Owner Resident

Description

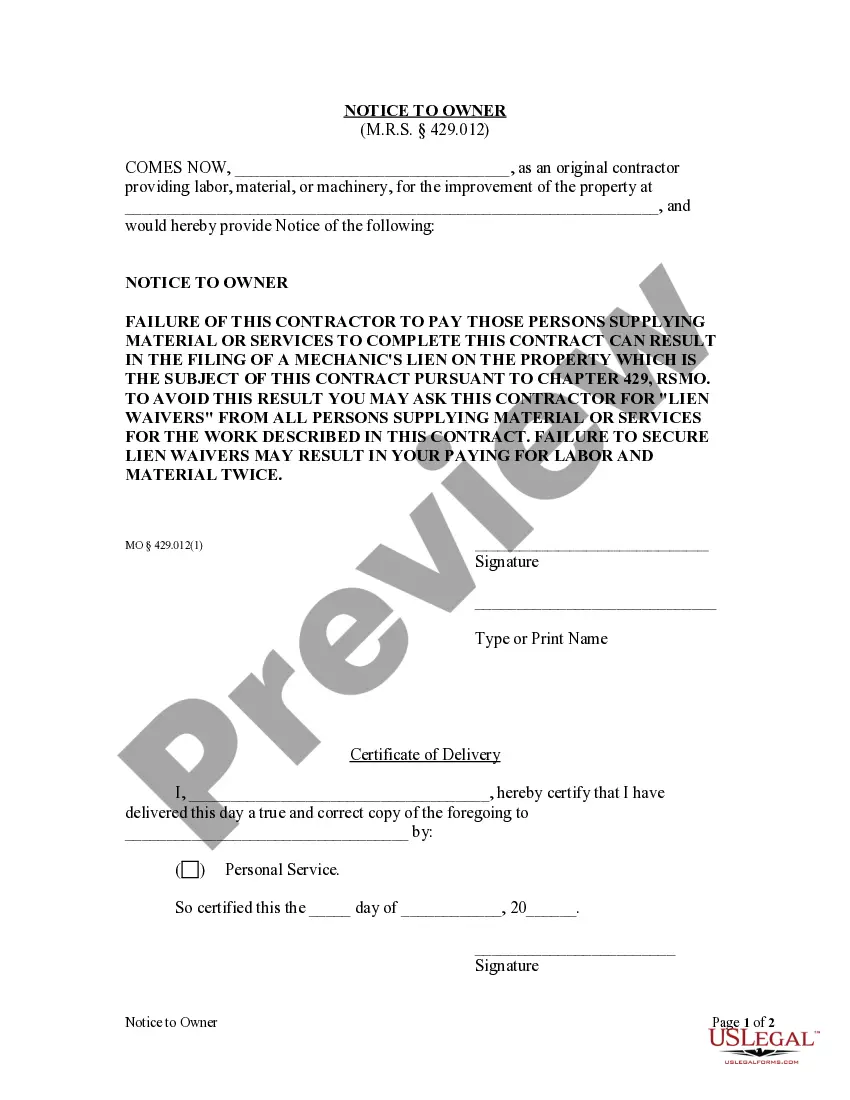

How to fill out Missouri Consent Of Owner - Residential - Individual?

- If you're already a user, log into your account and click the Download button for your desired form. Ensure your subscription is active; if not, renew it based on your selected plan.

- For first-time users, begin by reviewing the available forms in the Preview mode. Choose the correct one that aligns with your requirements and local laws.

- If adjustments are needed, utilize the Search tab to find alternative templates that better fit your situation before proceeding.

- Purchase the selected document. Click 'Buy Now' and select a subscription plan that works for you. You'll need to create an account to access additional resources.

- Finalize your transaction by entering payment details either via credit card or PayPal.

- Download the completed form and save it to your device. It will also be available in the My Forms section for future reference.

By following these steps, owner residents can benefit from US Legal Forms’ robust library and expert assistance. The platform secures precise and legally sound documents effortlessly.

Start today and take advantage of US Legal Forms to simplify your legal needs!

Form popularity

FAQ

Some individuals are not required to file taxes in Connecticut, especially if their income falls below specific thresholds. If you are an owner resident earning under the minimum amounts or meet particular age criteria, your filing may not be necessary. Additionally, certain types of income, such as Social Security benefits, might not trigger a filing requirement. Always verify your status to avoid unnecessary filings.

Filling out registration and title applications in Connecticut is essential for an owner resident purchasing a vehicle. You will need to provide personal identification, proof of ownership, and a completed application form. Additionally, gathering necessary documentation, such as bill of sale or previous title, will streamline the process. For step-by-step assistance, consider using resources like US Legal Forms to ensure accuracy.

Certain individuals may be exempt from state income tax in Connecticut, including low-income earners and specific categories of citizens. For example, if your income is below the threshold, you might not need to file. Additionally, some retirees and veterans may qualify for exemptions. It's crucial to review your situation, as being an owner resident doesn’t automatically exempt you from tax obligations.

Yes, as an owner resident, you can sue your condo association for negligence if they fail to maintain common areas or violate their duties. Connecticut law allows residents to seek compensation for damages resulting from the association’s negligence. It’s advisable to document any incidents and consult an attorney experienced in condo law to evaluate your case. Taking action can help ensure your rights are respected.

As an owner resident in a condominium, you have several rights that protect your interests. These include the right to access documents, participate in meetings, and be heard on issues affecting the property. Additionally, you can enjoy the common areas and expect proper maintenance under the governing documents. Knowing your rights ensures you can advocate effectively for your living environment.

In Connecticut, the minimum income to file taxes varies depending on your filing status. For an owner resident who is single, you need to file if your income is $15,000 or more, while married residents must file if their income is $24,000 or greater. Understanding these limits can help you stay compliant and avoid penalties. Always consult the latest tax charts or a tax professional.

As an owner resident in Connecticut, you must file state income tax if your income exceeds certain thresholds. Generally, if you are single and earned more than $15,000, or you are married and earned more than $24,000, you will need to file. Residents with specific types of income must also meet filing requirements. It’s essential to check the current guidelines annually to ensure compliance.

In real estate, 'residential' refers to properties designed for living, including single-family homes, apartments, and townhouses. This term encompasses various housing types, indicating they are intended for personal occupancy. Understanding this classification helps in identifying suitable properties that meet your living needs.

A residential property owner is someone who holds a deed to a property intended primarily for living purposes. This ownership not only conveys rights to the property but also imposes responsibilities such as maintenance and property taxes. Understanding your role as a residential property owner is essential for effective management and long-term planning.

The primary difference between a tenant and a resident lies in ownership. A tenant rents a property and does not hold ownership rights, whereas a resident owner owns their dwelling and occupies it. Knowing this difference impacts various aspects of housing laws and financial agreements.