Trust And Indenture Act

Description

Form popularity

FAQ

The purpose of the Trust Indenture Act is to protect the rights of bondholders by ensuring that indentures provide comprehensive information and safeguards. Ultimately, this Act promotes accountability and transparency in the issuance of debt securities, fostering trust between issuers and investors. Engaging with platforms like US Legal Forms can help you navigate the requirements of the Trust Indenture Act, ensuring you adhere to all necessary regulations.

The Trust Indenture Act of 1939 applies to indentures related to debt securities exceeding $5 million in offer size. This includes corporate bonds, notes, and debentures issued by various entities. It is crucial for issuers and underwriters to understand these regulations, as non-compliance could result in significant financial and legal consequences.

The Trust Indenture Act regulates the issuance of certain types of debt securities in the United States, primarily to protect the interests of bondholders. By enforcing standards for the indentures associated with these securities, the Act ensures that bondholders receive necessary disclosures, making investment decisions more informed. Overall, the Trust Indenture Act aims to create a fair and transparent environment for both issuers and investors.

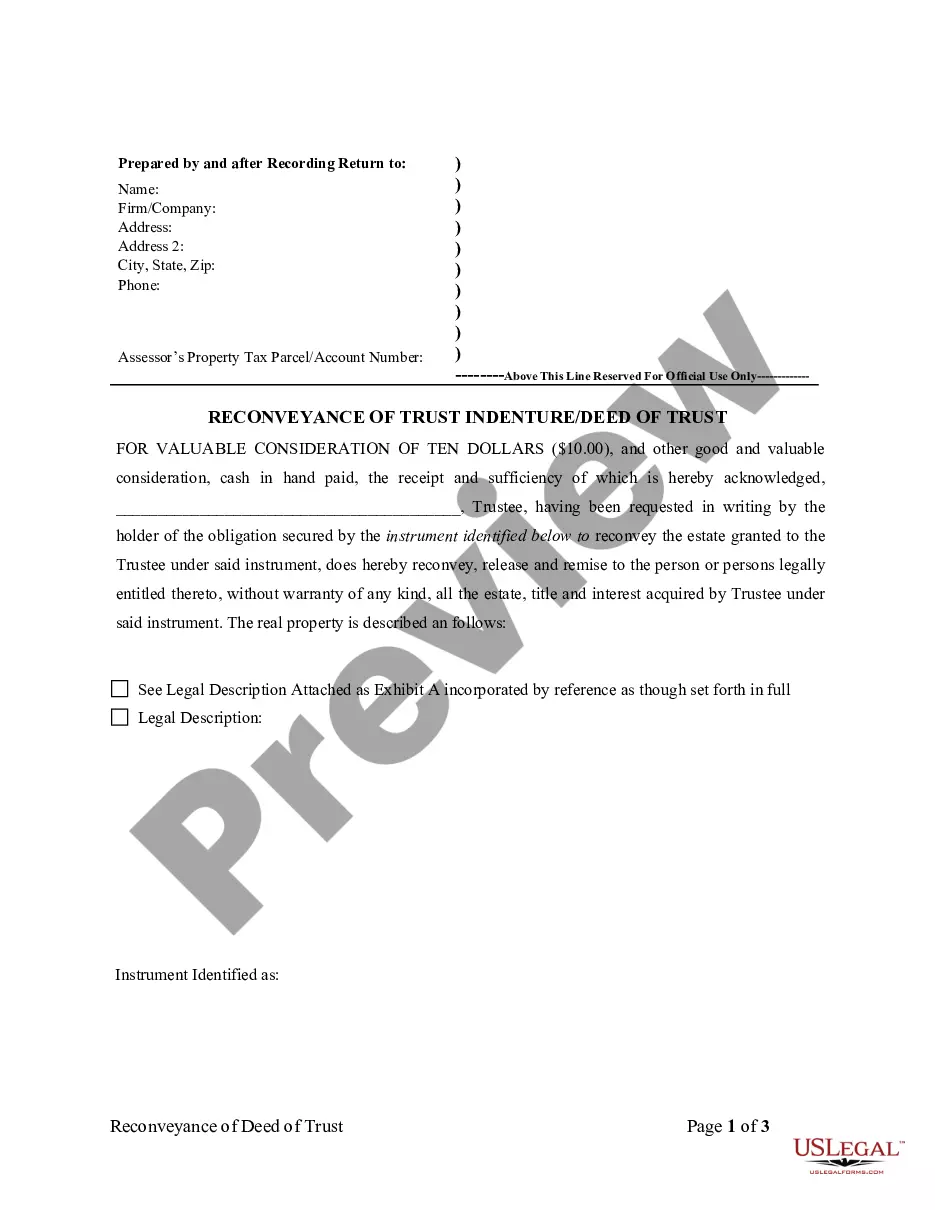

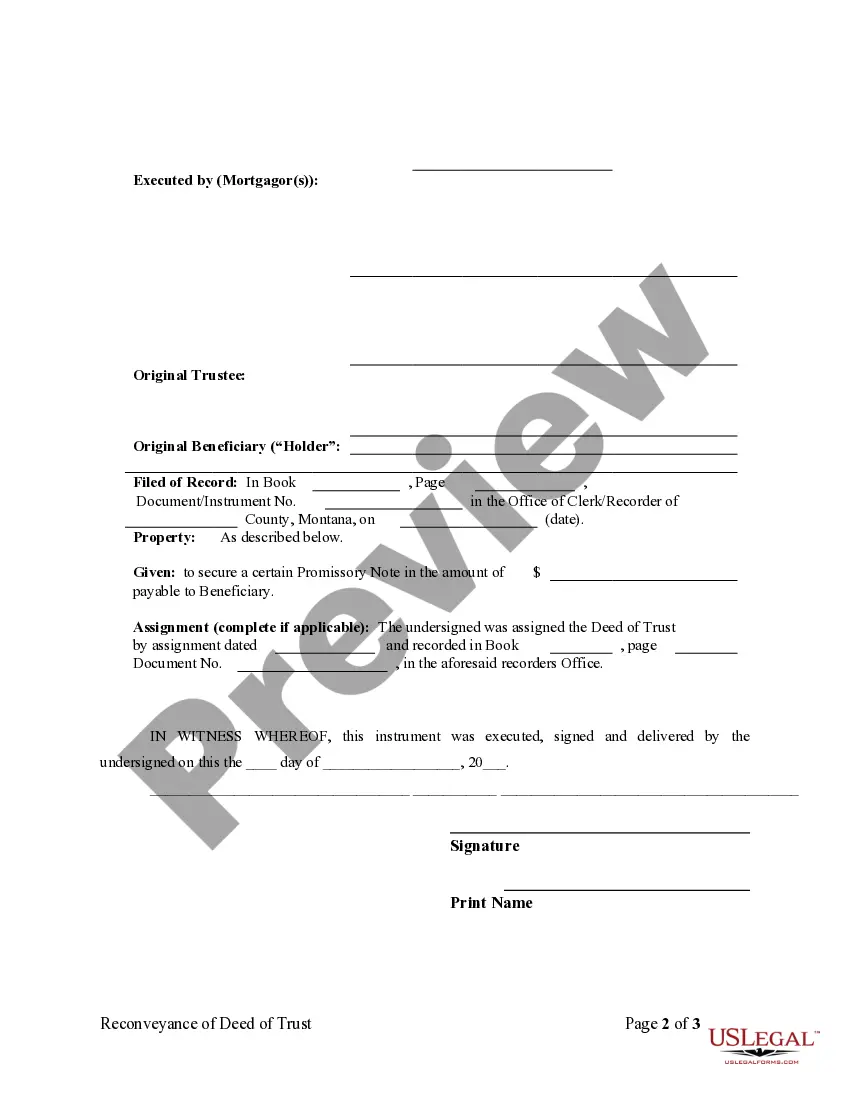

The indenture serves as a legal contract between the issuer of the securities and the bondholders. It outlines the specific terms, rights, and responsibilities associated with the bonds, ensuring protection for investors. Essentially, the indenture's purpose is to provide a clear structure and expectations, which is crucial in maintaining the integrity of the Trust Indenture Act.

The Trust Indenture Act sets a specific threshold of $5 million in total assets for offerings that must comply with its requirements. This means that any issuer of debt securities, with a debt of this magnitude or more, must ensure that their indentures meet the necessary legal standards. It's important to understand this threshold because it helps determine whether certain obligations apply to your offerings under the Trust Indenture Act.

A bond issue must have a trust indenture when it meets the size criteria set by the Trust and Indenture Act. Specifically, bonds issued in amounts over $5 million require this formal agreement to outline the obligations of the bond issuer. By establishing a trust indenture, bondholders gain a legal framework protecting their investment rights. Familiarizing yourself with these requirements can provide peace of mind when investing in bonds.

According to the Trust and Indenture Act, any bond issue that exceeds the $5 million threshold must have a trust indenture. This requirement safeguards the interests of bondholders. Through a trust indenture, issuers outline essential details, including payment schedules and what happens in case of default. Thus, it is vital for both new and seasoned investors to familiarize themselves with these stipulations.

A trust indenture agreement is often required for registered bonds, particularly those exceeding $5 million. Under the Trust and Indenture Act, this agreement acts as a contract between the bond issuer and the bondholders, detailing the rights and responsibilities of both parties. By establishing these terms, the trust indenture ensures that investors have a clear understanding of their investment. This requirement enhances the security of your investment, making the bond market more reliable.

Typically, corporate bonds and some municipal bonds must comply with the Trust and Indenture Act. This regulation ensures that bondholders are protected and that the terms of the bond offering are clearly defined. It applies to most offerings exceeding a certain dollar amount, providing necessary oversight and transparency. Understanding these requirements is essential for both issuers and investors.

An example of a trust indenture would be the agreement created for a corporate bond offering, which documents the terms of the bond issuance, including interest rate and maturity date. This document acts as a legal framework establishing the relationship between the bond issuer and the bondholders. Using a platform like UsLegalForms, you can easily draft compliance-ready indentures tailored to your specific needs, helping to streamline the process.