Living Trust Form Sample With Example

Description

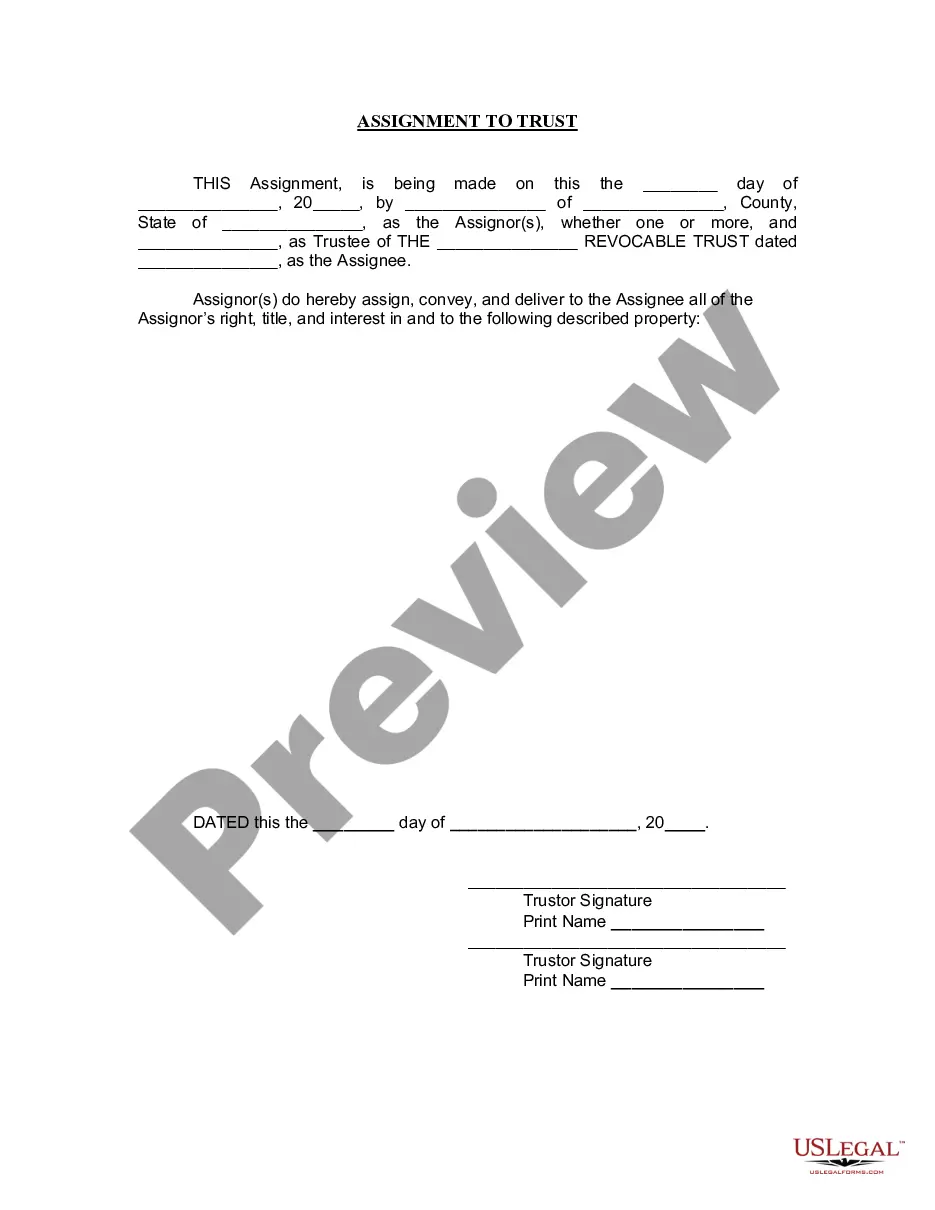

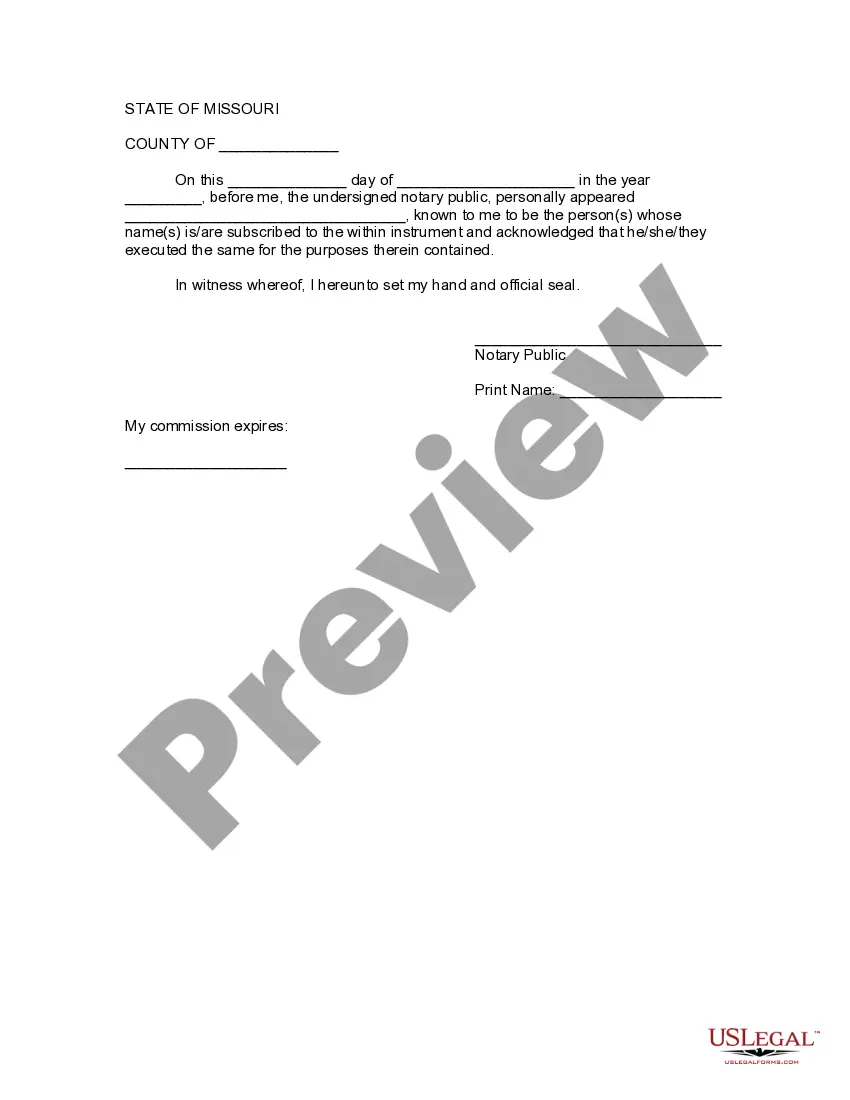

How to fill out Missouri Assignment To Living Trust?

- If you're a returning user, visit the US Legal Forms website and log into your account. Ensure your subscription is current and download the necessary living trust form by clicking on the Download button.

- For new users, start by checking the Preview mode and detailed description of the living trust form sample. Confirm it meets your needs and complies with your jurisdiction's requirements.

- If needed, search for alternative templates using the Search tab to find one that fits your specific requirements.

- Once you select the appropriate document, click the Buy Now button and choose a suitable subscription plan. Make sure to create an account to access the legal resources.

- Proceed with the payment by entering your credit card information or using your PayPal account to finalize your subscription.

- After making your purchase, download the living trust form to your device and save it for future use. You can also access it anytime from the My Forms section in your profile.

In conclusion, US Legal Forms provides an extensive library that empowers individuals and lawyers to efficiently execute legal documents. With over 85,000 fillable forms and expert assistance, you can create legally sound documents with ease.

Get started today and streamline your legal documentation process!

Form popularity

FAQ

The most common living trust is the revocable living trust. It allows individuals to retain control over their assets while providing a structured way to transfer those assets after death. Many people choose a living trust form sample with example templates to simplify the creation process. By using a reliable platform like US Legal Forms, you can access various living trust form samples with examples, making your estate planning easier and more efficient.

To create a living trust template, begin by defining the key components you want included, such as grantor details, trustee selection, and beneficiary information. You can reference a living trust form sample with example available on platforms like US Legal Forms to guide the structure of your template. Using a reliable template simplifies the process and ensures your trust is comprehensive and legally sound.

Creating a living trust by yourself is a straightforward process. First, gather essential information, such as your assets and beneficiaries. Next, you can use a living trust form sample with example available online to draft your document. With careful attention to detail, you can ensure that your trust meets all legal requirements and reflects your wishes.

Filling out a living trust form sample with example involves several straightforward steps. Start by gathering required information, such as the names of the beneficiaries and details of the assets you wish to include. Then, follow a reliable template to ensure accuracy. To simplify the process, visit US Legal Forms for user-friendly templates that guide you through each section confidently.

When considering a living trust form sample with example, it is important to know which assets to exclude. Generally, retirement accounts such as 401(k) and IRA should remain outside the trust, as they have specific beneficiary designations. Additionally, assets with title restrictions, like vehicles used for business, might not be ideal for inclusion. To manage this process easily, consider utilizing US Legal Forms for detailed guidance.

If your parents want to ensure their assets are managed according to their wishes, establishing a trust can be a great option. A trust can simplify the transfer of assets and help avoid probate. They can utilize a living trust form sample with example to make the process clearer and easier to understand.

Putting assets in a trust can sometimes limit your control over those assets, as the trust becomes the legal owner. This can create complications in financial decision-making. However, with a well-drafted living trust form sample with example, you can establish guidelines that allow for greater flexibility while still protecting your assets.

A disadvantage of a family trust is that it may require ongoing management, which can be burdensome for some families. Additionally, there may be tax implications that need to be considered. Utilizing a living trust form sample with example can help clarify these details and outline how the trust will function in the long term to alleviate some of these concerns.

The primary downfall of having a trust is the complexity it can introduce to your estate planning. If not managed properly, trusts can lead to disputes among beneficiaries. Therefore, using a living trust form sample with example can help outline the terms clearly, reducing potential conflicts and making the process smoother for everyone involved.

One of the biggest mistakes parents make is failing to communicate their intentions regarding the trust fund effectively. Clear instructions are crucial to avoid confusion or conflict among beneficiaries. This oversight can be avoided by using a living trust form sample with example to ensure that everyone understands the purpose and terms of the trust.