Missouri Foreign Llc Registration With Itin

Description

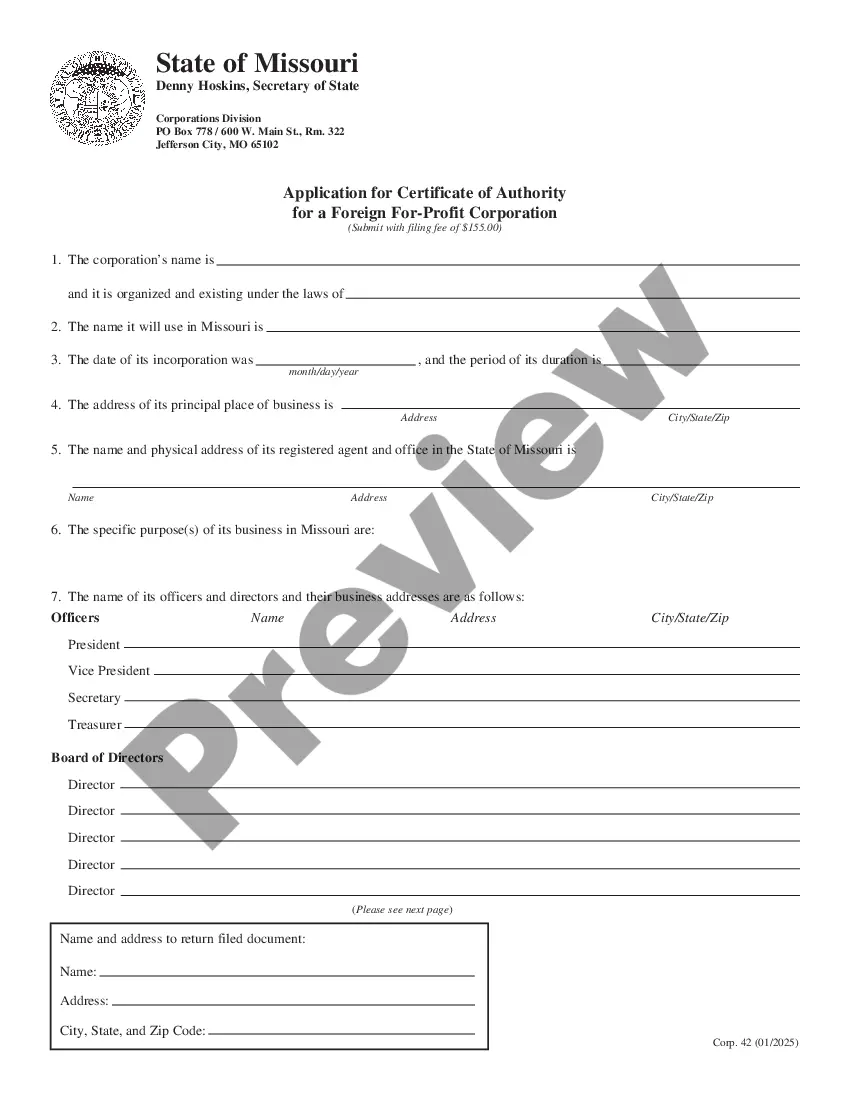

How to fill out Missouri Registration Of Foreign Corporation?

Obtaining legal document examples that comply with federal and local regulations is crucial, and the web provides a multitude of choices to select from.

However, what's the purpose of spending time looking for the properly crafted Missouri Foreign Llc Registration With Itin template online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for various professional and personal situations.

Review the template using the Preview option or through the text outline to ensure it satisfies your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring your documentation is always current and compliant when you acquire a Missouri Foreign Llc Registration With Itin from our site.

- Getting a Missouri Foreign Llc Registration With Itin is fast and simple for both existing and new users.

- If you have an account with an active subscription, Log In and store the document sample you need in your desired format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

Missouri law requires any person or business entity which transacts business in the state under a name other than their own ?true name? to register that business name with the Secretary of State's Office as a Fictitious Name Registration.

Missouri law requires any person or business entity which transacts business in the state under a name other than their own ?true name? to register that business name with the Secretary of State's Office as a Fictitious Name Registration.

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your Missouri LLC is paying the correct amount.

Starting an LLC in Missouri will include the following steps: #1: Draft a Business Plan. #2: Research Your Business Structure Options. #3: Register a Business Name. #4: Appoint a Registered Agent. #5: File Articles of Organization. #6: Obtain an Employer Identification Number (EIN) #7: Draft an Operating Agreement.

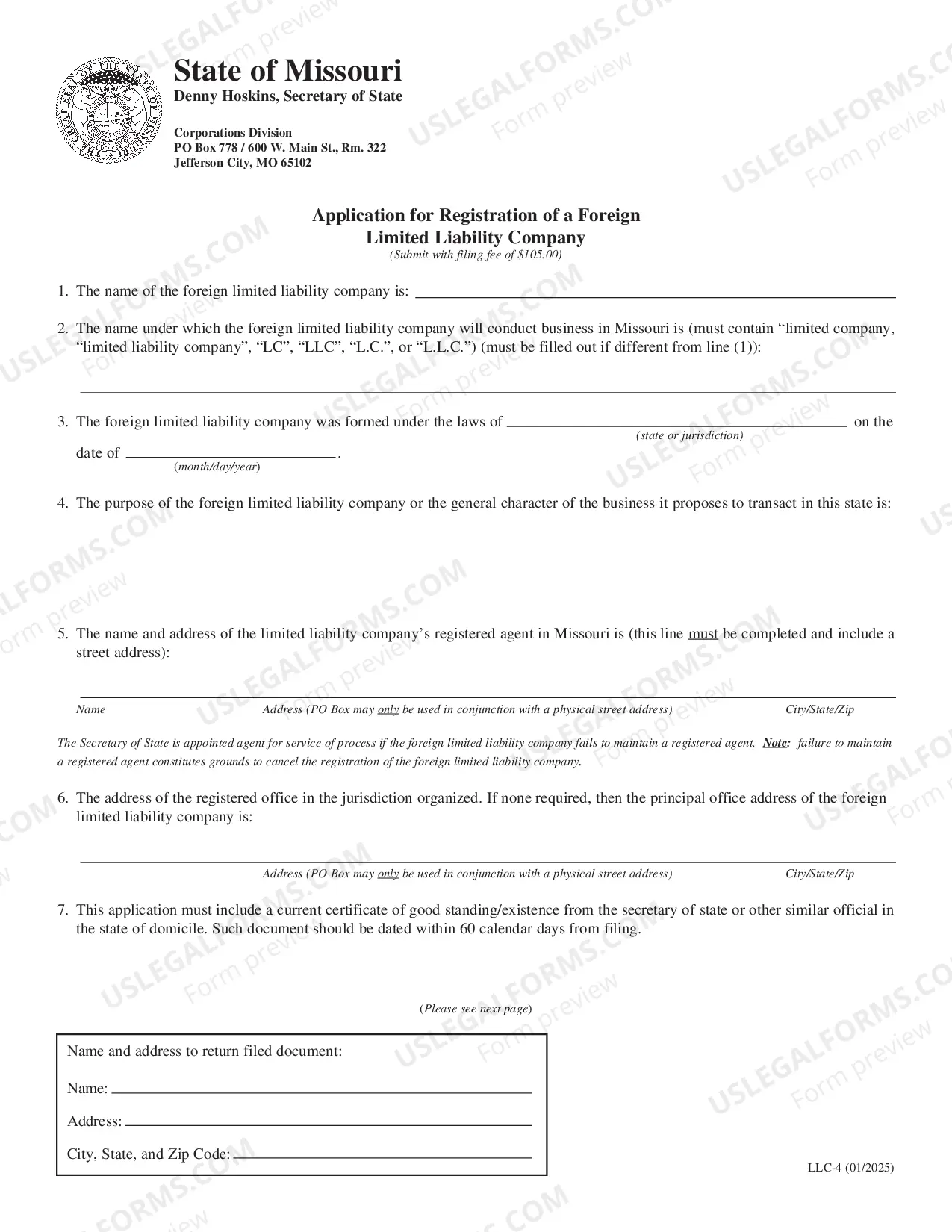

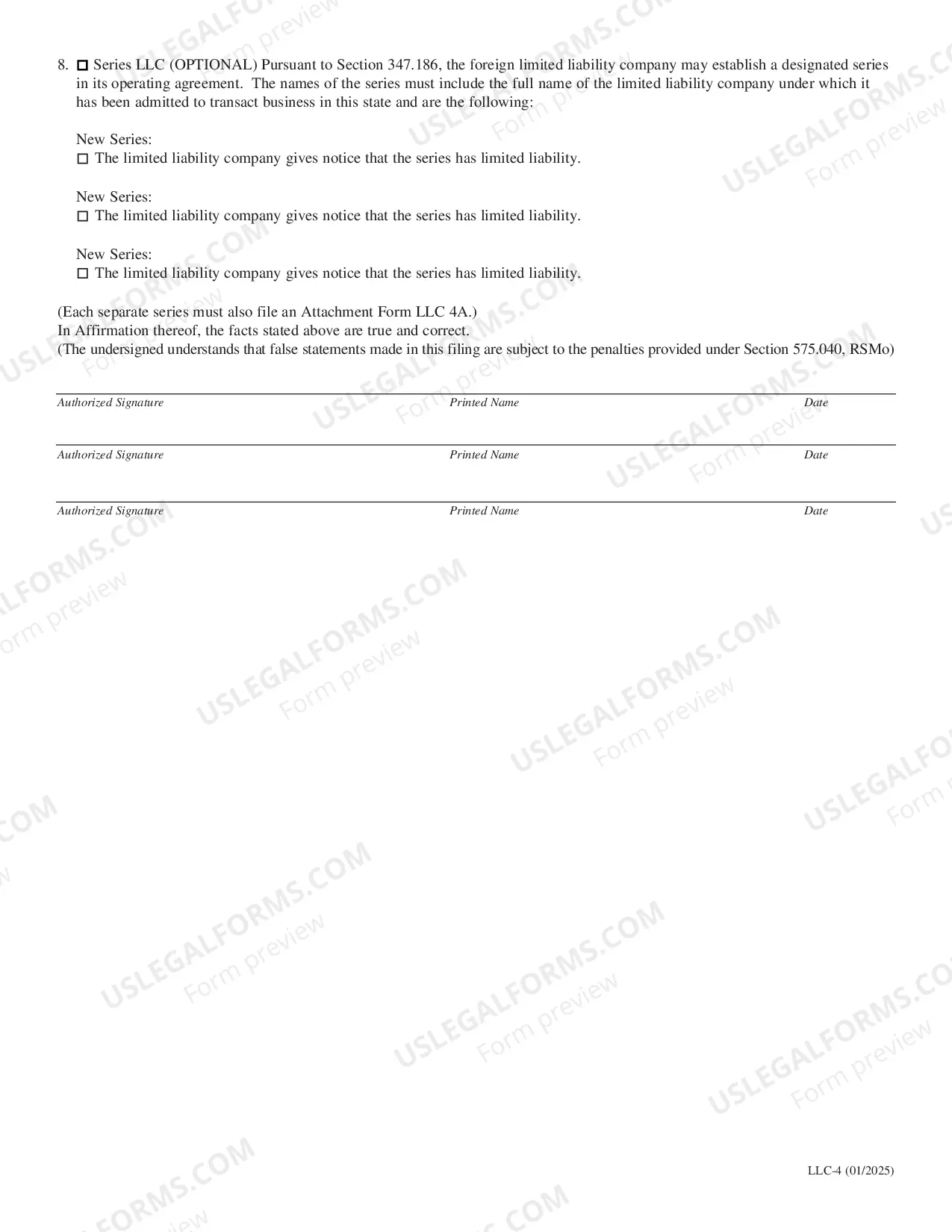

To do business as a foreign LLC in Missouri, you'll need to appoint a local registered agent, file an Application for Registration of a Foreign Limited Liability Company with the Missouri Secretary of State, and pay the state filing fee of $105 (plus a 2.15% added fee if paying by credit card).