Power Of Attorney For Spouse With Dementia

Description

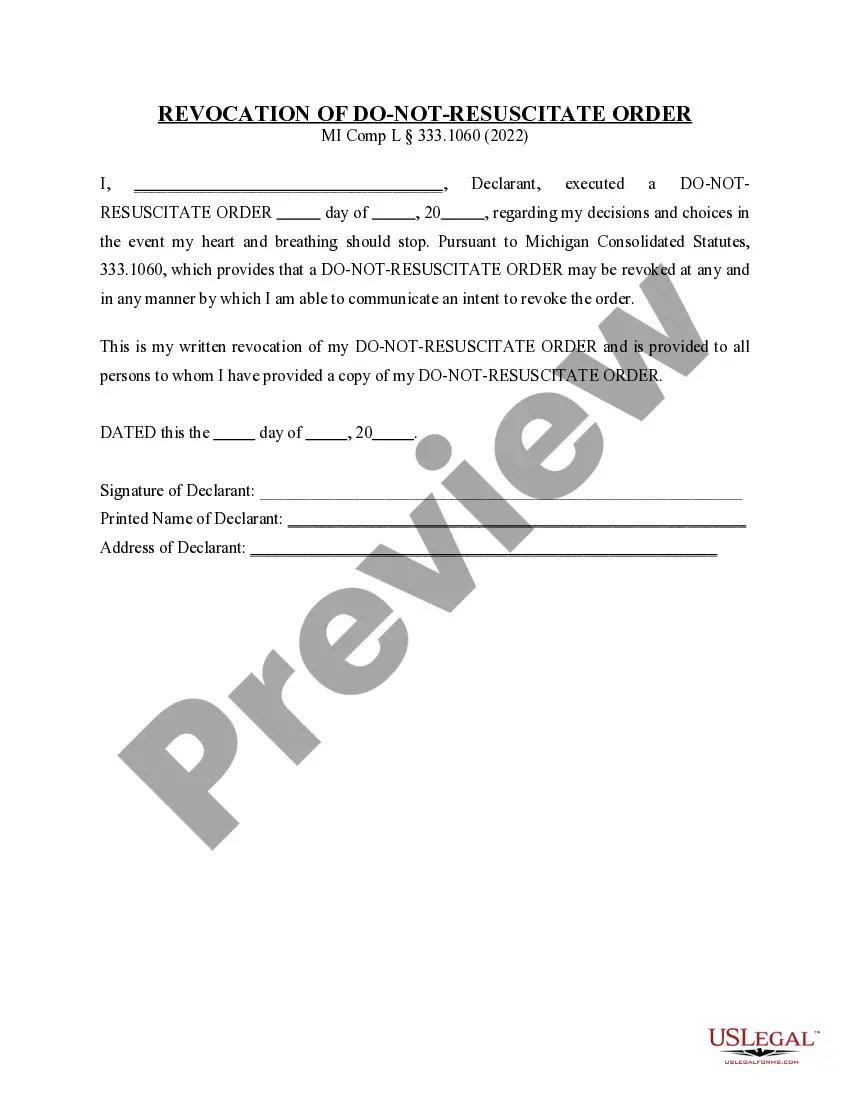

How to fill out Michigan Revocation Of Do Not Resuscitate Order?

Whether for business purposes or for individual affairs, everyone has to handle legal situations sooner or later in their life. Filling out legal documents demands careful attention, starting with picking the proper form sample. For instance, if you pick a wrong version of a Power Of Attorney For Spouse With Dementia, it will be declined once you submit it. It is therefore important to get a trustworthy source of legal documents like US Legal Forms.

If you have to get a Power Of Attorney For Spouse With Dementia sample, follow these easy steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Power Of Attorney For Spouse With Dementia sample you require.

- Download the template if it matches your requirements.

- If you have a US Legal Forms profile, click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Power Of Attorney For Spouse With Dementia.

- After it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate template across the web. Utilize the library’s straightforward navigation to get the right template for any occasion.

Form popularity

FAQ

Introduction: The five-word test (5WT) is a serial verbal memory test with semantic cuing. It is proposed to rapidly evaluate memory of aging people and has previously shown its sensitivity and its specificity in identifying patients with AD.

A properly drafted Will ensures your assets provide for your spouse's care. Financial Power of Attorney: A Durable General Power of Attorney appoints the person or persons you wish to manage your assets once your dementia advances. Your current document might name your spouse, requiring an update.

The user has to memorize the words and recite them back in the correct order. The test is exclusive to English and will not work with other languages. The five words range from easy to difficult, and the difficulty of the words increases with each new selection.

Ideally, older adults should name their power of attorney and have the papers drawn up prior to any medical crisis, including a dementia diagnosis. However, if your loved one has not but already has a diagnosis of dementia, you can work together to name the power of attorney.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.