File A Lien In Montana With Secretary Of State

Description

How to fill out Montana Construction Lien Notice - Individual?

Creating legal paperwork from the ground up can frequently be intimidating.

Some situations may require extensive research and significant financial expenditure.

If you’re seeking a more direct and economical method of producing File A Lien In Montana With Secretary Of State or any other documents without unnecessary complications, US Legal Forms is perpetually available to you.

Our online collection of over 85,000 current legal documents encompasses nearly all facets of your financial, legal, and personal affairs. With just a few clicks, you can immediately obtain state- and county-specific forms meticulously prepared for you by our legal professionals.

Review the form preview and descriptions to ensure you are on the correct form you require. Confirm the selected form meets the standards of your state and county. Choose the most appropriate subscription plan to purchase the File A Lien In Montana With Secretary Of State. Download the document. Then, fill it out, sign it, and print it. US Legal Forms boasts a flawless reputation and more than 25 years of expertise. Become part of our community now and make the document completion process simple and efficient!

- Utilize our platform whenever you seek a dependable and trustworthy service to easily find and download the File A Lien In Montana With Secretary Of State.

- If you’re familiar with our services and have registered an account previously, simply Log In to your account, find the form, and download it immediately, or access it again later in the My documents section.

- Don’t have an account? No problem. Setting it up takes only a few minutes, allowing you to browse the catalog efficiently.

- Before directly downloading File A Lien In Montana With Secretary Of State, keep these recommendations in mind.

Form popularity

FAQ

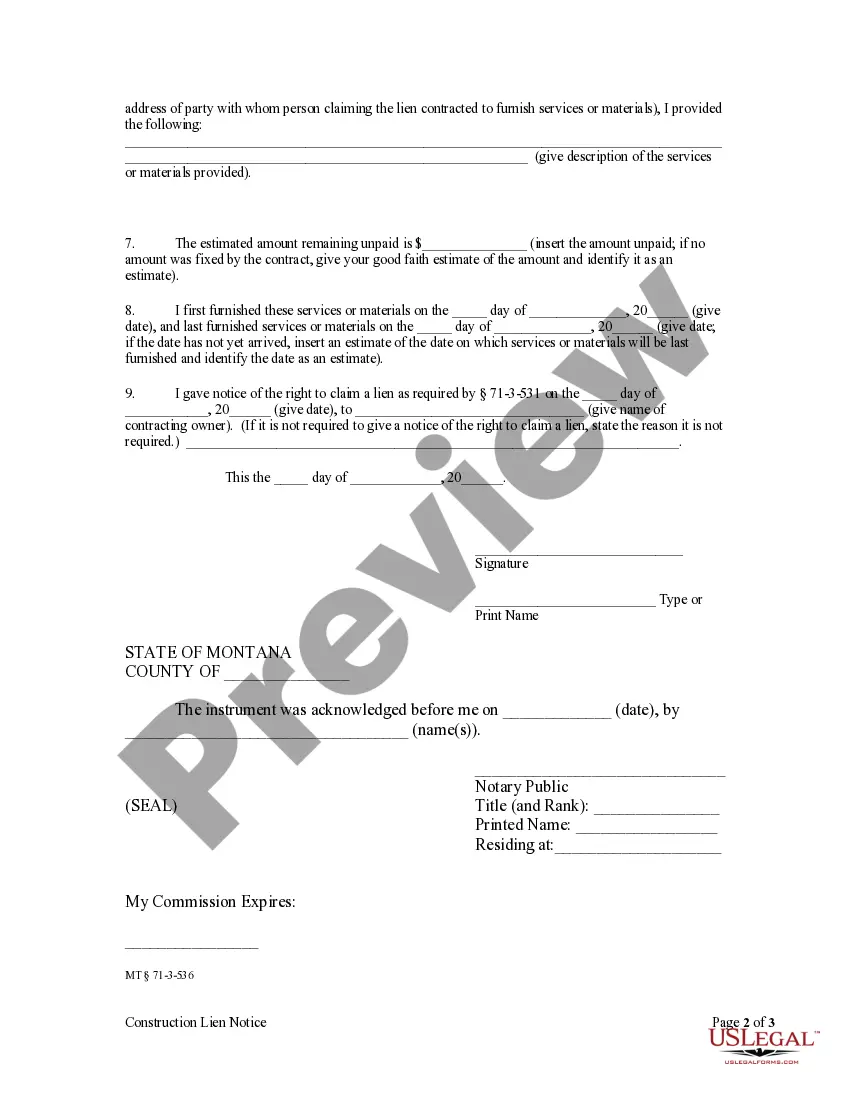

How to File a Montana Mechanics Lien | A Step-by-Step Guide to Get You Paid Properly identify yourself. Identify the property owner(s) Describe the labor or materials provided. Identify the hiring party. State the amount of the lien claim. Provide the first and last dates when labor or materials were provided.

Lien must be filed within 90 days of last providing labor or materials. An action to enforce a mechanics lien in Montana must be initiated within 2 years from lien's filing.

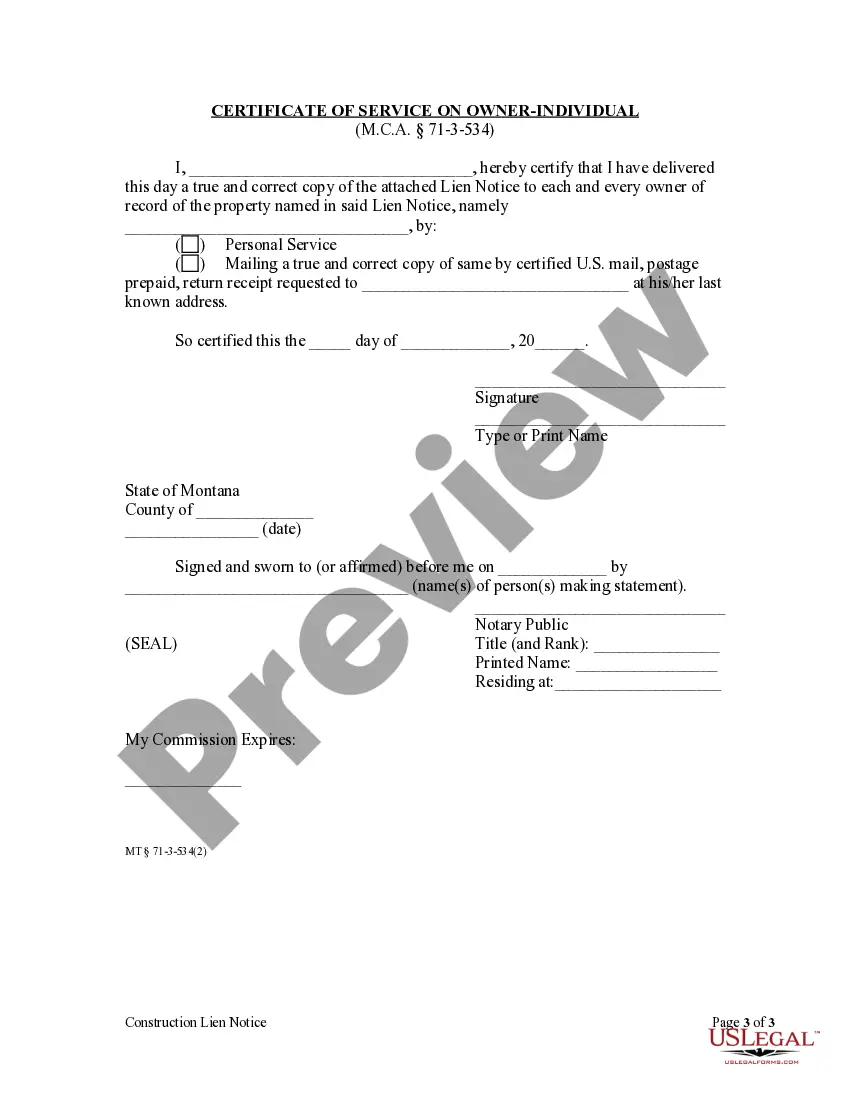

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

About Montana Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.