Temporary Custody Form Mn Withholding Tax

Description

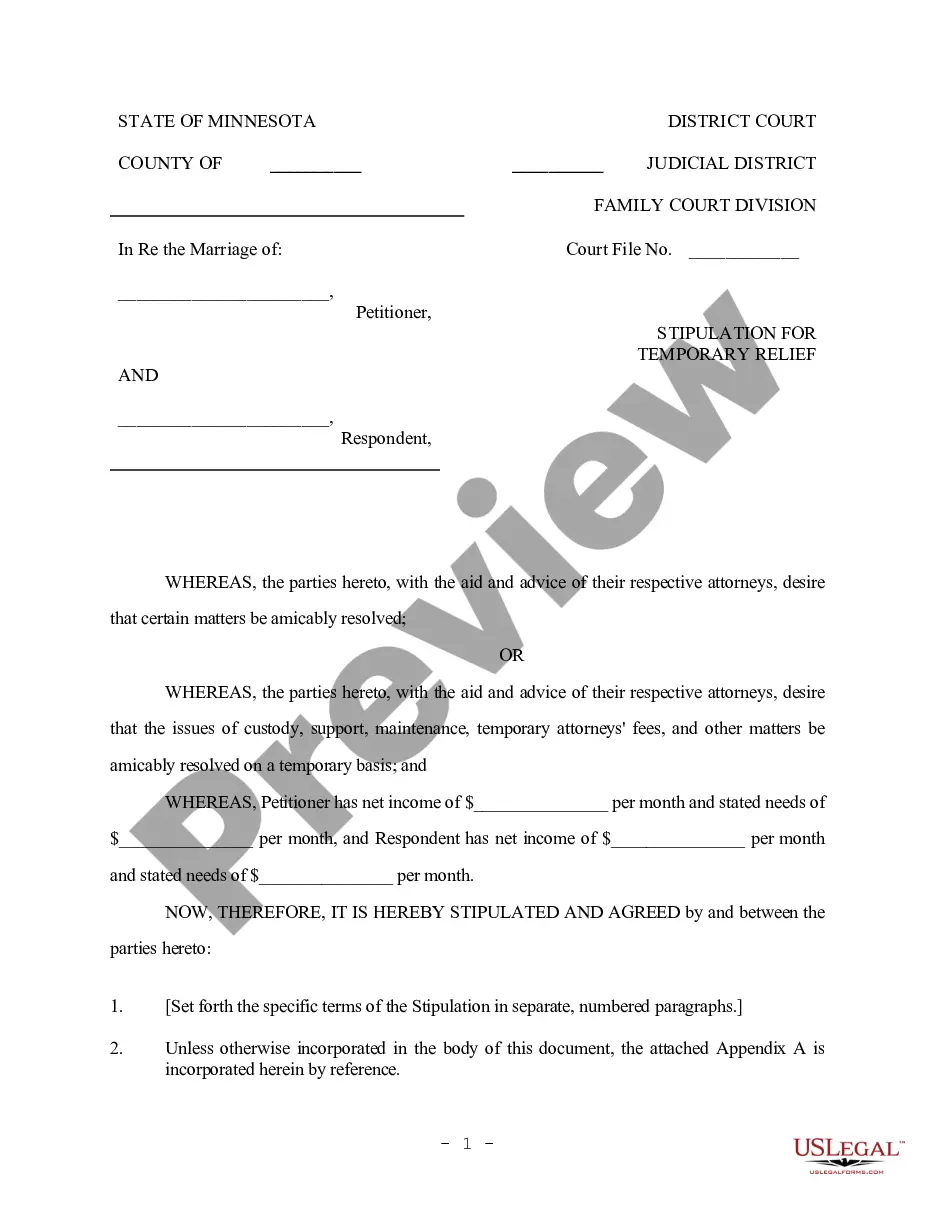

How to fill out Minnesota Stipulation For Temporary Relief - Custody And Child Support?

Obtaining legal document examples that adhere to federal and state regulations is essential, and the web provides countless alternatives to select from.

However, why spend time looking for the right Temporary Custody Form Mn Withholding Tax example online when the US Legal Forms digital library has all such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for any commercial and personal situation.

Review the template using the Preview feature or through the text outline to confirm it fits your needs.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts keep up with legal changes, ensuring your form is current and compliant when obtaining a Temporary Custody Form Mn Withholding Tax from our site.

- Acquiring a Temporary Custody Form Mn Withholding Tax is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your desired format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

Common tax mistakes in Minnesota include errors in calculating withholding amounts, misreporting income, and failing to file the M1W form. Taxpayers often overlook the implications of their temporary custody situations, which can affect their tax obligations. To prevent these mistakes, it is essential to stay organized and informed. Uslegalforms offers comprehensive resources to help you avoid these pitfalls and ensure proper compliance with Minnesota tax laws.

To claim 0 on your Minnesota W4, you must fill out the form accurately and indicate that you want no allowances. This means that the maximum amount of withholding will be taken from your paychecks, which can help you avoid underpayment of taxes at the end of the year. If you are dealing with temporary custody issues, understanding your tax implications is vital. Uslegalforms can assist you in completing the W4 correctly and managing any related tax matters.

When claiming allowances in Minnesota, it is crucial to evaluate your personal financial situation carefully. The number of allowances you claim affects how much tax is withheld from your paycheck. If you are uncertain, consider using a temporary custody form mn withholding tax calculator to assess your needs. Additionally, uslegalforms provides resources to help you make informed decisions about allowances and tax strategies.

The M1W form is the Minnesota Withholding Tax Statement, which you use to report the amount of state tax withheld from your income. It is essential for employees and businesses to accurately complete this form to ensure correct tax reporting. If you are managing temporary custody situations, you may need to consider how withholding impacts your overall tax situation. Using uslegalforms can help you navigate the necessary documentation and ensure compliance with Minnesota's withholding tax regulations.

The total number of allowances claimed is important?the more tax allowances claimed, the less income tax will be withheld from a paycheck; the fewer allowances claimed, the more tax will be withheld.

If you are exempt from Minnesota withholding, your employer or payer does not have to withhold Minnesota tax. You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding.

Effective January 1, 2022, taxable IRA distributions to Minnesota residents are subject to mandatory state withholding. This includes one-time distributions as well as scheduled payments, which are all nonperiodic distributions.

Form W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate, is the Minnesota equivalent of federal Form W-4. Your employees must complete Form W-4MN to determine their Minnesota tax withheld. You also may need to submit Forms W-4MN to the Minnesota Department of Revenue.

Complete Form W-4MN so that your employer can withhold the correct Minnesota income tax from your pay. Consider completing a new Form W-4MN each year and when your personal or financial situation changes. Complete Section 1 OR Section 2, then sign the bottom and give the completed form to your employer.