Limited Company Llc For Your Business

Description

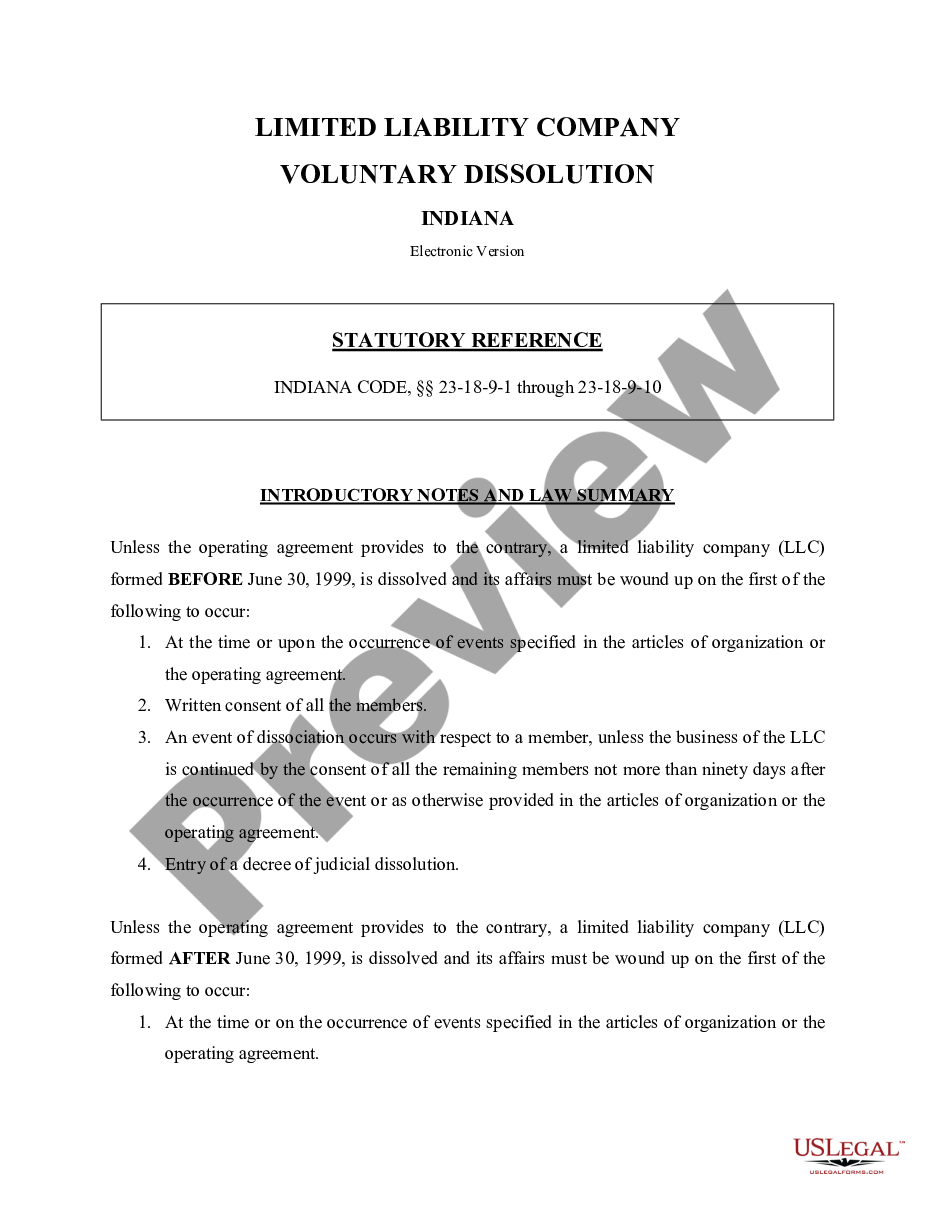

How to fill out North Carolina Limited Liability Company LLC Operating Agreement?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; consider renewing it if necessary.

- For new users, explore the preview mode to review the form descriptions. Confirm that you select the correct document matching your business needs and local regulations.

- If you don't find the right form, utilize the Search feature at the top to locate a suitable template.

- Once you’ve found your form, click 'Buy Now' and select your desired subscription plan, creating an account if needed.

- Proceed to checkout by entering your payment details, whether using credit or a PayPal account.

- Finally, download your form to your device, which will also be available anytime in your 'My Forms' section.

US Legal Forms offers a vast library with over 85,000 customizable legal documents, making it the optimal choice for your business needs.

Start your journey to a secure business structure today. Explore US Legal Forms to ensure you have everything you need to establish your limited company LLC!

Form popularity

FAQ

An LLC should be written as either 'LLC' or 'Limited Liability Company,' depending on your preference, for a Limited Company LLC for your business. The key is to include the designation clearly and consistently on all official documents. Accurate representation ensures legal compliance and enhances professionalism. Resources like uslegalforms can support you in maintaining the correct format throughout your documentation.

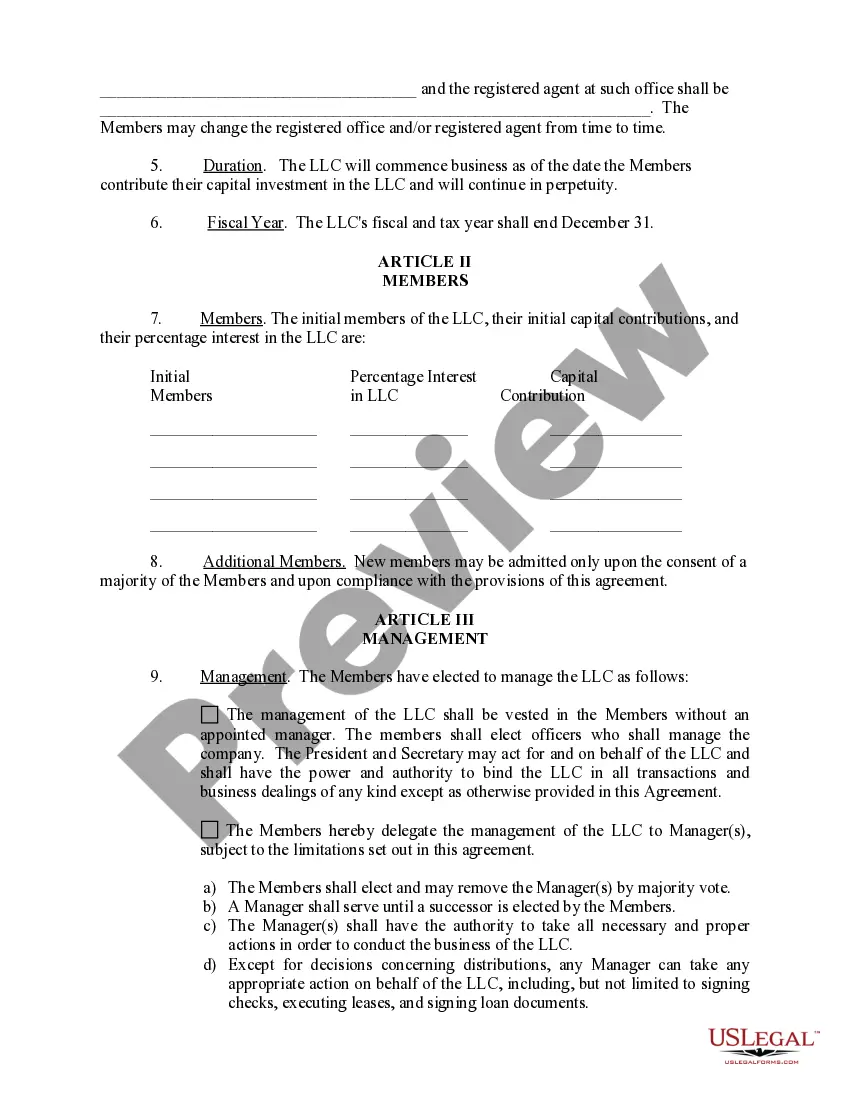

The best structure for a Limited Company LLC for your business often depends on your specific needs and goals. Generally, a single-member LLC offers simplicity, while a multi-member LLC allows for shared ownership and responsibilities. It’s beneficial to consider factors like taxation and management when deciding on the structure. Consulting with professionals or resources from uslegalforms can offer you valuable insights.

Yes, you can file your Limited Company LLC for your business by yourself, which is often referred to as filing 'pro se.' However, ensure that you understand your state's specific requirements and forms needed for filing. If you feel overwhelmed, using a service like uslegalforms can ease the burden and guide you through the necessary steps.

Filing for a Limited Company LLC for your business involves several steps. You need to write and submit Articles of Organization to your state’s Secretary of State office. Additionally, you may need to create an operating agreement that outlines the management structure. Uslegalforms provides templates and resources to help you navigate this process effectively.

The proper format for a Limited Company LLC for your business typically includes the designation 'LLC' or 'Limited Liability Company' in its official name. This clears any confusion regarding the structure and limited liability protection. Always ensure that your business name complies with the state's requirements before filing. For a detailed guide, visit uslegalforms.

If you fail to file taxes for your Limited Company LLC for your business, you may face penalties and interest on unpaid taxes. The IRS could also revoke your LLC's status, which may expose your personal assets to business debts. To avoid these complications, it is crucial to stay informed about your tax responsibilities. US Legal Forms can help you navigate your filing obligations and keep your LLC in good standing.

Yes, you can establish a Limited Company LLC for your business and choose not to engage in any activities. However, it is important to remember that LLCs still must comply with state regulations, including filing annual reports. Keeping your LLC active, even with minimal or no business activity, can protect your personal assets from business liabilities. Consider using US Legal Forms to ensure you meet all necessary requirements for maintaining your LLC.

Yes, you can file your Limited Company LLC for your business separately if you choose to be taxed as a corporation. This option can be beneficial in certain circumstances, as it allows for different tax treatment compared to sole proprietorships. However, this choice requires careful consideration and planning. US Legal Forms can provide resources and guidance to help you determine the best option for your LLC.

As a single owner Limited Company LLC for your business, you typically file taxes using IRS Form 1040 along with Schedule C. This form allows you to report your business income and expenses directly on your personal tax return. It's essential to keep accurate records of your earnings and deductions to ensure compliance with tax regulations. By using a service like US Legal Forms, you can simplify the process of understanding your tax obligations.

Establishing a Limited company LLC for your business can provide significant advantages, such as personal liability protection and tax flexibility. Additionally, an LLC structure can enhance your business’s credibility with customers and partners. If you are serious about protecting your assets and streamlining your operations, forming an LLC might be a wise choice for your small business.