Montana Affidavit Of Repossession

Description

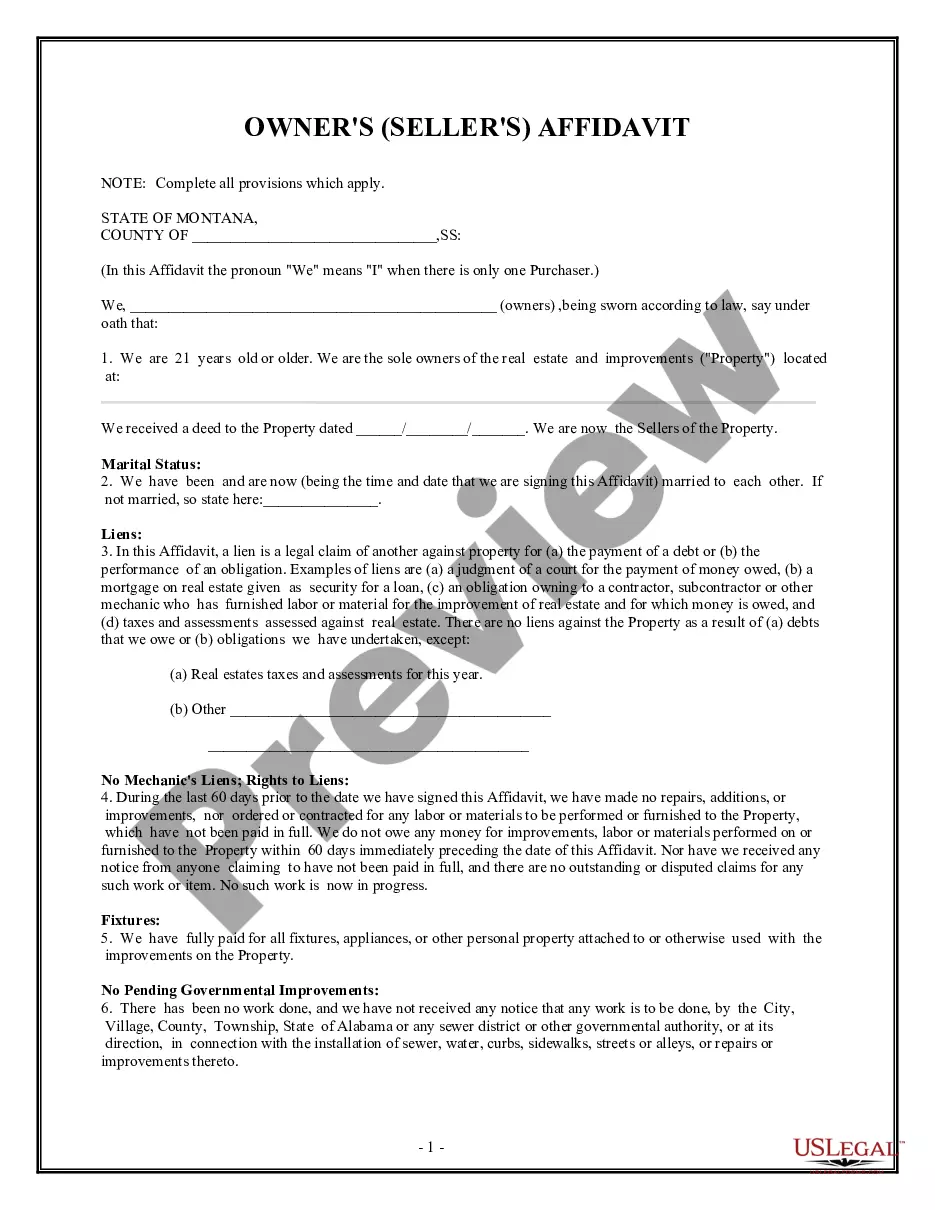

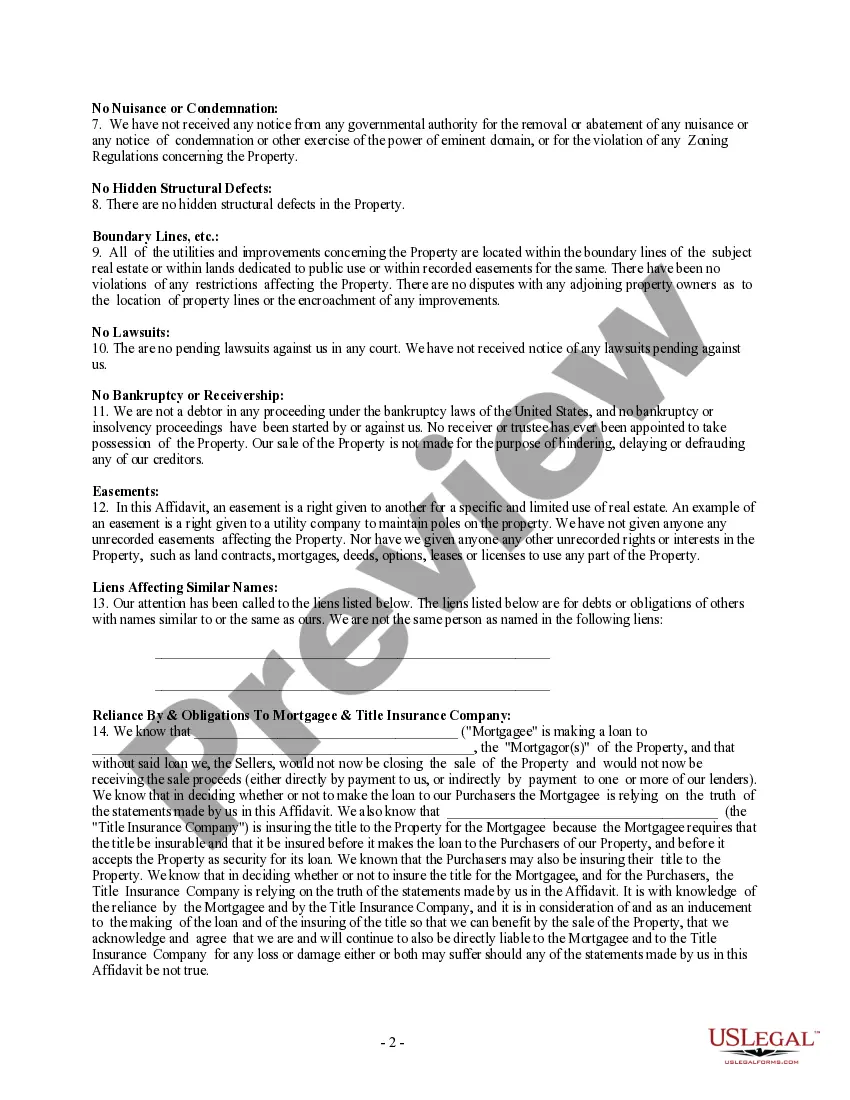

How to fill out Montana Owner's Or Seller's Affidavit Of No Liens?

Maneuvering through the red tape of official documents and formats can be challenging, particularly if one does not engage in that work regularly.

Even selecting the appropriate format for a Montana Affidavit Of Repossession can be a lengthy endeavor, as it must be valid and accurate to the final detail.

However, you will need to invest considerably less time finding a fitting format from a trusted resource.

Acquire the proper document in a few straightforward steps: Enter the document's name in the search box. Find the appropriate Montana Affidavit Of Repossession among the outcomes. Review the sample description or open its preview. If the format fits your needs, click Buy Now. Move forward to select your subscription plan. Use your email to create a password to establish an account at US Legal Forms. Choose a credit card or PayPal for the payment method. Download the document file to your device in your preferred format. US Legal Forms will save you considerable time verifying whether the document you discovered online is appropriate for your requirements. Establish an account and gain unlimited access to all the forms you need.

- US Legal Forms is a service that streamlines the process of locating the right documents online.

- US Legal Forms is the singular resource you should turn to for the latest versions of documents, review their application, and download these documents for completion.

- This is a compilation of over 85,000 forms relevant to various sectors.

- When looking for a Montana Affidavit Of Repossession, you won't need to doubt its authenticity since all the documents are validated.

- Having an account at US Legal Forms will ensure you possess all the essential documents readily available.

- Store them in your record or add them to your My documents collection.

- You can retrieve your stored documents from any device by clicking Log In at the library web portal.

- If you do not yet have an account, you can always look for the document you need.

Form popularity

FAQ

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.

Tips to write an effective repossession letter to your client:Choose the medium of sending the letter: It is always better to choose how you are going to send the letter, beforehand.Keep it professional: Always remember, this letter is not personal.Be kind: You never know what the other person may be going through.More items...

To successfully transfer a vehicle title in Montana, you need these documents:Application for Certificate of Title for a Motor Vehicle (Form MV1)Proof of Security Interest or Lien (Lien Release Form) (Form MV37A)Bill of Sale (Form MV24)Payment for all applicable fees.

Court OrderIf the judge agrees that the debt is valid, the repossessor can ask the court to order repossession. The debtor must turn the vehicle over to the lender or allow the lender to repossess it after a court orders the repossession.

Here are five steps you can take to recover from a repossession:Ask why your car was repossessed.Find out if you can get it back.Know your rights.If the car is sold, ask if you still owe money.Work on improving your credit.