Mississippi Child Support Withholding Calculator

Description

How to fill out Mississippi Complaint For Filiation And Child Support?

Individuals frequently link legal documentation with something intricate that only an expert can handle.

In a certain manner, this holds true, as formulating the Mississippi Child Support Withholding Calculator necessitates considerable knowledge of subject standards, including state and county laws.

However, with US Legal Forms, the process has become more straightforward: ready-made legal templates for any life and business scenario tailored to state regulations are consolidated in a single online repository and are now accessible to everyone.

Create an account or Log In to continue to the payment page. Pay for your subscription using PayPal or your credit card. Choose your file format and click Download. Print your document or upload it to an online editor for quicker filling. All templates in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85,000 current documents categorized by state and application area, making it quick to search for Mississippi Child Support Withholding Calculator or any other specific template.

- Users who have previously registered and hold an active subscription must Log In to their accounts and click Download to retrieve the form.

- New users will need to create an account and subscribe before they can save any legal documentation.

- Follow these steps to obtain the Mississippi Child Support Withholding Calculator.

- Carefully examine the page content to ensure it meets your requirements.

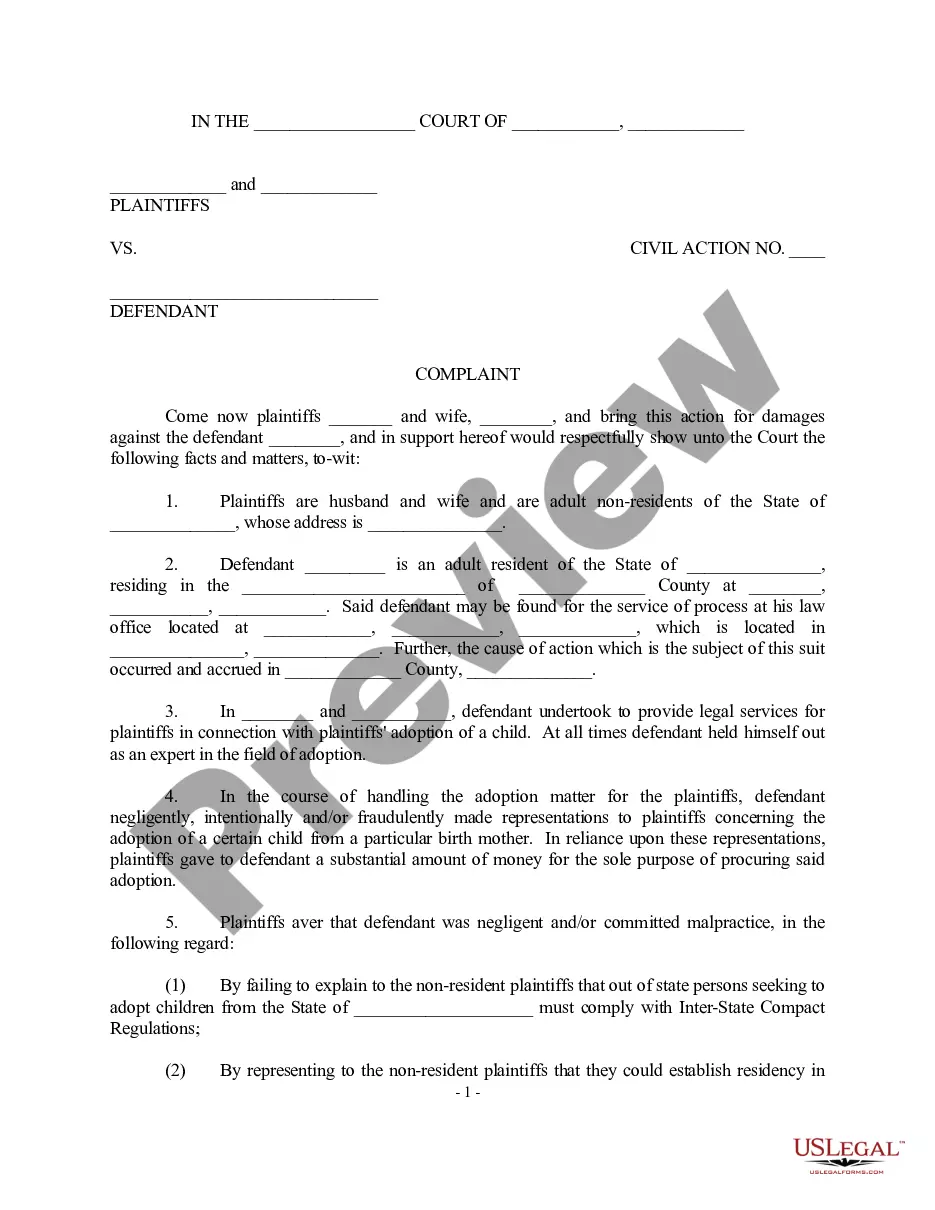

- Review the form description or check it via the Preview option.

- If the previous template doesn’t meet your needs, look for another sample using the Search field above.

- When you find the suitable Mississippi Child Support Withholding Calculator, click Buy Now.

- Select a pricing plan that fits your needs and budget.

Form popularity

FAQ

Yes, child support deductions typically appear on your W2 as part of your total deductions. Employers report these withholdings to provide a transparent view of financial obligations. It's essential to keep track of these amounts for your records. For precise tracking, consider using a Mississippi child support withholding calculator throughout the year.

To deduct child support from payroll, employers must receive a withholding order from the court. This order specifies the amount to be deducted from the employee's wages. Ensure payroll systems are updated to include this deduction accurately. Users can also utilize a Mississippi child support withholding calculator to determine the appropriate withholding amounts.

Child support is deducted from payroll before taxes are calculated. This means it reduces your taxable income, which can be beneficial for managing finances. Employers must comply with state regulations regarding these deductions. To estimate the impact, a Mississippi child support withholding calculator can be very useful.

To file for child support in Mississippi, start by gathering necessary documents. You can fill out the appropriate forms at your local courthouse or through the Mississippi Department of Human Services. Once you have completed the forms, submit them to the court and attend any required hearings. Using a Mississippi child support withholding calculator can help you understand potential payment amounts.

The maximum amount that can be withheld for child support varies depending on the income level of the non-custodial parent and the number of children involved in the support order. Mississippi law outlines specific guidelines that detail permissible withholdings based on earnings. A Mississippi child support withholding calculator can help you determine the maximum amounts accurately based on your specific financial information.

In Mississippi, up to 50% of disposable income can be withheld for child support if the non-custodial parent supports another family. If they do not have any additional support obligations, the percentage may increase. For these calculations, a Mississippi child support withholding calculator is an excellent resource to ensure that you're abiding by the legal limits while meeting your obligations.

The maximum amount of child support that can be withheld from a non-custodial parent's paycheck is based on federal and state laws. In Mississippi, deductions may not exceed a specified percentage of disposable income, which varies with the number of dependents. For precise calculations, refer to a Mississippi child support withholding calculator, which can guide you in determining the exact allowable withholding based on your case.

The maximum rate for child support in Mississippi varies depending on the number of children involved. Typically, the guideline suggests that payments should be a certain percentage of the non-custodial parent's income. Utilizing a Mississippi child support withholding calculator can provide you the exact percentage that aligns with your circumstances and help ensure compliance with state guidelines.

In Mississippi, child support is typically calculated based on the gross income of the non-custodial parent, which means it is generally done before taxes are deducted. This approach allows for a more standard calculation, as taking taxes into account can vary greatly among individuals. To ensure accurate calculations, using a Mississippi child support withholding calculator can help you determine the appropriate amount based on your unique financial situation.

Child support in Mississippi is calculated using the income shares model, considering both parents' incomes and the needs of the child. The Mississippi child support withholding calculator serves as an excellent tool to estimate obligations based on specific income levels and expenses. This approach ensures that both parents contribute fairly to the child's upbringing. Always refer to reliable resources or legal advice to understand your specific situation.