Trust Deeeds

Description

How to fill out North Carolina Warranty Deed - Seven Individuals To A Trust?

- Log in to your account if you are a returning user. Make sure your subscription is active to access your documents.

- If you're new to the service, begin by browsing the Preview mode and read the form description thoroughly to ensure it meets your local jurisdiction requirements.

- If adjustments are needed, utilize the Search tab to find the correct template that aligns with your needs.

- Once you’ve found the suitable document, click on the Buy Now button and select your preferred subscription plan, ensuring you register for an account.

- Complete your purchase by providing your payment details, whether through credit card or PayPal.

- Download your selected form and save it on your device. You can find it anytime in the My Forms section of your profile.

Utilizing US Legal Forms not only saves you time but also empowers you with a comprehensive collection of legal resources. Trust deeeds to provide you with the precision and ease needed to handle your legal documentation.

Start your hassle-free legal journey today and empower yourself with the tools to succeed. Visit US Legal Forms now!

Form popularity

FAQ

Yes, you can set up a trust without an attorney in Arizona, as the state allows individuals to create their own trust documents. However, it's important to understand the legal requirements involved. Utilizing services like US Legal Forms can provide valuable tools and templates, making the process more manageable and ensuring that you establish a compliant trust.

You can write your own trust deed, but crafting a legally binding document requires precision in wording and adherence to local laws. It’s essential to ensure that the deed accurately reflects your intentions and complies with state regulations. Platforms like US Legal Forms offer valuable templates that simplify the process and help you avoid common pitfalls.

Whether you need to declare a trust deed depends on your state laws and the type of trust you establish. In many cases, formal declarations are not required, but keeping accurate records is crucial. If you're unsure about the requirements, resources from US Legal Forms can provide the necessary forms and guidance to navigate your obligations.

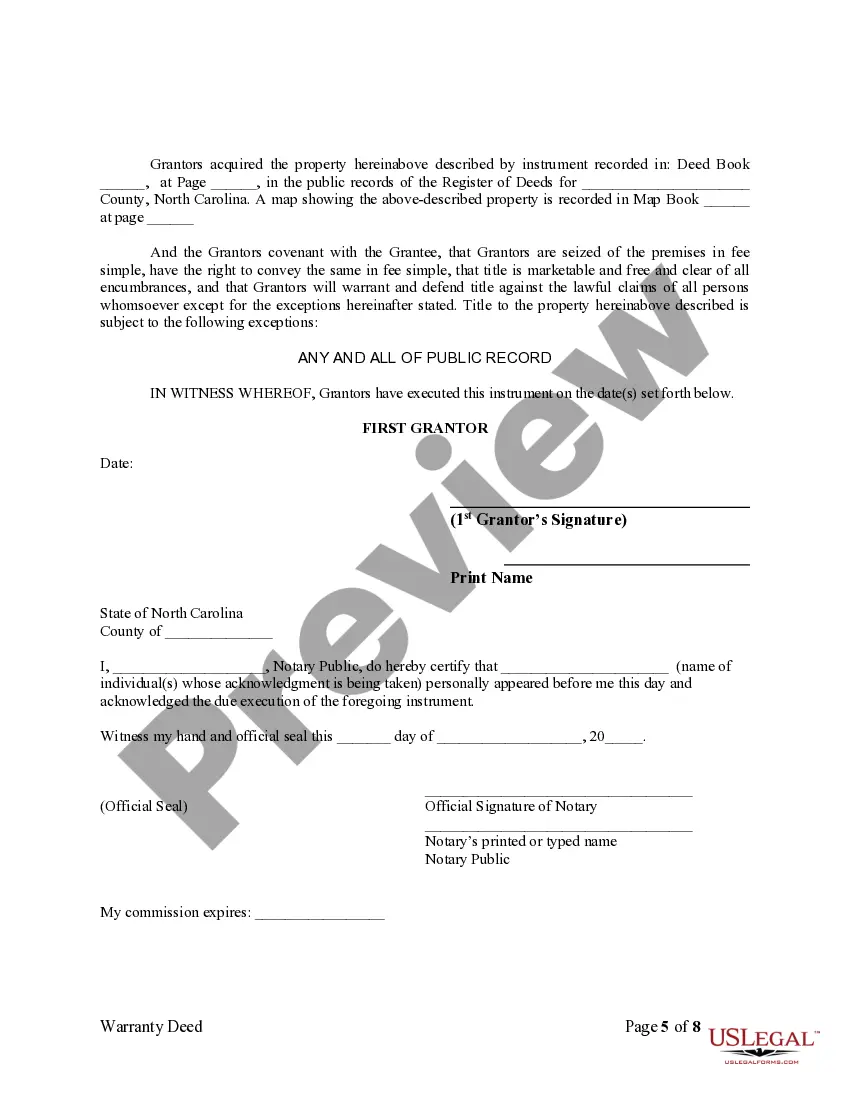

Writing a trust deed involves drafting a document that describes the trust's purpose, the trust property, and the responsibilities of the trustees. Clarity in the language is essential, and you should include details about the beneficiaries and the distribution of assets. For a seamless experience, consider using templates from US Legal Forms to guide you in creating a legally sound trust deed.

Yes, you can create your own certificate of trust, but it is vital to follow your state's guidelines. This document serves as evidence of the trust without disclosing detailed terms. Utilizing resources from US Legal Forms can aid you in creating a valid certificate, ensuring you cover all necessary legal aspects effectively.

A trust document becomes legal when it meets specific requirements set by state law. Typically, it must be in writing and signed by the creator, known as the grantor. Additionally, it should clearly outline the terms of the trust, trustees, and beneficiaries. Understanding these legal nuances is essential, and using platforms like US Legal Forms can help ensure your trust document is compliant.

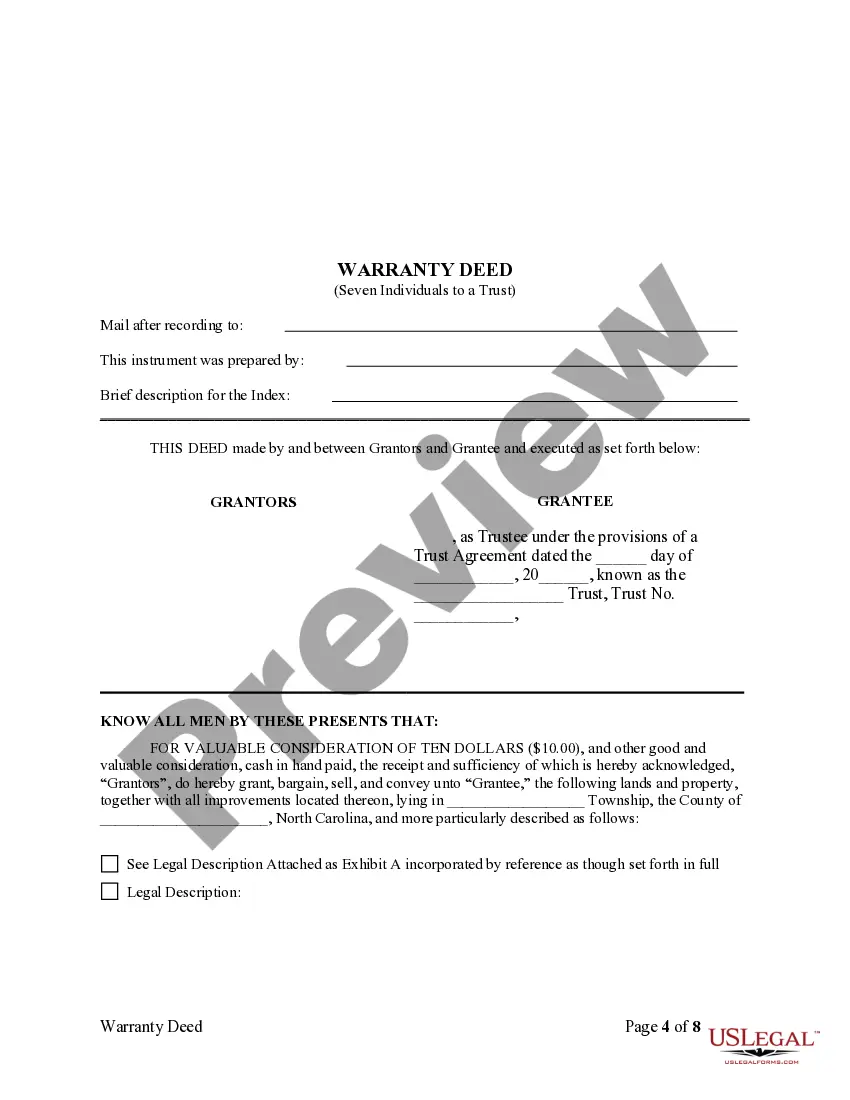

A trust deed is a foundational document in the world of trusts that defines how property and assets are to be held and managed. It creates a fiduciary relationship between the trustee and the beneficiaries, ensuring that assets are managed properly. By offering a structured approach to asset management, trust deeds provide peace of mind and clarity for those involved.

The primary purpose of a trust deed is to manage the distribution of assets according to the wishes of the trust creator. It also serves to protect assets from creditors and ensure they are used for specific purposes, such as education or healthcare. Trust deeds can effectively safeguard the interests of beneficiaries while providing clear guidelines for the trustee.

A common example of a trust deed is a family trust, where parents create a trust to manage assets for their children. In this scenario, the trust deed specifies how assets like property or investments should be distributed to the children upon certain events, such as reaching a specific age. This example illustrates how trust deeds are used to plan for future asset distributions and protect beneficiaries.

While trust deeds can be beneficial, they also come with potential drawbacks. One disadvantage is that they can limit the flexibility of asset management, meaning changes to the trust may require legal intervention. Additionally, the costs of setting up and maintaining a trust deed can be significant, especially if professional services are involved.