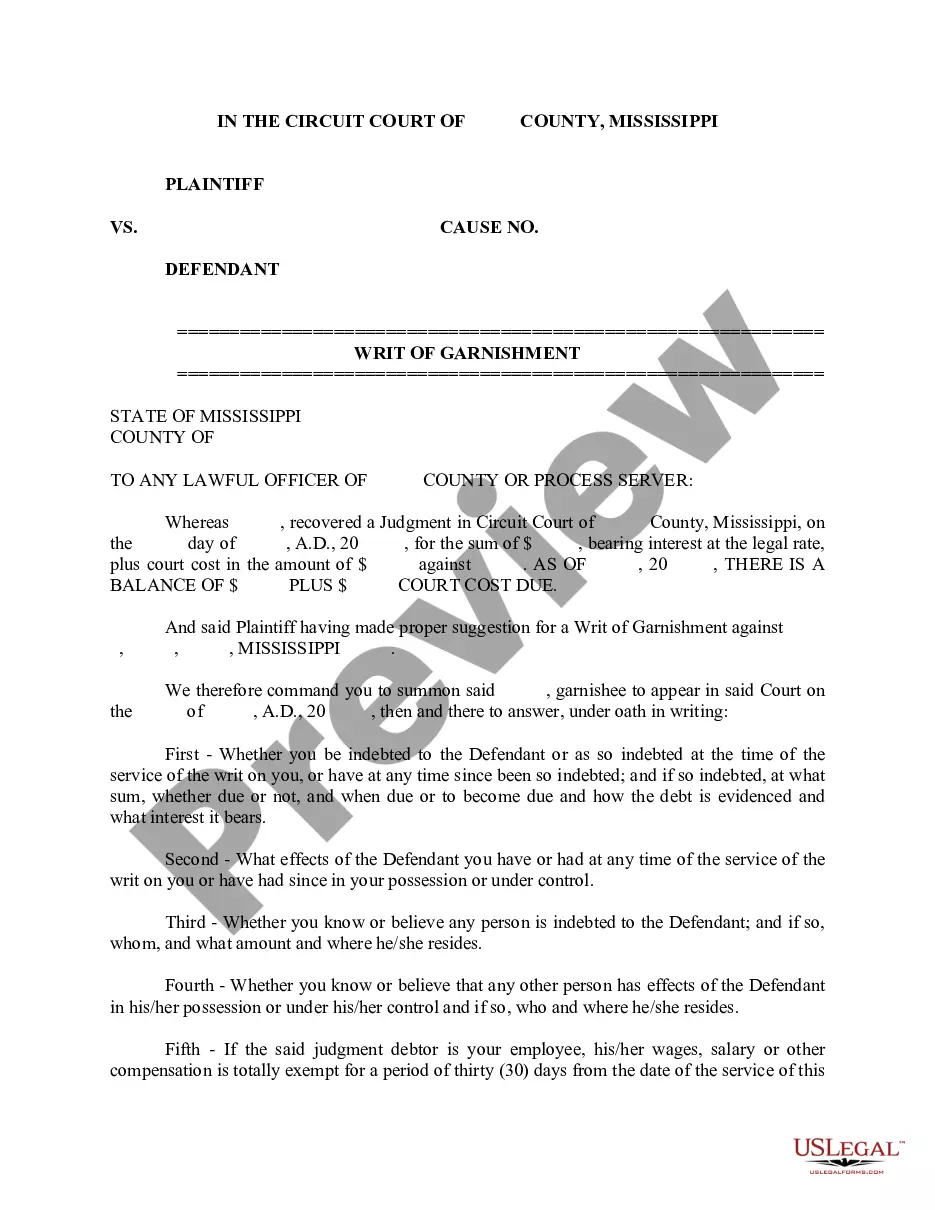

Mississippi Writ Of Garnishment Form

Description

How to fill out Mississippi Writ Of Garnishment Form?

Properly prepared official documents are one of the essential assurances for preventing problems and legal disputes, but acquiring it without a lawyer's help may require time.

Whether you need to swiftly locate an up-to-date Mississippi Writ Of Garnishment Form or any other templates for employment, family, or business situations, US Legal Forms is consistently here to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Additionally, you can access the Mississippi Writ Of Garnishment Form at any future time, as all documents previously acquired on the platform remain accessible within the My documents tab of your profile. Save time and money on preparing official documents. Try US Legal Forms today!

- Verify that the form is appropriate for your case and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Press Buy Now upon finding the relevant template.

- Select the pricing plan, Log In to your account or set up a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Mississippi Writ Of Garnishment Form.

- Click Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

In Mississippi, the maximum amount you can sue for in civil court can depend on the type of case. Generally, for most civil actions, there is no cap on damages, but small claims court has a limit of $3,500. It's wise to understand how these limits apply when pursuing a case related to garnishment or debts, particularly when utilizing resources like the Mississippi writ of garnishment form on US Legal Forms.

Writing an objection letter for wage garnishment requires clear communication. Begin with your name, contact details, and a formal greeting. Next, explain your situation and specify why you are objecting to the garnishment, referencing your rights under the Mississippi writ of garnishment form. This helps ensure your objections are understood and taken seriously.

Filling out a challenge to garnishment form is straightforward. Start by providing your personal information at the top, including your name and address. Then, clearly state the reasons for your challenge, citing relevant laws or circumstances. To simplify this process, consider using the Mississippi writ of garnishment form available on US Legal Forms, which offers guidance and easy-to-follow instructions.

In Mississippi, the maximum amount that can be garnished from an employee's paycheck is 25% of their disposable earnings for that week. This percentage may vary if child support or other special circumstances apply. Familiarizing yourself with the Mississippi writ of garnishment form ensures that you follow legal limits when garnishing wages.

In Mississippi, you can begin garnishing wages immediately after obtaining a judgment against the debtor. It is important to initiate the process as soon as possible to ensure timely collection. Utilizing the Mississippi writ of garnishment form effectively sets you on the right path.

To file a garnishment in Mississippi, start by obtaining a judgment from the court. After that, complete the Mississippi writ of garnishment form and submit it to the appropriate court. Following the filing, you will also need to serve the garnishment order on the third party holding the debtor's funds or wages.

If you receive a writ of garnishment, it is crucial to review the document carefully and understand its implications. You may want to consult a legal professional to explore your options. Additionally, knowing about the Mississippi writ of garnishment form and your rights can help you respond appropriately to the situation.

The process begins by filing a Mississippi writ of garnishment form after obtaining a judgment against the debtor. Once filed, the court notifies the third party (like an employer or bank) that they must withhold a portion of the debtor's wages or funds. Following notification, the third party must comply and remit the withheld amount to the creditor.

Garnishments typically take a few weeks to process after all necessary paperwork is submitted. The timeline can depend on various factors, including the court's schedule and the responsiveness of the financial institutions involved. It is important to prepare your Mississippi writ of garnishment form correctly to avoid delays in the process.

A release of writ of garnishment indicates that the court has determined that the garnishment is no longer necessary, often because the debt has been satisfied. This release allows any withheld funds to be returned to you, stopping further deductions from your earnings. Understanding how to properly file for this release, often using the Mississippi writ of garnishment form, can help streamline the process and restore your financial control.