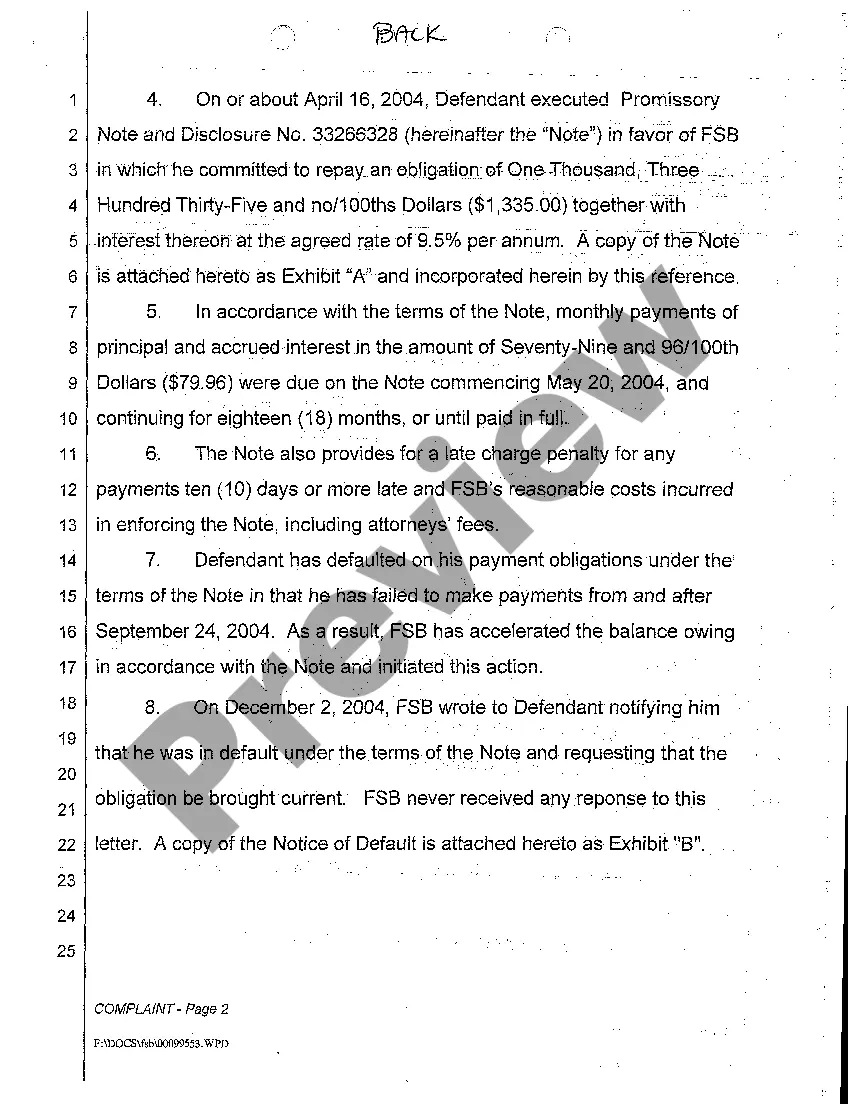

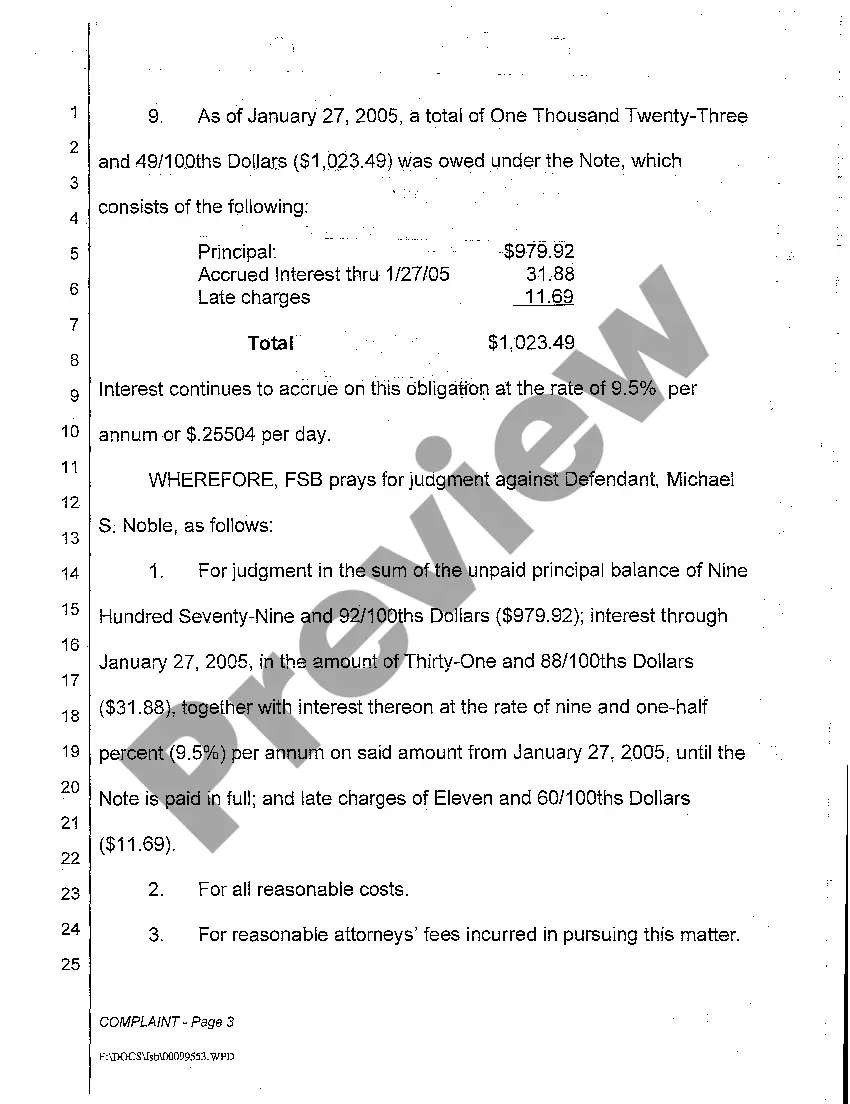

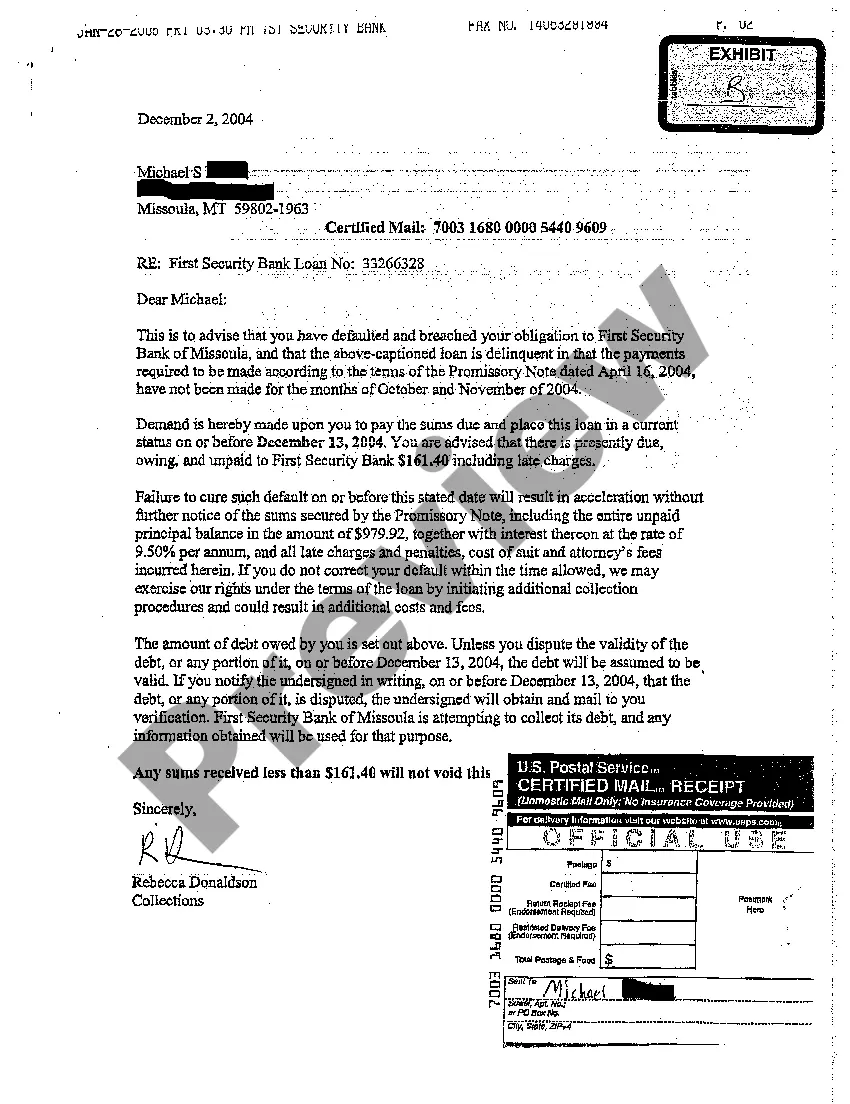

Breach Of Promissory Note With Example

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

No matter if you engage with documentation frequently or you occasionally have to send a legal report, it is essential to acquire a resource where all the examples are pertinent and current.

The initial step you need to take with a Breach Of Promissory Note With Example is to ensure that it is the latest version, as it determines its eligibility for submission.

If you wish to simplify your hunt for the most recent document samples, look them up on US Legal Forms.

Utilize the search menu to locate the document you need. Review the Breach Of Promissory Note With Example preview and outline to confirm it is exactly what you're seeking. After verifying the document, simply select Buy Now. Choose a subscription option that suits you best. Either create an account or Log In to your existing one. Complete the purchase using your credit card information or PayPal account. Select the format for download and confirm it. Eliminate any confusion when dealing with legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that features nearly every sample you might search for.

- Seek out the templates you need, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Acquire the Breach Of Promissory Note With Example templates in just a few clicks and store them in your account anytime.

- Having a US Legal Forms account allows you to access all the samples you need with convenience and minimal hassle.

- Simply click Log In in the header of the website and go to the My documents section containing all the forms you need at your fingertips, saving time on searching for the right template or verifying its relevance.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.