Life Estate With Powers

Description

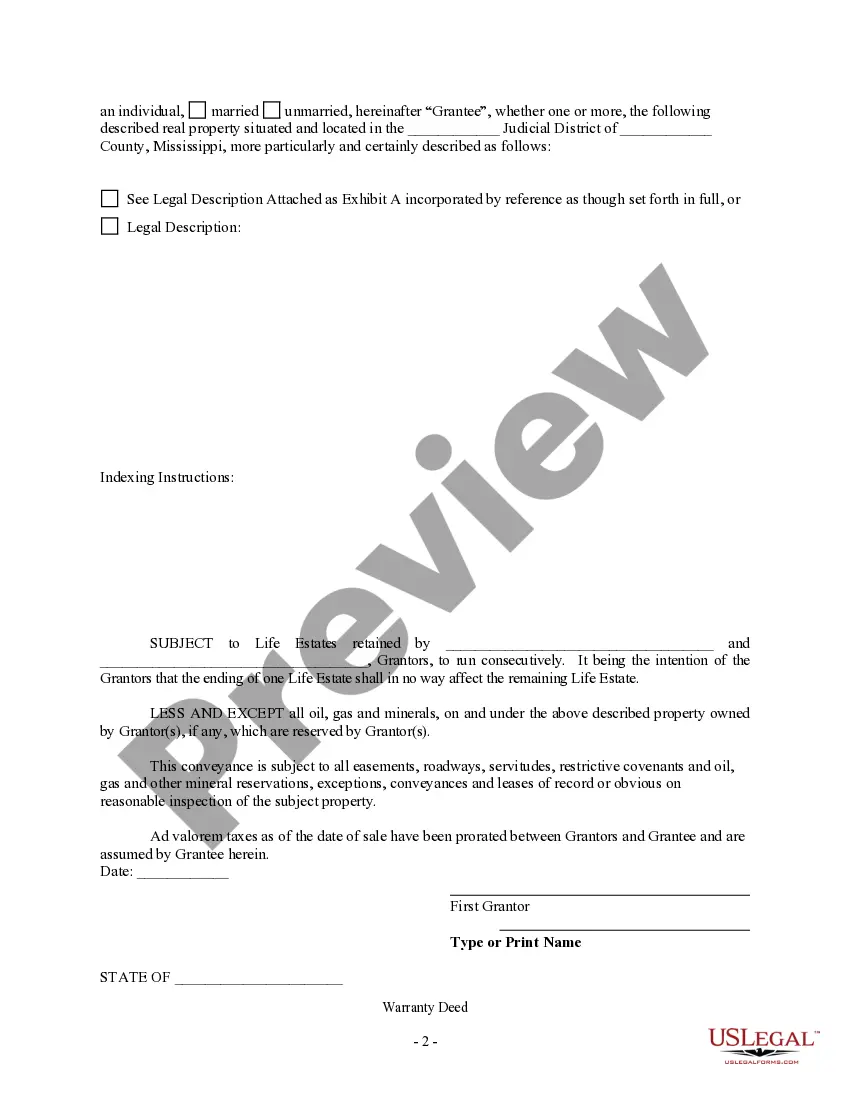

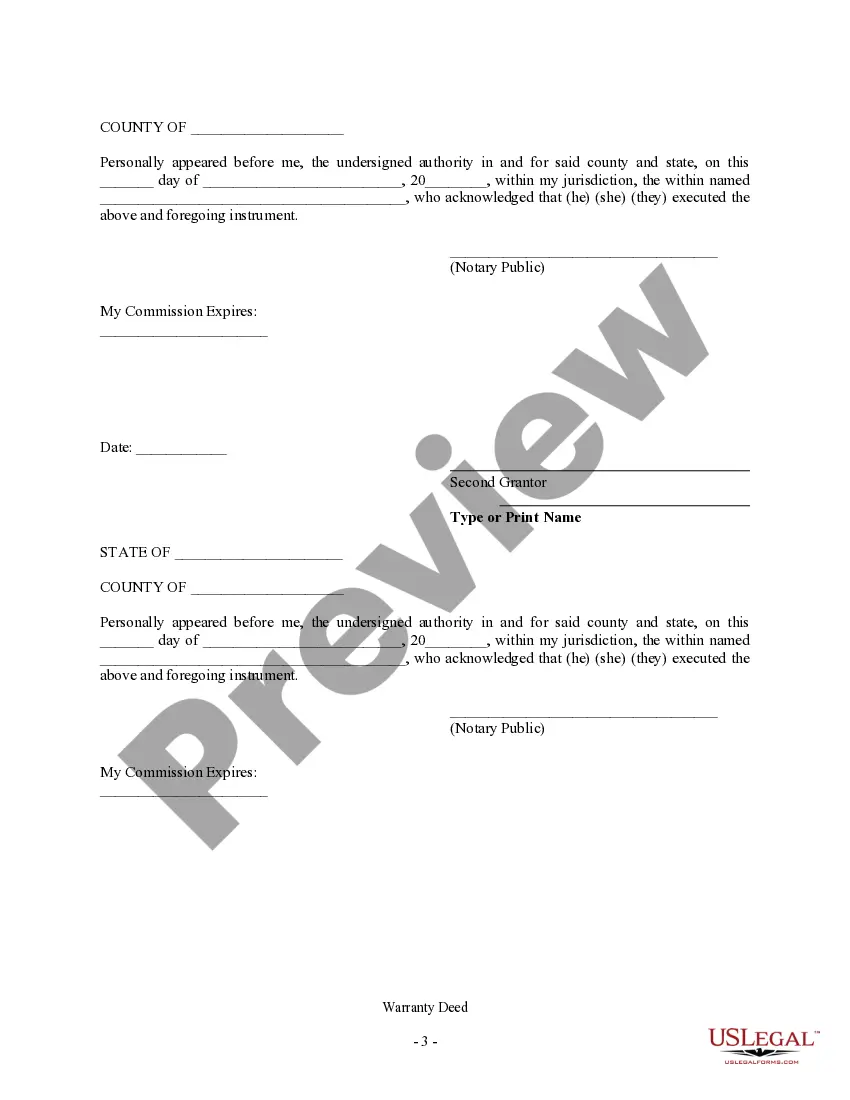

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

- If you are an existing user, log in to access your account and download the required life estate template directly. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by examining the preview and description of the life estate with powers form. Make sure it fits your specific legal needs and adheres to your state’s regulations.

- If the document does not meet your requirements, use the search feature to find an alternative template that does.

- Once you find the appropriate form, click the Buy Now button. Choose a subscription plan that suits you and create an account to access the full library of legal resources.

- Complete your purchase by entering your credit card or PayPal details to secure your subscription.

- Finally, download the form to your device. You can also access it anytime in the My Forms section of your profile.

By utilizing US Legal Forms for your life estate with powers documentation, you gain access to an unparalleled collection of over 85,000 customizable legal forms, along with support from premium experts, ensuring your legal documents are both accurate and comprehensive.

Take the next step in securing your legal needs today by exploring US Legal Forms.

Form popularity

FAQ

The primary disadvantage of a life estate with powers is that it limits the ability to sell or transfer the property without the cooperation of the remainderman. Additionally, any debts or liens tied to the property can become the responsibility of the life tenant, which may complicate matters. It’s crucial to weigh these factors carefully, and consulting with platforms like USLegalForms can provide valuable insights.

A life estate lasts for the lifetime of the individual who holds it. Upon their death, the estate automatically transfers to the remainderman, who is the individual or entity designated to receive the property. This arrangement means that while you control the property during your life, future ownership is predetermined. Utilizing resources from USLegalForms can help clarify these important details.

Yes, you can grant yourself a life estate with powers in your property. This allows you to maintain control and use of the property while also designating who will inherit the property after your death. Many people choose this route for estate planning purposes to ensure a smooth transition. Exploring options through USLegalForms can help you set this up correctly.

A life estate can be sold, but it is important to remember that the sale only allows the buyer to hold the property for the duration of the original owner's life. The seller retains power during their lifetime, but any value added or changes a new owner makes will revert once the life tenant passes away. For navigating these complex transactions, a platform like USLegalForms can guide you through the necessary documentation.

The duration of a life estate is based on the lifetime of the individual holding the interest. This means that the life estate lasts as long as that person is alive. Once they pass away, the rights to the property typically transfer to the next designated party. Understanding these nuances regarding a life estate with powers can help you plan effectively.

Yes, you can sell a house that is in a life estate with powers. The owner of the life estate holds the right to sell the property, but the buyer should understand that the life estate remains in place. This means the original life tenant will continue to live in the home until their death. If you have questions about navigating this process, US Legal Forms offers resources to guide you through the legal requirements.

People create life estates to maintain control over their property while planning for the future. This arrangement allows individuals to ensure that their heirs inherit the property, providing peace of mind. Moreover, a life estate with powers can aid in avoiding probate, simplifying the transfer of assets after passing away.

While a life estate can provide benefits, it also comes with downsides. For instance, life tenants may face challenges if they need to move or if their financial situation changes, as they cannot freely sell the property without consent from remainder beneficiaries. Furthermore, taxes and maintenance responsibilities typically fall on the life tenant, which can be a burden over time.

In Maryland, a life estate with powers grants the life tenant specific rights, allowing them to sell, transfer, or mortgage the property while they are alive. This arrangement benefits individuals who want to maintain some level of control over their property, while also ensuring that the remainder beneficiaries ultimately receive the asset. It is essential to consult legal resources, like UsLegalForms, to understand how Maryland’s laws impact your estate planning choices.

A life estate deed can create complications in estate planning, particularly if the life tenant wishes to sell or modify the property. The remainder beneficiaries may have limited control until the life tenant passes away, which could lead to disagreements. Additionally, creditors of the life tenant may pursue claims against the property, simplifying obstacles in managing the estate.