Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

Mississippi Subordination Agreement With Irs

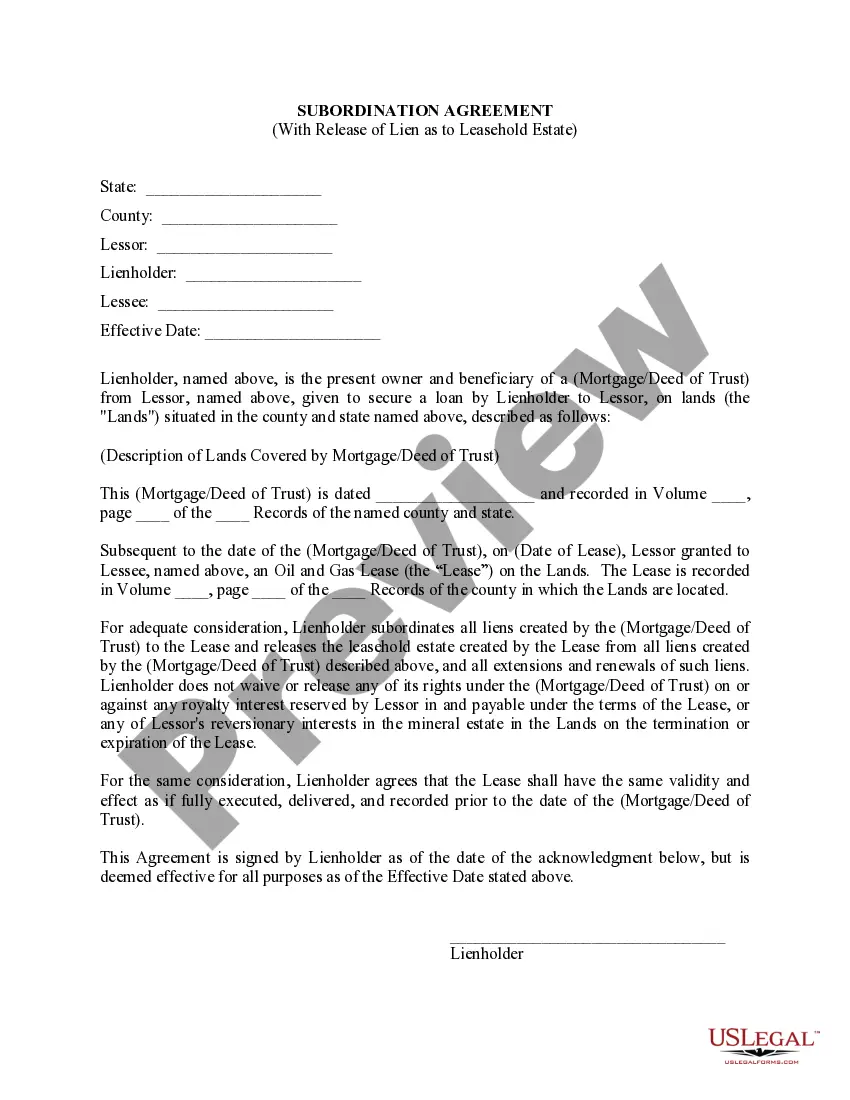

Description

How to fill out Mississippi Lease Subordination Agreement?

Precisely crafted formal paperwork serves as a crucial safeguard against issues and disputes; however, obtaining it independently without legal representation may require time.

Whether you are in need of promptly locating an updated Mississippi Subordination Agreement With Irs or any other documents for work, family, or business circumstances, US Legal Forms is readily available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button adjacent to the selected document. Furthermore, you can retrieve the Mississippi Subordination Agreement With Irs at any time later, as all documents obtained through the platform are stored within the My documents section of your profile. Conserve time and resources on drafting official documents. Experience US Legal Forms immediately!

- Confirm that the document fits your situation and locality by reviewing the description and preview.

- Search for an alternative example (if necessary) using the Search bar located in the page header.

- Select Buy Now once you locate the suitable template.

- Choose a pricing plan, Log In to your account, or create a new account.

- Select your preferred payment method to purchase the subscription (via credit card or PayPal).

- Choose either PDF or DOCX format for your Mississippi Subordination Agreement With Irs.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Apply for a certificate of subordination of federal tax lien by following the instructions in Publication 784. You will need to complete Form 14134. It is also a smart idea to watch this self-help IRS video. It is important to apply at least 45 days before a loan settlement meeting.

How Can a Taxpayer Request a Federal Tax Lien Subordination?The IRS may subordinate the tax lien if you agree to pay them an amount equal to the interest they are subordinating.The IRS may subordinate their interest if it increases the amount they will realize.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

The normal processing time for a Subordination may be as long as 30 to 60 days. However, when there is danger of losing the loan, the IRS may expedite the certificate at the taxpayer's or representative's request.

In essence, federal tax lien subordination means the IRS is giving up its priority on your property so you can get a loan, mortgage, or other financing. With tax lien subordination, the IRS tax lien remains on your property, but it will be a lower priority than the financial interest of new lenders.