Lien Discharge Bond Form

Description

Form popularity

FAQ

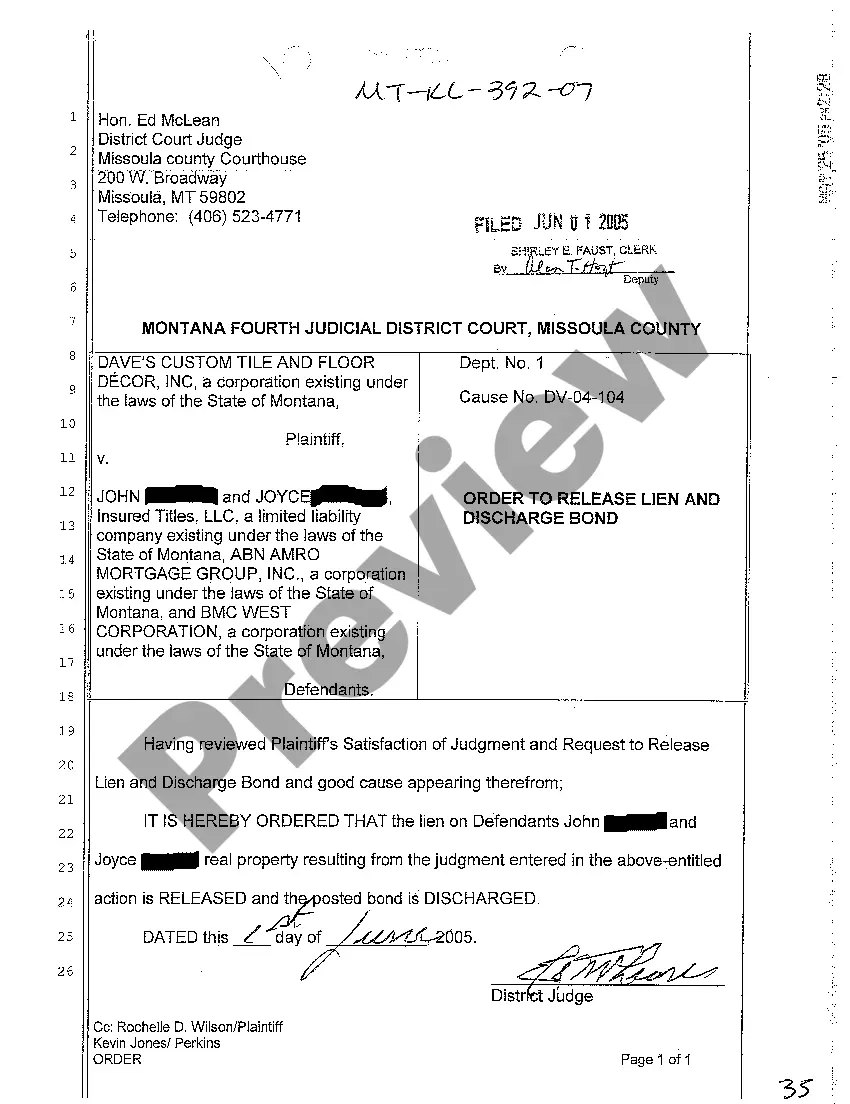

Yes, you can bond around a lien, which means you can secure a bond to release the lien from the property. This process usually involves filling out a lien discharge bond form and providing it to the court, thereby allowing the property owner to remove the lien while keeping the creditor's rights intact. This can be a proactive way to manage lien disputes and maintain project progress. For guidance, platforms like uslegalforms can streamline this process.

Yes, you can file a lien in Florida without a notice to the owner; however, doing so may limit your rights. The notice to owner serves as a formal alert, enabling property owners to recognize potential claims against their property. It is generally advised to send this notice to ensure your lien is enforceable. Using a lien discharge bond form can provide more security and clarity in these situations.

Transferring a lien to a bond in Florida involves filing a lien discharge bond form with the court, which serves as a guarantee for the amount of the lien. Make sure to follow the proper legal protocols, including notifying all relevant parties and providing documentation of the original lien. This transformation allows the property owner to lift the lien while securing the creditor's interest. Consulting with professionals can streamline this process.

To release a lien in Florida, you need to prepare a release document, often called a lien release or satisfaction of lien. This document should include your name, the owner’s name, property details, and a statement that the lien is being released. Once completed, file this release with the county clerk where the original lien was recorded. For smoother transactions, you may consider using a lien discharge bond form to ensure all requirements are met.

The 45 day lien law in Florida mandates that contractors, subcontractors, and suppliers must file a lien on the property within 45 days of the last day services or materials were provided. If a notice to owner was sent, this timeline remains critical to maintain lien rights. This law encourages swift action to ensure rightful claims, protecting parties who contribute to the project. Using a lien discharge bond form can help manage any disputes arising from this law.

To write a letter to remove a lien, start by addressing it to the lien holder. Clearly state your request to release the lien, including details such as your property address and the lien's reference number. It may also be beneficial to provide any relevant supporting documents, like proof of payment or fulfillment of conditions. Remember, if the lien is related to a construction project, using a lien discharge bond form could expedite the release process.

A lien is a legal right or interest that a lender has in someone else's property, granted until the debt obligation is satisfied. This means the lender can claim ownership of the property or asset if the borrower fails to repay the debt. Understanding this concept is crucial, especially when dealing with lien discharge bond forms, as these forms help fulfill obligations and remove liens effectively. Therefore, a clear grasp of the meaning of lien can empower you in managing your financial commitments.

To remove a lien on your account, you must first settle the debt related to the lien, or in some cases, dispute its validity. Once this is done, you can file a lien discharge bond form to formally request that the lien be removed. This form acts as a record of your compliance and can assist in expediting the release process. After filing, follow up with the lien holder to confirm the release has been processed.

Yes, you can file a claim against a lien discharge bond if the bond is required by the court as part of a legal process. Typically, this occurs when a party believes that they have a valid claim against the property or funds tied up by the lien. The lien discharge bond form serves as a safeguard, ensuring that all parties' interests are protected while matters are resolved.

In Texas, a bank typically has 30 days to release a lien after receiving the necessary payment or fulfillment of conditions. If they fail to comply, property owners can take further steps to ensure their lien is canceled. To expedite the release, consider using a lien discharge bond form, which can provide an additional layer of assurance during the process.