Minnesota Bankruptcy Chapter 7 With A Cosigner

Description

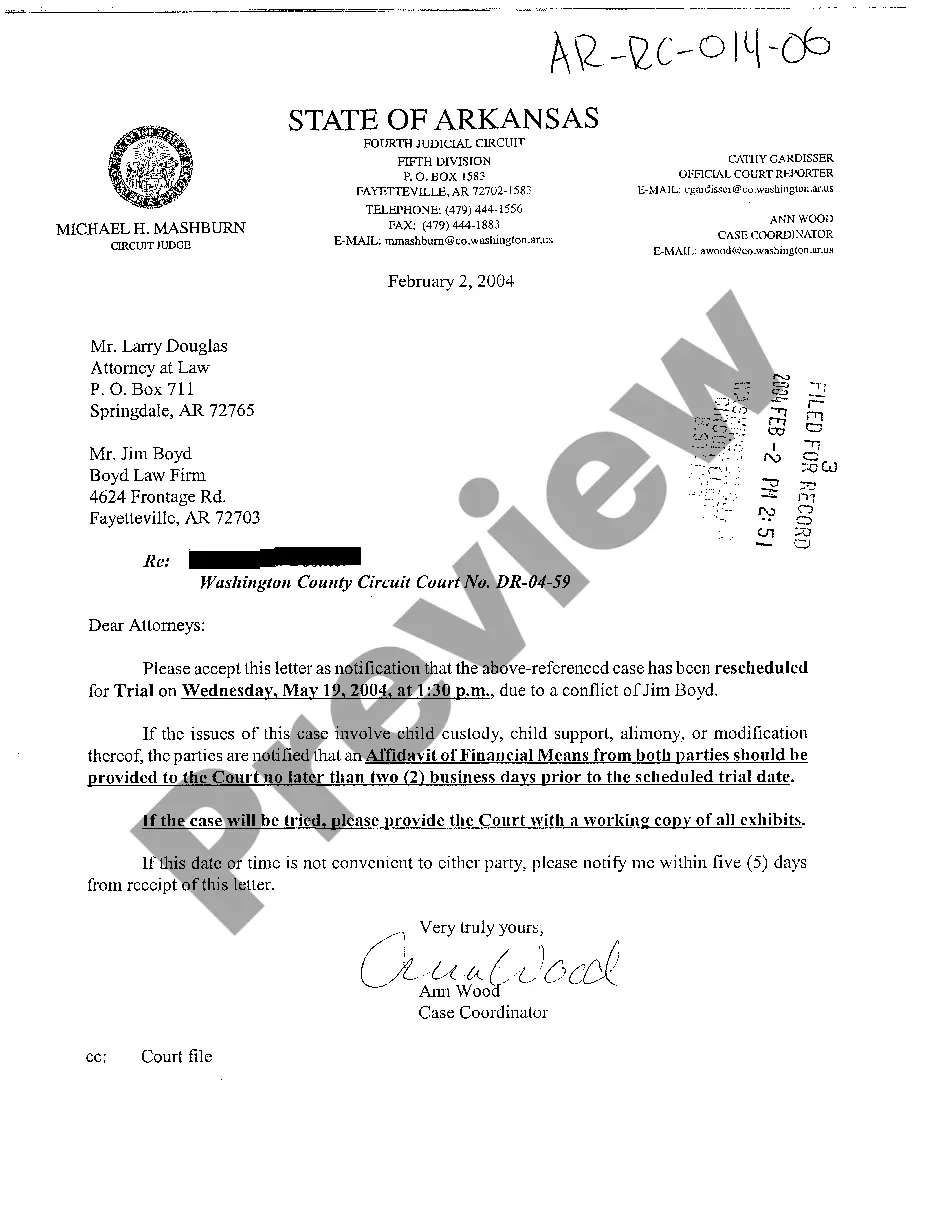

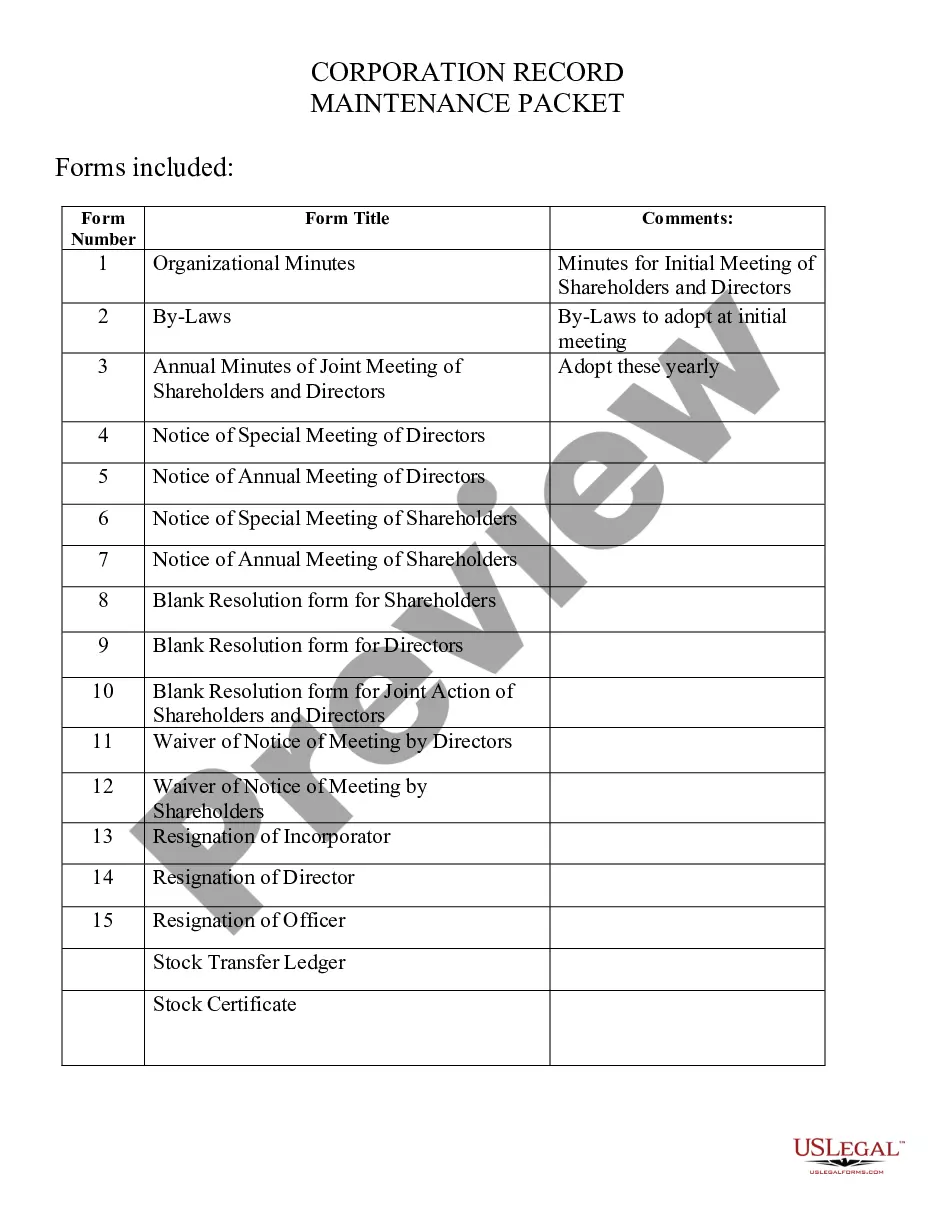

How to fill out Minnesota Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

How to locate professional legal documents aligned with your state regulations and prepare the Minnesota Bankruptcy Chapter 7 With A Cosigner without seeking an attorney? Numerous online services offer templates for various legal situations and requirements. However, it may take time to identify which of the existing samples meet both your needs and legal standards.

US Legal Forms is a reliable service that assists you in finding official documents crafted in accordance with the most recent state law revisions, helping you save on legal fees.

US Legal Forms is more than just a regular online directory. It is a repository of over 85,000 validated templates for diverse business and personal circumstances. All documents are categorized by jurisdiction and state to streamline your search process and make it more efficient. Additionally, it integrates with powerful tools for PDF editing and electronic signatures, allowing users with a Premium subscription to effortlessly complete their documents online.

Select the most suitable pricing plan, then Log In or create an account. Choose your payment method (using credit card or PayPal). Change the file format for your Minnesota Bankruptcy Chapter 7 With A Cosigner and click Download. The acquired documents remain in your ownership: you can always revisit them in the My documents section of your profile. Join our database and create legal documents independently like a seasoned legal professional!

- It requires minimal time and effort to acquire the necessary paperwork.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Minnesota Bankruptcy Chapter 7 With A Cosigner using the corresponding button adjacent to the file name.

- If you lack an account with US Legal Forms, then follow the directions listed below.

- Browse the webpage you have accessed and confirm if the form meets your requirements.

- To achieve this, use the form description and preview options if present.

- Look for another template in the header that provides your state if necessary.

- Click the Buy Now button when you locate the appropriate document.

Form popularity

FAQ

While it’s natural to think that creditors may become upset when you file for Minnesota bankruptcy chapter 7 with a cosigner, their main concern is often recovering what they can. They might be frustrated, but the law protects your right to file for bankruptcy as a means to manage insurmountable debt. Understanding this legal process can empower borrowers as they navigate their financial challenges. Utilizing platforms like US Legal Forms can help streamline your bankruptcy filing and clarify your rights.

Once you file for Minnesota bankruptcy chapter 7 with a cosigner, creditors generally cannot collect on discharged debts. However, they may still pursue payments from cosigners because their obligation remains intact unless explicitly included in the bankruptcy filing. Creditors must cease collection activities against the individual who filed for bankruptcy, putting an end to relentless calls and letters. This halt provides significant relief for those seeking a fresh financial start.

To protect yourself as a cosigner in a Minnesota bankruptcy chapter 7 situation, communicate openly with the borrower about filing options. Consider consulting with a legal expert who can help you understand your rights and responsibilities. Additionally, if possible, stay updated on the borrower's financial situation to address potential issues proactively. This can help you take necessary steps before the situation escalates.

In Minnesota bankruptcy chapter 7 with a cosigner, unsecured creditors typically do not receive full payment once the bankruptcy is filed. These creditors may lose their ability to collect debt. After the bankruptcy process, most unsecured debts can be discharged, meaning you will no longer owe them. This provides a fresh financial start for individuals attempting to regain stability.

If you file for Chapter 7 bankruptcy in Minnesota, your co-signer will likely remain responsible for the debt unless they also file for bankruptcy. While your bankruptcy can eliminate your personal liability for the debt, it does not automatically protect your co-signer. Your co-signer may have to continue making payments, which is something you should discuss openly to avoid misunderstandings. Using resources like Uslegalforms can help you navigate these complexities more effectively.

When a co-signer files for Chapter 7 bankruptcy in Minnesota, it can impact the primary borrower's responsibility for the debt. The bankruptcy will erase the co-signer's liability for that debt, but it may not remove the obligation from the primary borrower. It is crucial to understand this dynamic, especially when considering Minnesota bankruptcy chapter 7 with a cosigner. Consulting with legal experts can help clarify your specific situation.

When you file for Minnesota bankruptcy chapter 7 with a cosigner, the cosigner remains liable for the debt. This means that the lender can pursue the cosigner for repayment, as the bankruptcy only protects you. If you discharge the debt, your cosigner may face collection actions unless you negotiate with the lender. It’s crucial to communicate openly with your cosigner about your bankruptcy plans.

In Minnesota, the income limit for qualifying for Chapter 7 bankruptcy with a cosigner is based on the median income for households of your size. As of the latest updates, your household income should fall below the state median to be eligible for this type of bankruptcy. If your income exceeds this limit, you might still qualify by passing the means test, which evaluates your disposable income. Understanding these thresholds can help you determine if Minnesota bankruptcy chapter 7 with a cosigner is right for you.

The amount of debt to file for Minnesota bankruptcy chapter 7 with a cosigner depends on your financial situation. There is no specific minimum debt requirement; however, it’s essential that your debts are significant enough to justify the filing. Typically, if your debts outweigh your income, it may be a strong indicator that Chapter 7 is an option for you. Consider consulting with a legal expert to evaluate your particular circumstances.