Operating Agreement Llc Minnesota With Preferred Return

Description

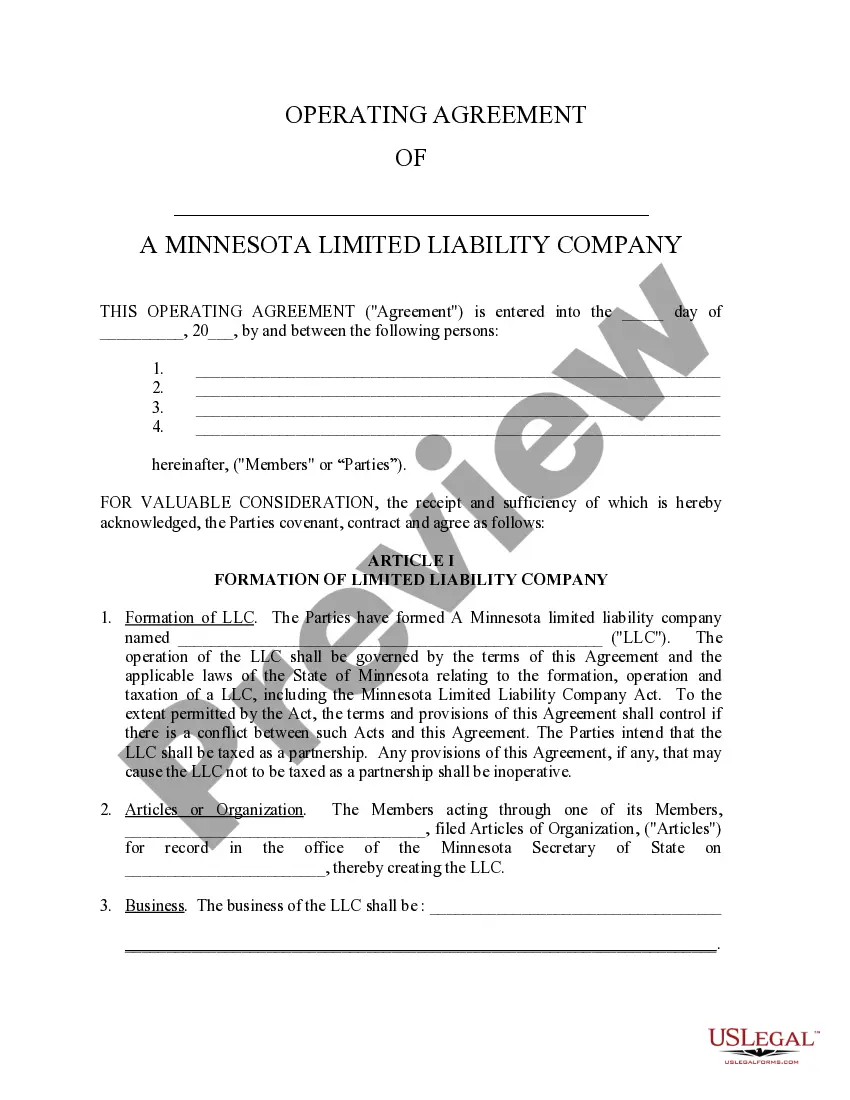

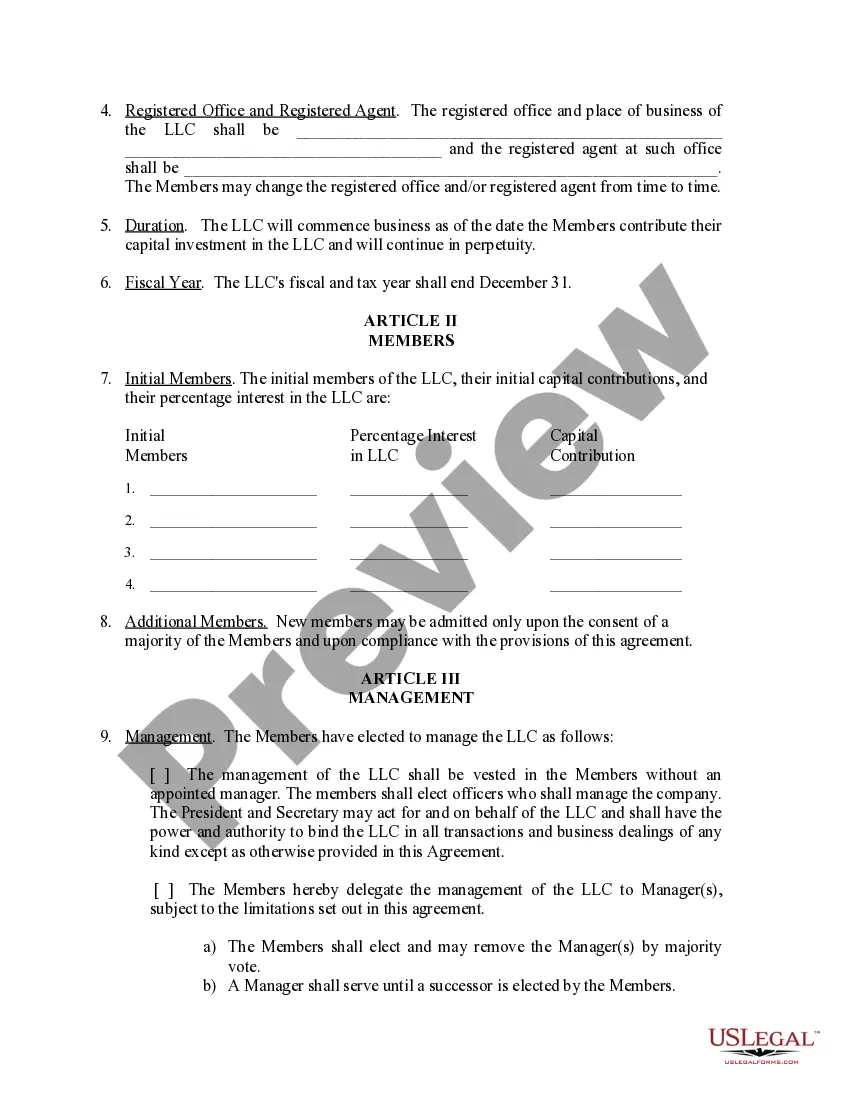

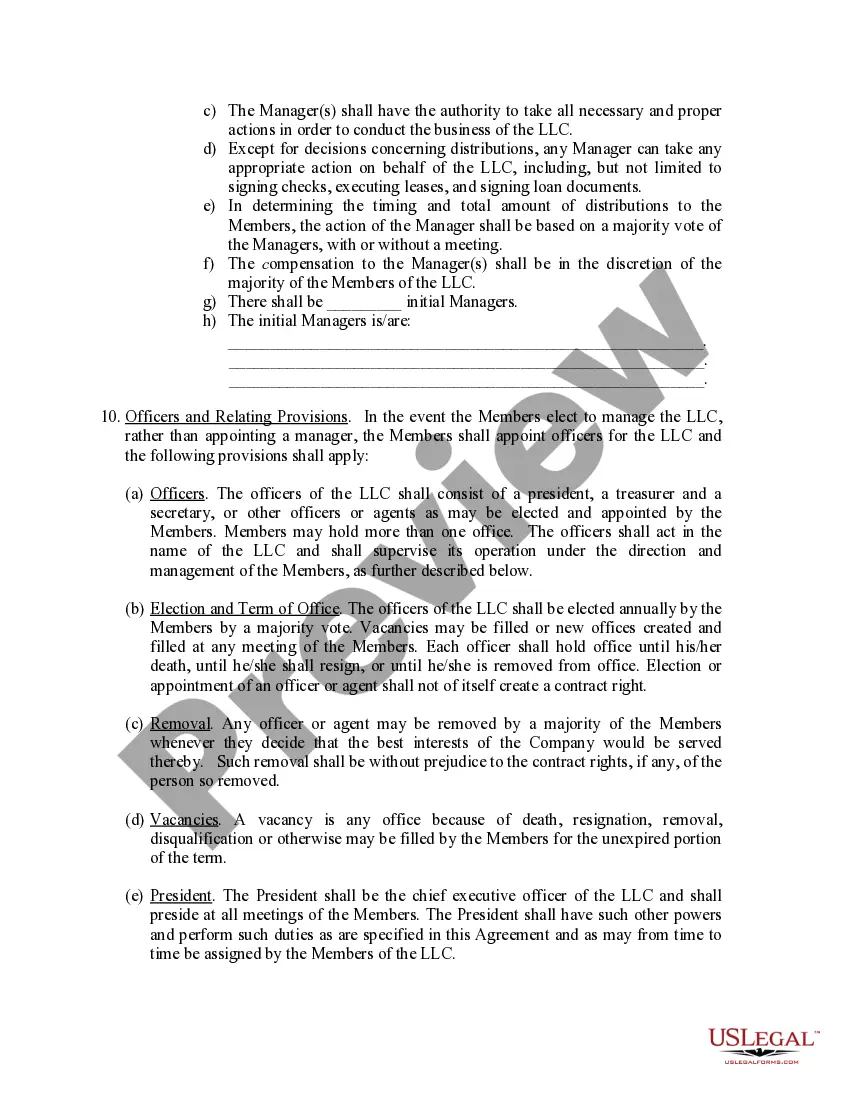

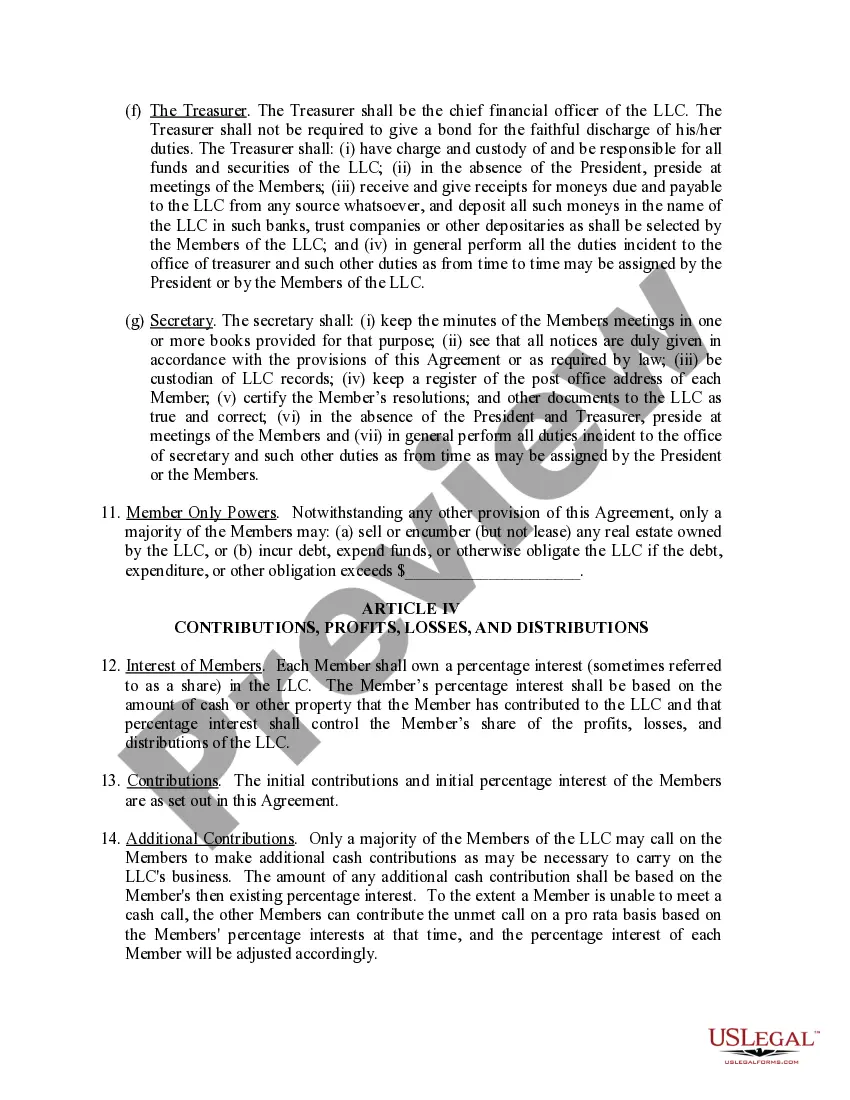

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Operating Agreement Llc Minnesota With Preferred Return or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates diligently put together for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Operating Agreement Llc Minnesota With Preferred Return. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Operating Agreement Llc Minnesota With Preferred Return, follow these recommendations:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Operating Agreement Llc Minnesota With Preferred Return.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business. A Bloomington LLC operating agreements lawyer could help you form an operations structure optimized for your business.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one. Still, we at Northwest strongly recommend adopting a written operating agreement.

Yes, all LLC distributions count as taxable income, so they're subject to annual income taxes. It's highly recommended to make quarterly estimated payments based on your allocated share of the profits for your personal tax returns. That way you'll avoid underpayment penalties.

?Preferred Return? means the return to a Member that would accrue on Unreturned Capital at eight percent (8%) per annum (cumulative, but not compounded); provided, however, such amount shall not begin to accrue on any Capital Contribution, or any portion thereof, as applicable, until such time as the Company transfers ...