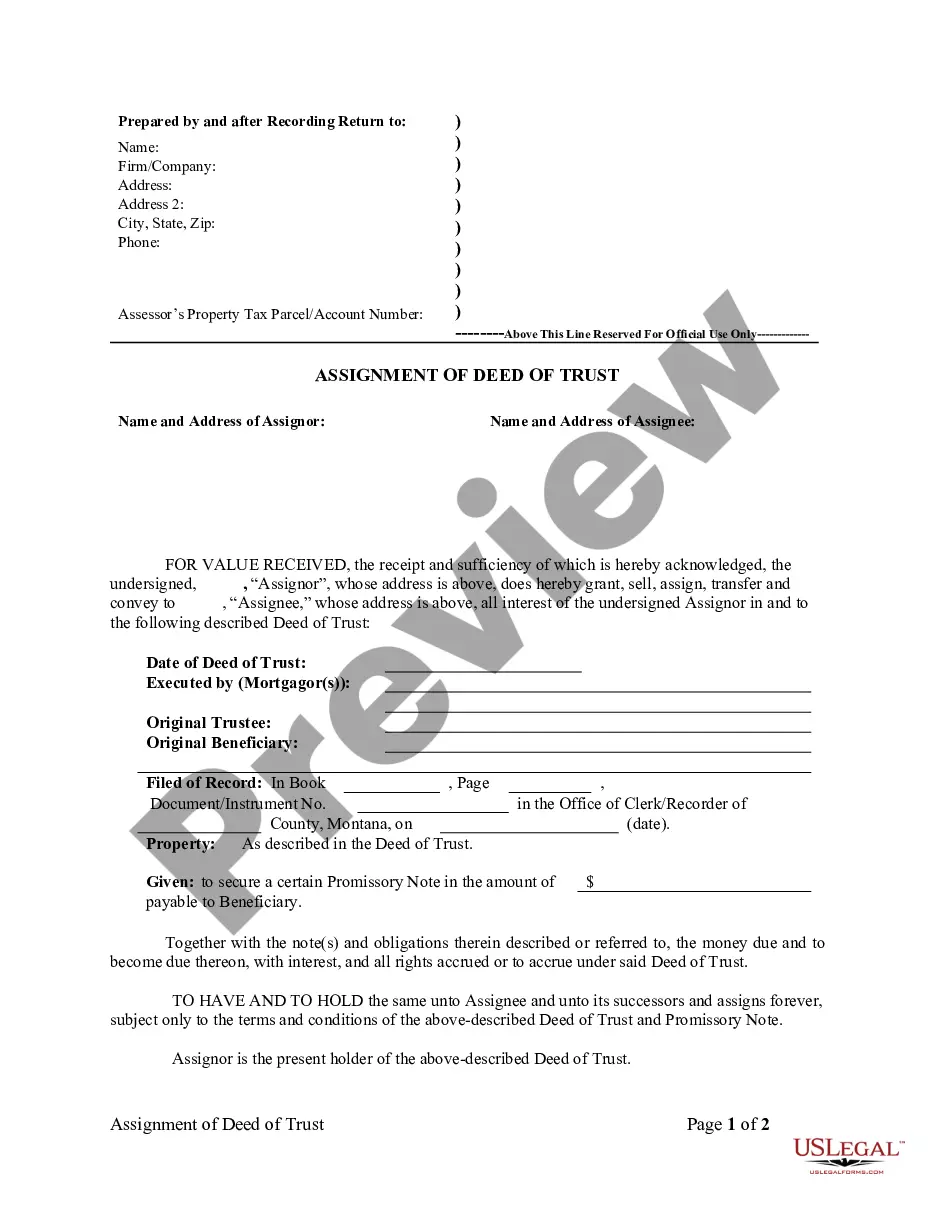

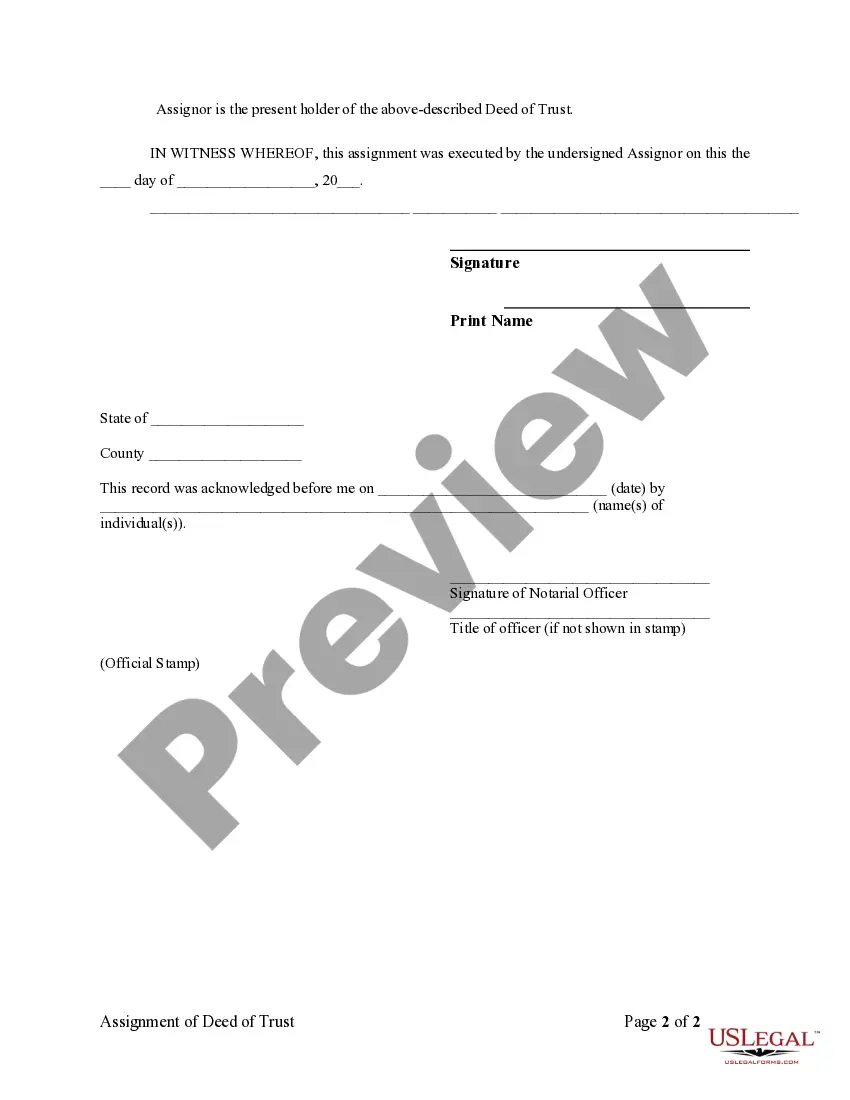

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Montana Deed Of Trust Withdrawal Form

Description

How to fill out Montana Deed Of Trust Withdrawal Form?

Well-constructed formal documentation serves as a crucial assurance for preventing problems and legal disputes, yet acquiring it without a lawyer's support may require time.

Whether you require a swift access to a current Montana Deed Of Trust Withdrawal Form or any other templates for job, family, or business occasions, US Legal Forms is consistently available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can access the Montana Deed Of Trust Withdrawal Form at any time later, as all documents ever obtained on the platform remain accessible within the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Ensure that the form is appropriate for your needs and locale by reviewing the description and preview.

- Search for another sample (if needed) using the Search bar located at the top of the page.

- Select Buy Now when you find the suitable template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Opt for PDF or DOCX file format for your Montana Deed Of Trust Withdrawal Form.

- Click Download, then print the document to complete it or incorporate it into an online editor.

Form popularity

FAQ

To file a quitclaim deed in New Jersey, first complete the necessary deed form, ensuring all parties are correctly listed. Sign the deed in front of a notary public, then bring the notarized document to the county clerk's office for filing. Remember to include any required fees and check local regulations for specific requirements. The process mirrors that of the Montana deed of trust withdrawal form, providing a clear pathway for property ownership changes.

Filing a quitclaim deed in Montana involves preparing the deed form correctly, ensuring all relevant information is included. Once you have filled out the form, you must sign it in front of a notary public. After notarization, you should file the quitclaim deed with your local county clerk's office. This straightforward method helps facilitate property transfers and can be as efficient as utilizing the Montana deed of trust withdrawal form for your legal needs.

The primary beneficiaries of a quitclaim deed are family members or individuals seeking to transfer property without involving a lengthy legal process. This deed is often used to clear up title issues or change ownership among relatives. Since it does not guarantee ownership rights, it’s essential for the grantor to possess clear title for the transaction to be meaningful. The simplicity of this process echoes the practical benefits found with the Montana deed of trust withdrawal form.

To complete a quitclaim deed in Montana, first obtain the appropriate deed form. Fill it out with the required details, such as the parties involved and a clear description of the property. After signing the deed in front of a notary, file it with the county clerk's office. This simple process effectively transfers any interest you have in the property, similarly to how a Montana deed of trust withdrawal form aids in property transactions.

To file a beneficiary deed in Montana, you start by preparing the deed form, which designates the beneficiary. You must sign the deed in front of a notary public. After signing, file the deed with the county clerk in the county where the property is located. This process helps ensure that your property transfers directly to your beneficiary without going through probate, which can simplify the transition much like the Montana deed of trust withdrawal form streamlines property management.

Typically, any adult who is legally competent can be appointed as a trustee for a deed of trust in Montana. It's important to choose someone trustworthy, as the trustee holds significant responsibilities. The trustee will manage the property and ensure the terms of the deed of trust are followed. For those seeking to complete a Montana deed of trust withdrawal form, having a reliable trustee can streamline the process significantly.

A deed of amendment to a trust deed is an official record that indicates changes to the terms of the trust deed. This amendment could involve updating beneficiaries or modifying asset distributions. To streamline this process, employing a Montana deed of trust withdrawal form can ensure that all changes are clear and legally effective.

A deed of amendment is a specific document used to alter the contents of an existing legal agreement, such as a trust. This document officially records the changes and ensures that the amended terms are enforceable. If you require modifications, utilizing a Montana deed of trust withdrawal form can facilitate this process efficiently.

Yes, beneficiaries of a trust can be changed through an amendment or a deed of amendment. This flexibility allows the trust creator to adapt their estate planning as personal circumstances evolve. If you need to update your beneficiaries, consider using a Montana deed of trust withdrawal form for a straightforward and effective solution.

An amendment to a trust refers to any change made to the trust's original terms. This could include adding or removing beneficiaries, altering how assets are distributed, or changing the trustee. For those looking to make such changes, a Montana deed of trust withdrawal form can serve as a vital tool to ensure that all modifications are legally binding and clearly documented.