Life Estate With Condition Subsequent

Description

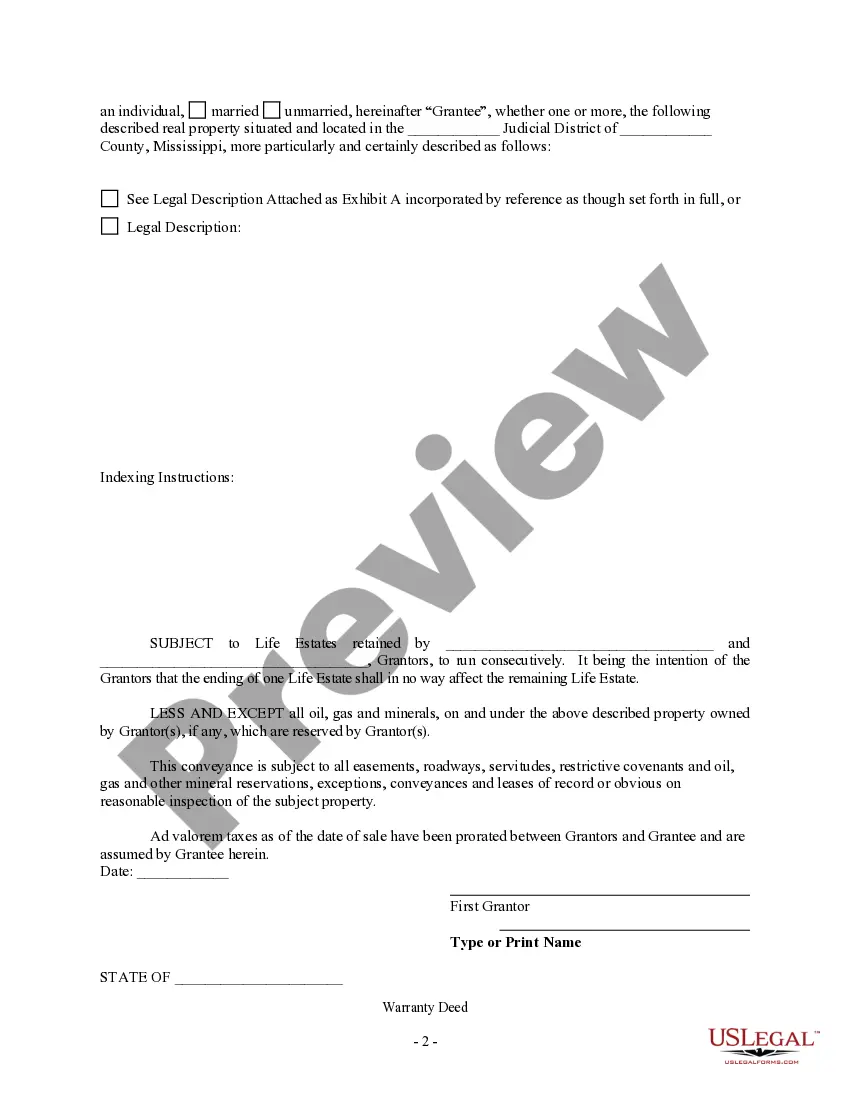

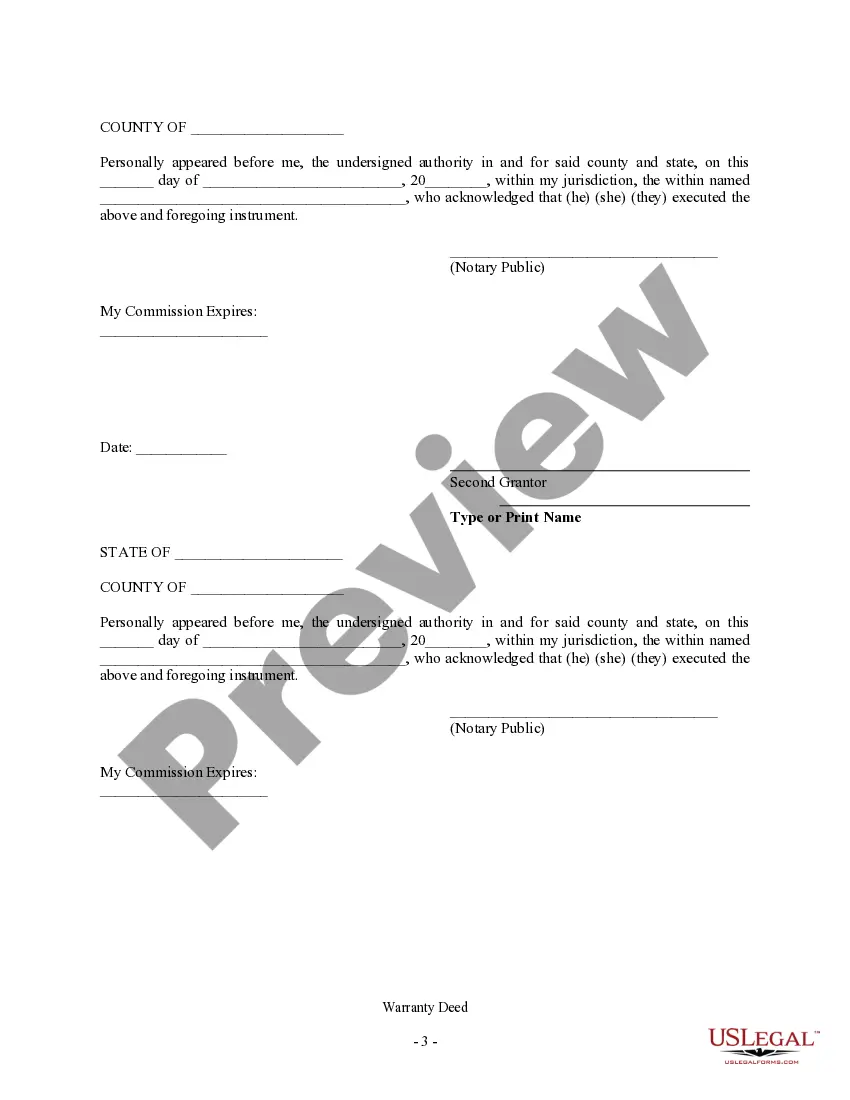

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

- For returning users, log in to your account and access the desired form to download it directly to your device. Verify your subscription status before proceeding, as renewal may be required.

- For first-time users, begin by exploring the Preview mode and form description. It’s essential to confirm that the selected template meets your specific needs while adhering to local jurisdiction standards.

- If you need a different template, utilize the Search tab located above to locate the appropriate one. Once you find a suitable document, continue to the next step.

- To acquire the form, click on the Buy Now button and choose a subscription plan that works for you. Registration is mandatory to gain full access to the vast library.

- Complete your purchase by entering your credit card information or opting to use your PayPal account for payment.

- Once the transaction is complete, download your form and save it on your device. You can find it later in the My Forms section of your profile.

In conclusion, US Legal Forms equips you with a powerful collection of legal templates that can ease your document preparation journey. Whether you're a returning user or new to the service, navigating legalities has never been more accessible.

Get started today and simplify your legal document needs with US Legal Forms!

Form popularity

FAQ

A life estate with condition subsequent grants an individual ownership of property for their lifetime, with the stipulation that the estate can terminate if specific conditions are violated. This type of estate allows for continued use during the owner's life but can create uncertainty regarding future ownership. It is vital to consider how this arrangement impacts your estate planning, ensuring that all parties involved clearly understand the terms.

While there are benefits to a life estate deed, such as avoiding probate, some disadvantages also exist. For instance, a life estate with condition subsequent can limit the owner's ability to sell the property or make modifications without facing potential reversion. Additionally, the complexities of ownership can lead to misunderstandings among family members or beneficiaries, which makes thorough planning essential.

A determinable estate is a type of property interest that continues until a specified event occurs, causing it to end automatically. In these situations, if the outlined condition is violated, ownership reverts back to the grantor without further action required. Grasping this concept is essential for anyone considering how their estates will function under various circumstances.

Determinable estates automatically revert to the grantor upon breach of condition, while a life estate with condition subsequent requires the grantor to take formal action to reclaim property. The consequences of these differences can influence how individuals choose to structure their estate plans. Understanding these nuances is crucial for anyone looking to navigate property interest intricacies.

The key distinguishing factor between a determinable estate and a condition subsequent estate is the automatic reversion of property. A life estate with condition subsequent requires active intervention by the grantor for reversion, unlike a determinable estate, which reverts automatically. This can significantly impact the strategies you employ during estate planning.

The most significant difference lies in the automatic nature of the transfer of interest. In a determinable estate, the estate automatically reverts back to the grantor when the specified condition occurs, whereas in a life estate with condition subsequent, the grantor must take action to regain the property. This means that conditional estates offer distinct legal implications that can affect your ownership rights and responsibilities.

A life estate with condition subsequent creates an interest that can be ended based on specific conditions, while an executory interest is a future interest that transfers ownership to another party upon the occurrence of a specified event. Essentially, a condition subsequent allows the original grantor to reclaim property if the conditions are not met, whereas executory interest automatically transfers the property to a third party. Understanding these distinctions ensures that you grasp the nuances of estate planning.

Individuals often choose a life estate with condition subsequent for various reasons. It allows a person to enjoy property rights during their lifetime while ensuring the property reverts to the original owner or their estate under specific conditions. This arrangement provides security for the life tenant, yet offers flexibility for the grantor to reclaim ownership if the conditions are not met. Platforms like US Legal Forms can simplify the creation of such legal documents, ensuring that all terms are clearly defined and legally binding.

Exiting a life estate with condition subsequent typically requires legal intervention. You may need to seek a formal agreement with the remainderman to relinquish your rights. In some cases, a legal action could result in a court-directed termination. Utilize resources like uslegalforms to streamline the process and ensure you complete the necessary documentation correctly.

If you're considering options around a life estate with condition subsequent, there are several pathways. One approach is to negotiate terms directly with the remainderman, who ultimately inherits the property. Engaging a legal professional can provide clarity and assistance in navigating these conditions. Additionally, platforms like uslegalforms can offer guidance on structuring agreements effectively.