Financial Disclosure Form For Federal Employees

Description

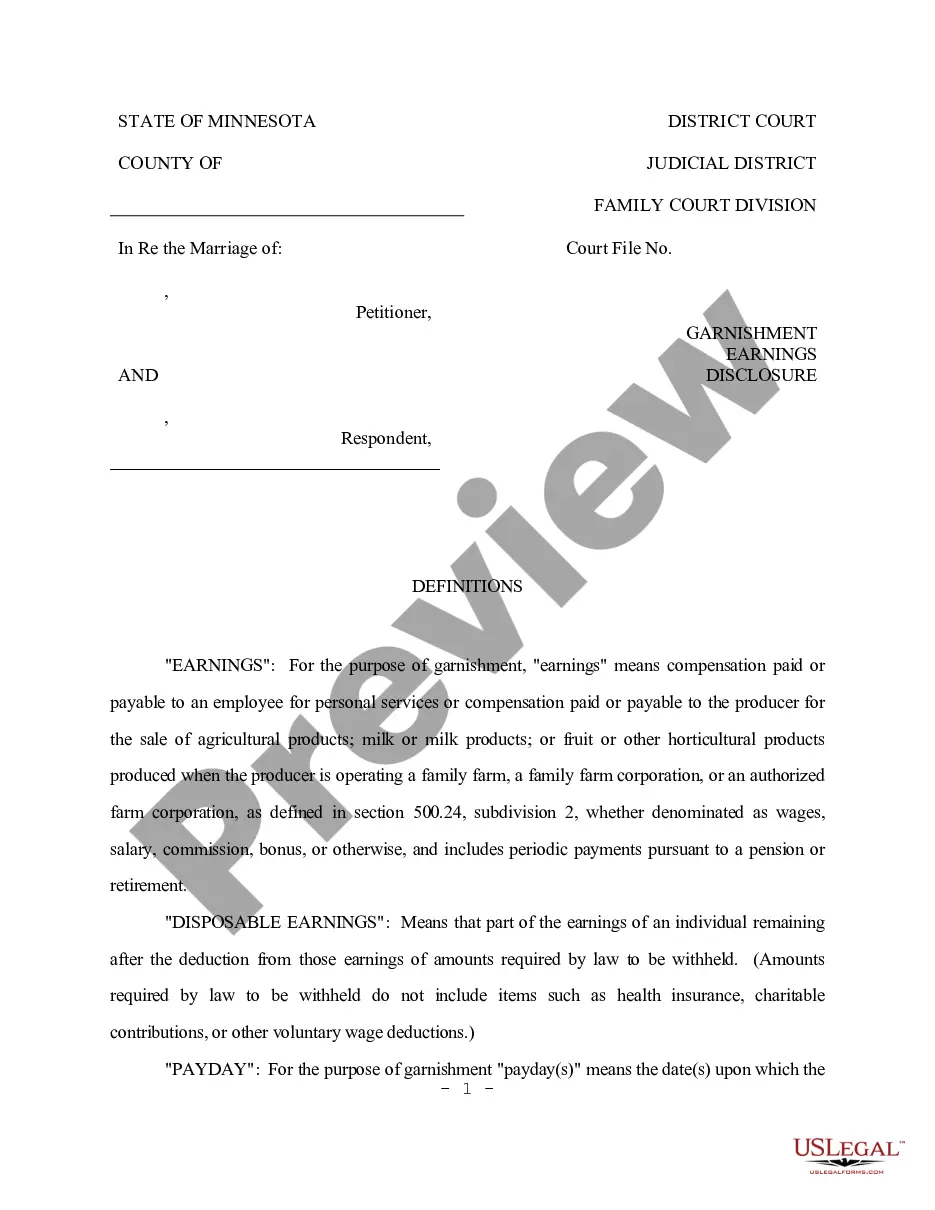

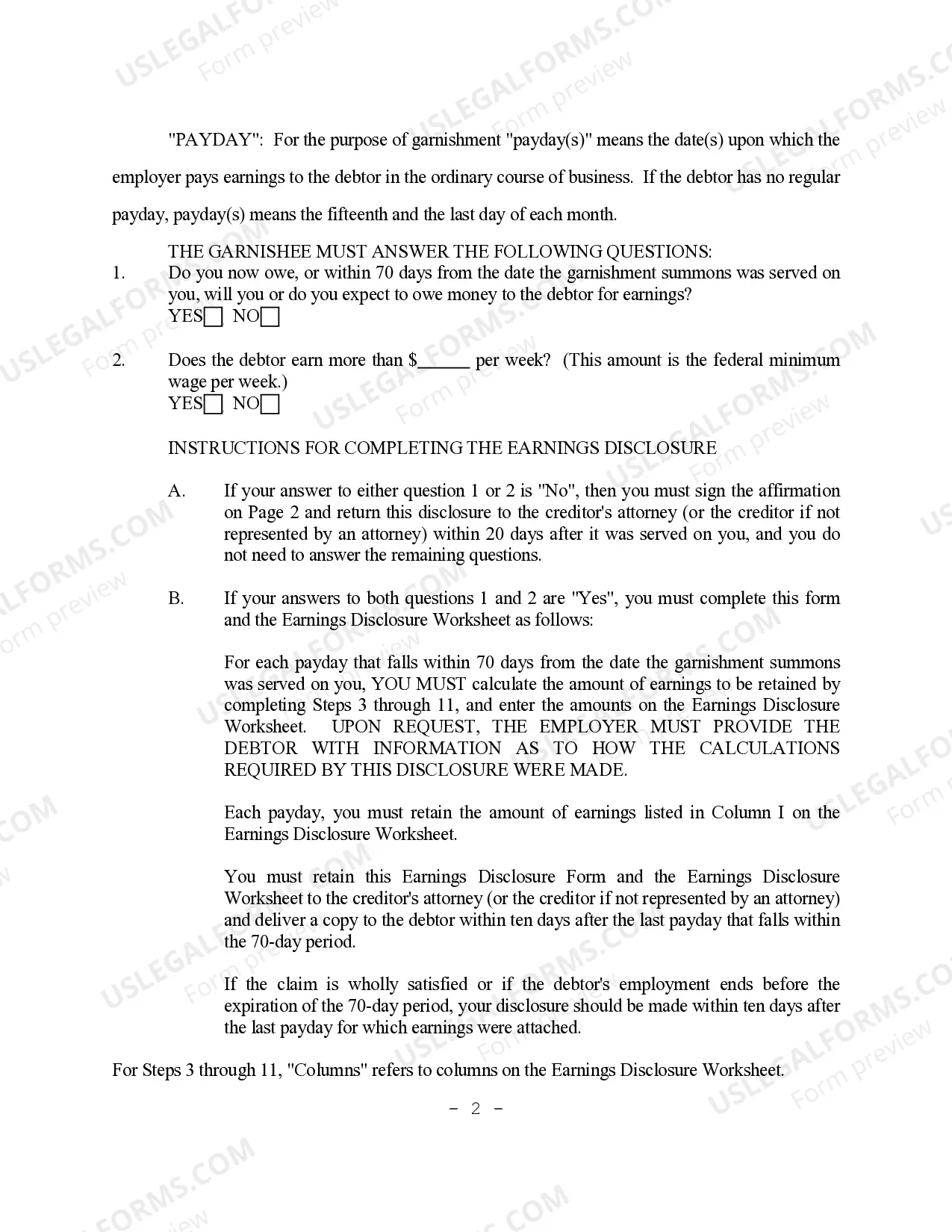

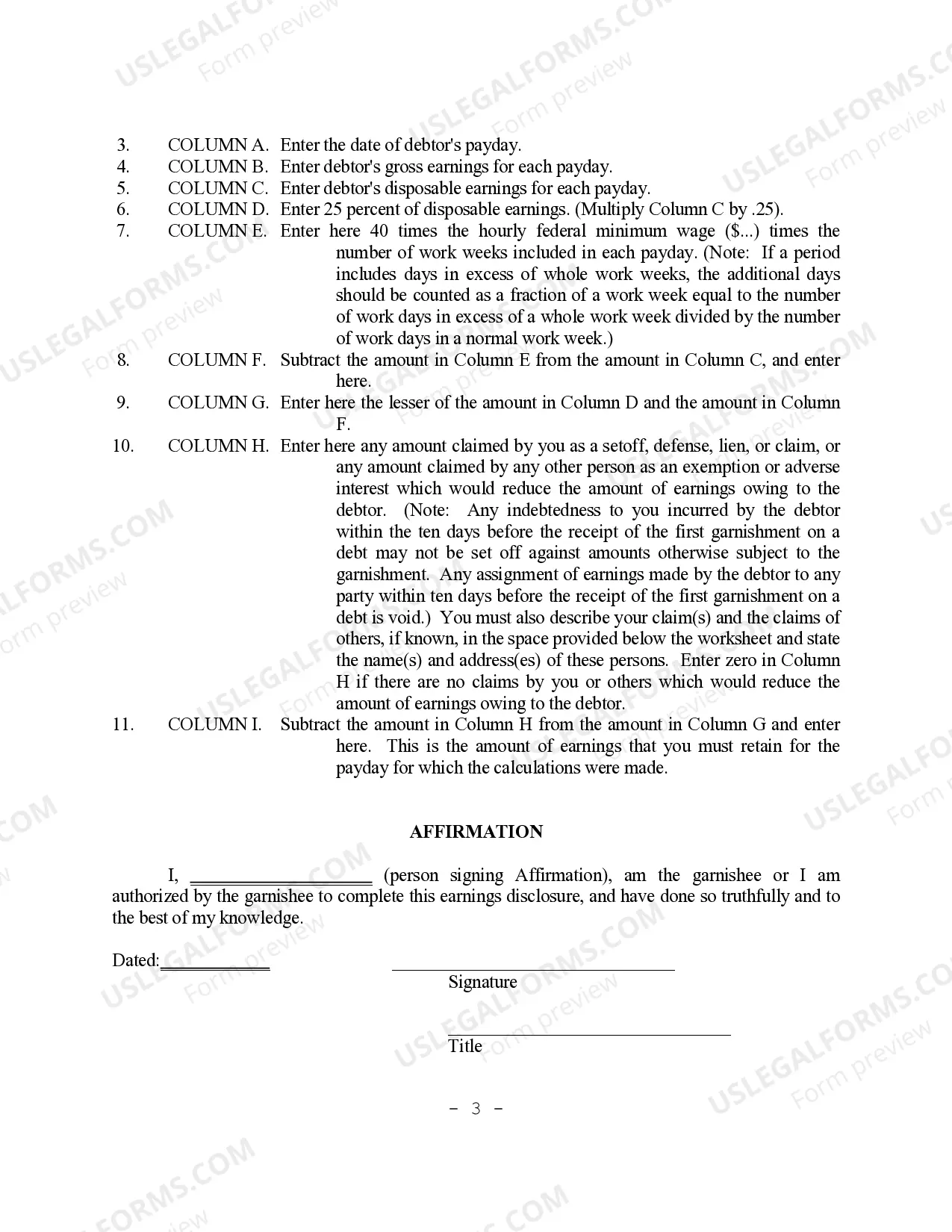

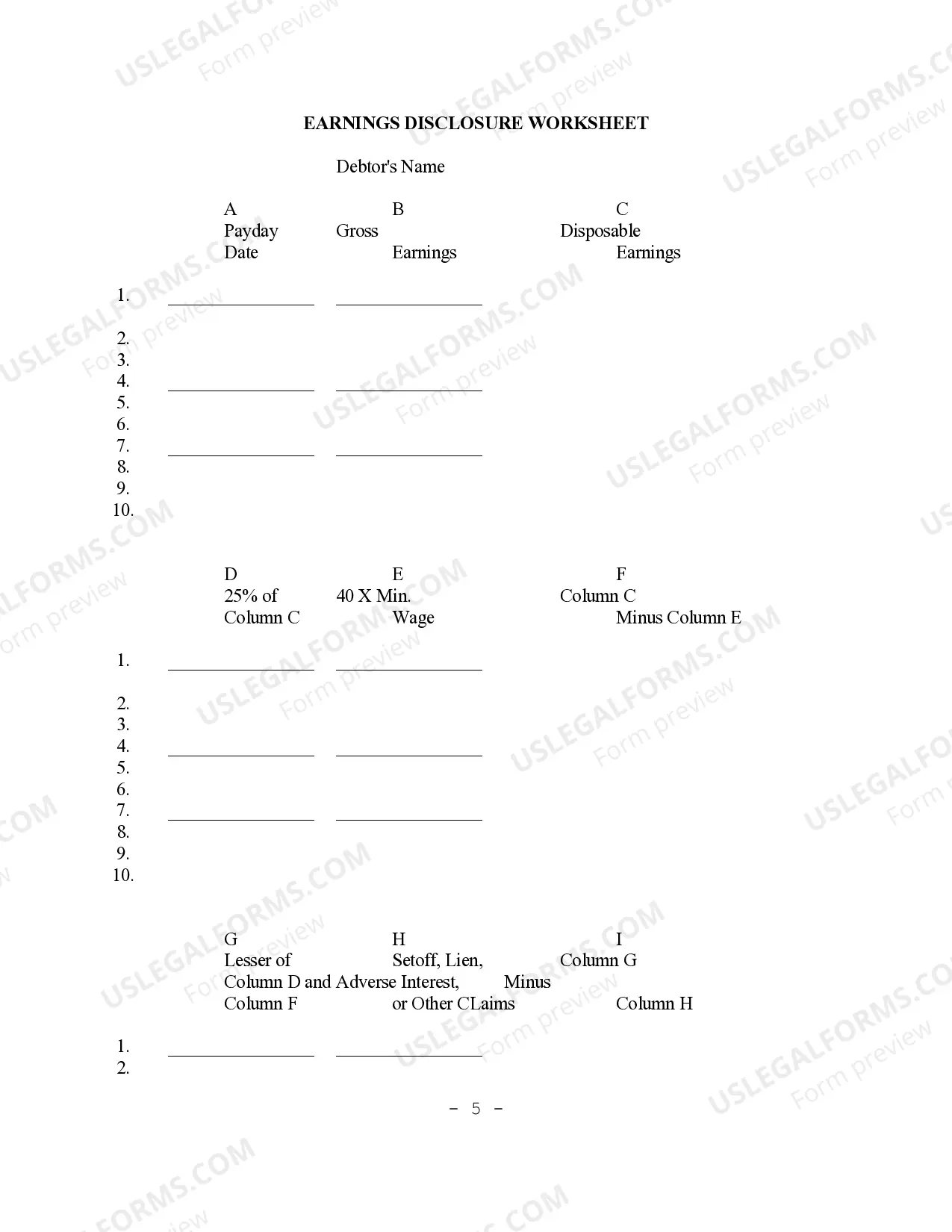

How to fill out Minnesota Garnishment Earnings Disclosure Instructions?

Regardless of whether you handle documentation frequently or only need to submit a legal instrument occasionally, it is essential to find a resource where all examples are pertinent and current.

The first step you need to take with a Financial Disclosure Form For Federal Employees is to confirm that it is indeed the latest version, as this determines its submittability.

If you desire to make your quest for the most recent document examples easier, seek them out on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search function to locate the form you need. Review the preview and description of the Financial Disclosure Form For Federal Employees to confirm it is precisely what you require. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card details or PayPal information to complete the transaction. Choose the file format for downloading and confirm. Eliminate the hassle of managing legal documents; all your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents featuring almost any sample form you might need.

- Look for the templates you need, verify their relevance instantly, and learn more about their application.

- With US Legal Forms, you gain access to more than 85,000 form templates across a diverse range of areas.

- Find the Financial Disclosure Form For Federal Employees samples in just a few clicks and store them anytime in your account.

- A US Legal Forms account will enable you to access all the samples you need with greater ease and less hassle.

- You only need to click Log In in the website header and navigate to the My documents section where all the forms you need will be available.

- This way, you won't have to spend time searching for the right template or verifying its relevance.

Form popularity

FAQ

The notes to financial statement disclosures provide additional context and explanations regarding the numbers presented in a financial disclosure form for federal employees. These notes may include descriptions of accounting policies, detailed breakdowns of significant items, and any relevant legal or regulatory information. By reviewing these notes, stakeholders can gain deeper insights into the financial nuances of federal employees and their adherence to transparency.

A disclosure statement for federal employees generally includes personal financial information such as bank accounts, investments, property holdings, and debts. This statement provides the necessary context for understanding an employee's financial disclosures. By accurately completing these disclosure forms, employees demonstrate their commitment to ethical standards and responsibility in handling public trust.

An accounting of disclosures involves a summary of all the financial disclosures made by a federal employee. This typically covers the nature, date, and purpose of each disclosure made throughout the reporting period. Knowing the accounting of disclosures is vital, as it allows federal employees to track their financial activities effectively and maintain compliance with required standards.

The disclosures in financial statements for federal employees detail various financial activities, including revenue sources, expenditures, and any contingent liabilities. Such disclosures provide critical insights into an employee's financial situation and support the integrity of the financial system. Having clear disclosures helps maintain public trust and ensures that federal employees adhere to accountability measures.

Financial disclosure forms for federal employees include essential information about an employee's assets, liabilities, income sources, and any financial transactions during the reporting period. These disclosures help promote transparency and accountability among federal staff. By understanding these components, employees can better prepare their financial statements and ensure compliance with ethical standards.

The financial due diligence process entails a comprehensive review of an individual's financial background to assess risks and compliance. For federal employees, this includes completing a financial disclosure form to ensure accurate reporting of financial interests. This step is crucial to maintaining ethical standards within government operations.

A public financial disclosure report is a formal document that outlines the financial interests of federal employees, making it accessible to the public. This report typically includes details such as assets, liabilities, and other financial interests. It serves to uphold transparency and accountability in the public sector.

The process of financial reporting involves compiling, analyzing, and presenting financial information within an organization. For federal employees, this includes submitting a financial disclosure form that details their financial activities and interests. Accurate financial reporting is essential for upholding ethical standards and governance.

The financial disclosure process requires federal employees to report their financial interests through the appropriate disclosure form. Each employee must collect relevant financial data and submit the form to designated authorities. This systematic approach promotes ethical behavior and accountability in government.

A financial disclosure is a document that outlines an individual's financial interests, including assets, liabilities, and sources of income. For federal employees, completing a financial disclosure form is critical to ensure ethical standards and prevent conflicts of interest. This transparency fosters trust in public service.