Quit Claim Deed Mn Cost

Description

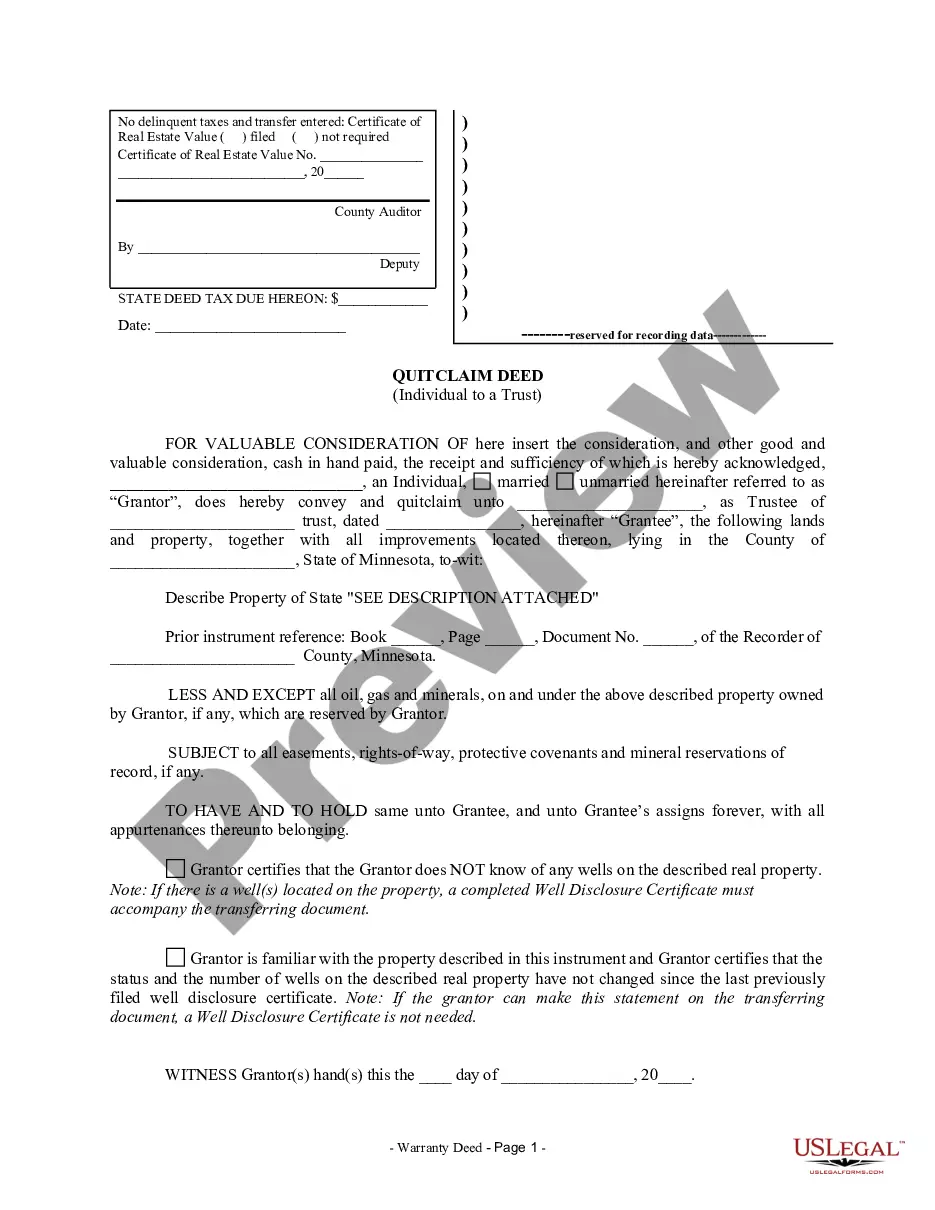

How to fill out Minnesota Quitclaim Deed From Individual To A Trust?

Managing legal documents can be perplexing, even for seasoned professionals.

When you are looking for a Quit Claim Deed Mn Cost and lack the time to search for the accurate and current version, the process can be daunting.

Obtain a repository of articles, guides, and materials pertinent to your situation and needs.

Save time and effort in your document search and use US Legal Forms’ sophisticated search and Preview function to find Quit Claim Deed Mn Cost and obtain it.

Leverage the US Legal Forms web library, supported by 25 years of expertise and reliability. Transform your daily document management into an effortless and straightforward process today.

- If you have a subscription, Log In to your US Legal Forms account, look for the form, and acquire it.

- Check the My documents tab to see the documents you have previously saved and to manage your files as preferred.

- If this is your initial experience with US Legal Forms, create an account and gain unlimited access to all features of the library.

- Here are the steps to follow after obtaining the form you need.

- Confirm it is the right form by previewing it and reviewing its details.

- Make sure the template is acknowledged in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription plan.

- Choose your desired file format, then Download, complete, eSign, print, and submit your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your needs, from personal to business paperwork, all in one location.

- Utilize advanced tools to fill out and manage your Quit Claim Deed Mn Cost.

Form popularity

FAQ

A quitclaim deed primarily benefits individuals looking to transfer property quickly without the complexities of a traditional sale. This includes family members, divorcing couples, or those transferring property between trusts. While it can save time and resources, understanding the quit claim deed MN cost is crucial to ensure it fits your situation. Consequently, consider your options carefully before proceeding.

The best way to obtain a quitclaim deed is through a reputable source, ensuring the document meets all legal requirements. You can draft it yourself or use a professional service. Online platforms like USLegalForms simplify this process, allowing you to create a valid quit claim deed tailored to your needs. Keep in mind the quit claim deed MN cost when selecting your method.

Filing a quitclaim deed in Minnesota involves several straightforward steps. First, draft the deed, ensuring all required information is accurate. Next, sign the document in front of a notary and submit it to the appropriate county office for recording. It’s wise to consider the quit claim deed MN cost when assessing whether to handle this process independently or seek professional assistance.

To file a quitclaim deed in Minnesota, you first need to prepare the deed document. Ensure it includes the names of the parties, a description of the property, and the consideration amount. After completing the form, you must sign it in front of a notary and file it with the county recorder. Remember, the quit claim deed MN cost includes both preparation and filing fees.

A quitclaim deed transfers ownership without guaranteeing clear title, which can lead to problems later. If there are existing liens or claims on the property, the new owner may inherit those issues. Therefore, potential buyers should carefully consider these risks before proceeding. The quit claim deed MN cost may seem appealing, but be aware of these hidden pitfalls.

To obtain a quitclaim deed in Minnesota, start by gathering the necessary information about the property, including legal descriptions and current owners' details. You can then access a reliable platform like US Legal Forms, which offers templates and guidance specific to Minnesota laws. Once you complete the form, ensure you have it signed by all parties involved before a notary public. Afterward, you will need to file the quitclaim deed with the local county recorder's office, considering that the quit claim deed MN cost may include recording fees.

Minnesota's deed tax is calculated based on the consideration for the transfer. The rate for most transfers is 0.33 percent of the purchase price. Minnesota law authorizes Hennepin and Ramsey Counties to charge an additional . 01 percent of consideration.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

The only thing a quit claim deed Minnesota does is allows the grantor (the person selling/giving away the property to ?quit??give up all rights to?his or her claim on the property. It makes no assertion as to whether that claim is valid, or whether the title is clear.