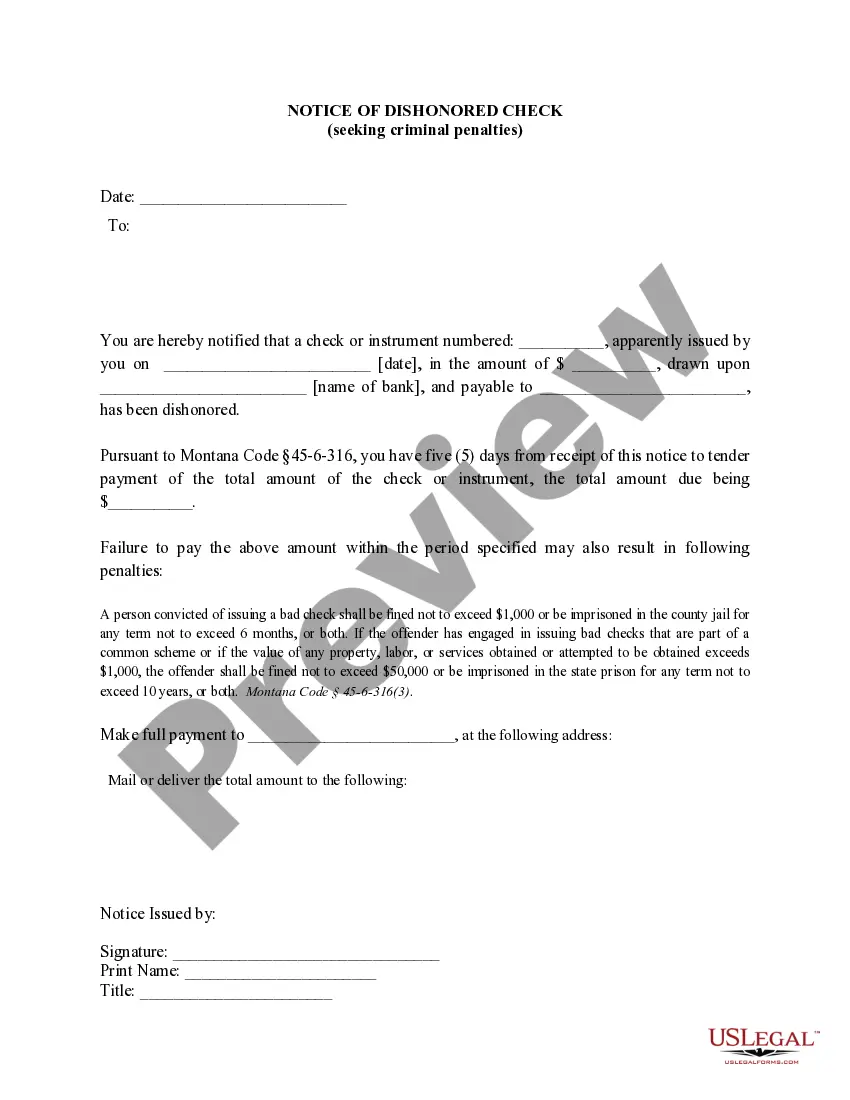

This is a Complaint/Warrant for Dishonored Check (Criminal). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Bad Check Notice Form

Description

How to fill out Bad Check Notice Form?

Properly composed formal documents are a crucial assurance for preventing problems and lawsuits, but acquiring them without the assistance of an attorney may require some time.

Whether you are in need of promptly locating a current Bad Check Notice Form or any other templates for work, family, or business events, US Legal Forms is consistently here to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If you have an active subscription, you simply need to Log In to your account and click the Download button next to the selected document. Additionally, you can access the Bad Check Notice Form at any time later, as all previously acquired paperwork on the platform is available in the My documents tab of your profile. Save time and funds on preparing official documents. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for an alternate example (if necessary) using the Search bar in the header.

- Select Buy Now when you find the appropriate template.

- Choose your pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Bad Check Notice Form.

- Click Download, then print the document to complete it or upload it to an online editing tool.

Form popularity

FAQ

Depositing a bad check can lead to various penalties, including fees from your bank and potential legal repercussions. If your bank disputes your actions, you may face additional complications. To protect against such issues, always verify funds before depositing checks. If you’ve received a bad check, utilizing a bad check notice form can help clarify the situation and signal your intent to resolve the matter.

Yes, you can sue someone for writing a bad check, especially if you can prove intent to defraud. Legal action can recover the amount owed, along with potential additional fees. Before pursuing a lawsuit, it’s generally a good idea to attempt resolution through a bad check notice form. This formal communication might encourage the issuer to rectify the situation without escalating to court.

Absolutely, writing a check that bounces can lead to legal trouble. Depending on the circumstances, you might face civil penalties or even criminal charges. To avoid these problems, it’s wise to familiarize yourself with local laws. If you receive a bad check, consider using a bad check notice form to notify the issuer and outline your next steps.

Yes, banks can prosecute individuals for writing bad checks. When a check bounces, the bank may file charges against the issuer if they suspect fraud or intent to deceive. It's important to understand that banks often follow strict protocols in response to bad checks. Using a bad check notice form can help you document the situation properly and communicate your intent to resolve the issue.

Writing a check for less than $1 is unlikely to be considered a federal crime. Typically, legal consequences stem from the overall intent and the check's handling. A bad check notice form can serve as an effective tool to clarify misunderstandings concerning small transactions.

Writing a bad check is typically not a federal offense; it is primarily a state issue. However, if the check involves interstate transactions or federal institutions, it may be subject to federal laws. To handle such matters effectively, consider a bad check notice form as a first step toward resolution.

Yes, it is possible to get a warrant for writing a bad check, especially if it is deemed fraudulent. The severity often depends on the amount of the check and the local laws. Using a bad check notice form can help you manage the situation and potentially avoid legal action.

Writing a bad check is generally considered a state crime, not a federal crime. However, in some cases, such as when a check is written across state lines, it may involve federal laws. To stay proactive, consider using a bad check notice form to inform the recipient and resolve the issue before it escalates.

Writing a demand letter for a bad check involves clearly stating the amount owed, the reason for the demand, and a deadline for payment. Begin with a courteous introduction, and then include any relevant details from the bounced check, along with the potential consequences for not complying. Utilizing a Bad check notice form can enhance clarity and ensure all necessary information is included. This structured letter can motivate the recipient to act promptly.

To create a letter of insufficient funds, clearly state the reason for the letter, including the check details and the date it was presented. Use a concise format and ensure you include the amount due and any associated fees. Incorporating a Bad check notice form can add professionalism to your letter, helping communicate the issue formally and effectively. This approach can clarify expectations and promote resolution.