Tenants In Common Missouri Foreclosure

Description

Form popularity

FAQ

Filing a deed in lieu of foreclosure involves offering your property to your lender to avoid a lengthy foreclosure process. Start by contacting your lender to discuss the situation and express your intent to file. You will need to provide all necessary documentation, including your mortgage details and a statement of your financial hardship. Platforms like US Legal Forms can assist you in preparing the required documents, making it easier to navigate the complexities of tenants in common Missouri foreclosure.

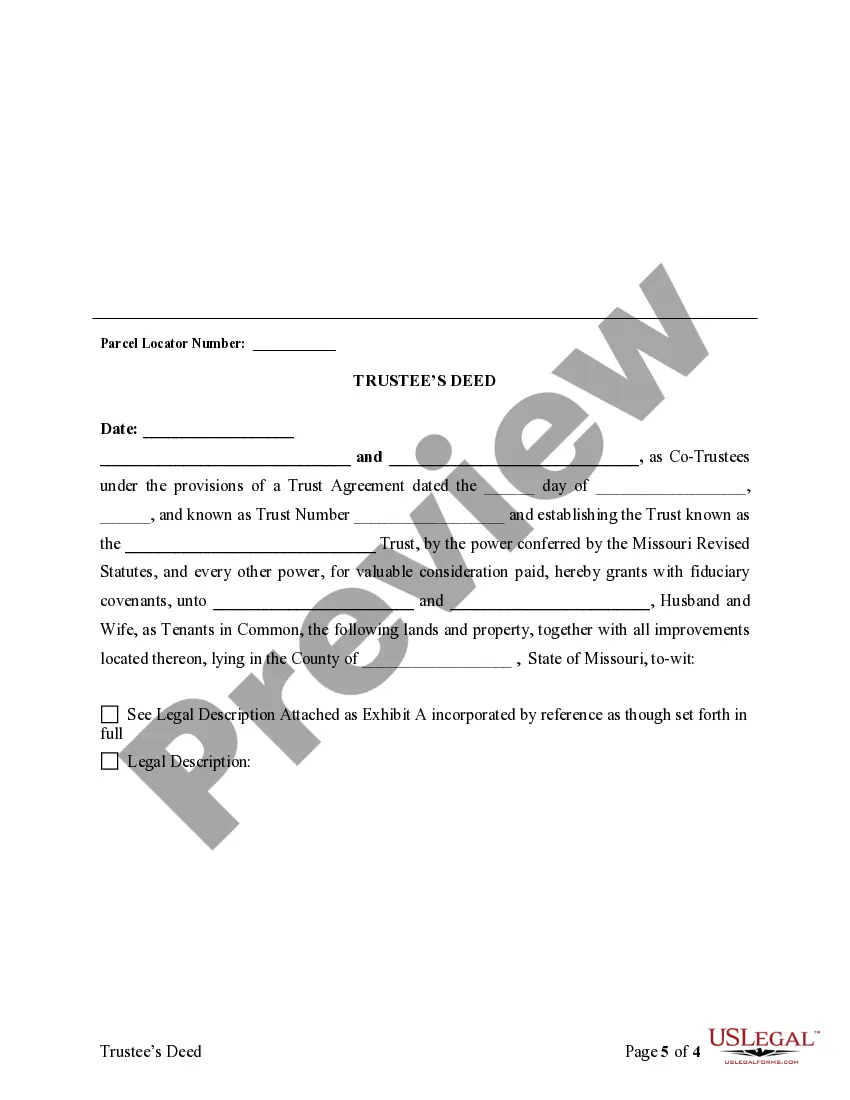

To change your deed to tenants in common in Missouri, you must draft a new deed that clearly states your intention to hold the property as tenants in common. After completing the new deed, you need to sign and date it, and then have it notarized. Finally, file the deed with the appropriate county recorder's office to ensure that it reflects the tenants in common ownership. This process is essential, especially if you want to address issues related to tenants in common Missouri foreclosure.

The biggest difference lies in the right of survivorship allocated to joint tenancy, which allows the surviving owner to inherit the deceased owner's share automatically. In contrast, tenancy in common allows each owner to decide how their share is handled upon death. This distinction is significant for tenants in common managing properties through a Missouri foreclosure, as it impacts ownership and future ownership rights.

A foreclosure can occur relatively quickly in Missouri, potentially within a few months, depending on the lender’s actions and the borrower’s response. Engaging with legal resources or advisors can help homeowners delay or avoid foreclosure. Tenants in common should familiarize themselves with the process to safeguard their interests in any Missouri foreclosure situation.

The main difference is that joint tenancy includes the right of survivorship, meaning if one owner passes away, their interest automatically transfers to the surviving owner. Meanwhile, tenancy in common allows each owner to pass on their share to heirs or sell it freely. For tenants in common facing foreclosure in Missouri, recognizing these differences can influence decisions on property management.

Tenancy in common (TIC) offers several advantages, including shared ownership, flexible individual interests, and separate ability to transfer or sell interests. However, it also comes with challenges such as shared responsibility for debts and potential disagreements among co-owners. Understanding these pros and cons is particularly important when dealing with the complexities of Missouri foreclosure.

In Missouri, lenders usually start the foreclosure process after three to six missed mortgage payments. However, this can vary based on the lender’s policies and state regulations. It’s essential for tenants in common to communicate or negotiate with the lender at an early stage to prevent foreclosure. Taking proactive steps can lead to more favorable outcomes.

In most cases, renting a house in foreclosure is legal, although it can be complicated. Property owners can typically lease their homes until the foreclosure process is finalized, but tenants must be aware of any possible changes. Tenants in common should consult resources such as US Legal Forms to navigate potential legal challenges during a Missouri foreclosure.

Tenancy in common in Missouri refers to a property ownership structure where two or more individuals hold shares. Each owner can sell or transfer their interest independently without impacting the others. This arrangement is often chosen for its flexibility, especially during a Missouri foreclosure scenario where managing shared ownership can become complex.

The foreclosure process in Missouri usually involves several key steps: the lender must send a notice of default, followed by a period for the borrower to cure the default. If unresolved, the lender may initiate a foreclosure sale. It's vital for tenants in common to stay informed about these steps to address any issues with the Missouri foreclosure process effectively.