North Carolina Deed Of Trust Requirements

Description

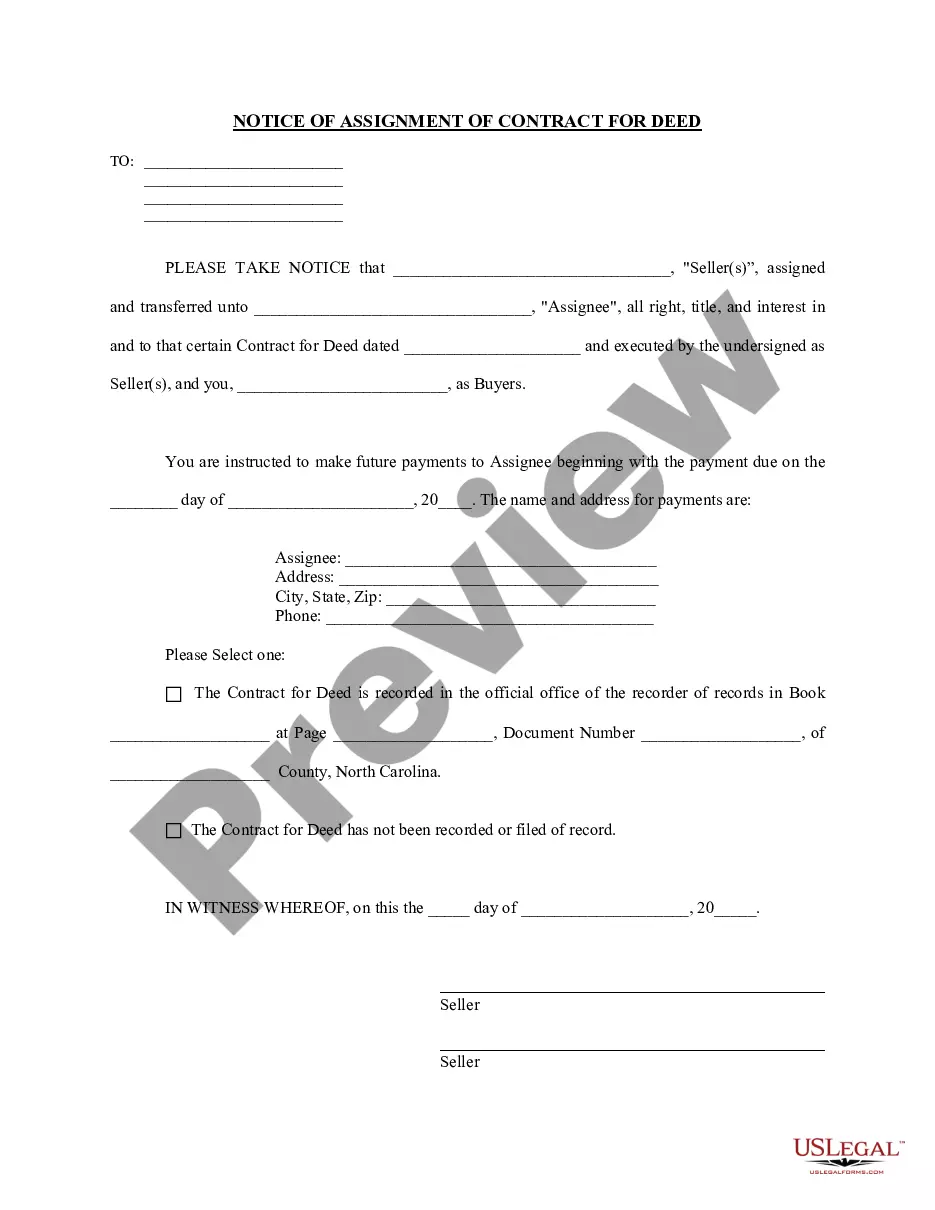

How to fill out North Carolina Notice Of Assignment Of Contract For Deed?

Finding a reliable location to obtain the most up-to-date and pertinent legal samples is a significant part of dealing with bureaucracy. Selecting the appropriate legal documents requires precision and careful consideration, which is why it is crucial to obtain samples of North Carolina Deed Of Trust Requirements solely from reputable sources, such as US Legal Forms. An incorrect template will squander your time and postpone the situation you are handling.

With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document's applicability and significance for your circumstances and within your state or vicinity.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms catalog to locate legal samples, verify their applicability to your scenario, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Review the form's details to ensure it meets your state and county's criteria.

- Access the form preview, if present, to confirm that the form is indeed the one you require.

- Continue searching to find the suitable template if the North Carolina Deed Of Trust Requirements do not align with your needs.

- Once you are certain of the form's importance, download it.

- If you are a registered user, click Log in to verify and gain access to your selected templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the template.

- Choose the payment plan that aligns with your needs.

- Proceed to the registration to complete your purchase.

- Finalize your acquisition by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading North Carolina Deed Of Trust Requirements.

- After you have the form on your device, you can modify it with the editor or print it and complete it manually.

Form popularity

FAQ

A trust is a legal entity that holds and manages assets for the benefit of beneficiaries, while a certificate of trust is a document that provides evidence of the trust's existence and its key provisions. The certificate does not contain all the details of the trust, which helps maintain privacy. Understanding these distinctions is crucial for navigating North carolina deed of trust requirements effectively.

To transfer property to a trust in North Carolina, you must execute a new deed that lists the trust as the grantee. Ensure that the deed meets the North carolina deed of trust requirements by including relevant details and having it signed by the current property owner. After notarization, file the deed with your local register of deeds to complete the transfer.

Typically, a trust does not need to be recorded in North Carolina. However, when properties are held in trust, complying with the North carolina deed of trust requirements may necessitate recording certain documents like a deed of trust. Recording can simplify transactions and clarify the trust's terms to third parties.

A certificate of trust in North Carolina is a legal document that provides evidence of a trust's existence and its key provisions. It contains vital information such as the name of the trust, the trustee, and any related powers granted. This certificate can facilitate transactions without disclosing the entire trust document, adhering to North carolina deed of trust requirements.

To record a certificate of trust in North Carolina, you need to draft the document outlining the trust's key details, including its name and the trustee's powers. After finalizing the document, take it to your local register of deeds office. Submitting the certificate there will allow it to be recorded, satisfying specific North carolina deed of trust requirements.

In North Carolina, a certificate of trust does not need to be recorded like a deed. However, if you want to provide proof of the trust's existence, you may choose to record it to comply with North carolina deed of trust requirements. This helps in asserting the authority of the trustee when managing trust assets. Always consult with an attorney for advice tailored to your situation.

To file a deed in North Carolina, you must first ensure that the document meets the North Carolina deed of trust requirements. This involves preparing the deed and having it signed by the grantor. Next, you need to have the deed notarized before submitting it to the local register of deeds office in your county. Once recorded, this deed will be a public record.

Yes, North Carolina primarily uses a deed of trust for real estate transactions, especially in relation to financing options. This legal document allows lenders to foreclose on properties without going through lengthy court proceedings. To navigate this process effectively, be sure to familiarize yourself with the specific North Carolina deed of trust requirements, which can help ensure a smooth transaction.

A deed is deemed valid in North Carolina if it is signed by the grantor, contains a legal description of the property, and is properly notarized. Furthermore, the deed must be delivered to the grantee to finalize the transfer. By understanding the North Carolina deed of trust requirements, you can ensure your deed complies with state laws and protects your interests.

In North Carolina, a deed must meet certain requirements, including a clear description of the property, the grantor's signature, and proper notarization. It is also essential for the deed to be recorded in the county where the property is located. Meeting the North Carolina deed of trust requirements ensures legal transfer of property ownership and protects the interests of all parties involved.