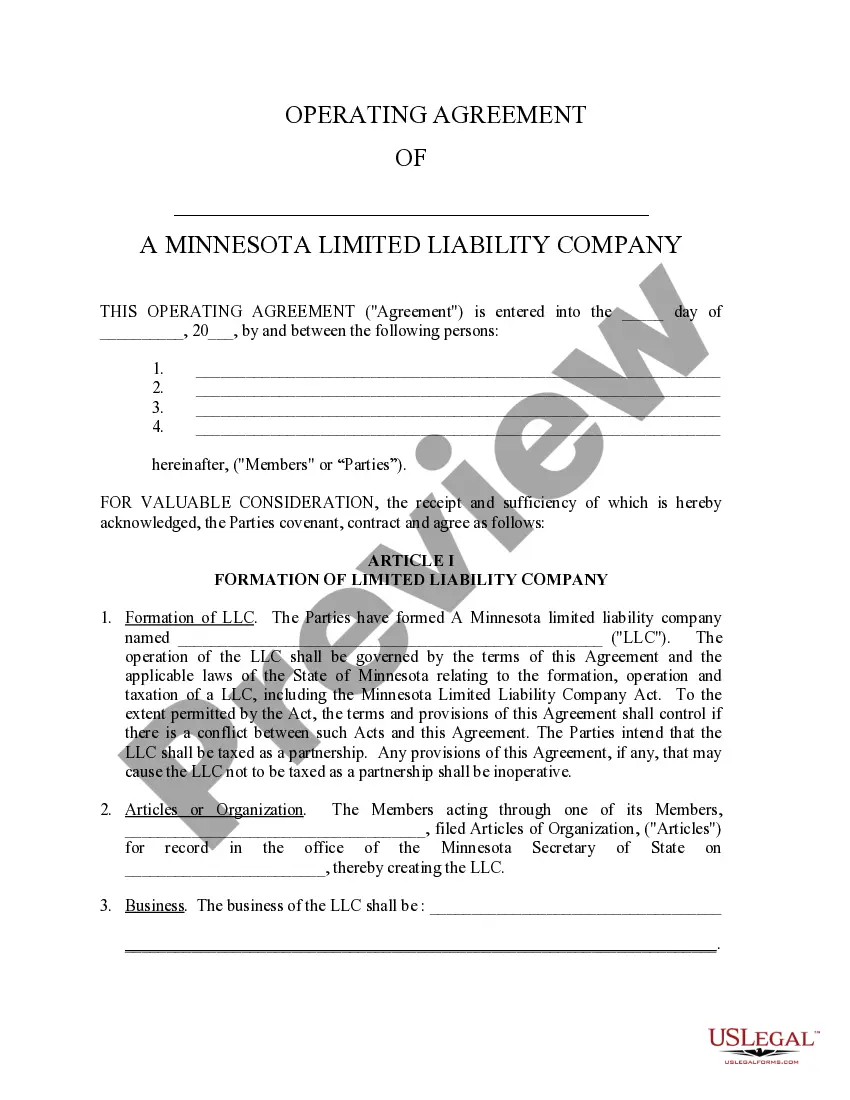

Llc Operating Agreement Minnesota For Two Partners

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

The Llc Operating Agreement Minnesota For Two Partners you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Llc Operating Agreement Minnesota For Two Partners will take you only a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your needs. If it does not, use the search option to get the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Choose the format you want for your Llc Operating Agreement Minnesota For Two Partners (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your papers again. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

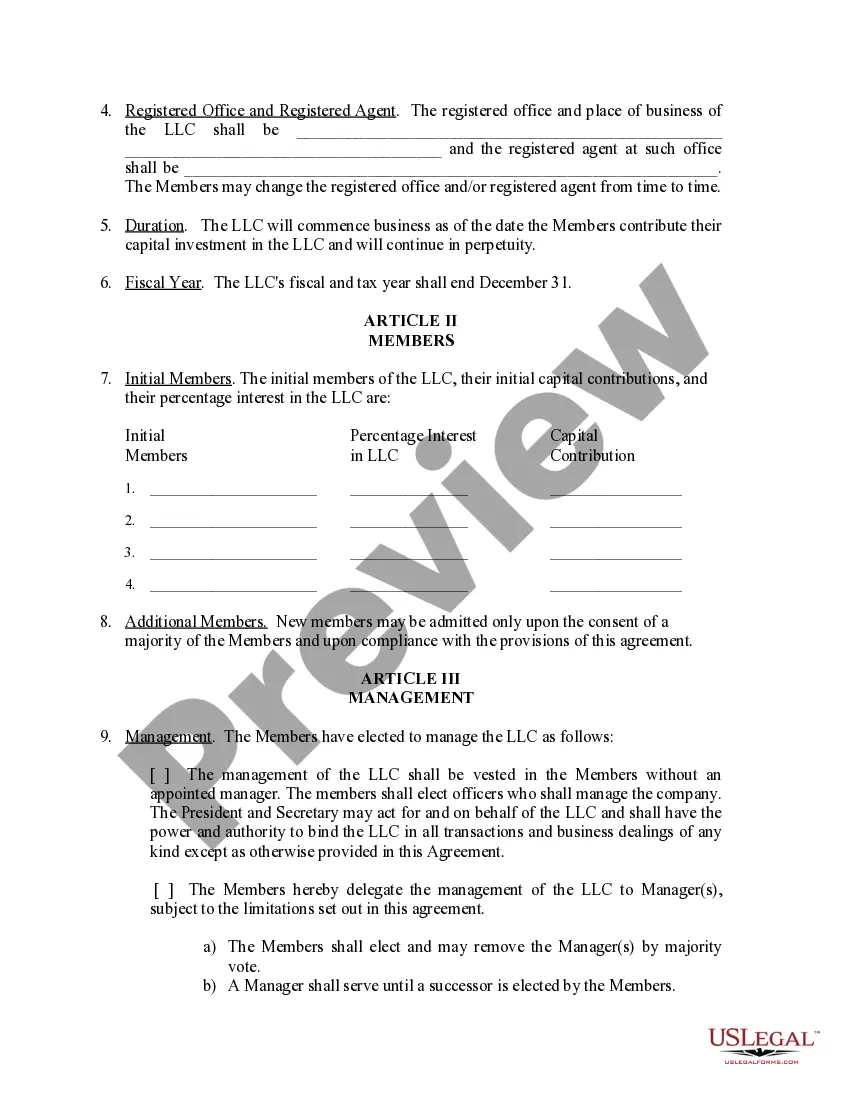

The process of adding a member to a Minnesota LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

For example, an LLC could split into two resulting LLCs with the same partners. Both resulting LLCs would be continuing LLCs. However, only one of the continuing LLCs can be treated as the divided LLC. That LLC retains the prior LLC's identity for federal income tax purposes.

Here are the steps to forming an LLC in Minnesota Search your LLC Name. Search your Minnesota LLC Name to make sure it's available in the state. ... Choose a Minnesota Registered Agent. ... File Minnesota LLC Articles of Organization. ... Create a Minnesota LLC Operating Agreement. ... Get an EIN for your LLC. ... Get a Minnesota Tax ID Number.

Divide ownership of the LLC by calculating total cash investment by the members. Give each member an ownership stake equal to his cash investment. Four members contributing $25,000 apiece would each receive a 25 percent stake in the company.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.