Transfer Death Beneficiary Form With Decimals

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive research and significant financial resources. If you are seeking a simpler and more cost-effective method for preparing the Transfer Death Beneficiary Form With Decimals or any other documentation without dealing with unnecessary complications, US Legal Forms is readily accessible.

Our online repository of more than 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can immediately access state- and county-specific forms carefully assembled for you by our legal professionals.

Utilize our site whenever you need dependable and trustworthy services to easily find and download the Transfer Death Beneficiary Form With Decimals. If you are already familiar with our services and have previously created an account with us, simply Log In, choose the template, and download it or re-download it anytime from the My documents section.

Not registered yet? No problem. Setting it up and browsing the catalog takes minimal time. However, before proceeding to download the Transfer Death Beneficiary Form With Decimals, consider these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and simplify the process of executing forms!

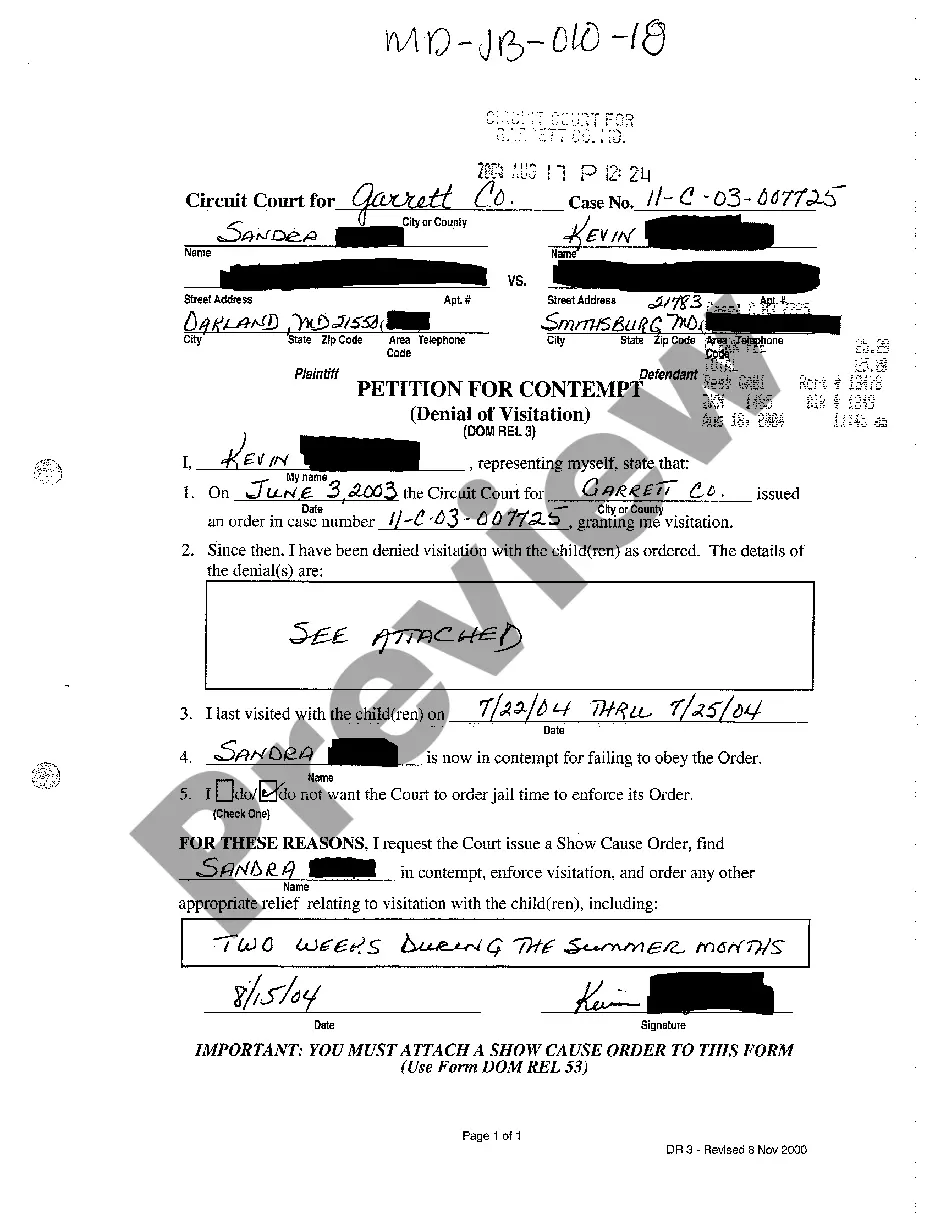

- Review the form preview and descriptions to confirm you have located the document you need.

- Ensure the template you select complies with the laws and regulations of your state and county.

- Select the appropriate subscription option to purchase the Transfer Death Beneficiary Form With Decimals.

- Download the form. Then fill it out, certify it, and print it.

Form popularity

FAQ

Filling out a transfer on death deed involves providing the owner’s information, property description, and details about the beneficiaries. Clearly list the beneficiaries and their percentages, using decimals for precision. Finally, remember to sign and notarize the document as required by your state. A well-prepared transfer death beneficiary form with decimals will facilitate a smooth transfer of property upon your passing.

While you do not necessarily need a lawyer to file a transfer on death deed, consulting one can be beneficial. A lawyer can provide clarity on legal requirements and help you avoid mistakes that could lead to complications later. Using a reliable platform like uslegalforms can also guide you through the process, ensuring that your transfer death beneficiary form with decimals is filled out correctly.

When writing beneficiary percentages, use decimals to represent fractions accurately. For example, if you want to divide your property among three beneficiaries equally, you should write 0.33 for each. This method provides clear guidance on how the asset should be divided, which is essential when using a transfer death beneficiary form with decimals. It helps prevent misunderstandings among beneficiaries.

To fill out a transfer on death form, start by clearly stating the owner’s name and property details. Next, indicate the beneficiaries and their respective percentages using decimals for clarity. Finally, ensure that the form is signed and dated according to your state’s requirements. Utilizing a transfer death beneficiary form with decimals ensures that your wishes are accurately documented.

One disadvantage of a transfer on death (TOD) is that it does not avoid probate if the beneficiary does not survive the owner. This means that any disputes regarding the transfer may lead to legal complications. Additionally, if the beneficiary is not clearly defined, it can create confusion about the distribution. Therefore, using a transfer death beneficiary form with decimals can help specify percentages accurately, minimizing potential conflicts.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

Name only living persons as beneficiaries, unless you are naming a trust, your estate or an organization. Do not name the same person or organization as both a primary and secondary beneficiary. Do not use the word ?or? when designating multiple beneficiaries. Do not impose any conditions on payment.

Life insurance beneficiaries can be individuals, such as a spouse or adult child, or entities, such as a trust. For example, if you have minor children, you may choose to establish a trust and name it as the beneficiary of your life insurance policy.