Power Of Attorney Revocation Form For Irs

Description

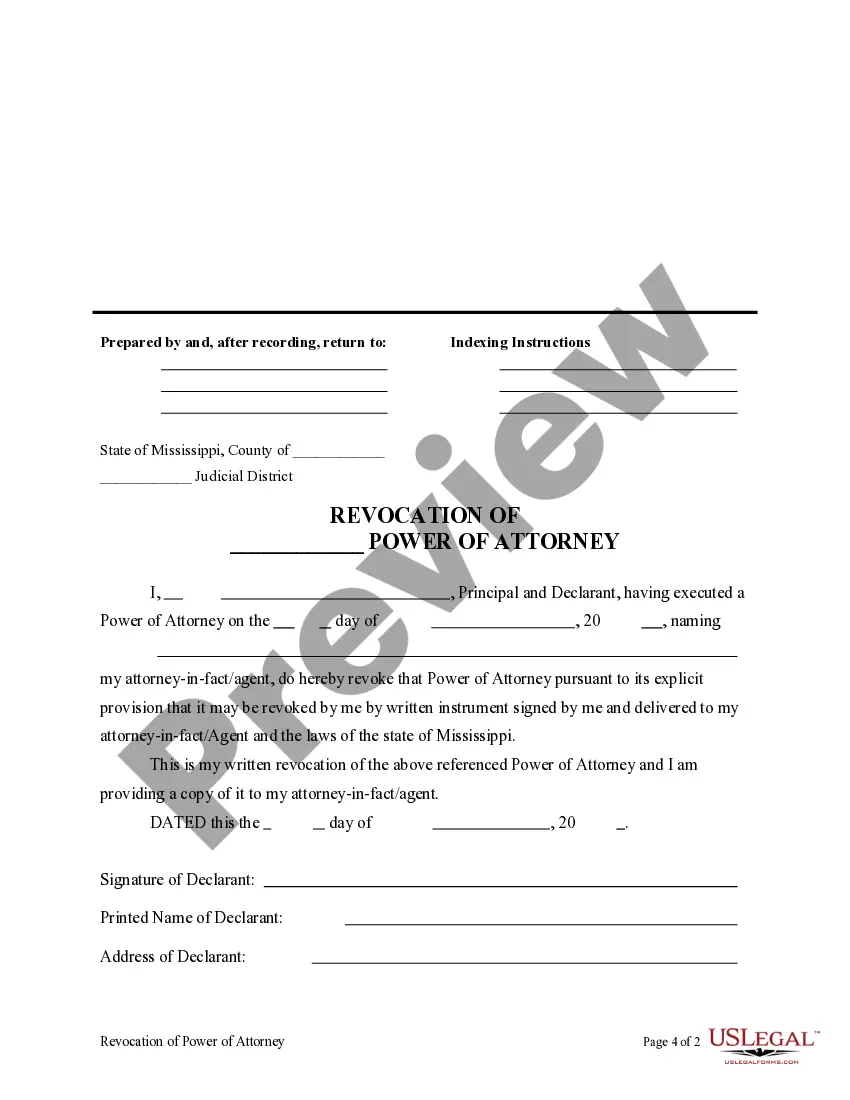

How to fill out Mississippi Revocation Of General Durable Power Of Attorney?

Well-prepared official records serve as one of the essential safeguards against complications and legal disputes, but acquiring them without the assistance of an attorney may require time.

If you are in search of a timely and current Power Of Attorney Revocation Document For Irs or various other templates related to employment, family, or business matters, US Legal Forms is consistently available to assist.

The procedure is even more convenient for existing users of the US Legal Forms database. If your subscription is current, you merely need to Log In to your account and press the Download button next to the selected document. Furthermore, you can retrieve the Power Of Attorney Revocation Document For Irs at any point thereafter, as all the documents acquired on the platform are accessible within the My documents section of your profile. Conserve time and resources on crafting official records. Experience US Legal Forms today!

- Ensure that the document fits your situation and locality by reviewing the description and preview.

- Search for another example (if required) using the Search bar located in the page header.

- Press Buy Now once you find the suitable template.

- Select the payment plan, Log In to your account or set up a new one.

- Choose your preferred method of payment to acquire the subscription plan (through a credit card or PayPal).

- Select the PDF or DOCX file format for your Power Of Attorney Revocation Document For Irs.

- Click Download, then print the sample to fill it in or upload it to a web-based editor.