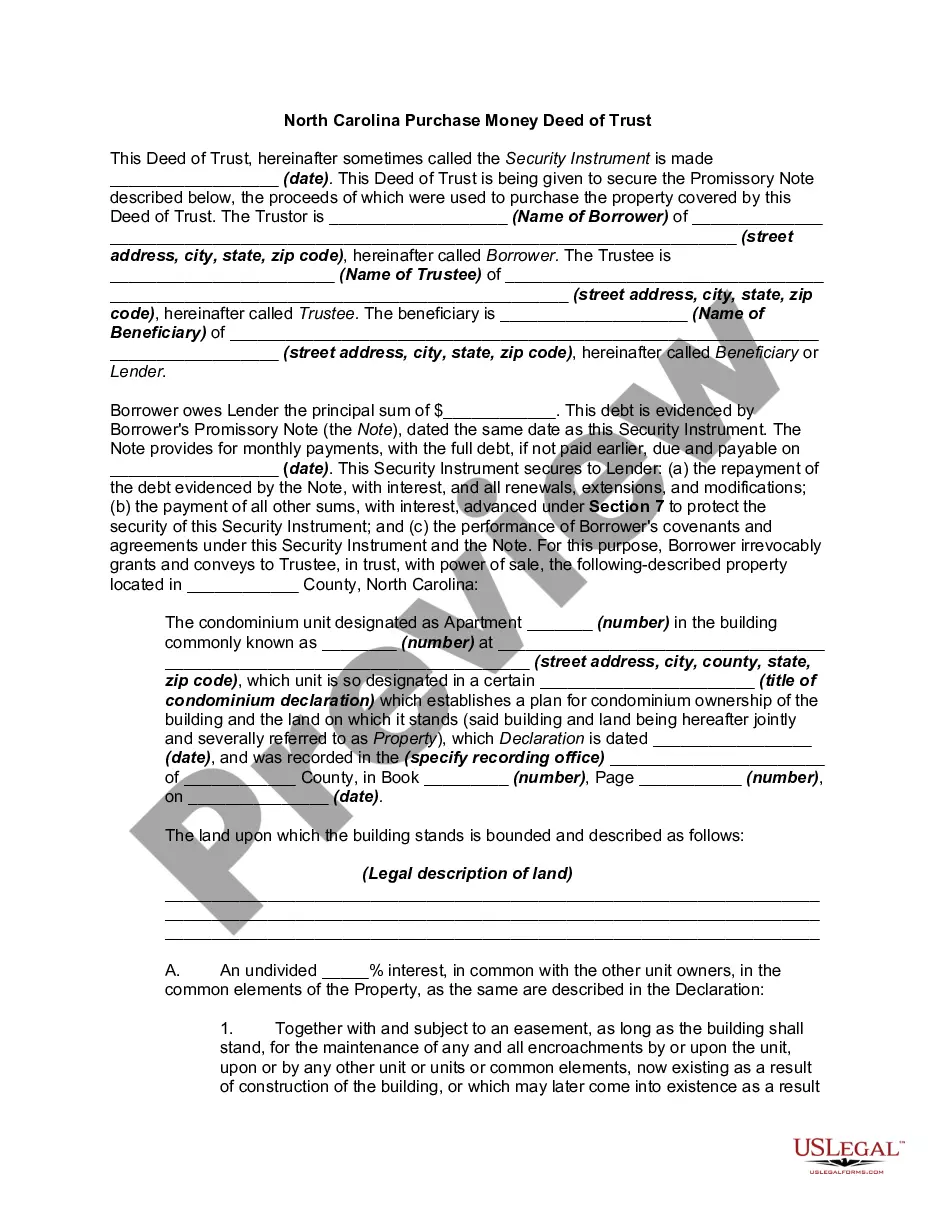

How to fill out North Carolina Purchase Money Deed Of Trust - Condominium?

How to locate professional legal documents that adhere to your state regulations and prepare the North Carolina Condominium Withholding without consulting a lawyer? Numerous online services provide templates to address various legal scenarios and formalities.

However, it may require time to identify which of the accessible examples meet both your use case and legal prerequisites. US Legal Forms is a reliable platform that assists you in finding formal documents crafted in accordance with the latest state law updates and economizing on legal services.

US Legal Forms is not just a typical internet library. It comprises over 85,000 verified templates for diverse business and personal situations. All documents are categorized by sector and state to enhance your search efficiency and convenience. It also integrates with robust solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly finalize their documentation online.

Select the most appropriate pricing plan, then Log In or register for an account. Choose the payment method (by credit card or via PayPal). Select the file format for your North Carolina Condominium Withholding and click Download. The acquired documents remain yours: you can always revisit them in the My documents section of your profile. Subscribe to our platform and create legal documents independently like a seasoned legal professional!

- It requires minimal time and effort to obtain the necessary documentation.

- If you already possess an account, Log In and ensure your subscription is active.

- Download the North Carolina Condominium Withholding using the appropriate button adjacent to the file name.

- If you do not have an account with US Legal Forms, proceed with the instructions below.

- Browse the webpage you've opened and verify that the form meets your requirements.

- To do this, utilize the form description and preview options if available.

- Search for another template in the header indicating your state if necessary.

- Click the Buy Now button once you find the correct document.

Form popularity

FAQ

HOA bylaws refer to the official governing documents that outline how the association operates, whereas rules are specific guidelines that residents must follow. Bylaws are typically more formal and require a membership vote to change, while rules can often be modified by the board. Both play a critical role in managing North Carolina condominium withholding by maintaining community standards and ensuring compliance.

Condo documents are a broad category that includes various legal papers like declarations, amendments, and rules, while bylaws specifically detail how the condo association is governed. Bylaws cover issues such as meetings, voting rights, and member responsibilities. Clear distinctions are crucial for understanding responsibilities related to North Carolina condominium withholding.

The North Carolina Planned Community Act governs townhouse projects with more than 20 units established on or after January 1, 1999. This law outlines the management and operational protocols for such communities. Understanding this act can be beneficial for residents who want to navigate North Carolina condominium withholding effectively.

You can find condominium bylaws in several places, such as the deed recorded in the county clerk’s office or directly from the condo association. Often, condo associations provide copies of their bylaws to current and prospective owners. For clarity on North Carolina condominium withholding, reviewing these documents is advisable to ensure you understand your rights and obligations.

The Uniform Condominium Act of 1980 is a legislative framework that governs the formation and operation of condominiums in various states, including North Carolina. This act provides guidelines for issues such as ownership, management, and common areas. Understanding how this act affects North Carolina condominium withholding is crucial for new buyers and existing owners.

Yes, condominiums are required to have bylaws. These bylaws serve as the foundation for the governance of the condo community, detailing the rights and responsibilities of unit owners. Familiarizing yourself with bylaws helps ensure compliance with North Carolina condominium withholding regulations.

The bylaws of a condominium outline the rules and regulations that govern the property. These bylaws manage the day-to-day operations of the condo association, including how meetings are held and how decisions are made. In North Carolina, understanding condominium withholding is essential, as these laws impact legal compliance and ownership responsibilities.

The percentage you should hold back for taxes reflects your estimated annual tax liability. For North Carolina condominium withholding, it’s advisable to hold back enough to cover federal and state taxes based on your income level. Keeping your withholding in check can prevent unexpected tax bills when you file and provide peace of mind about your financial planning.

The percentage of your paycheck withheld for taxes can depend on several factors including your overall income and deductions. In the context of North Carolina condominium withholding, it's essential to consider both federal and state tax rates. Regularly reviewing your paycheck can help you ensure appropriate withholding levels throughout the year.

For North Carolina state taxes, the withholding percentage typically aligns with the state tax rate, which may vary depending on your income bracket. Considering North Carolina condominium withholding, this percentage is essential for ensuring you meet your tax obligations. A general rule is to utilize the state’s withholding tables to accurately determine the correct amount.