Missouri Promissory Note With Chattel Mortgage

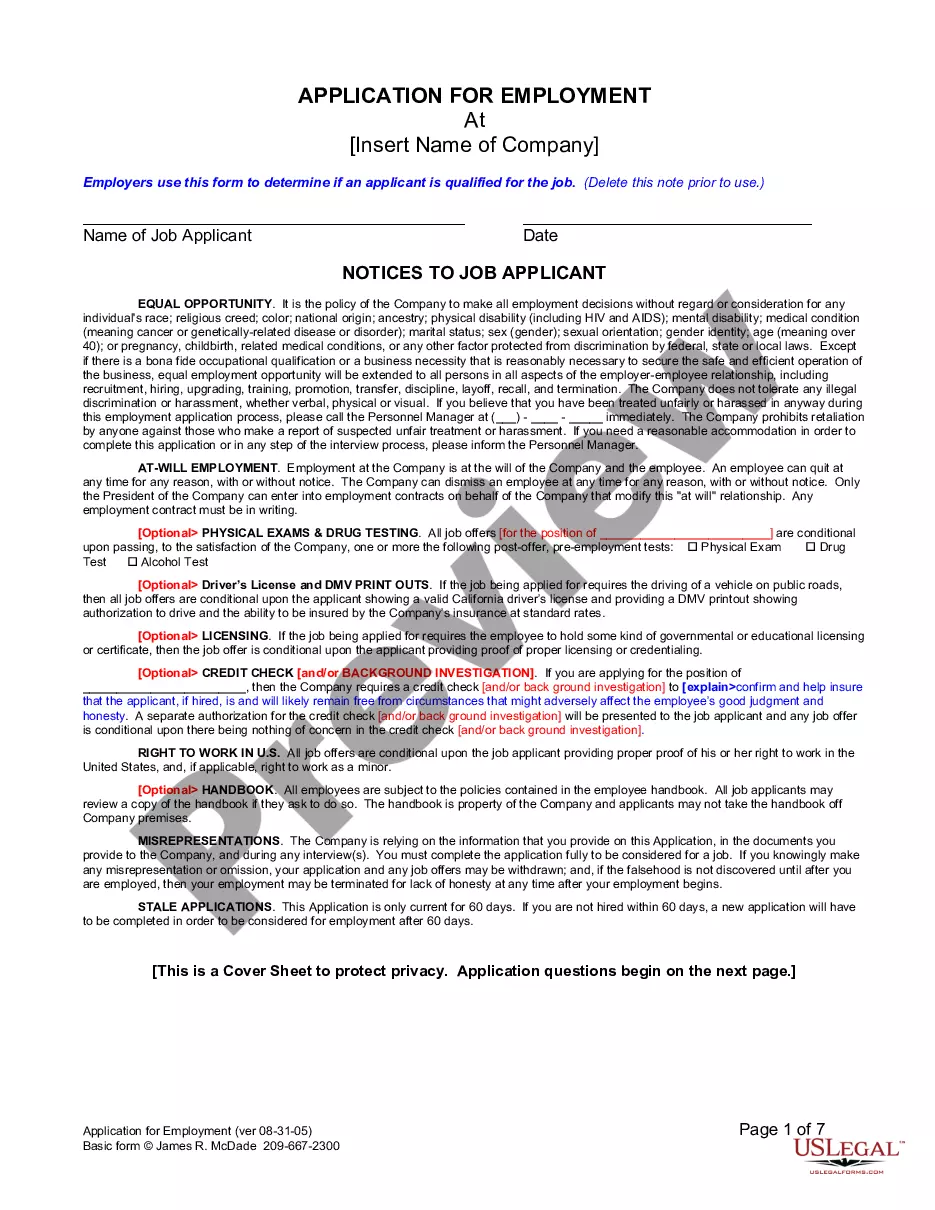

Description

How to fill out Missouri Unsecured Installment Payment Promissory Note For Fixed Rate?

Steering through the red tape of official documents and formats can be challenging, particularly when one is not engaged in that field. Even locating the appropriate template for a Missouri Promissory Note With Chattel Mortgage will be labor-intensive, as it must be valid and accurate to the very last detail.

Nonetheless, you will find yourself investing considerably less time obtaining a fitting template from a trusted source.

US Legal Forms is a service that streamlines the task of finding the correct documents online.

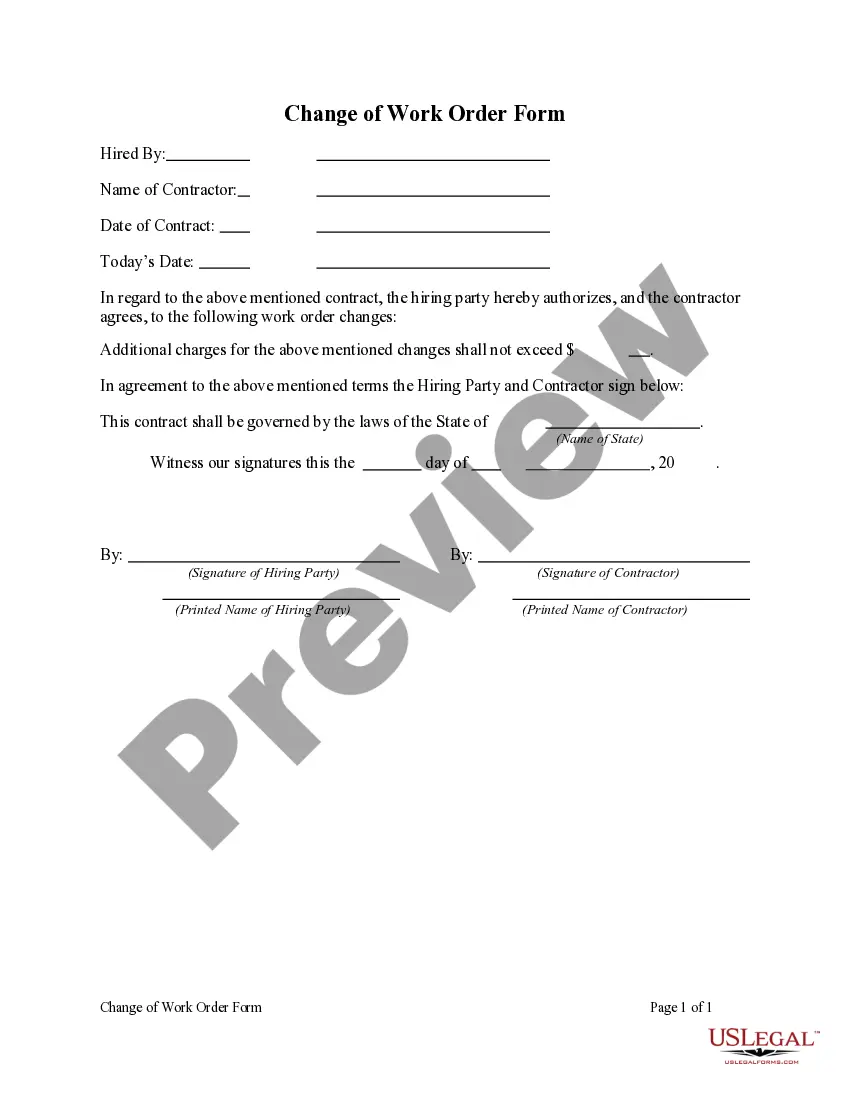

Type the document name in the search bar. Select the relevant Missouri Promissory Note With Chattel Mortgage from the list of results. Review the sample description or preview it. If the template meets your needs, click Buy Now. Proceed to choose your subscription plan. Use your email to create a password and register an account on US Legal Forms. Choose a credit card or PayPal payment method. Download the template file to your device in your preferred format. US Legal Forms can save you time and effort determining if the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms serves as a single destination to acquire the latest examples of documents, check their usage, and download these samples for completion.

- It boasts a repository of over 85,000 forms applicable in various professional sectors.

- When searching for a Missouri Promissory Note With Chattel Mortgage, you need not question its validity as all documents are authenticated.

- Having an account at US Legal Forms will ensure you have all the necessary samples at your fingertips.

- You can save them in your archive or add them to the My documents collection.

- Access your saved documents from any device by simply clicking Log In at the library site.

- If you have yet to create an account, you can always search again for the template you require.

- Retrieve the appropriate document in a few simple steps.

Form popularity

FAQ

There is no legal requirement to have a Missouri promissory note notarized. The promissory note needs to be signed and dated by the borrower and any co-signer.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

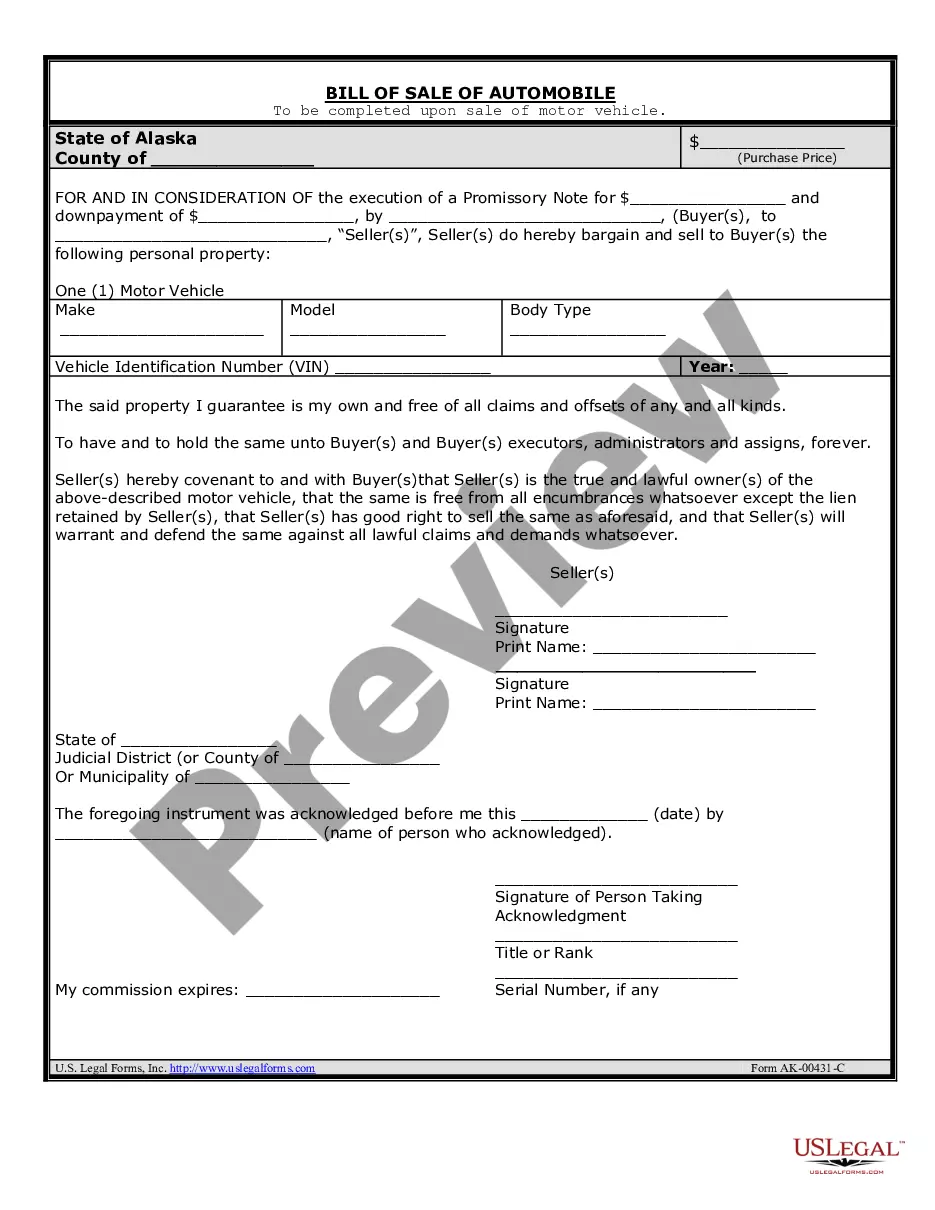

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.