Mt Lien Individual 3 Complete Withholding

Description

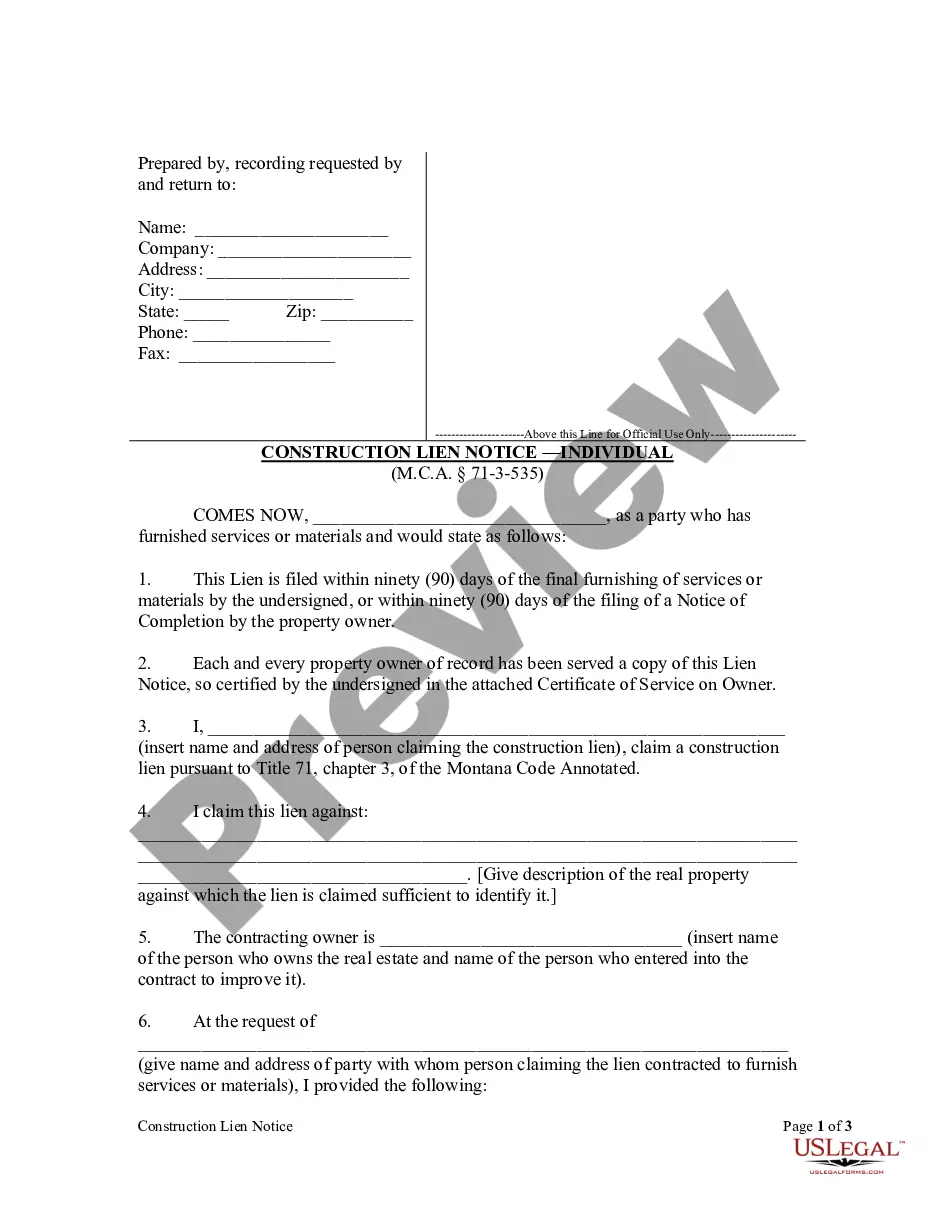

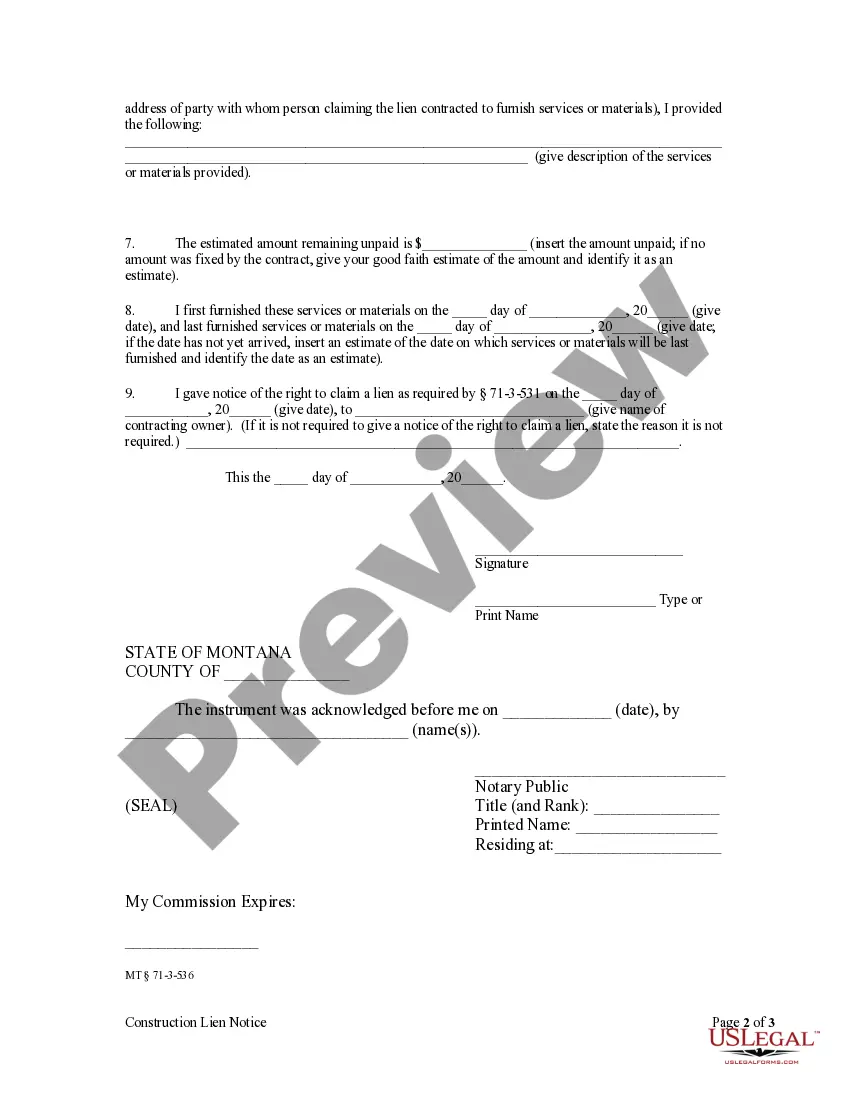

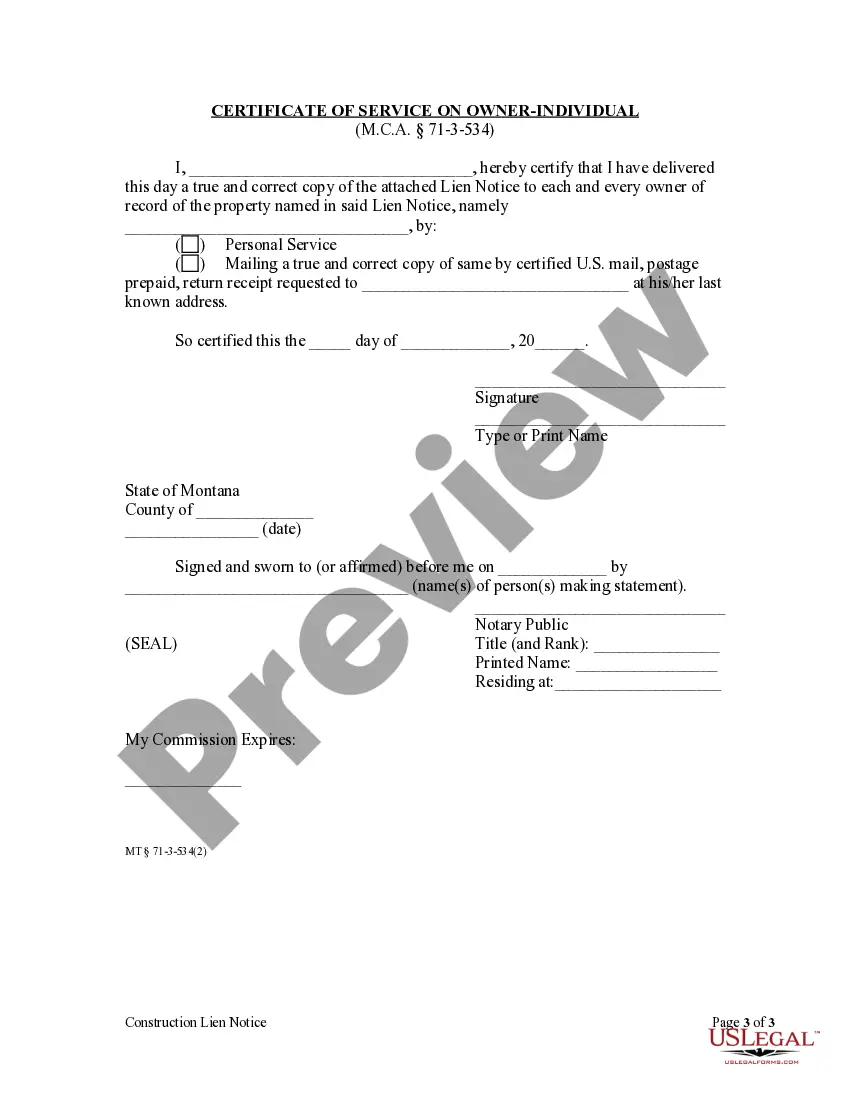

How to fill out Montana Construction Lien Notice - Individual?

Creating legal documents from the ground up can occasionally be daunting. Certain situations may require extensive research and significant financial outlay. If you’re in search of a simpler and more cost-effective method of generating Mt Lien Individual 3 Complete Withholding or any other paperwork without unnecessary complications, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can promptly retrieve state- and county-specific templates meticulously assembled for you by our legal experts.

Utilize our platform whenever you need a dependable service through which you can swiftly locate and download the Mt Lien Individual 3 Complete Withholding. If you’re already familiar with our services and have previously established an account with us, simply Log In to your account, choose the template, and download it or re-download it anytime from the My documents section.

Don’t have an account? No worries. It takes only a few minutes to create one and explore the catalog. But before diving into downloading Mt Lien Individual 3 Complete Withholding, adhere to these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make form completion a straightforward and efficient process!

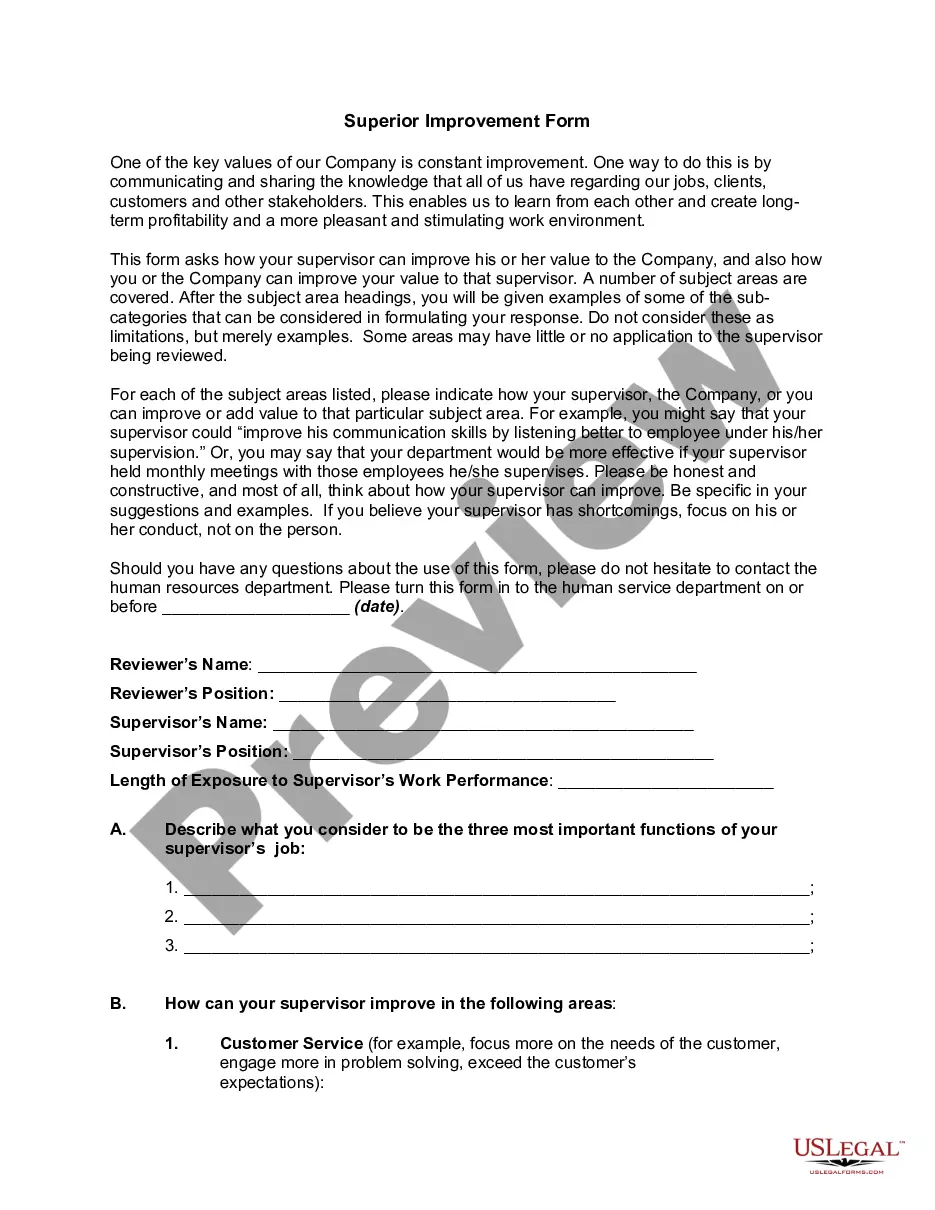

- Examine the form preview and descriptions to ensure you have located the document you need.

- Verify if the form you choose complies with the statutes and regulations of your state and county.

- Select the most suitable subscription option to purchase the Mt Lien Individual 3 Complete Withholding.

- Download the form. Then complete, certify, and print it out.

Form popularity

FAQ

The time it takes to file a lien in Montana can vary based on the type of lien and the filing method. Generally, electronic filings can be processed quickly, often within a few days. However, paper filings may take longer, depending on the workload of the county office. To expedite your process related to the Mt lien individual 3 complete withholding, consider using uslegalforms for efficient filing.

To file a vehicle lien in Montana, you will need to complete a lien application that includes details about the vehicle and the parties involved. You must submit this application to the Montana Department of Justice along with any required fees. Using platforms like uslegalforms can simplify this process, ensuring you correctly file your Mt lien individual 3 complete withholding without any complications.

The right to lien in Montana allows creditors to place a legal claim on a debtor's property if the debtor fails to meet their obligations. This right is protected under state law and extends to various types of debts. To ensure you are correctly utilizing this right, it is advisable to familiarize yourself with the specific regulations and procedures, such as those concerning the Mt lien individual 3 complete withholding.

Filing a personal lien in Montana involves a few key steps. First, you must prepare the lien document, ensuring it includes all relevant details about the debtor and the debt. Next, you will file this document with the appropriate county office. For guidance and resources, consider using uslegalforms, which can help streamline the process of filing a Mt lien individual 3 complete withholding.

In Montana, you typically have a period of 6 months to file a lien after the debt becomes due. This timeframe is crucial to protect your rights under the Mt lien individual 3 complete withholding. Missing this deadline may result in losing the ability to claim the lien. Therefore, it is advisable to act promptly and ensure all necessary paperwork is filed in time.

Line 3 on the W-4 form is where you indicate the number of allowances you wish to claim, which directly impacts your tax withholding. To fill it out, assess your personal and family situation, considering factors such as dependents and other deductions. More allowances mean less tax withheld, while fewer allowances result in more tax being withheld. If you need help determining the right number for your Mt lien individual 3 complete withholding, uslegalforms can offer valuable assistance.

To fill out a withholding exemption, start by obtaining the proper form from your employer or the IRS website. Complete the form by providing accurate personal information and any necessary details about your dependents. Make sure to review your qualifications for claiming an exemption, as improper claims may lead to under-withholding. For guidance through this process, consider using the resources available at uslegalforms, which can help clarify your Mt lien individual 3 complete withholding.