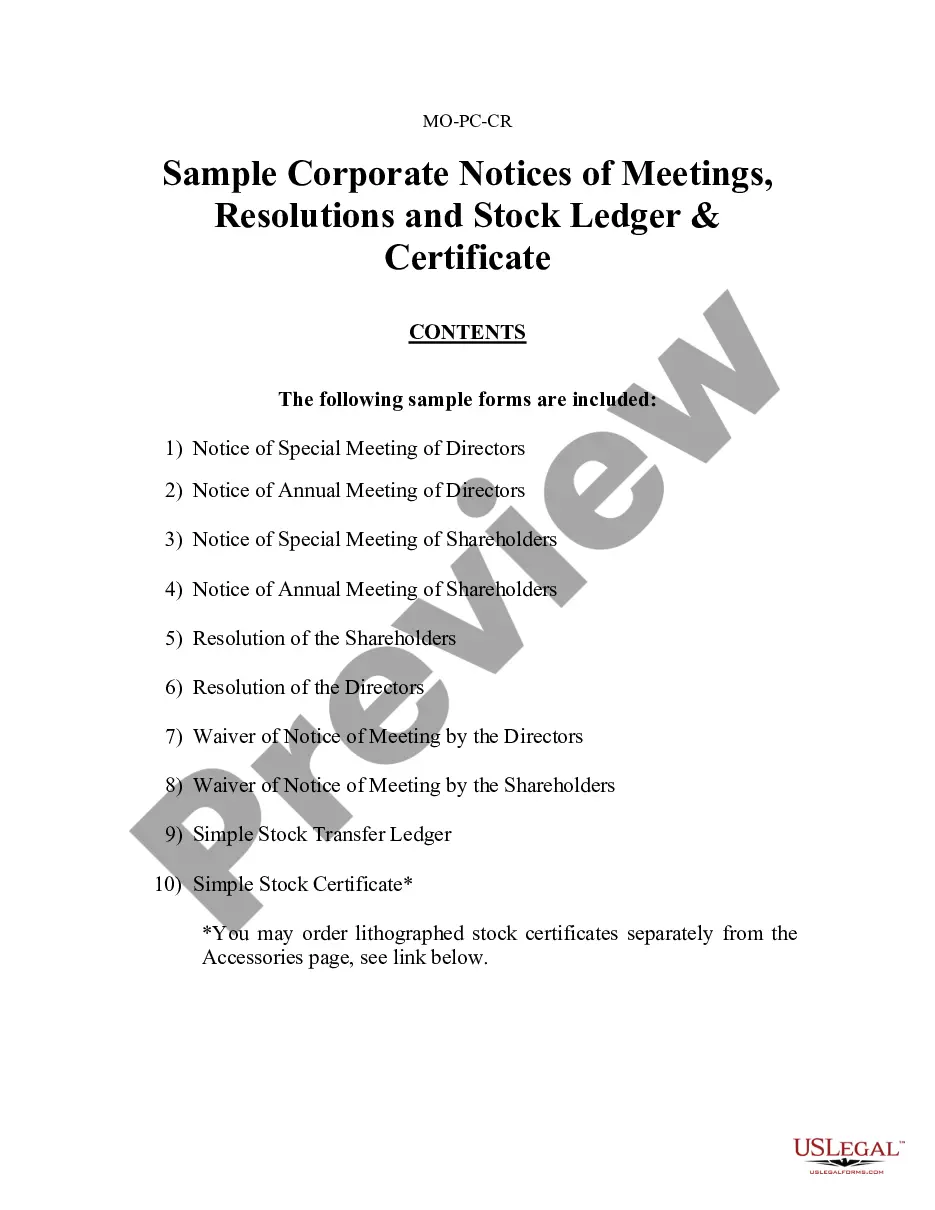

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Missouri Form Certificate Withdrawal

Description

How to fill out Missouri Form Certificate Withdrawal?

When it's necessary to complete the Missouri Form Certificate Withdrawal that adheres to your local state's rules and regulations, there may be numerous options to select from.

There's no need to inspect each form to confirm it aligns with all the legal standards if you are a subscriber to US Legal Forms.

It is a trustworthy service that can assist you in acquiring a reusable and current template on any topic.

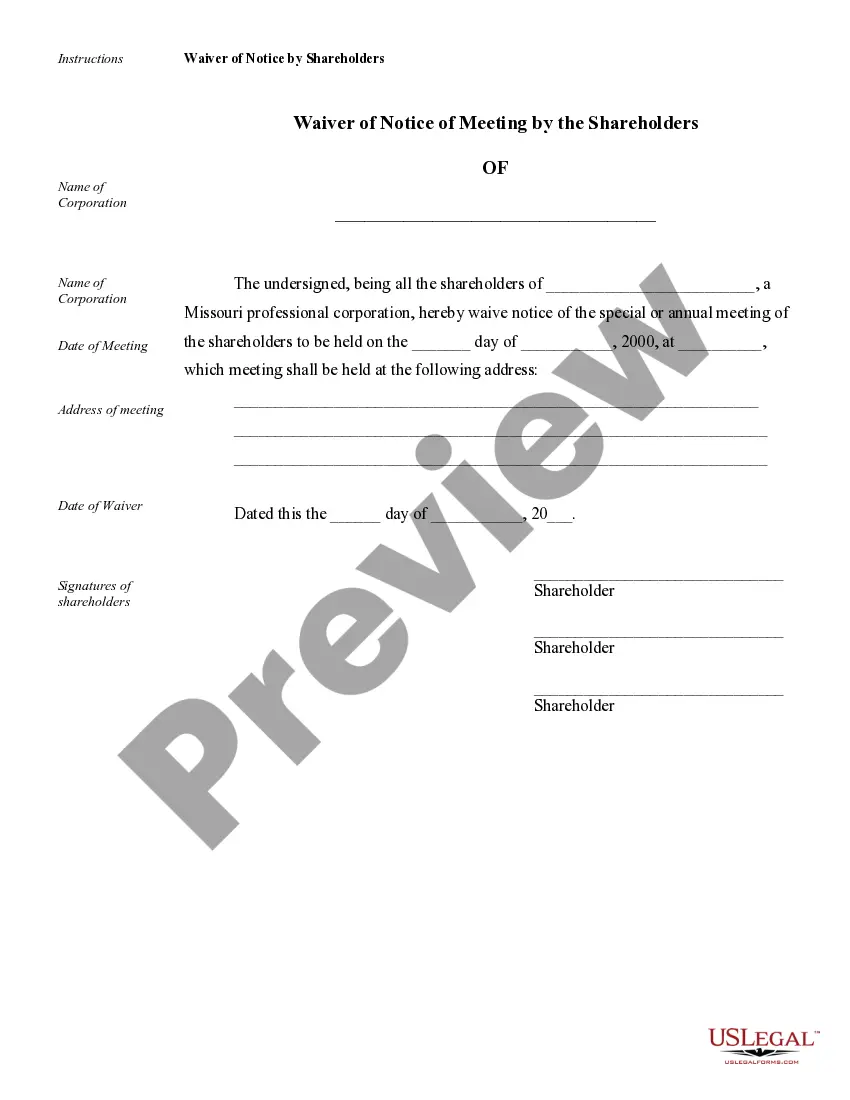

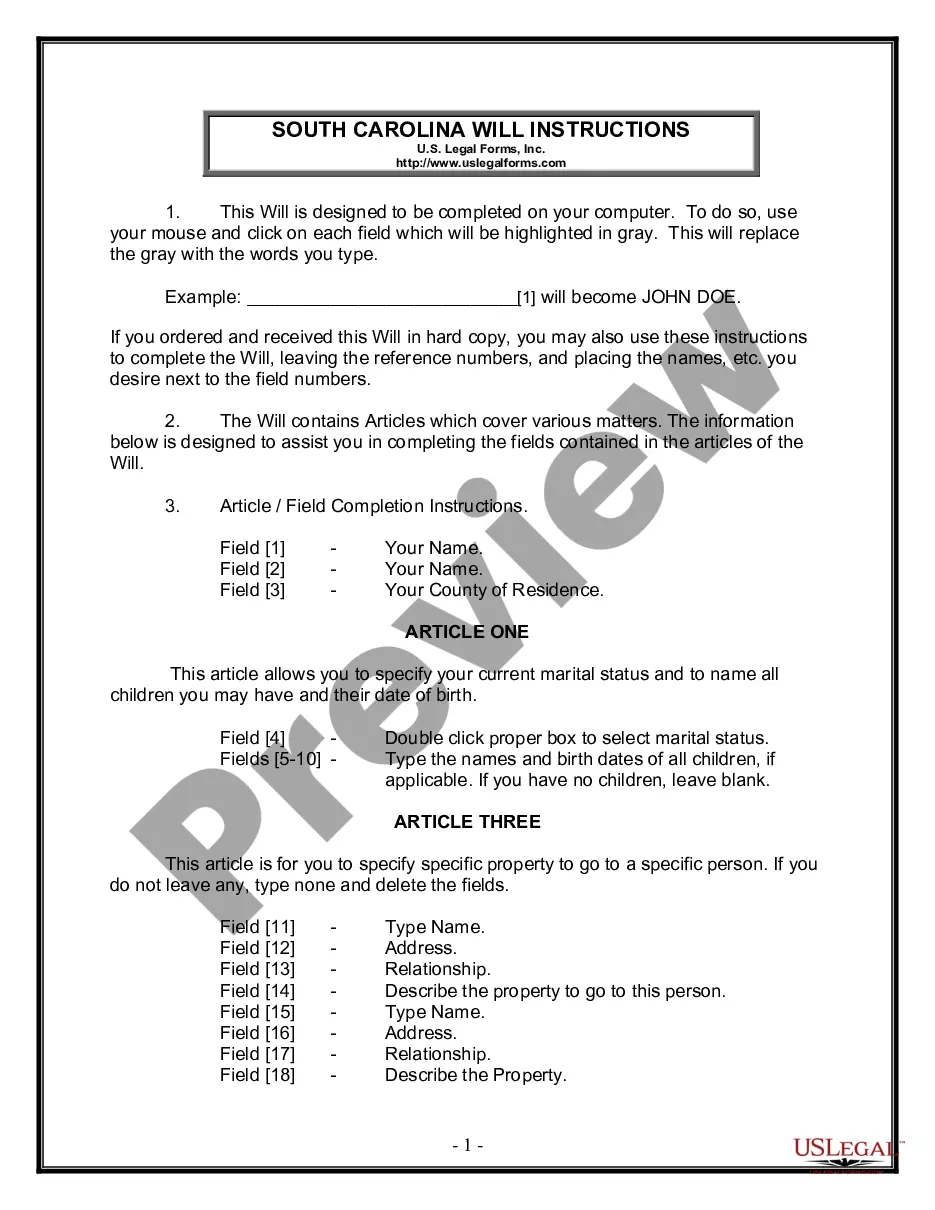

Navigate the suggested page and verify it for alignment with your requirements. Utilize the Preview mode and review the form description if available. Search for another sample using the Search bar in the header if needed. Click Buy Now when you identify the correct Missouri Form Certificate Withdrawal. Select the most appropriate subscription plan, Log Into your account, or create one. Pay for a subscription (PayPal and credit card methods are available). Download the form in the desired file format (PDF or DOCX). Print the document or complete it electronically in an online editor. Securing properly drafted formal documentation becomes simple with US Legal Forms. Moreover, Premium users can also take advantage of powerful integrated solutions for online document editing and signing. Try it today!

- US Legal Forms is the most all-inclusive online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are confirmed to comply with the regulations of each state.

- Thus, when you download the Missouri Form Certificate Withdrawal from our site, you can be confident that you possess a valid and current document.

- Obtaining the required sample from our platform is remarkably straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and have access to the Missouri Form Certificate Withdrawal at any time.

- If this is your first experience with our library, please adhere to the instructions below.

Form popularity

FAQ

A certificate of fact is a document that formally verifies specific details about a business or organization. It serves as proof of various operational aspects, assuring banks and other parties of the entity's legitimacy. Obtaining a certificate of fact might be necessary during the withdrawal process of business documentation. If you need help with Missouri form certificate withdrawal, our platform provides comprehensive solutions to assist you.

A Missouri certificate of fact is an official document that certifies particular details about your business entity. This includes critical information like your business's formation date or status. Having this certificate can be instrumental, especially when dealing with withdrawal requirements. Our platform can facilitate obtaining your Missouri form certificate withdrawal to streamline the administrative tasks.

MO form 943 is an annual reconciliation form that employers in Missouri must file to report state income tax withheld from employees. This form provides the state with vital information regarding tax collections and helps ensure accuracy in payroll. If you're in the process of managing LLC operations or need assistance with Missouri form certificate withdrawal, consider using our platform for efficient guidance.

To shut down an LLC in Missouri, you need to file Articles of Termination with the Secretary of State. This step formally dissolves your business and ensures that no further liabilities accrue. You should also settle all your debts before proceeding. If you have questions about Missouri form certificate withdrawal during this process, our platform is here to assist you.

No, a certificate of Good Standing is not the same as a business license. The former certifies that your business is compliant with state requirements and allowed to operate, while a business license permits you to conduct specific activities. Understanding these distinctions can help you navigate the legal landscape effectively. If you require a Good Standing certificate for your Missouri form certificate withdrawal, we can guide you through the process.

A certificate of fact in Missouri is a document that confirms specific information about your business, such as its existence or status. This certificate serves as proof that your business is operating legally within the state. If you need to withdraw from a certain business entity or settle accounts, ordering this certificate can be essential. Our platform offers resources to assist with your Missouri form certificate withdrawal.

Yes, you must have a registered agent for your LLC in Missouri. This agent acts as your official point of contact for legal documents and government notices. It's crucial to choose someone reliable to ensure all important paperwork reaches you promptly. Using a professional service can simplify this process and help with Missouri form certificate withdrawal if needed.

Transferring ownership of an LLC in Missouri requires updating your operating agreement and filing the necessary paperwork with the Missouri Secretary of State. It's essential to ensure that all members agree on the transfer terms. If you face any tax implications during this process, be sure to address these through the Missouri form certificate withdrawal.

To cancel an LLC in Missouri, you need to file Articles of Termination with the Missouri Secretary of State. This form officially ends your LLC's registration. If you have any tax liabilities, consider obtaining a Missouri form certificate withdrawal to clear any outstanding issues before completing the cancellation.

Form 2928 in Missouri is utilized for claiming a Tax Credit for Contributions to Education. This form helps individuals receive a tax credit for their contributions to eligible educational institutions. Keep in mind that if you are applying for various tax adjustments, the Missouri form certificate withdrawal may be beneficial.