Minnesota Homestead Form With 2 Points

Description

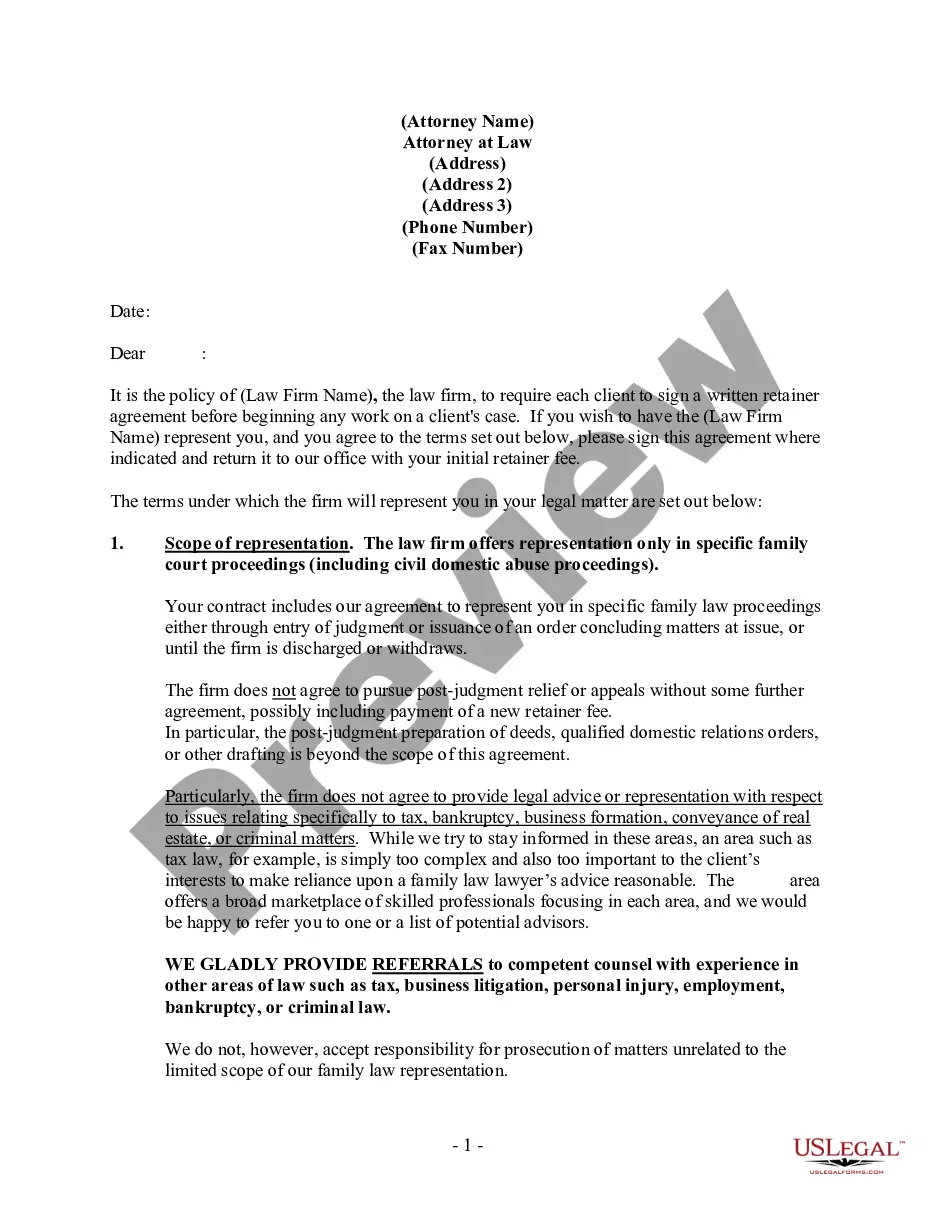

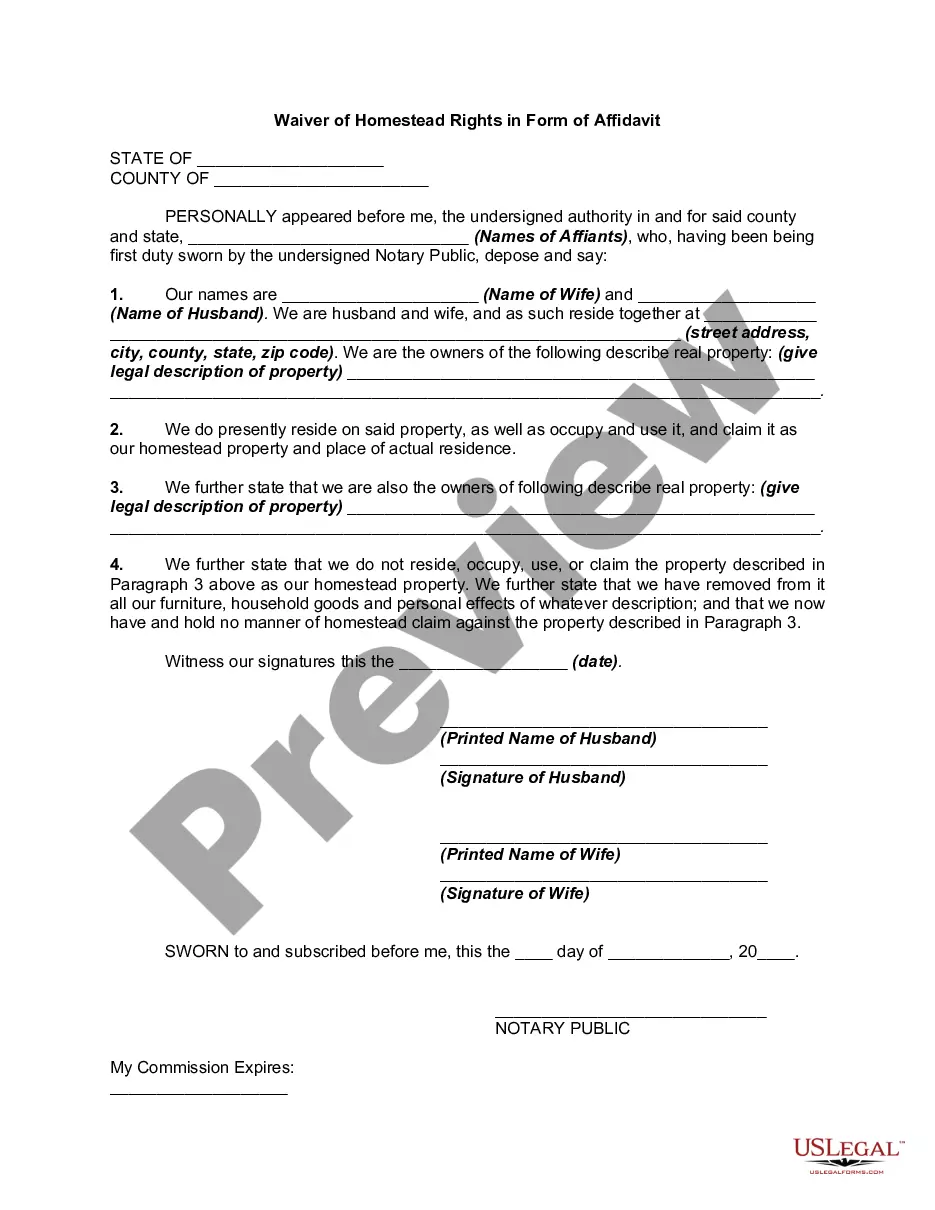

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

The Minnesota Homestead Document With 2 Points you observe on this page is a versatile official template created by experienced attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any corporate and personal situation. It’s the fastest, simplest, and most dependable method to acquire the forms you require, as the service assures bank-grade data security and anti-malware defenses.

Register for US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and verify it.

- Select the pricing package that fits your needs and establish an account.

- Choose the format you desire for your Minnesota Homestead Document With 2 Points (PDF, DOCX, RTF) and store the sample on your device.

- Print the template to fill it out by hand. Alternatively, utilize an online multifunctional PDF editor to efficiently and accurately complete and sign your document with an eSignature.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved templates.

Form popularity

FAQ

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

Claiming Multiple Properties If a property is occupied by a married owner, the owner's spouse may not claim another property as a homestead unless the spouse does not occupy the house due to 1 of the following reasons: Marriage dissolution proceedings are pending. The spouses are legally separated.

Many taxpayers in Minnesota, USA, are set to receive a tax refund over the coming days, thanks to a new tax rebate August 2023 law. Overall, over two million checks worth up to 1,300 dollars each will be sent out across August and September, thanks to a new initiative from Governor Tim Walz.

For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.