Mississippi Contractors Application For Material Purchase Certificate

Description

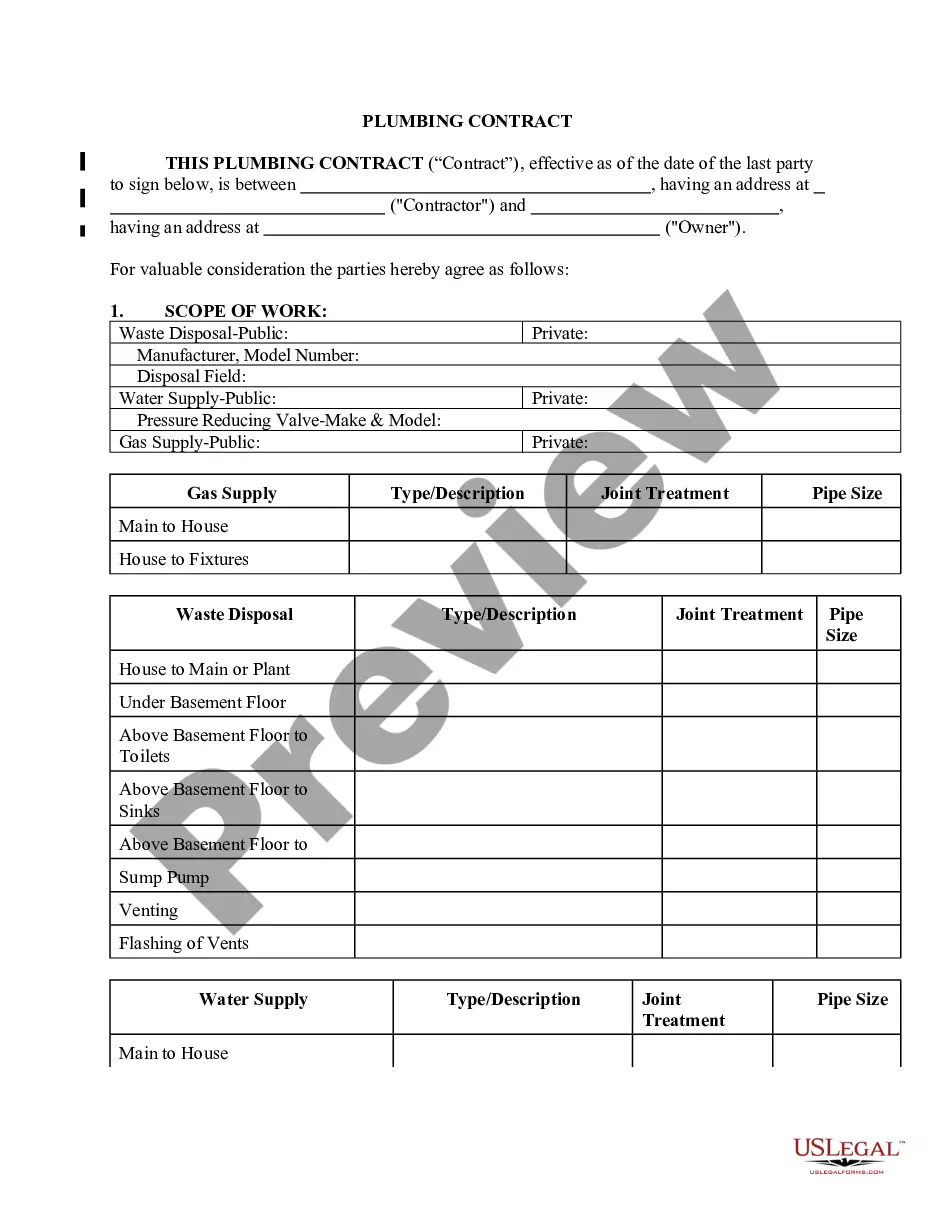

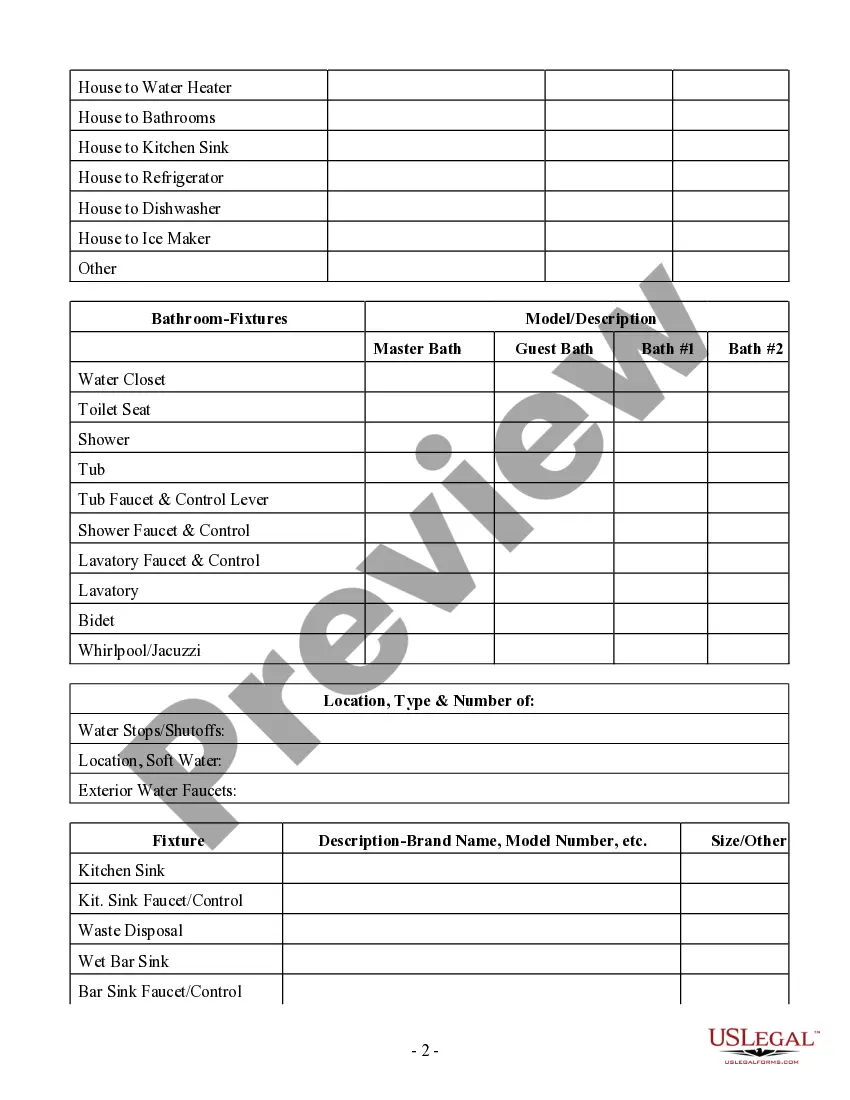

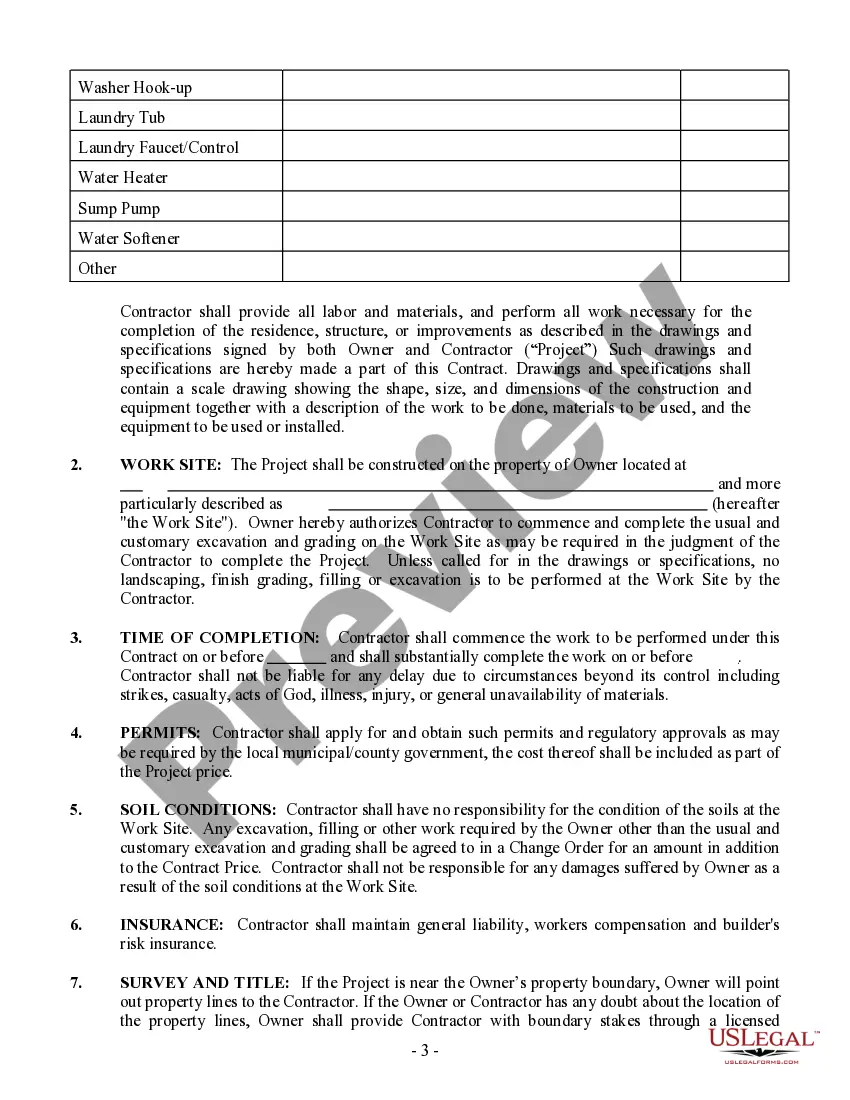

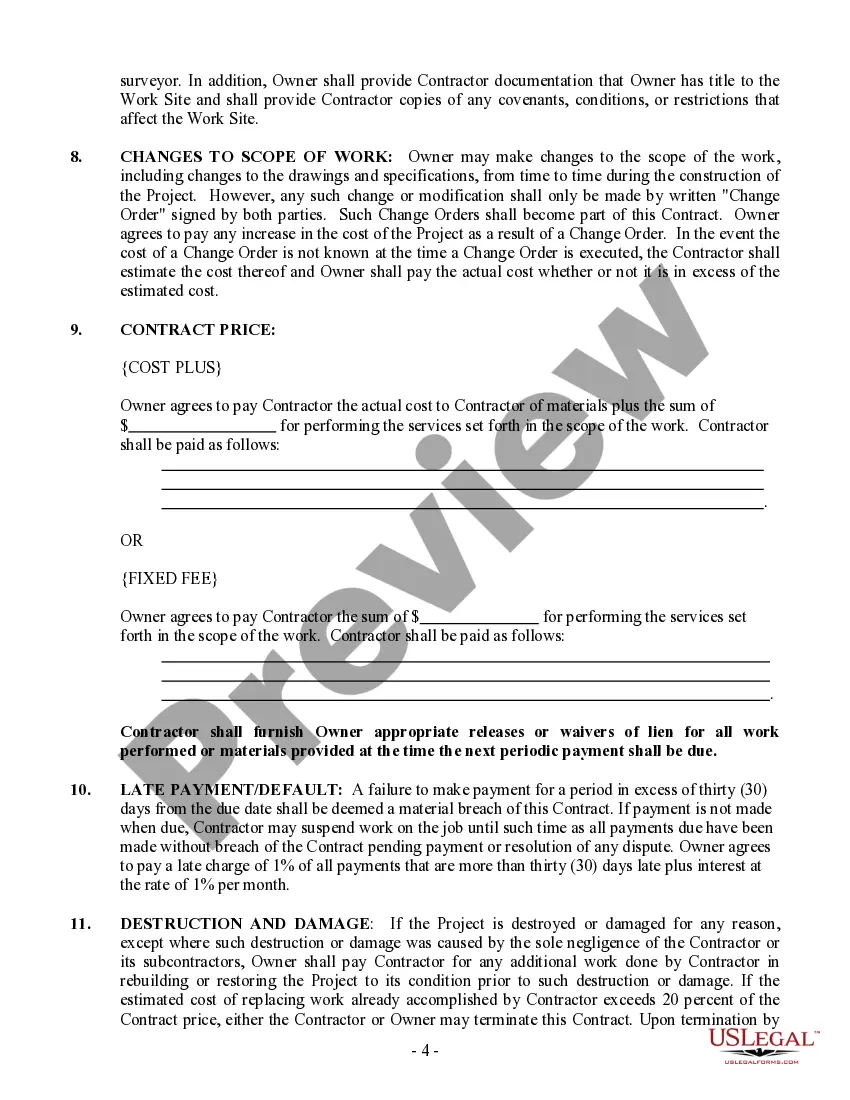

How to fill out Mississippi Plumbing Contract For Contractor?

Individuals often link legal documents with complexity that only an expert can handle.

In some respects, this is accurate, as preparing the Mississippi Contractors Application For Material Purchase Certificate requires significant knowledge of subject matter guidelines, including state and local laws.

Nonetheless, with US Legal Forms, accessing such documents has become easier: an online repository containing ready-to-use legal templates for various personal and business situations aligned with state regulations is now open to everyone.

Print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them anytime as needed via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, meaning that finding the Mississippi Contractors Application For Material Purchase Certificate or any other specific template only takes a matter of minutes.

- Registered users with an active subscription should Log In to their account and click Download to obtain the document.

- New users on the platform must first create an account and subscribe before they can save any documents.

- Here is a step-by-step guide on how to obtain the Mississippi Contractors Application For Material Purchase Certificate.

- Carefully review the page content to ensure it meets your requirements.

- Read the form description or confirm it through the Preview option.

- Use the Search bar above to find another template if the previous one does not fit your needs.

- Press Buy Now when you locate the suitable Mississippi Contractors Application For Material Purchase Certificate.

- Select a pricing plan that suits your preferences and budget.

- Establish an account or Log In to continue to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Choose the format for your template and click Download.

Form popularity

FAQ

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Material Purchase Certificate (MPC) Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract .

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract . You may apply for a MPC on TAP.

DOR. Declaration of Readiness to Proceed.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

501 A contractor's Material Purchase Certificate (MPC) number will be issued to a qualified contractor for each contract. The MPC number allows the contractor and his subcontractors to make tax-free purchases of materials and services that become a component part of the structure covered by the qualified contract.