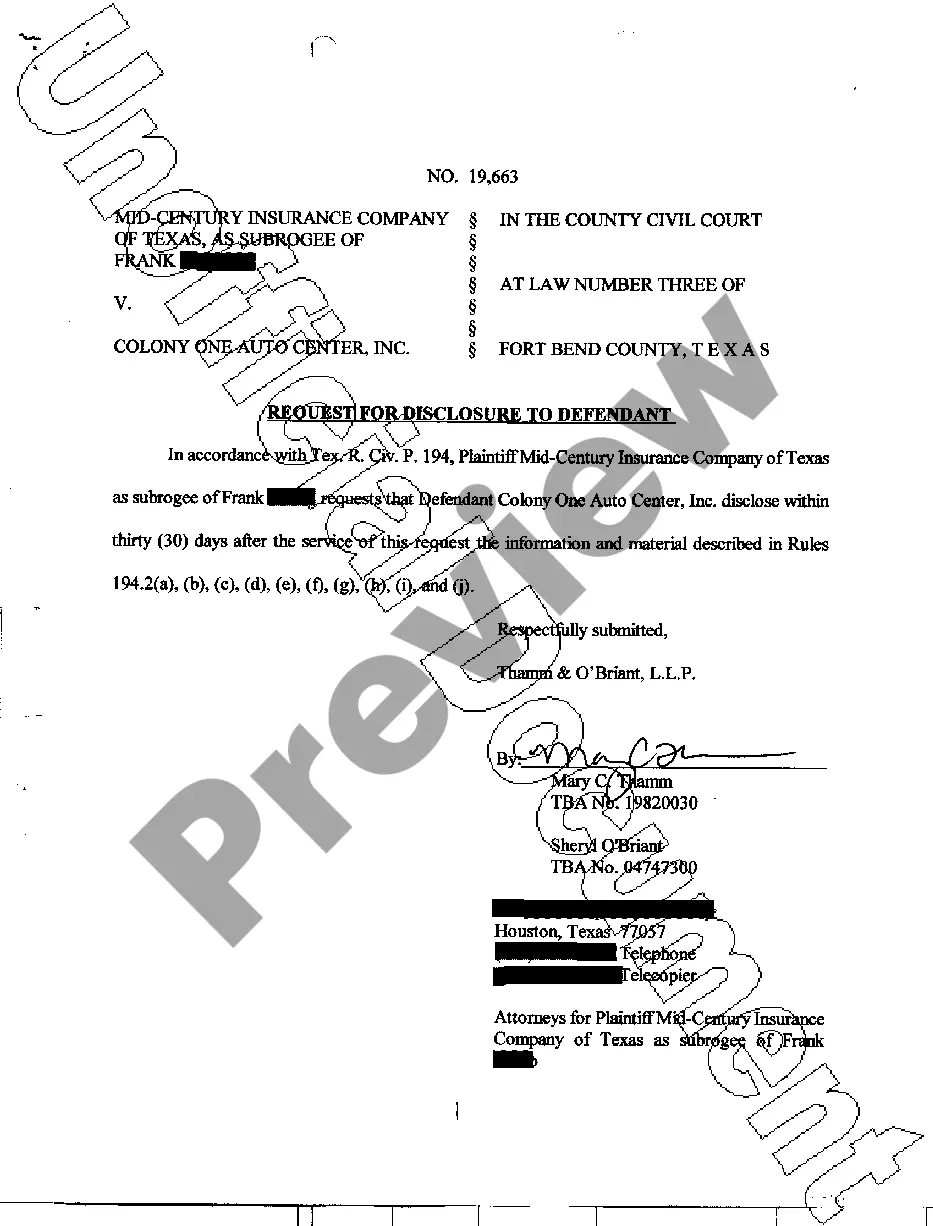

Conditional Lien Waiver Form Connecticut

Description

How to fill out Missouri Conditional Waiver And Release Of Lien Upon Progress Payment?

Creating legal documents from scratch can occasionally be daunting.

Certain situations may require extensive research and considerable financial investment.

If you are looking for a simpler and more economical method of preparing Conditional Lien Waiver Form Connecticut or any other documents without unnecessary obstacles, US Legal Forms is always here to assist you.

Our virtual inventory of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can immediately access state- and county-compliant templates meticulously created for you by our legal experts.

US Legal Forms has an impeccable reputation and more than 25 years of experience. Join us today and make document execution a straightforward and efficient process!

- Utilize our platform whenever you need a dependable service through which you can swiftly find and download the Conditional Lien Waiver Form Connecticut.

- If you are already a member of our website and have created an account, simply Log In, select the template, and download it or access it again later in the My documents section.

- Don’t have an account? No problem. It requires minimal time to register and browse the catalog.

- However, before proceeding to download the Conditional Lien Waiver Form Connecticut, consider these tips.

- Review the document preview and descriptions to confirm you have located the document you need.

Form popularity

FAQ

Yes, an employee can receive a W2 and a 1099, but it should be avoided whenever possible. That's because this type of situation is a red flag and frequently results in a response from the IRS seeking further information. It also takes unusual circumstances for this type of dual filing to be legitimate.

Ing to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor.

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.

The bottom line is - as long as your two roles are completely different, you can have two contracts with the same employer and receive both 1099 and W-2 forms to fill in. A note: If you have US contractors working for you from outside of the US, we've got you. From now on, Deel handles these 1099 forms too!

An independent contractor is free to set his or her own hours. An independent contractor is free to determine in what order or sequence to perform his or her duties. An employee is required by the employer to perform his or her services at times or in a particular order or sequence established by the employer.

Business licenses and registration Regardless of what type of contractor you are, all businesses in Wisconsin need to register with the State of Wisconsin Department of Revenue.

The 2021 IC Rule explained that independent contractors are not employees under the FLSA and are therefore not subject to the Act's minimum wage, overtime pay, or recordkeeping requirements.

With the prevalence of zero-hour contracts, it's very common for people to have more than one job, either to make up for a shortage of hours or because they need a little extra to make ends meet. It's perfectly fine and common for people to be both self-employed and employed in these types of situations.