Notice Creditors Form For Unsecured

Description

How to fill out Notice Creditors Form For Unsecured?

There’s no further justification to waste time searching for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in a single location and streamlined their access.

Our platform provides over 85,000 templates for any business and personal legal matters organized by state and area of application. All forms are properly constructed and verified for authenticity, so you can be confident in obtaining an updated Notice Creditors Form For Unsecured.

If you are acquainted with our platform and already possess an account, you must confirm that your subscription is active before acquiring any templates. Log In to your account, choose the document, and click Download. You can also access all obtained documents whenever necessary by opening the My documents tab in your profile.

Print your form to fill it out manually or upload the sample if you prefer to complete it using an online editor. Preparing official documents under federal and state laws and regulations is quick and straightforward with our platform. Try US Legal Forms today to keep your documentation organized!

- If you have never utilized our platform previously, the procedure will require a few additional steps to finalize.

- Here’s how new users can find the Notice Creditors Form For Unsecured in our library.

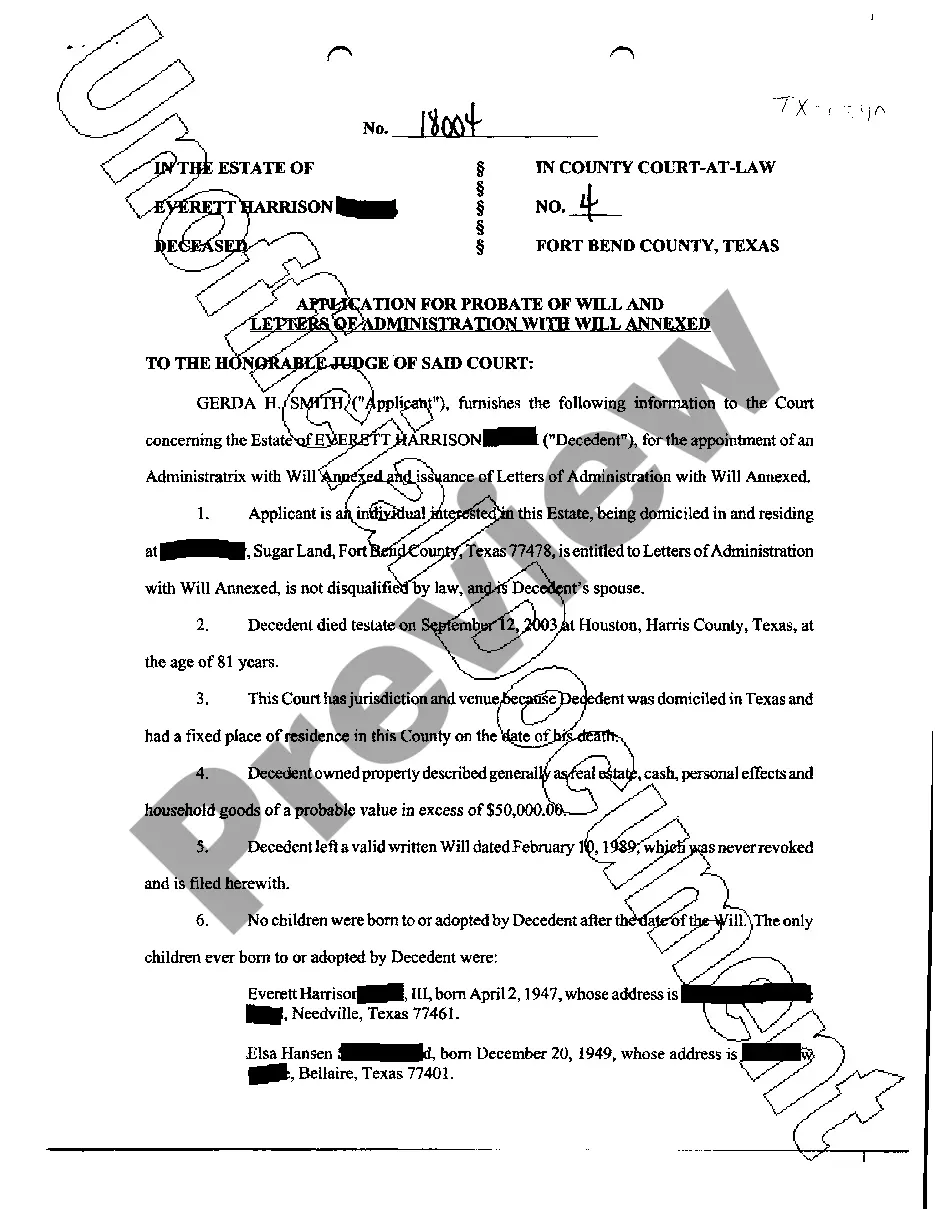

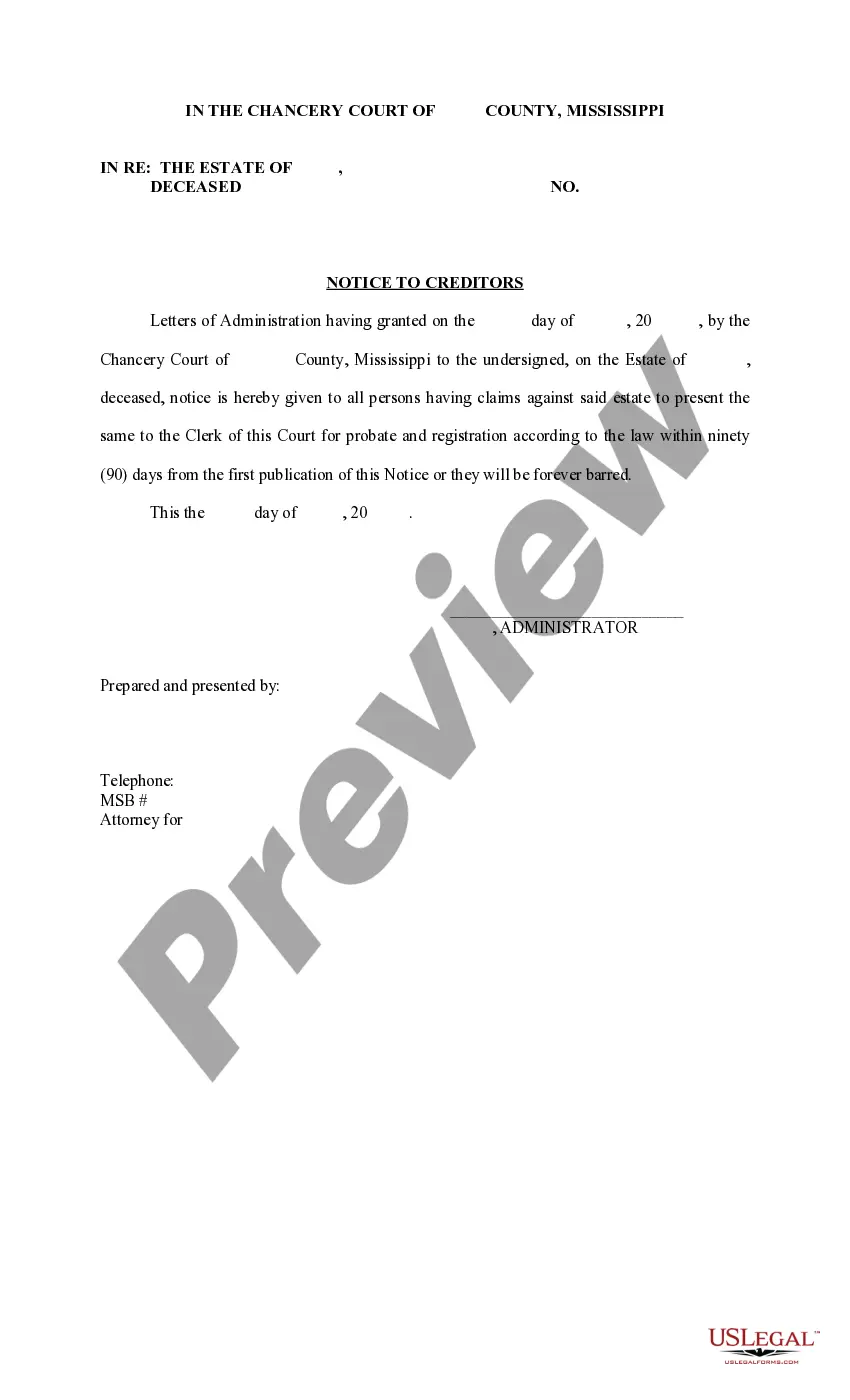

- Examine the page content thoroughly to confirm it includes the sample you require.

- To do so, employ the form description and preview options if available.

- Make use of the Search field above to look for another sample if the current one does not meet your needs.

- Click Buy Now beside the template name when you discover the correct one.

- Select the desired pricing plan and create an account or Log In.

- Complete your subscription payment with a credit card or through PayPal to proceed.

- Choose the file format for your Notice Creditors Form For Unsecured and download it to your device.

Form popularity

FAQ

The list of unsecured creditors comprises all parties that have claims against a debtor without collateral backing their loans or services. This list typically includes credit card issuers, utility companies, and medical providers. A well-organized list on your Notice creditors form for unsecured can streamline communication and resolution efforts.

You may be an unsecured creditor if you have extended credit or provided services without securing your payment with collateral. It's important to assess your transactions to determine your status. If you're uncertain, using the Notice creditors form for unsecured can clarify your position and how to proceed.

Unsecured creditors are individuals or entities that provide loans or credit without any collateral backing their debt. This means that if a borrower defaults, unsecured creditors may have limited rights to reclaim their funds. Understanding the implications of being an unsecured creditor is crucial, especially when filling out the Notice creditors form for unsecured.

Unsecured creditors may receive limited or no payment during bankruptcy proceedings. Their claims are settled only after secured debts are fulfilled. Depending on the case, they may negotiate settlements or receive a portion of remaining assets. Proper use of a Notice creditors form for unsecured can facilitate important communications with these creditors.

Unsecured creditors hold a lower rank in the payment hierarchy compared to secured creditors. Their claims are dependent on the availability of funds after higher-ranking debts are settled. This means they may receive partial payment or nothing at all if assets are insufficient. A Notice creditors form for unsecured can help you communicate transparently with these creditors!

The order of payment begins with secured creditors, followed by priority unsecured creditors, and finally, general unsecured creditors. This hierarchy ensures that those with secured claims receive their due before others. Understanding this process can help you plan your financial strategy and safeguard your assets. Utilizing a Notice creditors form for unsecured can help clarify your situation to creditors.

Unsecured creditors cannot take your house through direct means. However, if you fail to meet your payment obligations, they may pursue legal action. While this may result in wage garnishments or bank levies, seizing your home typically requires a secured claim. To navigate this situation effectively, consider utilizing a Notice creditors form for unsecured to alert them of your financial status.

First priority creditors typically include secured creditors, such as mortgage lenders or banks holding collateral. These creditors have the right to take possession of assets if debts are not repaid. Following secured creditors, priority claims can arise from government debts or certain tax obligations. Understanding the hierarchy is vital, and the use of a Notice creditors form for unsecured can clarify your obligations and rights as an unsecured creditor.

Filling out a proof of debt form involves providing essential details about the debt amount, the nature of the debt, and your contact information. You may also need to include supporting documentation that proves your claim. To ensure accuracy, double-check all entries before submission. If you're unsure about the process, using a Notice creditors form for unsecured can guide you and help ensure that you present your claim correctly.

A note regarding unsecured creditors highlights that these creditors rely on the borrower's promise to repay rather than any secured asset. Essentially, they assume greater risk, leading to higher potential returns in terms of interest. Acknowledging this distinction is crucial for anyone dealing with debt, as it influences repayment strategies. Utilizing a Notice creditors form for unsecured helps streamline communication with your creditors, ensuring they are aware of your situation.