Living Trust Form With Bank

Description

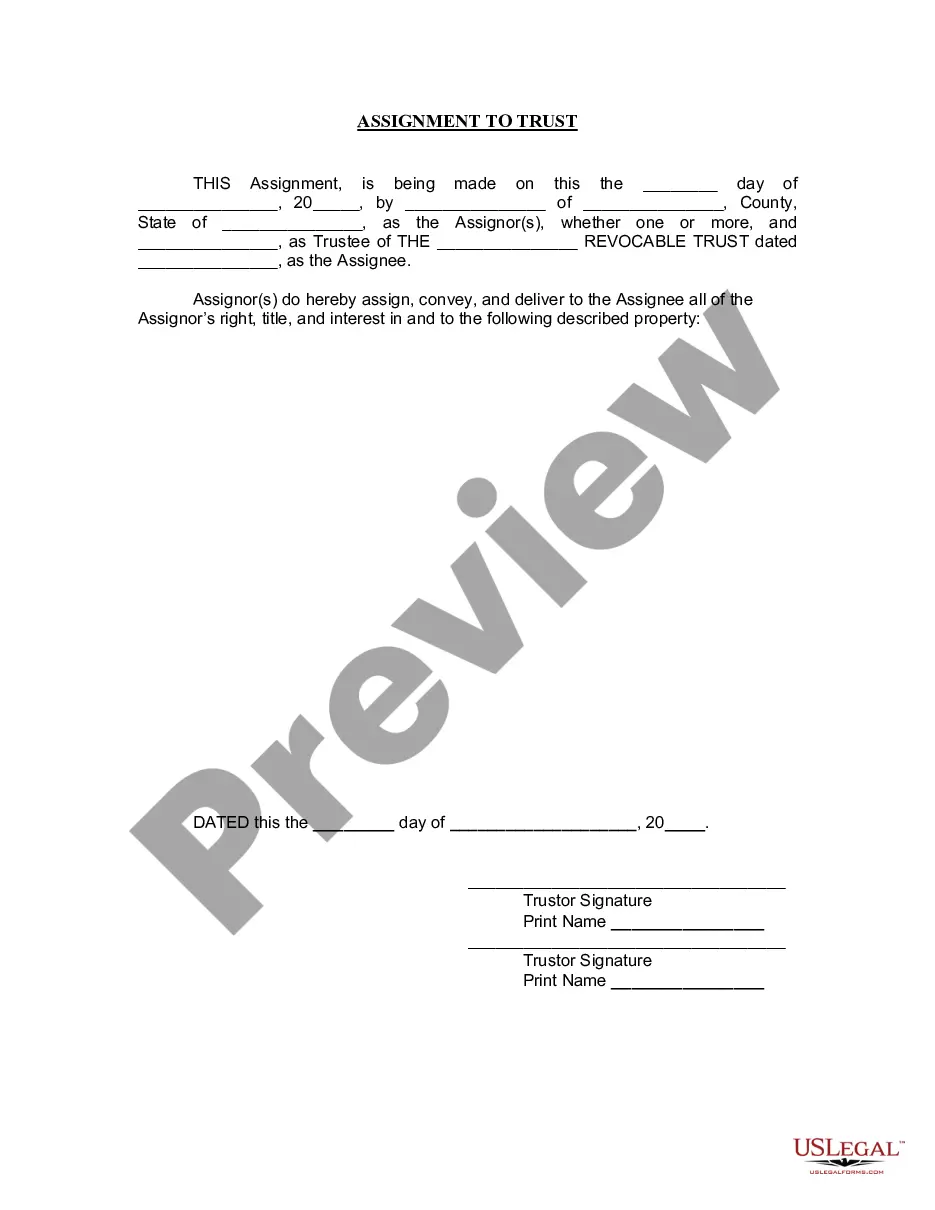

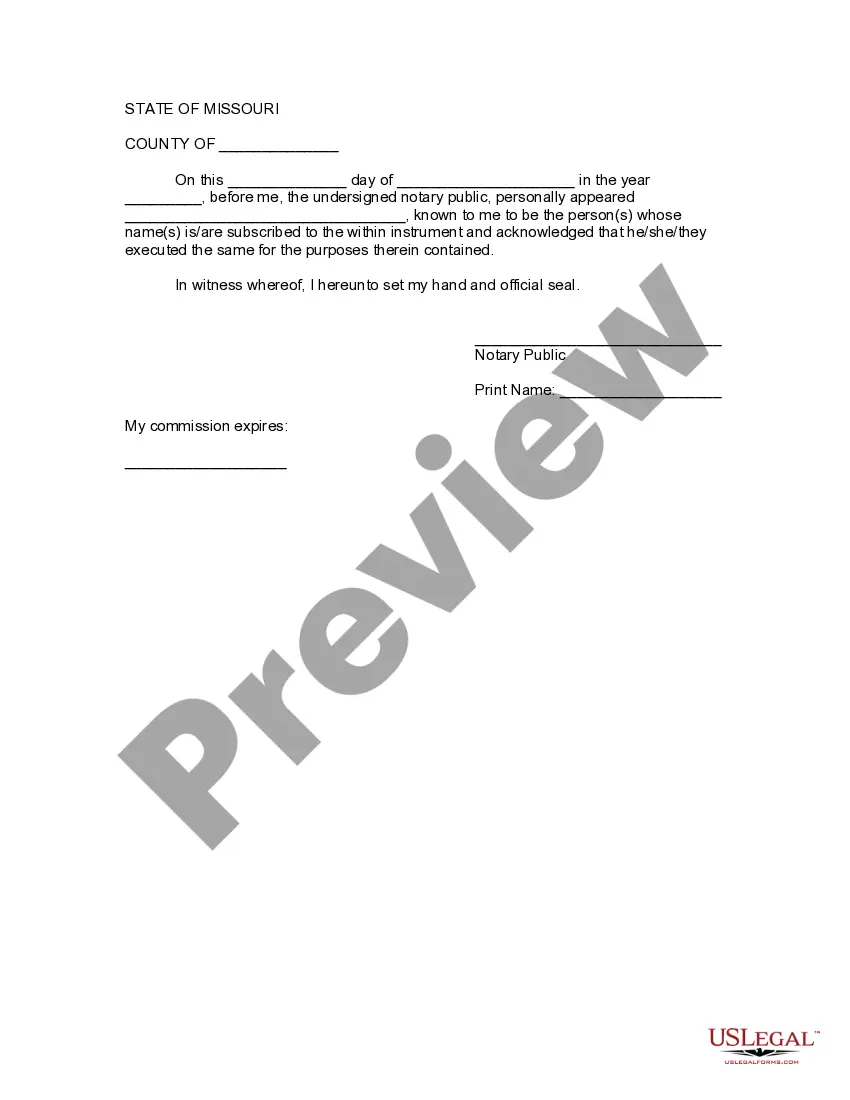

How to fill out Missouri Assignment To Living Trust?

- If you're an existing user of US Legal Forms, simply log in to your account and download the living trust form template by clicking the Download button. Ensure your subscription is active; if not, renew it according to your plan.

- For first-time users, begin by checking the Preview mode and form description to confirm it aligns with your requirements and complies with local regulations.

- If necessary, search for alternative templates using the Search tab to ensure the selected document fully meets your needs.

- Purchase the form by clicking on the Buy Now button and selecting a suitable subscription plan. Registration is required for access to the resources.

- Complete your transaction by entering your credit card information or using PayPal for subscription payment.

- Lastly, download your living trust form and save it on your device. You can also access it in the My Forms menu of your profile anytime.

In conclusion, leveraging the US Legal Forms platform makes the process of obtaining a living trust form with bank efficient and user-friendly. The vast collection and expert assistance enable users to create precise legal documents with ease.

Start your journey with US Legal Forms today, and empower yourself with the legal tools you need!

Form popularity

FAQ

Yes, you can set up a trust fund at most banks, and this process typically involves providing a copy of the living trust form with bank information. Once the bank verifies your trust documents, they will help you create an account specifically for the trust's assets. This service allows for efficient management of funds and ensures compliance with your estate planning. Always engage with your bank to understand any fees or requirements they may have to set up your trust fund.

The biggest mistake parents often make is failing to fund their trust properly. After establishing a trust, it's critical to transfer assets into it; otherwise, the trust remains inactive. Neglecting to include properties, bank accounts, and other assets can defeat the purpose of creating a trust. Ensuring that all intended assets are correctly placed in the trust is essential for effective estate planning.

To place your bank account into a living trust, begin by creating the trust and gathering the required documentation. Then, contact your bank to request their specific procedure for transferring account ownership. Usually, this involves completing the bank's forms and presenting the trust documents. This approach ensures your assets are managed according to your preferences in the living trust.

Including bank accounts in a living trust offers several advantages. It helps manage the funds according to your wishes and protects them from the probate process. When you include your bank accounts in a living trust, it simplifies the transfer of these assets to your beneficiaries. You can obtain a living trust form with bank details easily, streamlining the process.

Yes, putting assets in a trust can greatly benefit your parents by providing a clear plan for asset management and distribution. A living trust helps avoid probate, ensuring that their assets are transferred efficiently to beneficiaries after their passing. Moreover, it often offers privacy, as trust documents are not public like wills. This strategy can give peace of mind knowing their wishes will be honored.

To transfer a bank account to a living trust, you will first need to have your living trust set up. Next, visit your bank with the necessary documents, including the trust document and identification. The bank will typically require you to complete a form to change the account ownership to the living trust. This simple process ensures that your assets are managed according to your wishes.