Life Estate With Remainder

Description

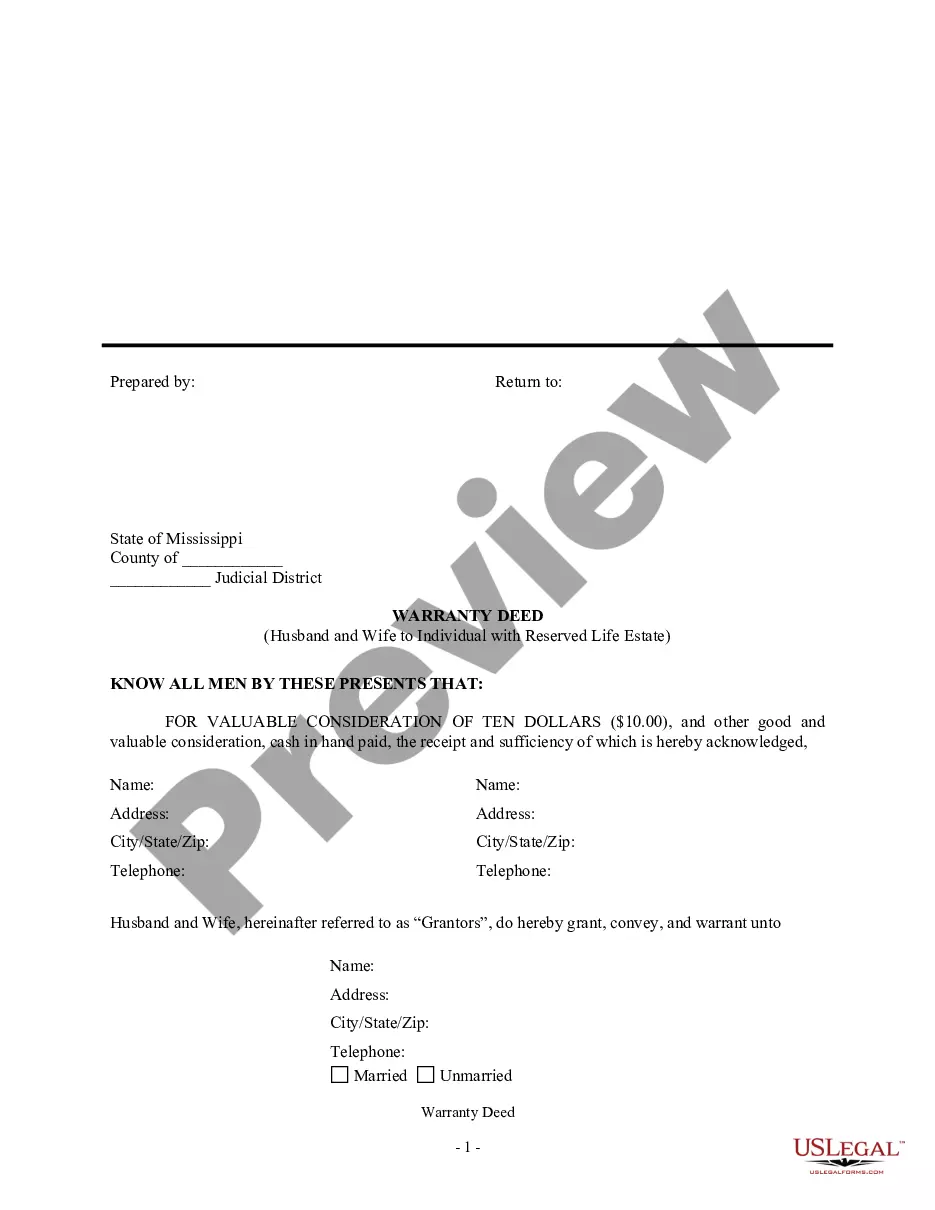

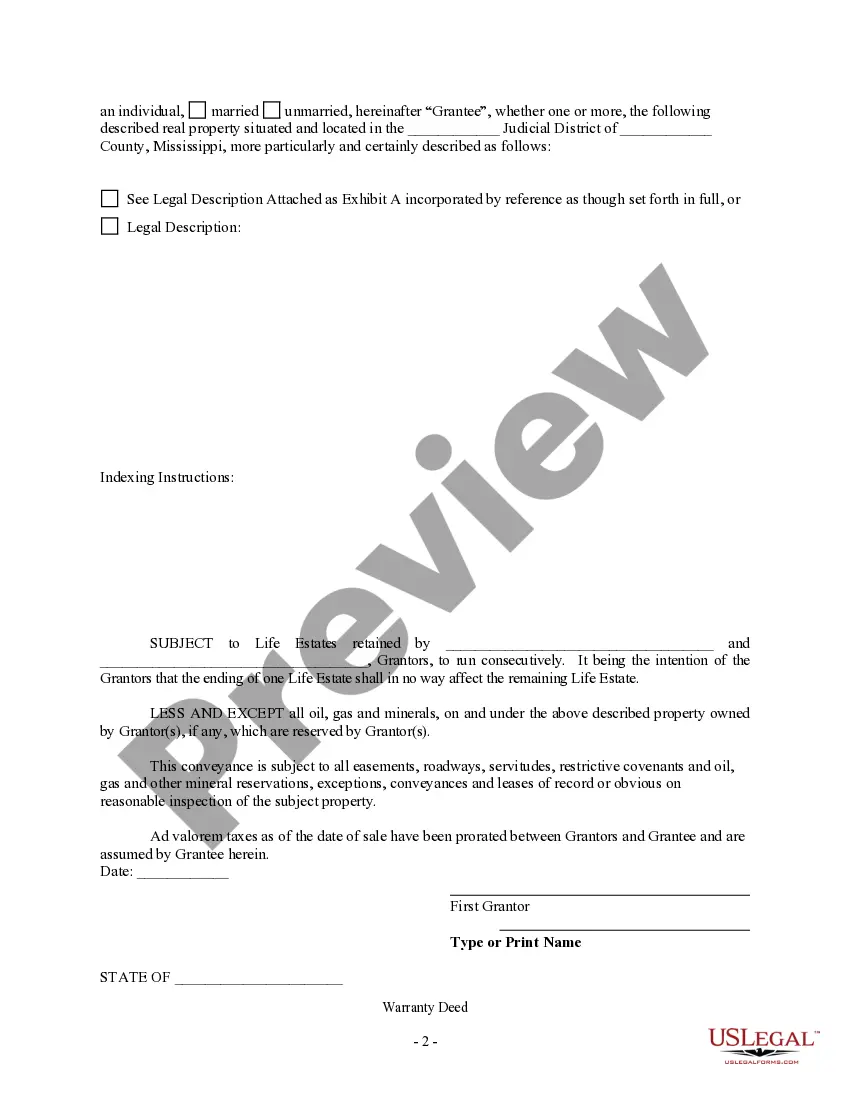

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log into your US Legal Forms account if you're an existing user, ensuring your subscription is active.

- If you’re new, start by checking the preview mode and form descriptions to select the appropriate legal documents that fit your needs.

- If necessary, utilize the search feature to find alternate templates that align more closely with your requirements.

- Proceed to purchase the selected document by clicking 'Buy Now' and selecting your desired subscription plan; remember to create an account if prompted.

- Complete your purchase by entering your payment details or opting for PayPal, securing your subscription.

- Download the completed document, and access it anytime through the 'My Forms' section in your profile.

With US Legal Forms, you gain access to a robust collection of over 85,000 forms, more than many competitors offer, making it easier to find exactly what you need. Plus, premium experts are available to assist you, ensuring your documents are accurately filled out and legally sound.

Don’t hesitate to start your legal journey with US Legal Forms today and simplify your estate planning process!

Form popularity

FAQ

There are two primary types of vested remainders: vested remainders subject to open and vested remainders subject to complete divestment. The former allows for additional heirs, while the latter can be cut off if certain conditions occur. Knowing these types can help you navigate the complexities of a life estate with remainder more effectively.

Generally, a life tenant cannot evict a remainderman from the property. The remainderman holds a future interest that becomes relevant only after the life tenant's rights conclude. This ensures that the remainderman retains their future claim to the property, making the life estate with remainder a stable arrangement for both parties.

One potential disadvantage of a life estate deed is that it can limit the life tenant's ability to sell or mortgage the property without the remainderman's consent. Additionally, the life tenant remains responsible for property taxes, maintenance, and insurance, which can be a financial burden. Choosing a life estate with remainder requires careful consideration of these factors.

A life estate grants an individual the right to use and occupy a property for their lifetime, while a remainder denotes the interest someone holds to inherit the property after the life estate ends. Simply put, the life tenant enjoys the property during their lifetime, and the remainderman waits for their inheritance. Understanding these distinctions helps in navigating estate planning effectively.

In most cases, a life estate with remainder allows the remainderman to receive a step-up in basis. This means the property is revalued at current market rates at the time of the life tenant’s death, which can significantly reduce capital gains taxes. This provision can benefit the heirs, making life estates with remainder an appealing choice in estate planning.

Yes, a life estate can be linked to a vested remainder. A vested remainder is a type of remainder that guarantees the remainderman will inherit the property upon the life tenant's death. By securing a vested remainder in a life estate, you can provide clarity and certainty about asset distribution after passing.

The remainder of a life estate refers to the interest that someone holds in a property after the life estate ends. When the life tenant passes away or terminates their interest, the property will revert to the remainderman. This arrangement ensures that the remainderman receives full ownership, making the life estate with remainder an effective estate planning tool.

An ordinary life estate with remainder interest is a legal arrangement where one person has the right to use the property for their life, while another gains ownership upon their passing. This type of estate secures clear pathways of ownership and rights. This arrangement not only provides lifetime enjoyment to the life tenant but also ensures that the next owner is predetermined, reducing potential disputes.

Valuing a remainder interest involves assessing the current value of the property and estimating its future worth when the life estate concludes. This is often calculated using life expectancy tables and market conditions. Evaluating a life estate with remainder can be complex, so consulting resources like US Legal Forms can provide valuable guidance on how to navigate this process efficiently.

A remainder beneficiary is the person designated to receive property after the life estate ends. For instance, when Liz gives Mark a life estate in a property, she can name Sarah as the remainder beneficiary who will inherit the property upon Mark's death. This setup allows Liz to control who benefits from her estate even after her lifetime.