Mississippi Support Application Withholding Order

Description

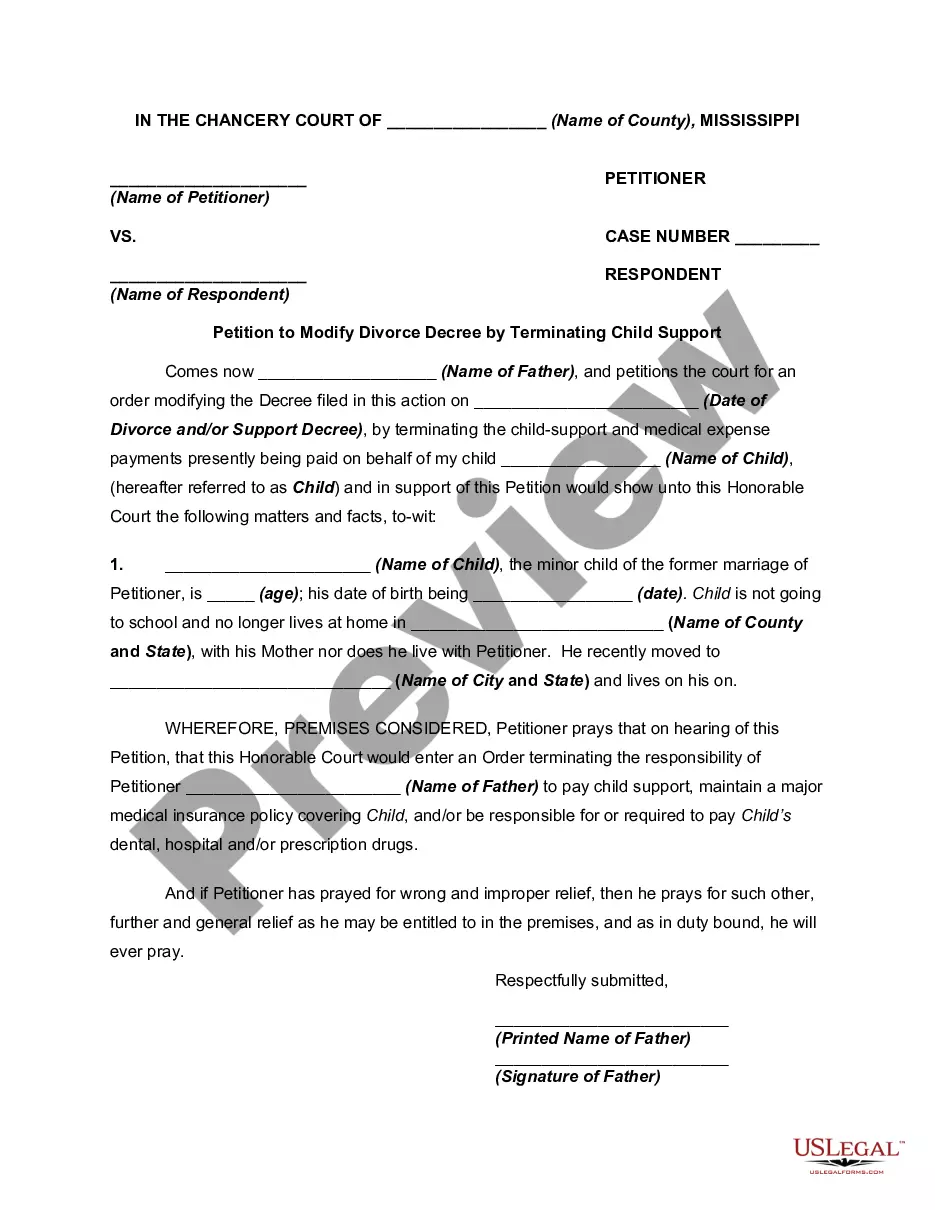

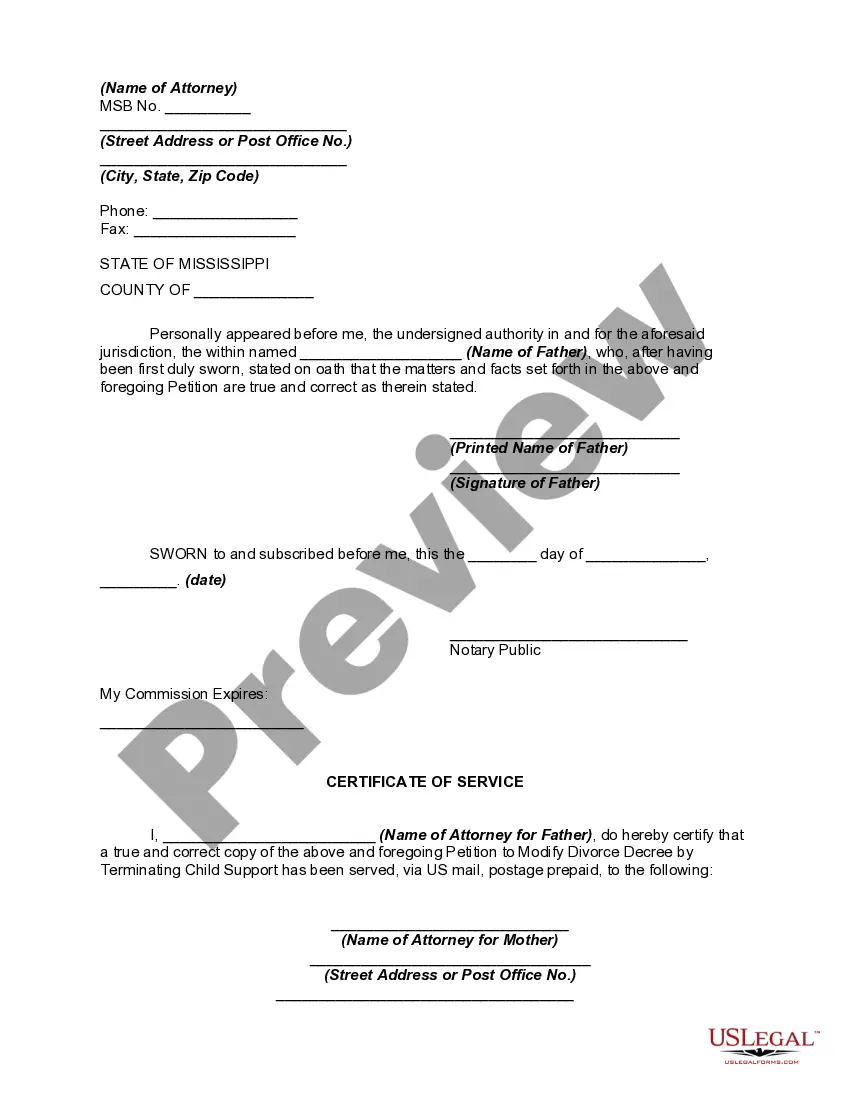

How to fill out Mississippi Petition To Modify Divorce Decree By Terminating Child Support - Child Emancipated?

Individuals often link legal documentation with something intricate that solely a professional can manage.

To some extent, this is accurate, as composing the Mississippi Support Application Withholding Order necessitates significant knowledge of subject matter, including state and county statutes.

However, with US Legal Forms, everything has become simpler: pre-made legal templates for any personal and business circumstance tailored to state regulations are compiled in a single online library and are now within reach for everyone.

Choose the format for your document and click Download. Print your file or upload it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them whenever needed via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, making the process of finding the Mississippi Support Application Withholding Order or any other specific template quick.

- Previously registered users with an active subscription must Log In to their account and click Download to access the form.

- New users will first need to create an account and subscribe prior to saving any documents.

- Here’s a step-by-step guide on how to acquire the Mississippi Support Application Withholding Order.

- Review the page content carefully to ensure it suits your needs.

- Examine the form description or preview it using the Preview option.

- If the previous one doesn’t meet your needs, search for another sample using the Search field above.

- When you find the appropriate Mississippi Support Application Withholding Order, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

- Create an account or Log In to continue to the payment section.

- Make the payment for your subscription via PayPal or with your credit card.

Form popularity

FAQ

To file for child support in Mississippi, you should begin by completing the necessary Mississippi support application withholding order. This application allows the court to establish the amount of support owed, and it can be submitted through an attorney or directly at your local court. Our platform, US Legal Forms, offers a step-by-step guide to help you through the filing process efficiently. Using our forms can streamline your experience and ensure you meet all requirements.

Yes, Mississippi has state withholding for child support payments. Under the Mississippi support application withholding order process, employers are required to withhold child support directly from an employee's paycheck. This ensures that payments reach the custodial parent consistently and on time. You can learn more about this process by using our user-friendly platform to navigate through Mississippi's regulations.

IWO stands for Income Withholding Order, a legal tool to ensure timely child support payments. This order directs an employer to withhold a portion of a parent’s income to fulfill child support obligations. Utilizing a Mississippi support application withholding order simplifies this process, making it easier for parents to secure regular payments. If you need assistance with obtaining an IWO, services like US Legal Forms can guide you through the necessary steps.

In Mississippi, the general rule is that child support obligations continue until the child turns 21 years old, unless the court specifies otherwise. Parents may apply for a modification of the support order through a Mississippi support application withholding order once the child reaches the age of majority. It’s important to understand how these laws affect your specific situation. If you’re unsure about the process, consider using platforms like US Legal Forms to help navigate your options.

The maximum amount that can be taken for child support in Mississippi generally aligns with federal guidelines, allowing up to 50% of a non-custodial parent's disposable income to be withheld. However, this amount may vary if there are additional legal obligations. To help with compliance, you can initiate a Mississippi support application withholding order. For personalized advice, it's helpful to consult an attorney who can assist you in understanding what applies to your specific case.

The maximum rate of child support in Mississippi is calculated based on multiple factors, including the income of both parents and the needs of the child. Each case is different, and the court considers guidelines to determine a fair rate. Engaging in a Mississippi support application withholding order can enforce these child support payments once established. For precise rates regarding your circumstances, work with a knowledgeable attorney.

In Mississippi, the maximum amount that can be garnished for child support is determined by federal guidelines. Generally, up to 50% of disposable income can be withheld for child support, but this can change based on other obligations. Utilizing a Mississippi support application withholding order can facilitate these garnishments effectively. It's advisable to seek consultation if you have questions about specific limitations based on your situation.

To stop child support payments in Mississippi, you must prove a significant change in circumstances, such as job loss or changes in custody. Simply wanting to stop payments is not sufficient; legal documentation is required. Filing for a modification through the courts can involve a Mississippi support application withholding order to adjust obligations. Always consult with a legal professional to navigate this process properly.

The maximum amount that can be withheld for child support in Mississippi generally depends on the payer's income and family size. Typically, the limit is set at 50% of disposable earnings if the non-custodial parent has other support obligations. To protect your interests, consider utilizing a Mississippi support application withholding order to ensure compliance. It's crucial to get accurate calculations based on your unique situation by consulting with legal experts.

Yes, child support is mandatory in Mississippi when a court orders it. The state enforces this obligation through mechanisms such as the Mississippi support application withholding order. It ensures that non-custodial parents contribute financially to their child's upbringing, which benefits the child's welfare.