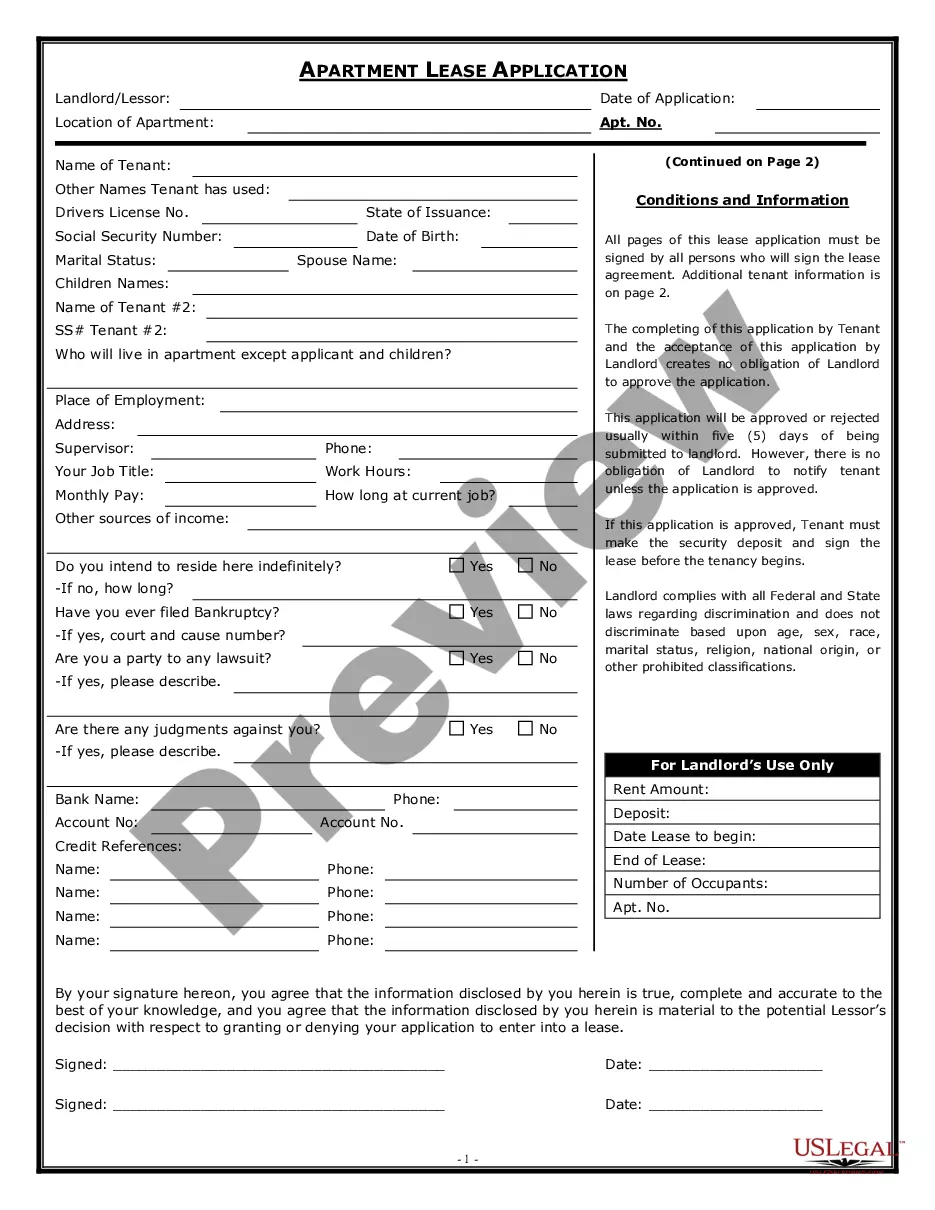

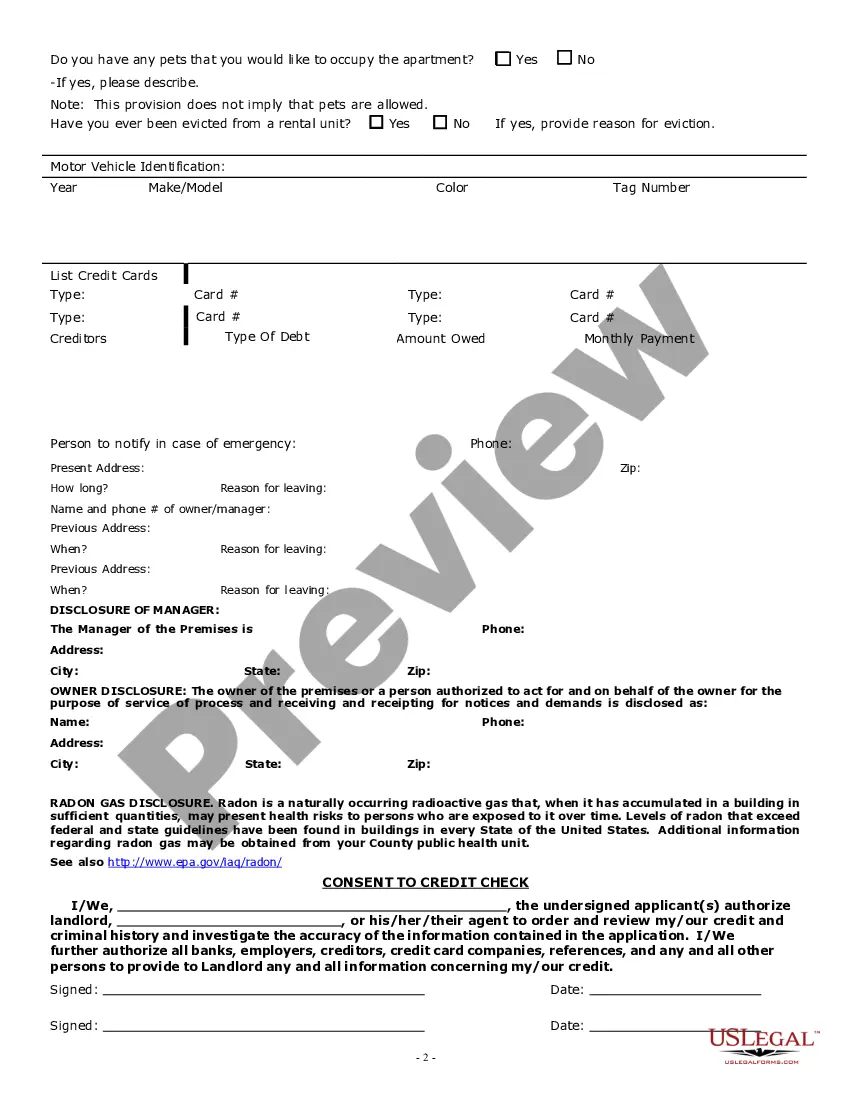

This Apartment Lease Rental Application Questionnaire form is an Apartment Lease Application for the Landlord to have the proposed Tenant complete and submit to the Landlord for the Landlord to evaluate. It contains the required disclosures and an authorization for release of information.

Missouri Rental Application Withholding

Description

How to fill out Missouri Rental Application Withholding?

What is the most reliable service to obtain the Missouri Rental Application Withholding and other updated versions of legal documents.

US Legal Forms is the solution! It boasts the largest assortment of legal forms for any scenario.

If you do not yet have an account with our library, follow these steps to create one: Examine form compliance. Before obtaining any template, ensure it meets your use case requirements and complies with your state or county laws. Review the form description and utilize the Preview if available. Search for alternative forms. If discrepancies arise, use the search bar in the page header to find another template. Click Buy Now to select the right one. Sign up and purchase a subscription. Choose the best pricing plan, Log In or create an account, and pay for your subscription using PayPal or a credit card. Download the documents. Choose the format you wish to save the Missouri Rental Application Withholding in (PDF or DOCX) and click Download to receive it. US Legal Forms is an ideal solution for anyone needing to manage legal documents. Premium subscribers can benefit even more by filling out and approving previously saved forms electronically at any time through the integrated PDF editing tool. Try it out today!

- Each template is meticulously drafted and verified for adherence to federal and local laws.

- They are organized by area and state of application, making it easy to find what you need.

- Experienced platform users only need to Log In, verify their subscription is active, and click the Download button next to the Missouri Rental Application Withholding to get it.

- Once saved, the template is accessible for future use within the My documents section of your profile.

Form popularity

FAQ

Yes, tenants in Missouri can legally withhold rent, but only under specific conditions, such as when the property is unsafe or uninhabitable. It is critical to follow the proper legal procedures and communicate with the landlord. If you find yourself confused about Missouri rental application withholding, consider seeking advice from US Legal Forms to understand your rights better.

Landlords in Missouri are responsible for maintaining the property in good condition, ensuring it is habitable and meets local health and safety standards. They must also respond to repairs in a timely manner and respect tenant rights. Being aware of these obligations is essential if you’re considering Missouri rental application withholding as a means of recourse.

In Minnesota, tenants may withhold rent if the landlord does not comply with housing codes and has not remedied the issue after being notified. It is crucial to keep detailed records of communication and any failed repairs. If you’re dealing with Missouri rental application withholding, being informed about similar laws in other states can strengthen your case.

In Oregon, tenants can withhold rent if the landlord fails to make necessary repairs that affect the livability of the space. This requires documented communication with the landlord about the needed repairs. Understanding situations like this can lead to clarity on Missouri rental application withholding, particularly if you find yourself in similar circumstances.

Certain states permit tenants to withhold rent under specific conditions, particularly when the rental property is uninhabitable. It is essential to review the local laws regarding tenant rights and responsibilities. If you find yourself navigating Missouri rental application withholding, you will need to be aware of these regulations to secure your rights.

Currently, there are several states in the U.S. that do not enforce any rent control laws. This means landlords have the freedom to set rental prices without restrictions. Understanding this dynamic is key when dealing with Missouri rental application withholding, as it can influence tenant and landlord relationships significantly.

The Missouri Property Tax Credit (PTC) has specific income limits that change periodically, typically based on the current tax year. For accurate figures, it's vital to check the latest guidelines from the state. Being aware of Missouri rental application withholding can help you ensure you qualify. Knowing the income thresholds allows you to plan your finances and understand your eligibility for the rebate.

The primary form for proof of rental income in Missouri often includes a rent receipt or lease agreement. These documents verify your rental payments and are crucial for various applications, including tax rebates. Understanding Missouri rental application withholding can further emphasize the importance of maintaining accurate records. Always have this proof ready when filing for claims or rebates.

To file a rent rebate in Missouri, you generally need to gather specific documents, including proof of your income and rent payments. The completed MO form 5674 will be essential for your application. Being informed about Missouri rental application withholding will streamline this process. Ensure all your documentation is accurate to facilitate quicker approval of your rebate.

Yes, in Missouri, you can claim rent on your taxes through the property tax credit program. This program allows eligible renters to receive some financial benefits based on their rent and income. Awareness of Missouri rental application withholding can aid you in properly documenting your expenses. To maximize your tax benefits, it’s advisable to keep thorough records of your rental payments.