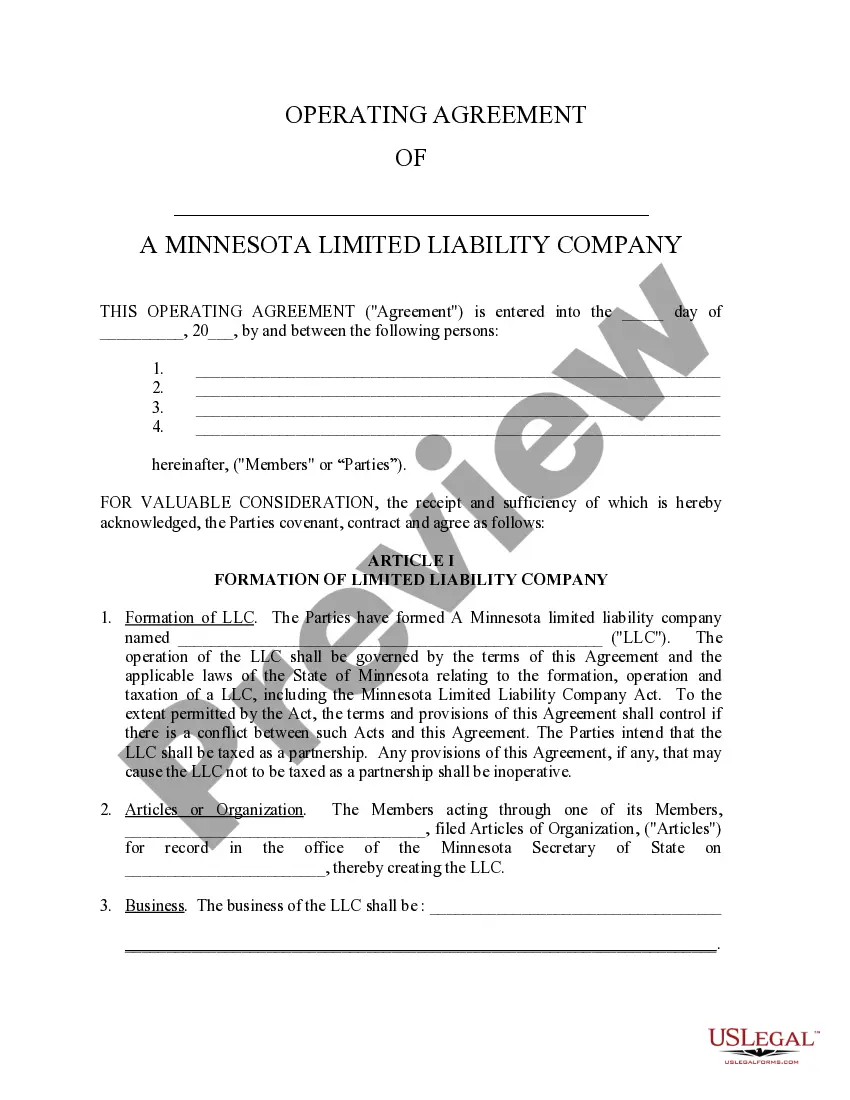

Llc Operating Agreement Minnesota Withholding

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

It’s no secret that you can’t become a legal professional immediately, nor can you grasp how to quickly prepare Llc Operating Agreement Minnesota Withholding without having a specialized set of skills. Creating legal forms is a time-consuming process requiring a particular training and skills. So why not leave the creation of the Llc Operating Agreement Minnesota Withholding to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our website and get the form you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Llc Operating Agreement Minnesota Withholding is what you’re searching for.

- Begin your search again if you need any other template.

- Set up a free account and select a subscription plan to buy the template.

- Pick Buy now. Once the payment is complete, you can download the Llc Operating Agreement Minnesota Withholding, complete it, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

It costs $155 to form an LLC in Minnesota. This is a fee paid for the Articles of Organization. You'll file this form with the Minnesota Secretary of State. And once approved, your LLC will go into existence.

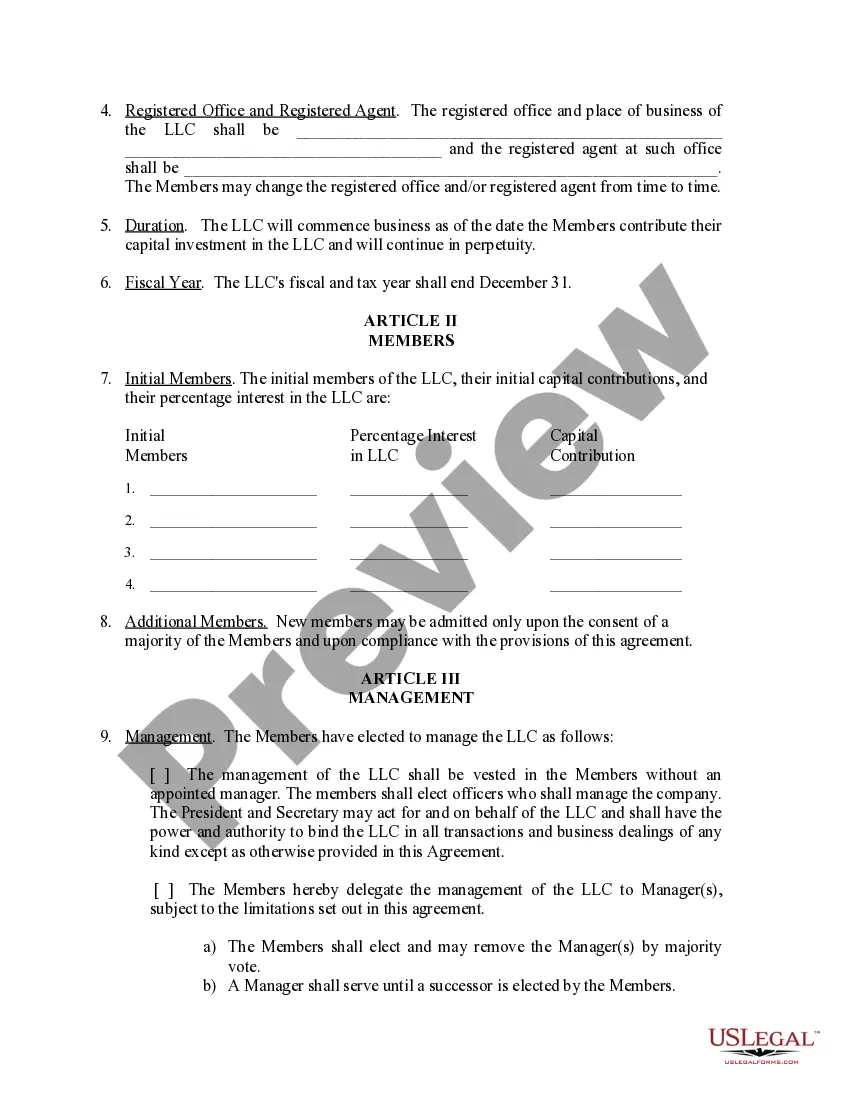

Here are the steps to forming an LLC in Minnesota Search your LLC Name. Search your Minnesota LLC Name to make sure it's available in the state. ... Choose a Minnesota Registered Agent. ... File Minnesota LLC Articles of Organization. ... Create a Minnesota LLC Operating Agreement. ... Get an EIN for your LLC. ... Get a Minnesota Tax ID Number.

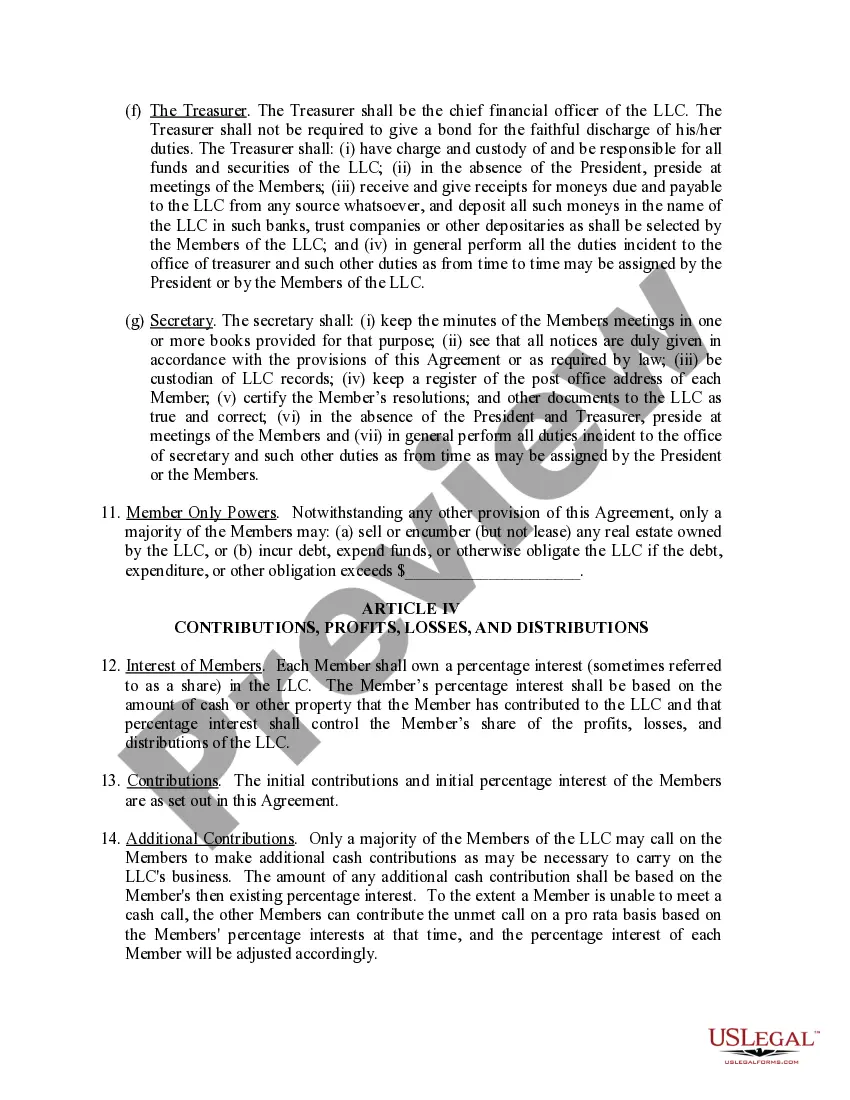

Minnesota LLC members must pay federal income tax at the 15.3% self-employment rate plus state income tax at a graduated rate. Minnesota collects a state sales tax of 6.875%, and most municipalities also levy a local sales tax.

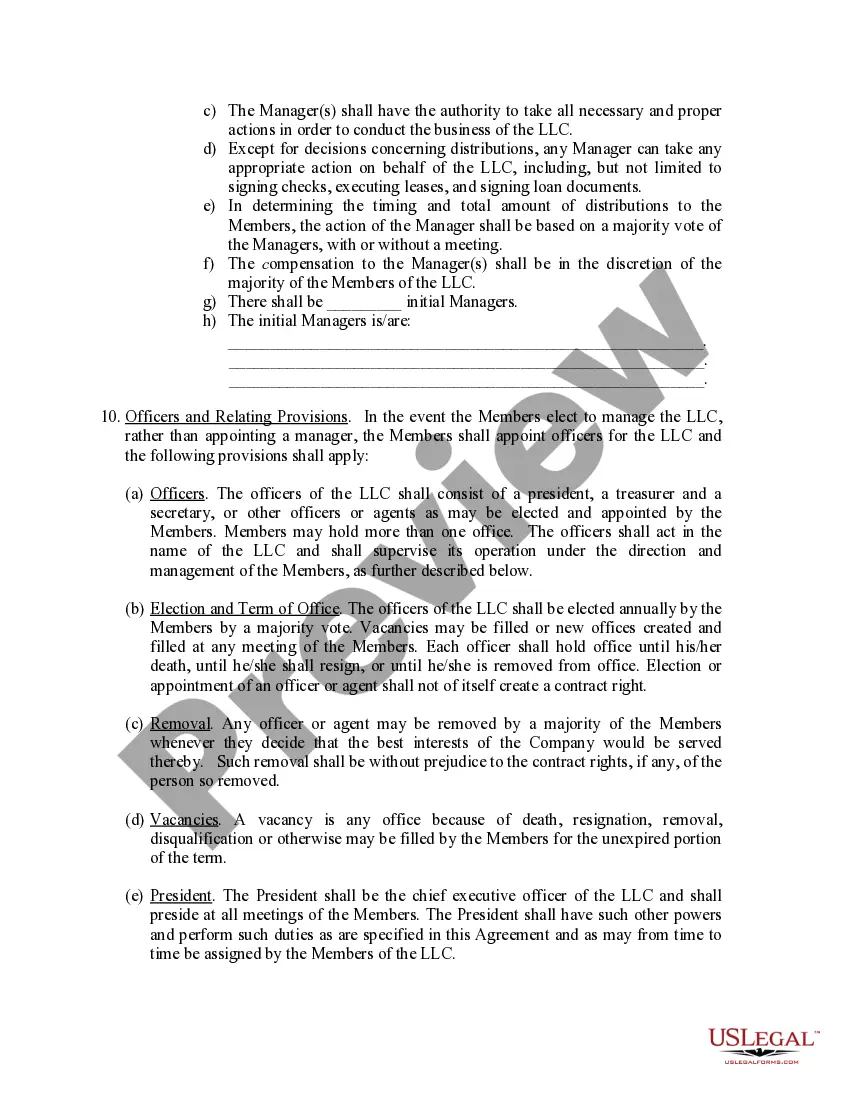

Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business. A Bloomington LLC operating agreements lawyer could help you form an operations structure optimized for your business.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one. Still, we at Northwest strongly recommend adopting a written operating agreement.