Minnesota Transfer Deed Form With Mortgage

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Legal management can be daunting, even for seasoned experts. When you are seeking a Minnesota Transfer Deed Form With Mortgage and lack the time to search for the correct and updated version, the processes can be challenging.

A robust online form directory could be a transformative solution for anyone wanting to handle these scenarios efficiently. US Legal Forms is a leader in online legal documents, with over 85,000 state-specific legal forms accessible at any time.

Access a resource library of articles, guides, handbooks, and materials pertinent to your situation and needs.

Save time and energy searching for the documents you require, and take advantage of US Legal Forms’ sophisticated search and Review tool to locate the Minnesota Transfer Deed Form With Mortgage and obtain it.

Leverage the US Legal Forms online directory, backed with 25 years of experience and reliability. Transform your daily document management into a simple and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents tab to view the documents you have previously saved and manage your folders as desired.

- If it is your first time with US Legal Forms, create an account and gain unlimited access to all the advantages of the platform.

- Here are the actions to take after acquiring the form you need.

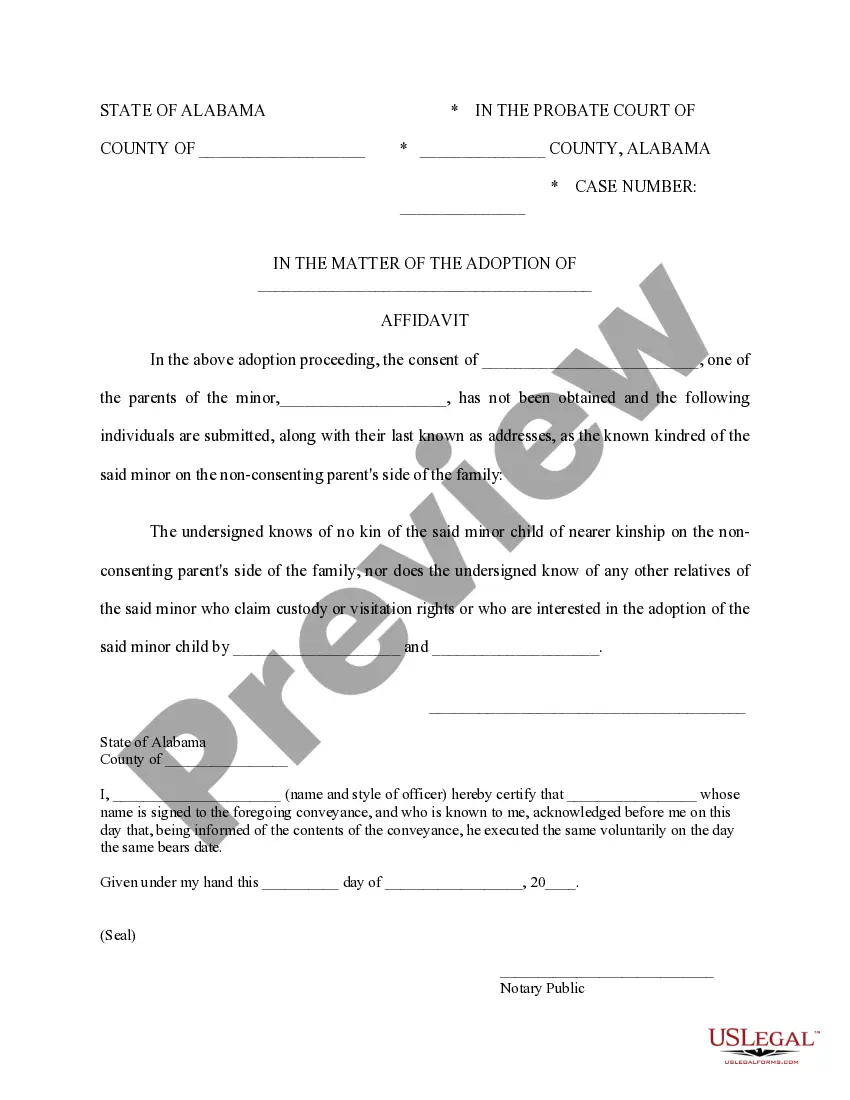

- Confirm it is the correct form by previewing it and reviewing its details.

- Ensure that the sample is accepted in your state or county.

- Click Buy Now when you are ready.

- Select a monthly subscription plan.

- Choose the file format you require, and Download, complete, sign, print, and send your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your requirements, from personal to business paperwork, all in one location.

- Utilize advanced tools to complete and manage your Minnesota Transfer Deed Form With Mortgage.

Form popularity

FAQ

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

Minnesota's deed tax is calculated based on the consideration for the transfer. The rate for most transfers is 0.33 percent of the purchase price. Minnesota law authorizes Hennepin and Ramsey Counties to charge an additional . 01 percent of consideration.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

Disadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.