North Carolina Corporation With 501c

Description

How to fill out North Carolina Business Incorporation Package To Incorporate Corporation?

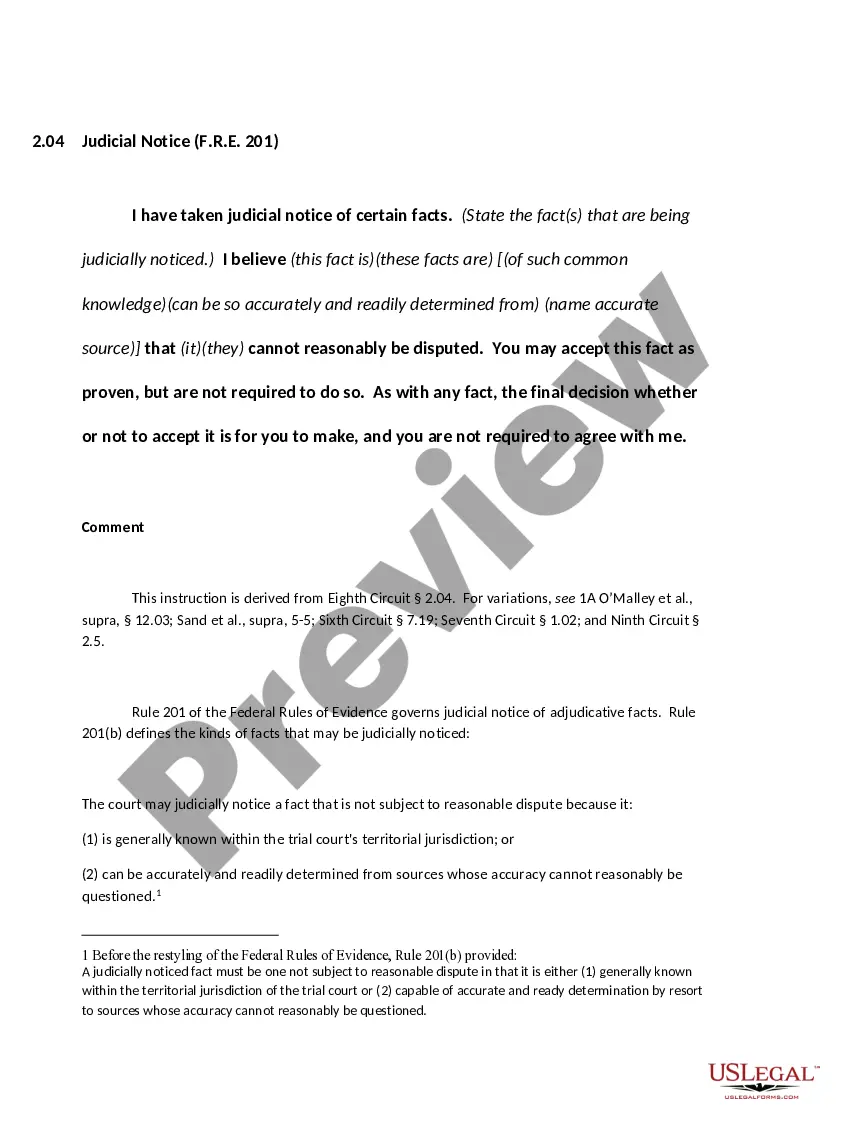

The North Carolina Corporation With 501c displayed on this page is a reusable legal framework crafted by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most reliable way to acquire the documents you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Register for US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now when you've found the template you need.

- Choose and Log In to your account.

- Select the pricing plan that fits your needs and register for an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

- Select the format you desire for your North Carolina Corporation With 501c (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the documentation.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a legally-binding electronic signature.

- Download your documents again.

- Use the same file again whenever necessary. Open the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

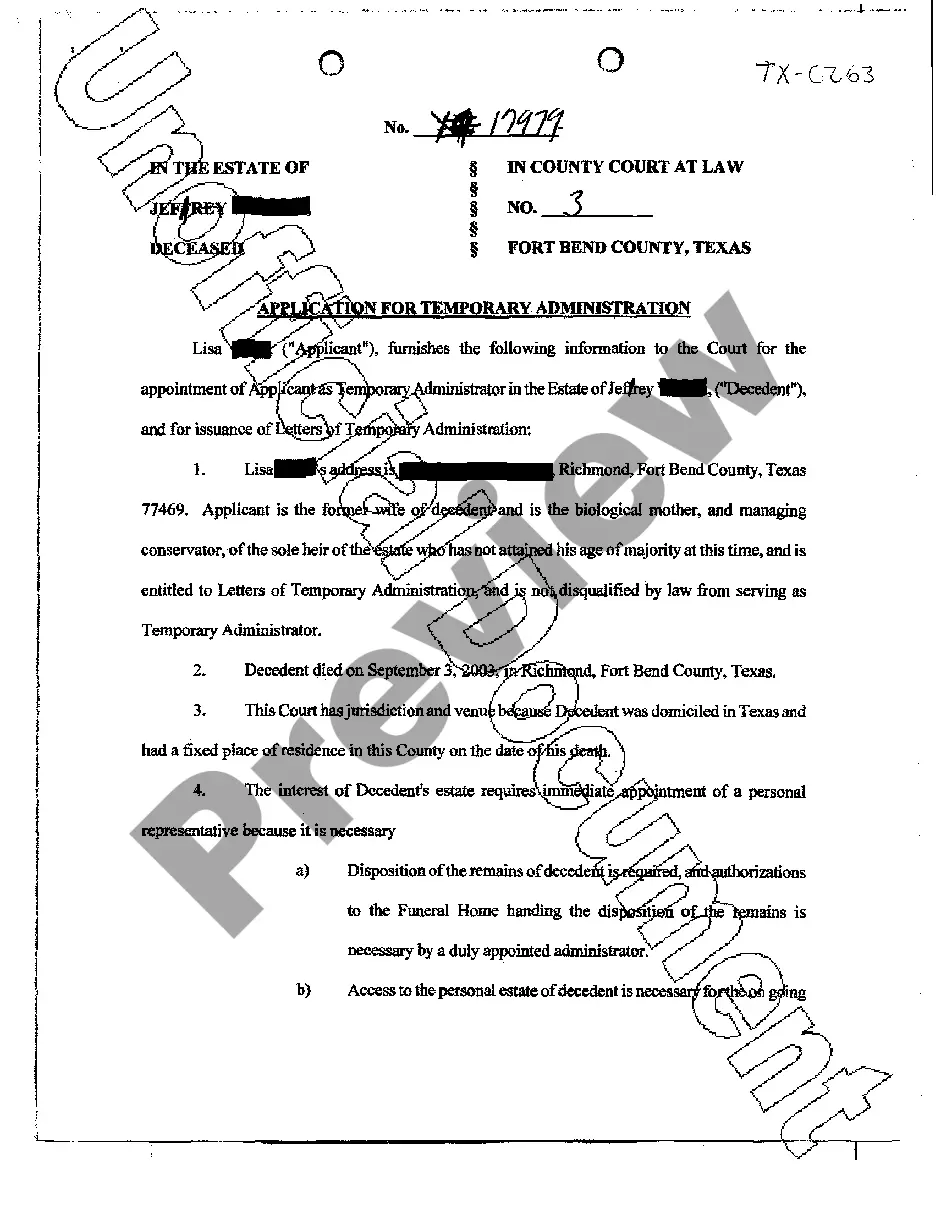

Costs of starting a new nonprofit in North Carolina Certificate of Incorporation: $60 + optional $100-200 expedite fee. Application for federal tax exemption or 501(c) tax-exempt status: $275 or $600 IRS fee.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the United States.

Nonprofit corporations are regulated under Section 501(c) of the Internal Revenue Code. Unlike C corporations, the purpose of nonprofit corporations is not to make profits for the owners. Instead, nonprofits are formed for charitable, literary, scientific, religious, and other activities.

Under North Carolina law, organizations that meet the requirements of Section 501(c)(3) are also exempt from paying state corporate income tax.

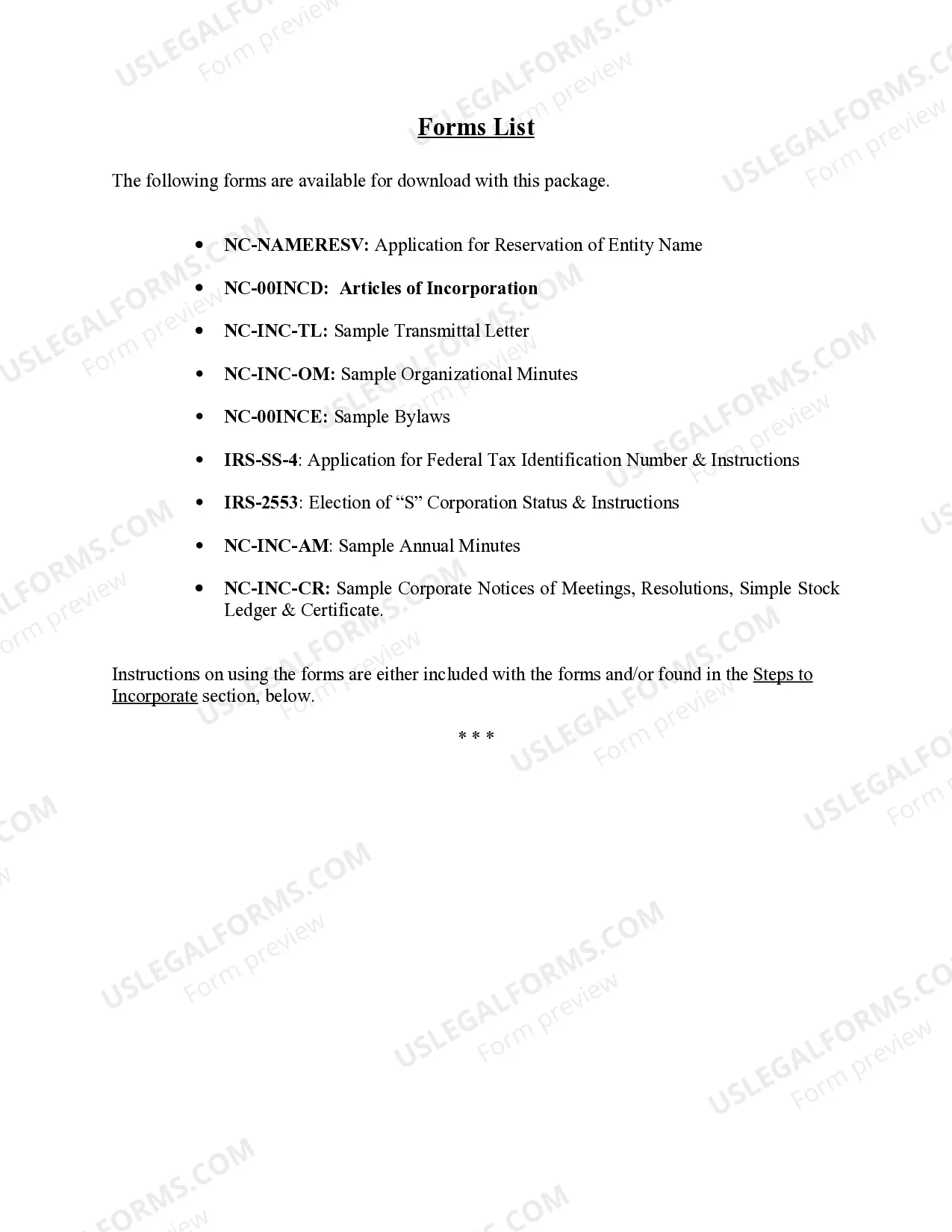

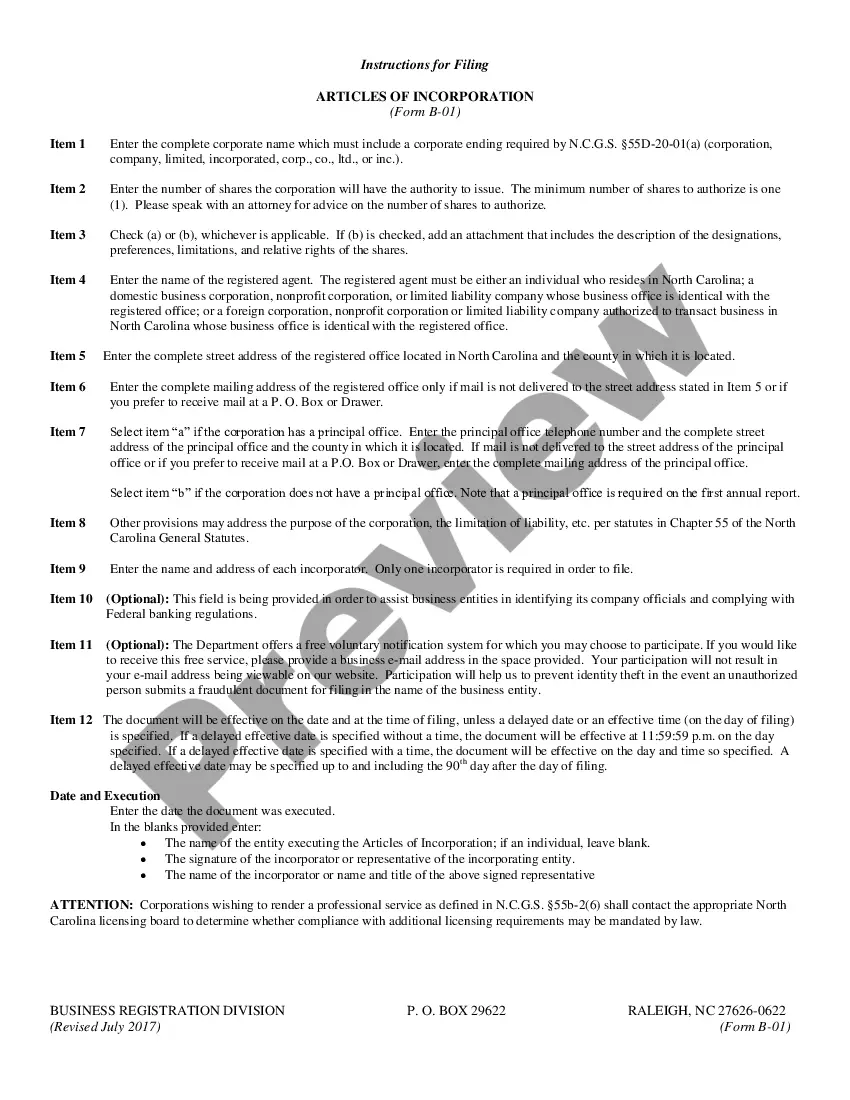

Name Your Organization. ... Name Incorporators and Directors. ... Appoint a Registered Agent. ... File North Carolina Articles of Incorporation. ... Apply for an Employer Identification Number (EIN) ... Hold Organization Meeting and Establish Nonprofit Bylaws. ... Apply for Federal and NC State Tax Exemptions.