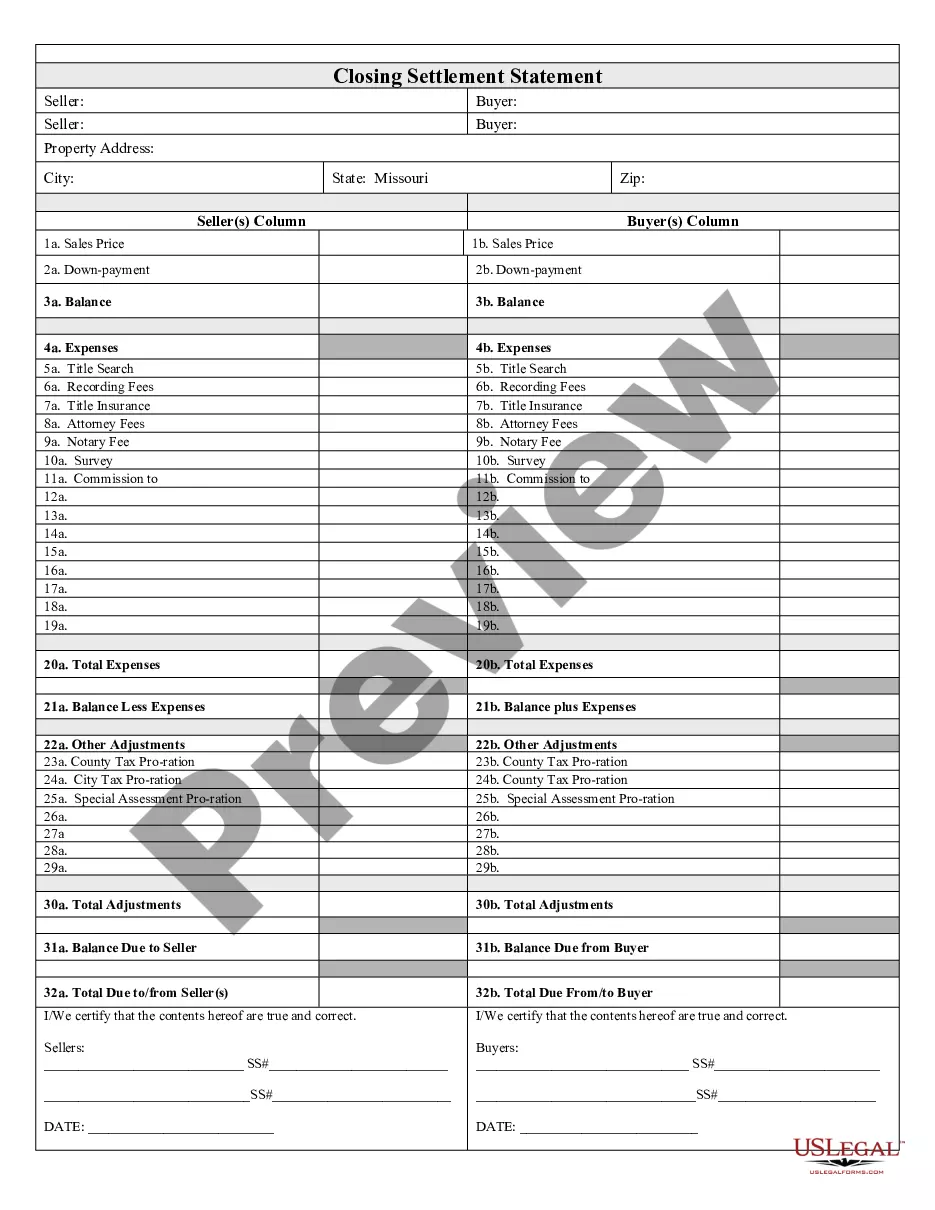

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Missouri Closing Costs For Seller

Description

How to fill out Missouri Closing Statement?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of handling bureaucracy. Finding the right legal files demands precision and attention to detail, which is the reason it is crucial to take samples of Missouri Closing Costs For Seller only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the details about the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Missouri Closing Costs For Seller:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s information to ascertain if it fits the requirements of your state and county.

- Open the form preview, if there is one, to ensure the form is the one you are looking for.

- Go back to the search and look for the right document if the Missouri Closing Costs For Seller does not suit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Pick the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a payment method (bank card or PayPal).

- Pick the document format for downloading Missouri Closing Costs For Seller.

- Once you have the form on your gadget, you may alter it with the editor or print it and finish it manually.

Remove the hassle that accompanies your legal documentation. Check out the extensive US Legal Forms collection to find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The seller is responsible for transfer taxes, commission, the owner's title policy, deed preparation fees, lien payoffs, and recording expenses.

Missouri is one of the few states that does not enforce a real estate transfer tax. Title Insurance. Title insurance protects the buyer in case there are any liens or disputes about the house's title. Even though this is for the benefit of the buyer, the seller typically pays this one-time cost.

Both the buyer and the seller have to pay certain closing expenses in Missouri. Seller closing costs in Missouri can amount to 8%-10% of the final sale price of the home. This does not include the mortgage payoff. The biggest closing cost (5%-6%) the seller has to pay is the listing and buyer's agent commission.

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

The closing cost percentage for buyers in Missouri accounts for 2% to 5% of the total purchase price. The exact closing costs depend on the type of loan, home value, sale contingencies, and local laws. You can ask for seller credits or concessions, negotiate with your lender, or opt for a no closing cost mortgage.