Creditor Search For Meaning

Description

How to fill out Creditor Search For Meaning?

Navigating through the red tape of official documentation and templates can be challenging, particularly if one does not handle that professionally.

Even locating the appropriate template to conduct a Creditor Search For Meaning will be laborious, as it must be legitimate and precise to the very last numeral.

Nonetheless, you will need to devote considerably less time procuring a fitting template from a source you can trust.

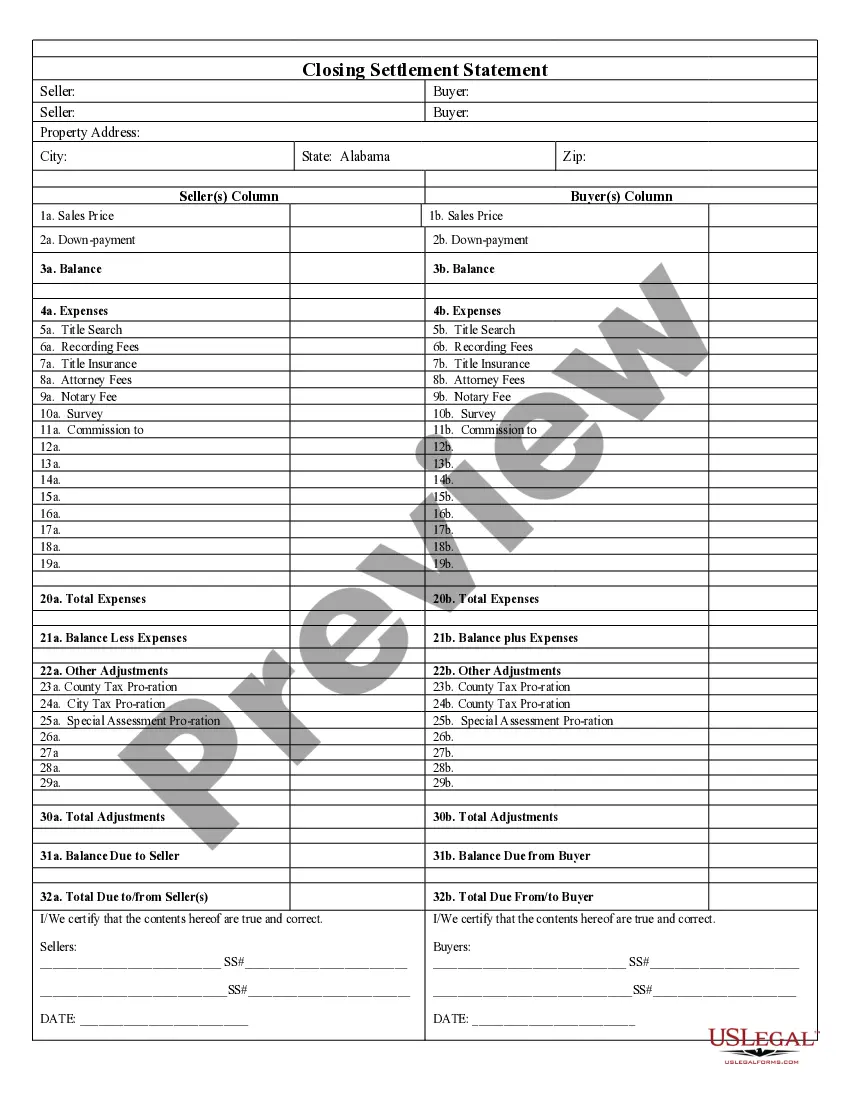

Obtain the correct form in a few straightforward steps: Enter the title of the document in the search bar. Locate the proper Creditor Search For Meaning from the list of results. Review the summary of the sample or access its preview. If the template meets your specifications, click Buy Now. Proceed to select your subscription option. Provide your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template document to your device in the format of your preference. US Legal Forms will save you time and effort verifying if the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms is a single repository where you can find the latest samples of documents, verify their usage, and download these samples to complete them.

- This is a collection with over 85K forms applicable in various fields.

- When searching for a Creditor Search For Meaning, you will not have to question its authenticity as all the forms are validated.

- An account at US Legal Forms will ensure you have all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents catalog.

- You can retrieve your saved forms from any device by clicking Log In on the library website.

- If you still haven't created an account, you can always search for the template you require.

Form popularity

FAQ

To compile a list of your creditors, begin by gathering personal financial documentation, including past statements and bills. A thorough review of your credit report also reveals outstanding debts and creditor details. Additionally, platforms like US Legal Forms offer resources to help you identify and document all creditors. Conducting a creditor search for meaning ensures you have a complete understanding of your financial landscape.

To find out who currently owns your debt, start by reviewing any account statements or notices you have received. Many creditors will indicate whether they have sold your debt to another collector. You can also request this information directly from the original creditor or utilize a creditor search for meaning to track down the new owner. Engaging in these steps will provide clarity on your financial obligations.

To obtain a creditor statement, reach out directly to the creditor or debt collector who manages your account. You can request a detailed statement that outlines your debt, payments made, and remaining balances. Alternatively, using services like US Legal Forms can assist in accessing necessary forms and understanding your rights in this matter. Engaging in a creditor search for meaning often facilitates clearer communication with creditors.

To find the creditors of a company, you can start by reviewing public records and financial statements. Check the company’s bankruptcy filings, if applicable, as this often lists creditors. Additionally, online databases and legal resources may provide insights on creditor associations. Utilizing a creditor search for meaning can help you identify these important relationships.

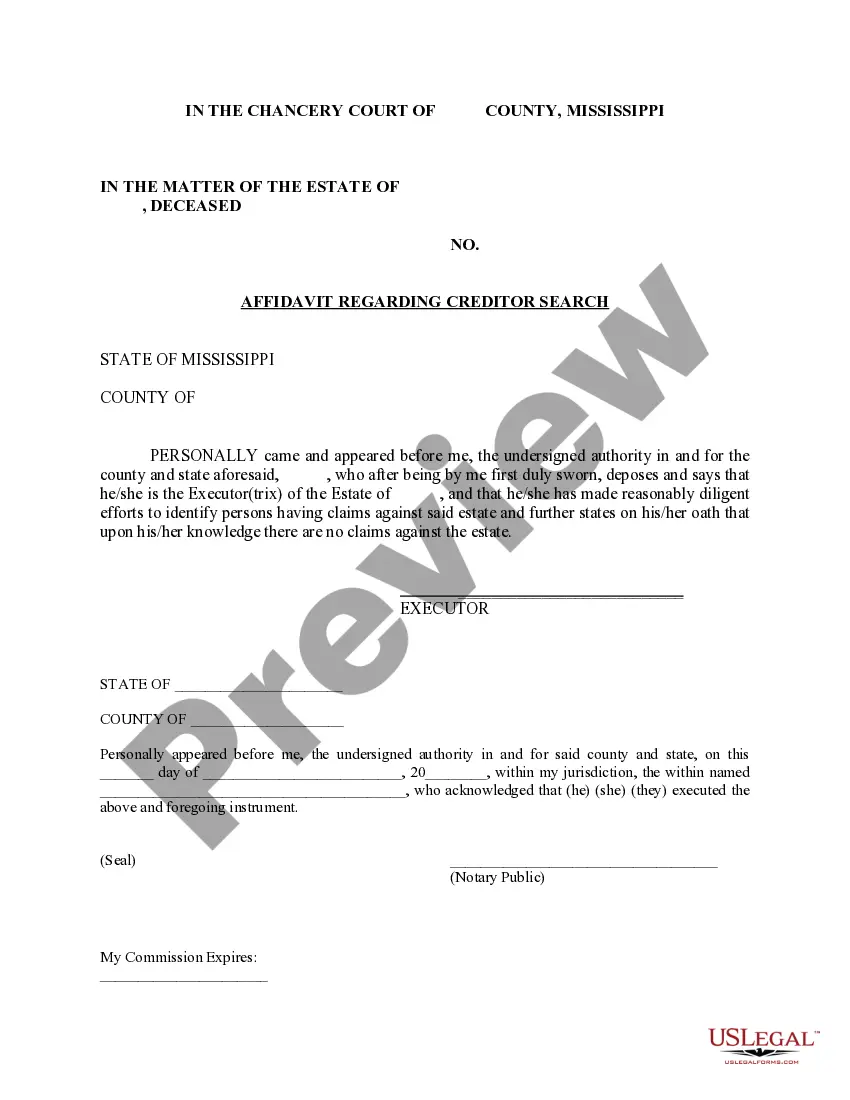

To complete a proof of debt, ensure all sections of the form are filled out accurately. Attach all necessary supporting documents, such as invoices or account statements, to verify your claim. It is advisable to review your submission for accuracy, as this directly impacts the creditor search for meaning and the likelihood of a smooth claims process during insolvency.

Filling in a proof of debt form involves several straightforward steps. First, gather relevant documents that support your claim. Then, clearly indicate the debtor's details, the total debt amount, and include any proof of transactions or agreements. Using USLegalForms can enhance your experience by providing easy-to-follow instructions and templates, aiding in your creditor search for meaning.

A proof of debt document is a formal statement that confirms a creditor's claim against a debtor. This document typically includes details such as the amount owed, the nature of the debt, and any relevant supporting evidence. Understanding this document aids in the creditor search for meaning, as it clarifies your rights as a creditor and the obligations of the debtor.

To fill in a creditor proof of debt form, begin by gathering all your relevant financial information. Ensure you accurately enter the debtor's name, the amount you claim, and any supporting documents. Using platforms like USLegalForms can simplify this process, providing templates that guide you through each required section, making your creditor search for meaning more efficient.

A proof of debt statement of account is a document that details the amount owed by a debtor to a creditor. This statement serves as evidence of the debt during bankruptcy or insolvency proceedings. It plays a crucial role in the creditor search for meaning because it outlines the financial obligation, helping both creditors and debtors understand the nature of their relationship.

Access to Non-Public Insolvency Information (NPII) is generally limited to specific authorized parties, such as creditors and legal professionals involved in debt recovery. However, knowing how the NPII operates can empower you during a creditor search for meaning. Platforms like US Legal Forms can provide guidance on how to navigate these processes.