Subcontractor Withholding Tax

Description

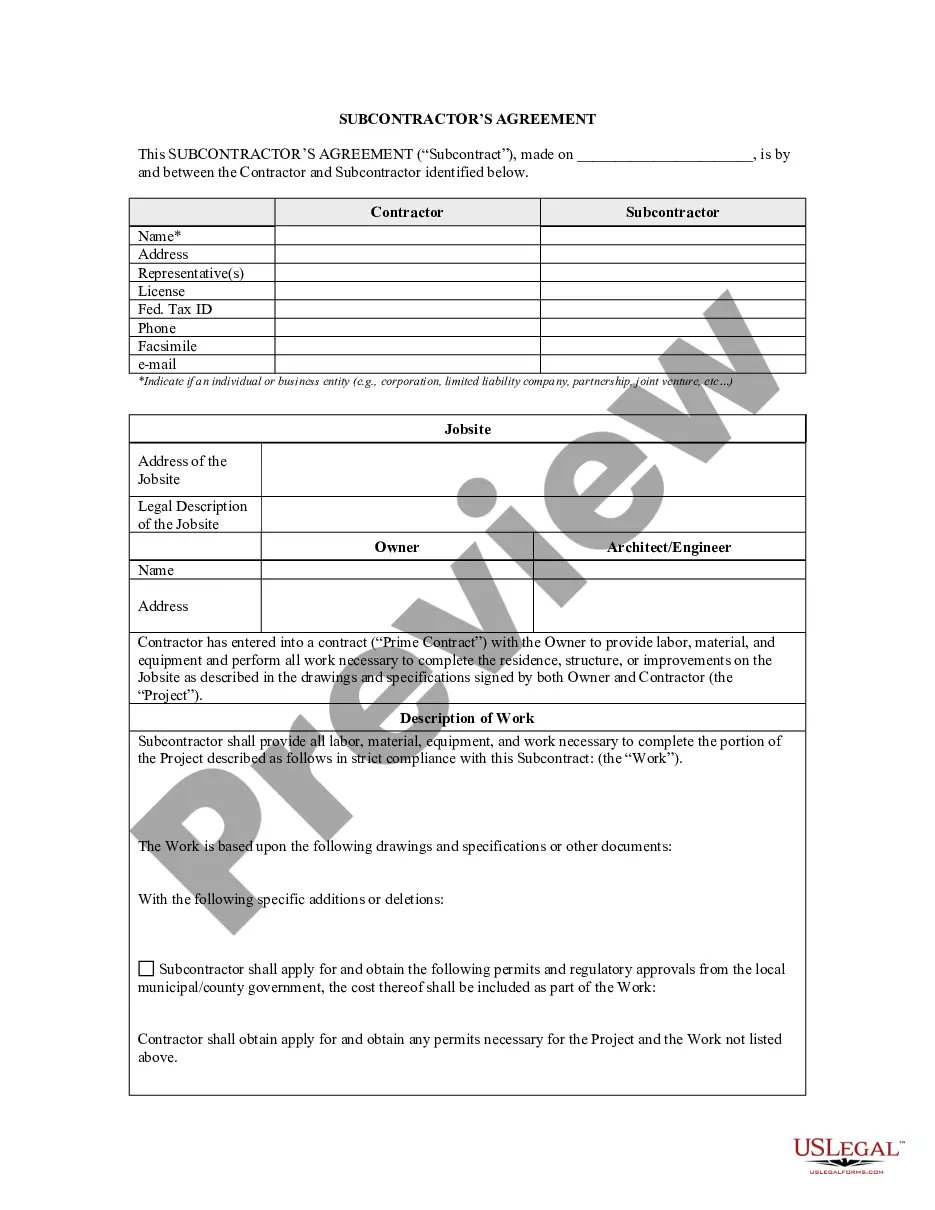

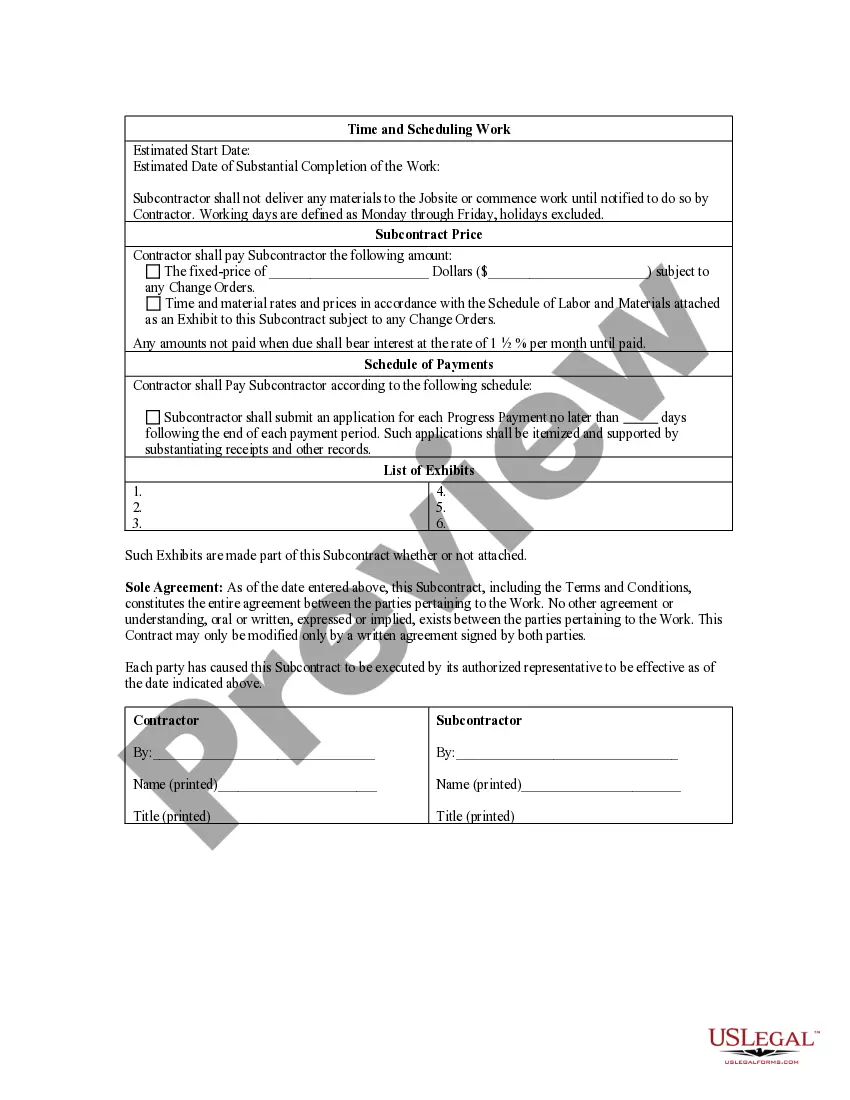

How to fill out Mississippi Subcontractor's Agreement?

Well-prepared official documents are among the key assurances for preventing issues and legal disputes, yet acquiring them without the aid of an attorney can be time-consuming.

If you need to swiftly locate an updated Subcontractor Withholding Tax or any other documents for employment, family, or business purposes, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can revisit the Subcontractor Withholding Tax at any time, as all documents obtained on the platform are accessible within the My documents section of your profile. Save time and resources when preparing official documents. Try US Legal Forms now!

- Ensure that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another template (if required) using the Search bar in the page header.

- Press Buy Now once you find the relevant document.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription (via credit card or PayPal).

- Select PDF or DOCX file format for your Subcontractor Withholding Tax.

- Click Download, then print the document to fill it in or upload it to an online editor.

Form popularity

FAQ

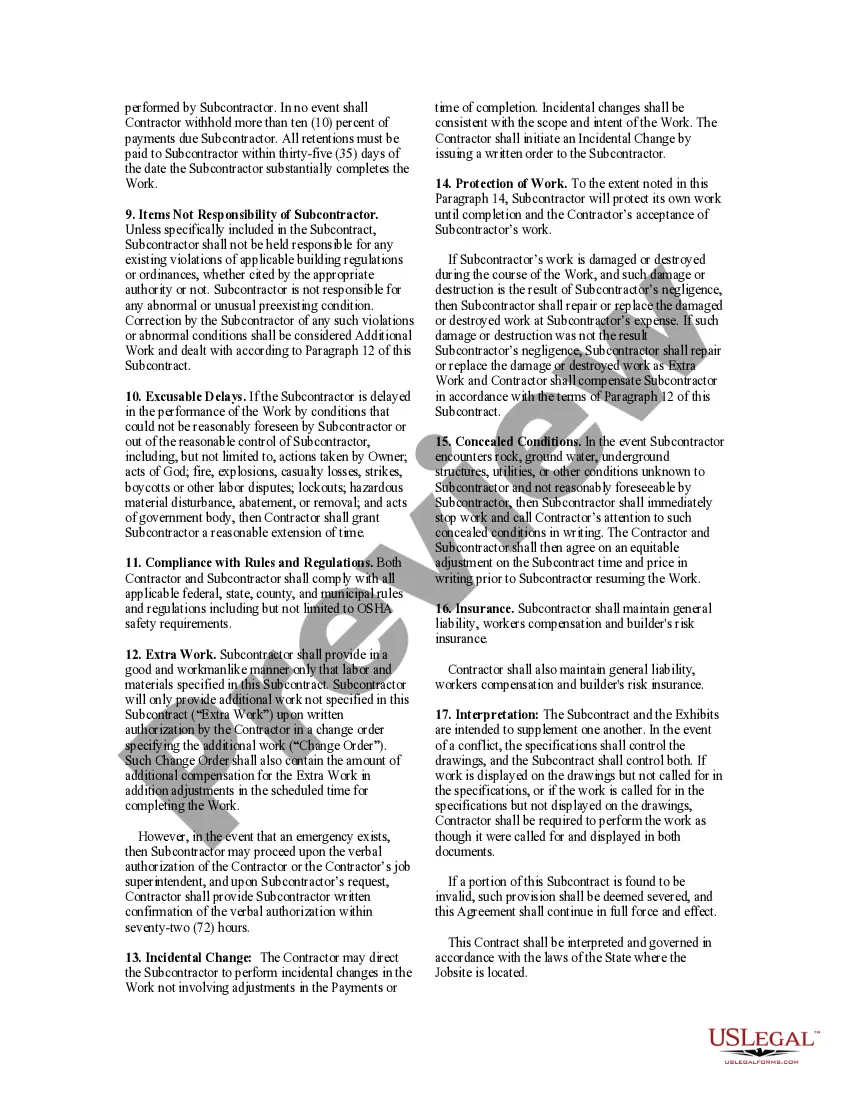

Who Needs to Complete Form W-9? You will usually submit a W-9 form when you engage with a company where reporting information to the IRS might be necessary, such as receiving payments for services you provide as an independent contractor, paying interest on your mortgage or even contributing money to your IRA account.

You do not generally have to withhold or pay any taxes on payments to independent contractors unless you are not provided with a required taxpayer identification number or are instructed to withhold by the Internal Revenue Service.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

What is the Self-Employment Tax? The self-employment tax rate is 15.3% (12.4% for Social Security tax and 2.9% for Medicare). The self-employment tax applies to your adjusted gross income. If you are a high earner, a 0.9% additional Medicare tax may also apply.