Motion To Interplead Funds With Low Minimum Investment

Description

Form popularity

FAQ

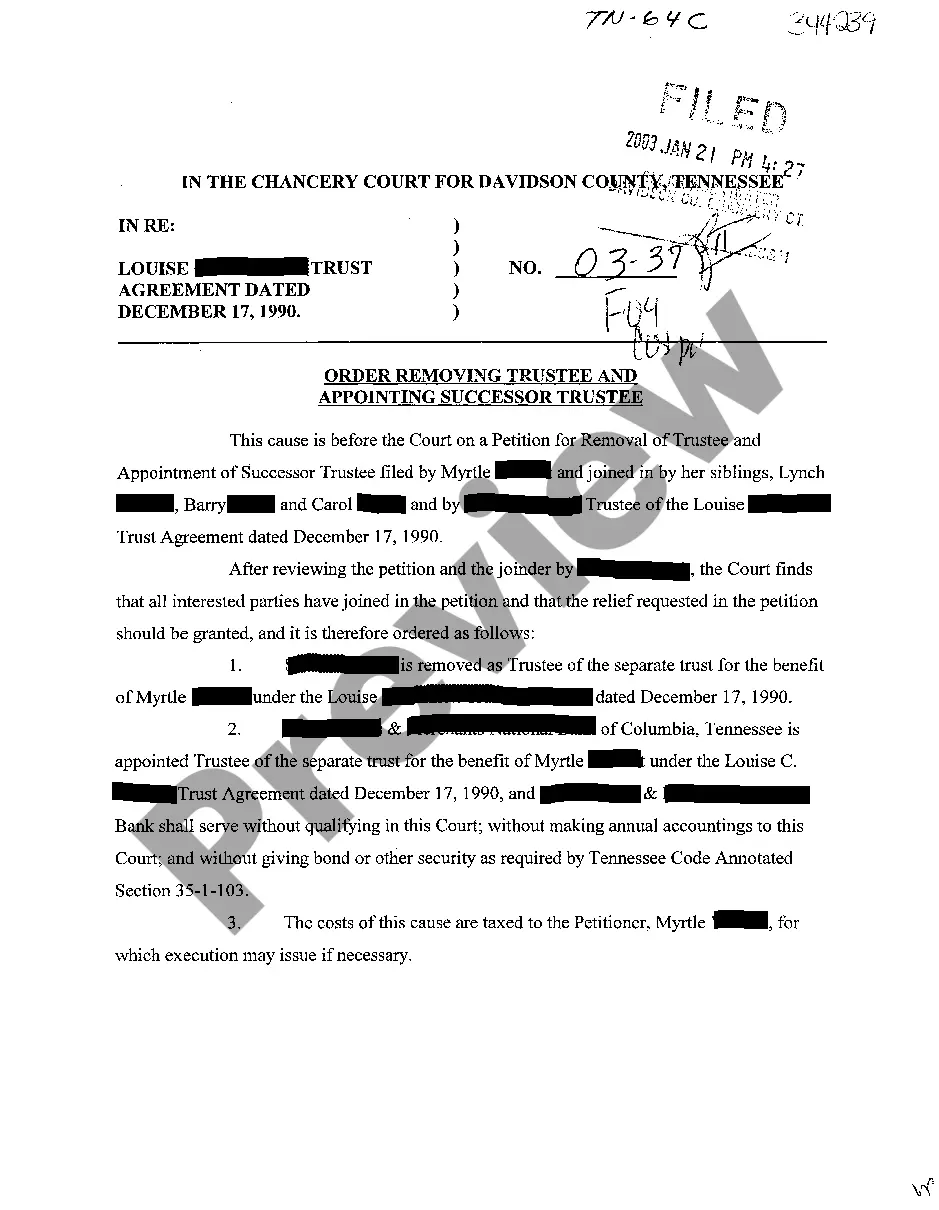

Interpleader proceedings in Malaysia provide a legal avenue for stakeholders facing competing claims over funds or property to resolve disputes efficiently. The process usually begins with a motion to interplead funds with low minimum investment, allowing stakeholders to deposit the conflicting funds with the court. This protects them from future liability while enabling all interested parties to contest their claims before a judge. Such proceedings promote fairness and resolve disputes systematically.

In Nigeria, there are several types of interpleaders, including statutory and common law interpleaders. A statutory interpleader often involves funds held by a stakeholder, while a common law interpleader deals with disputes over property rights. When considering a motion to interplead funds with low minimum investment, understanding the applicable type can help in resolving disputes effectively. Consulting legal resources can provide further guidance on the nuances of interpleader in Nigeria.

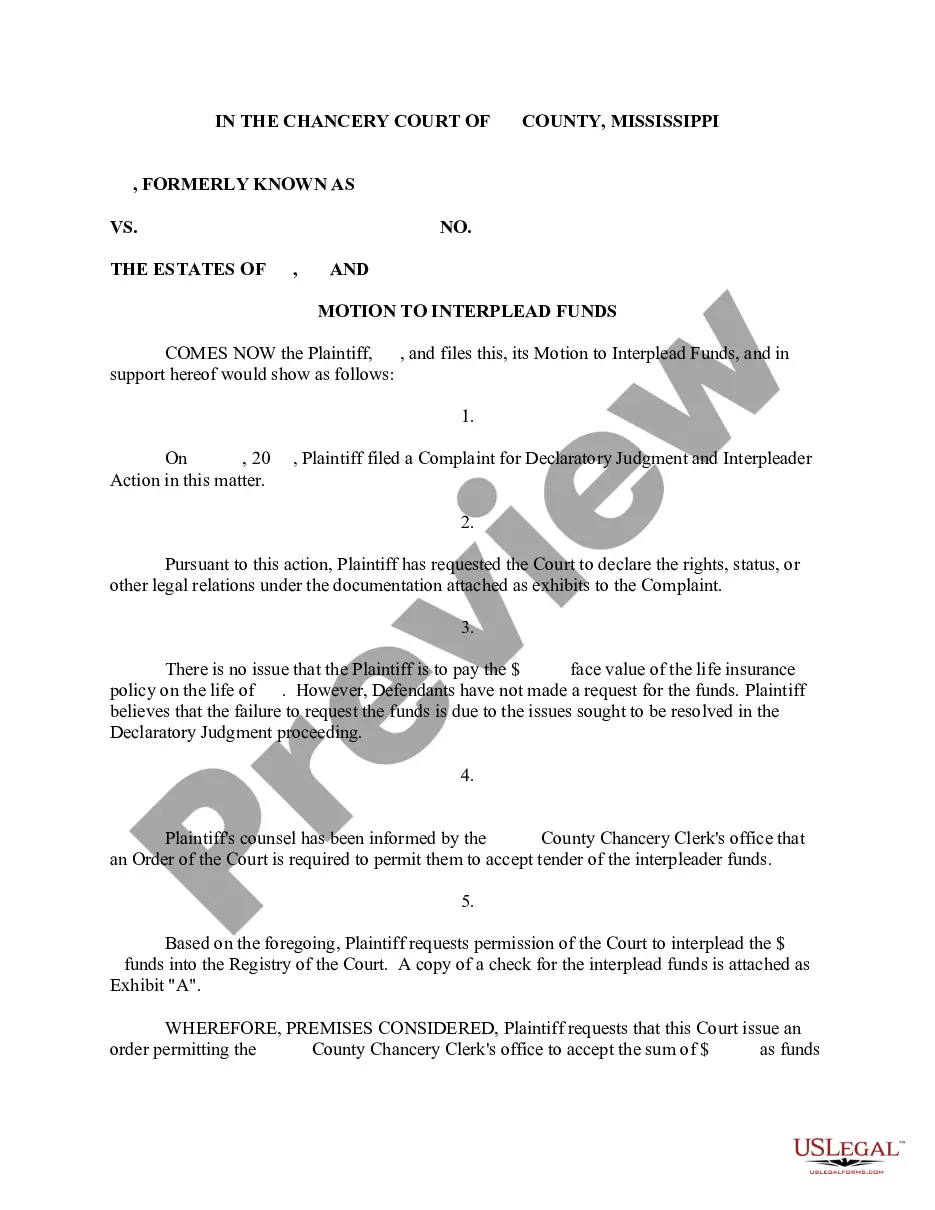

The procedure for interpleader typically involves filing a motion to interplead funds with low minimum investment with the appropriate court. The individual or entity must outline the conflicting claims against the funds or property. After reviewing the motion, the court will generally order the disputed funds to be deposited, allowing all claimants to present their cases in a single proceeding. This streamlined process not only expedites resolution but also conserves legal resources.

In Texas, the interpleader process allows a stakeholder, like a bank or insurance company, to file a motion to interplead funds with low minimum investment when multiple parties claim the same asset. The stakeholder submits a petition to the court, along with the conflicting claims. The court will then issue an order allowing the stakeholder to deposit the funds with the court, thereby releasing them from liability. This efficient method protects the stakeholder from being pulled into prolonged disputes.

Interpleader is not the same as third party proceedings, although they might seem similar. In interpleader, a party seeks to settle claims from others regarding a single fund or property, while third-party actions involve bringing in additional parties to defend against a claim. A motion to interplead funds with low minimum investment can help streamline the process by consolidating claims in one court, reducing confusion and potential costs. Understanding these distinctions can guide you to make informed legal decisions.

Interpleader jurisdiction in the Philippines refers to the court's authority to resolve disputes involving multiple claimants over the same funds or property. In this context, a plaintiff may file a motion to interplead funds with low minimum investment to protect themselves from multiple liabilities. The court directs all parties to present their claims, ensuring a fair resolution. This process helps avoid conflicting judgments and provides clarity on ownership.

Someone might initiate an interpleader action to avoid legal liability when unsure of who rightfully owns the assets in question. This process protects the stakeholder from having to choose sides among claimants. By filing a motion to interplead funds with low minimum investment, you can efficiently resolve disputes and safeguard your interests.

To successfully initiate an interpleader action, claimants must have differing claims on the same asset, and the court must have jurisdiction. Furthermore, the stakeholder must not have a vested interest in the outcome. Filing a motion to interplead funds with low minimum investment simplifies compliance with these requirements, allowing you to focus on resolution.

The requirements for Rule 22 interpleader include a determination that two or more parties have conflicting claims over the same funds or property. Additionally, the court must have jurisdiction based on diversity or a federal question. By filing a motion to interplead funds with low minimum investment, you can satisfy these requirements and navigate your claims smoothly.

Diversity requirements for interpleader state that the claimants must reside in different states or jurisdictions. This requirement ensures that a federal court can have authority over the parties involved. Utilizing a motion to interplead funds with low minimum investment can facilitate this process, as it allows you to bring together diverse claimants in court efficiently.