Bank Account For Trust

Description

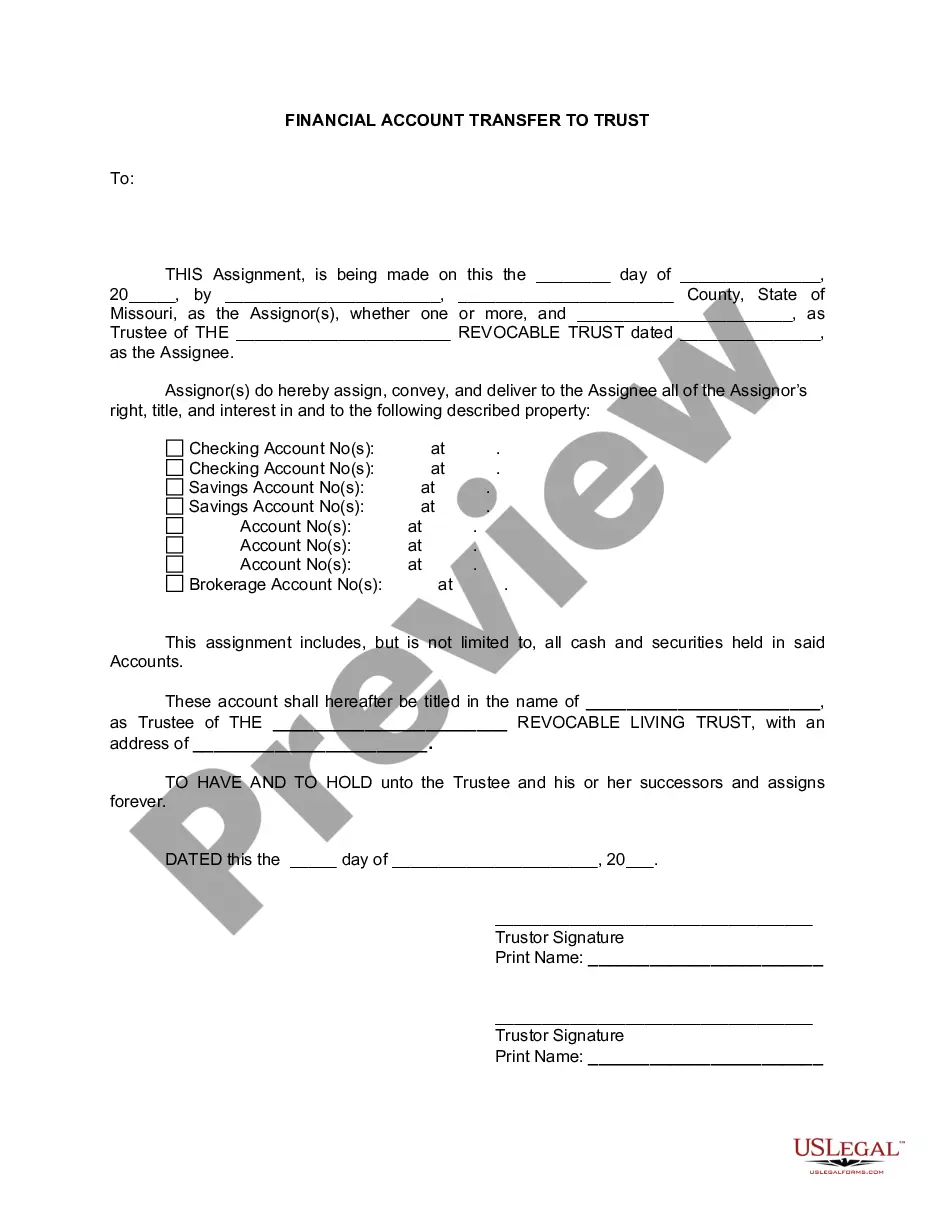

How to fill out Missouri Financial Account Transfer To Living Trust?

- Log in to your US Legal Forms account if you are a returning user. Make sure your subscription is current to access necessary templates.

- If you are a new user, begin by browsing through the extensive library of over 85,000 legal forms. Check the preview and form descriptions to select one that fulfills your requirements.

- Should you need to refine your search, utilize the Search feature to explore additional templates that meet your jurisdiction's criteria.

- Once you find the appropriate form, click on the Buy Now button to proceed with your chosen subscription plan. Create an account to unlock the library.

- Complete your purchase by entering your payment information via credit card or PayPal, ensuring a secure transaction.

- After purchasing, download your form and save it to your device. You can always revisit it in the My Forms section of your profile.

By following these simple instructions, you can efficiently set up a bank account for your trust using US Legal Forms.

Take action today and streamline your document management process with US Legal Forms, your trusted partner in legal documentation.

Form popularity

FAQ

When selecting a bank account for trust, consider options like checking accounts for daily transactions or savings accounts for passive income growth. Look for accounts with low fees, competitive interest rates, and features tailored to trust management. Establishing an efficient bank account for trust not only supports effective asset management but also enhances the trust's financial health. Check out US Legal Forms for resources on choosing the right account.

Yes, a trust can and should have its own bank account to hold assets and manage funds separately from personal accounts. This approach allows the trustee to manage the trust’s finances effectively while ensuring compliance with the trust's terms. Moreover, having a dedicated bank account for trust simplifies tax reporting and beneficiary distribution. US Legal Forms can provide guidance on best practices for setting up a trust account.

To open a bank account for trust, start by gathering essential documents such as the trust agreement and the tax identification number for the trust. Then, visit the bank of your choice and complete their application process, providing all required documentation. Remember that selecting the right bank can provide benefits such as better management tools and support for your bank account for trust. US Legal Forms can assist you with the necessary paperwork.

Yes, you should open a bank account in the name of your trust to clearly separate its assets from your personal finances. This step ensures that the trust's funds are managed according to its terms and facilitates smoother distribution to beneficiaries. Using a bank account for trust also enhances legal protection and simplifies financial reporting. Explore additional guidance on managing trust accounts through US Legal Forms.

The best bank to open a trust account depends on your specific needs and preferences. Look for banks that offer favorable terms, online access, and good customer service. Consider reviewing fees associated with managing a bank account for trust, as they can vary significantly. US Legal Forms provides resources and insights to help you make an informed choice.

Some banks have reduced their offerings for trust accounts due to increasing regulatory requirements and lower profitability. However, many financial institutions still provide trust services. It is essential to research and find banks committed to maintaining trust accounts, as these accounts play a crucial role in effective asset management.

The best type of bank account for a trust is often a dedicated trust account designed for this purpose. These accounts usually offer features such as higher interest rates, detailed transaction reporting, and easier management of trust assets. Always evaluate the specific services provided by your financial institution to find the most beneficial option.

Opening a bank account for a trust involves several steps. First, gather the necessary documents, including the trust agreement and the EIN. Next, visit your chosen bank and provide these materials to initiate the application process, ensuring compliance with the bank's requirements for a trust account.

The best place to open a trust account is at a bank or financial institution that offers specialized trust services. Look for banks that prioritize customer service and have a good reputation in trust management. Additionally, consider online platforms like US Legal Forms, which can provide guidance on setting up a trust and its associated bank account.

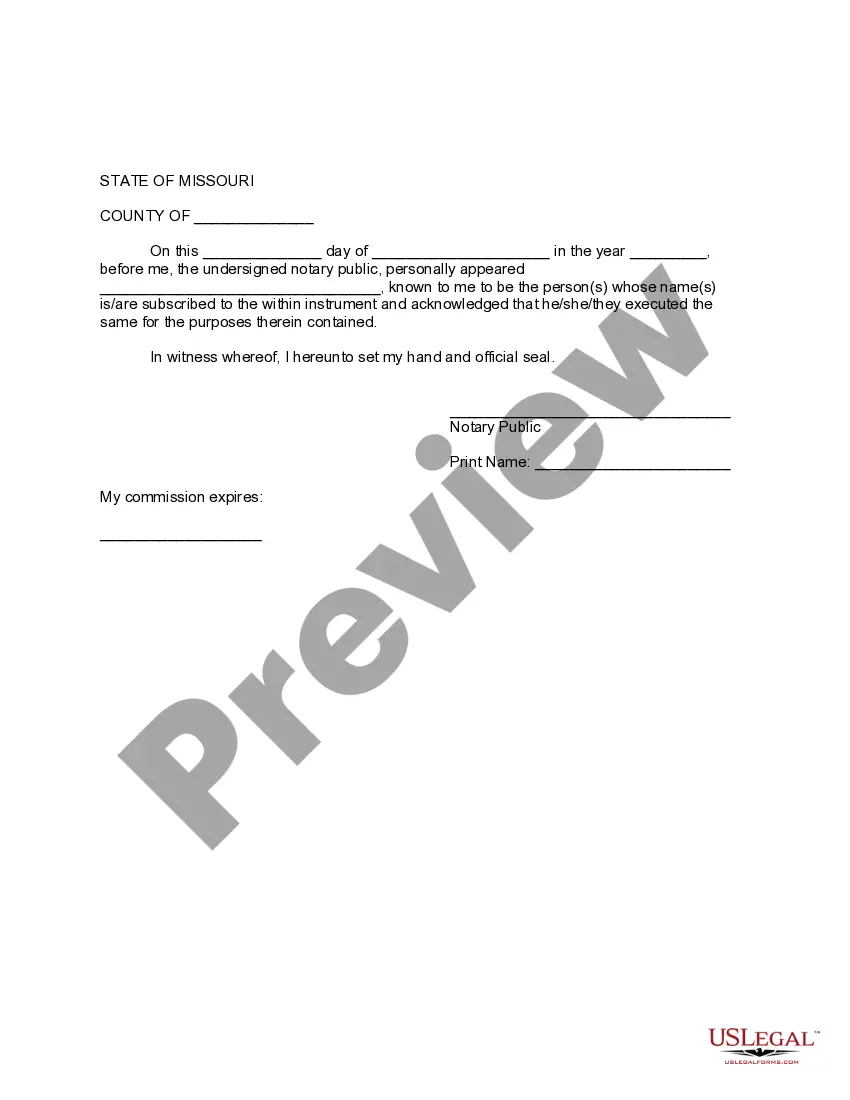

Typically, you will need an Employer Identification Number (EIN) to open a bank account for trust. This number identifies the trust for tax purposes and is necessary for filing tax returns. Obtaining an EIN is a straightforward process, and it will ensure compliance with tax regulations.