Living Trust Amendment With Pour-over Will

Description

Form popularity

FAQ

Handwritten changes, also known as holographic amendments, may be legal in some situations, but they can create complications. Such changes need to be clear and specific to avoid misunderstandings about the trust's intentions. It is typically a safer option to draft a formal amendment to ensure compliance with laws governing living trust amendment with pour-over will. For the best legal protection, using a reputable service like US Legal Forms can simplify the process and provide peace of mind.

Generally, an amendment to a trust does not need to be recorded like a deed does. However, it is advisable to keep the amendment with the original living trust document so that it is easily accessible. This ensures that all parties involved are aware of the changes made to the trust. For those considering a living trust amendment with pour-over will, proper documentation is crucial to avoid confusion.

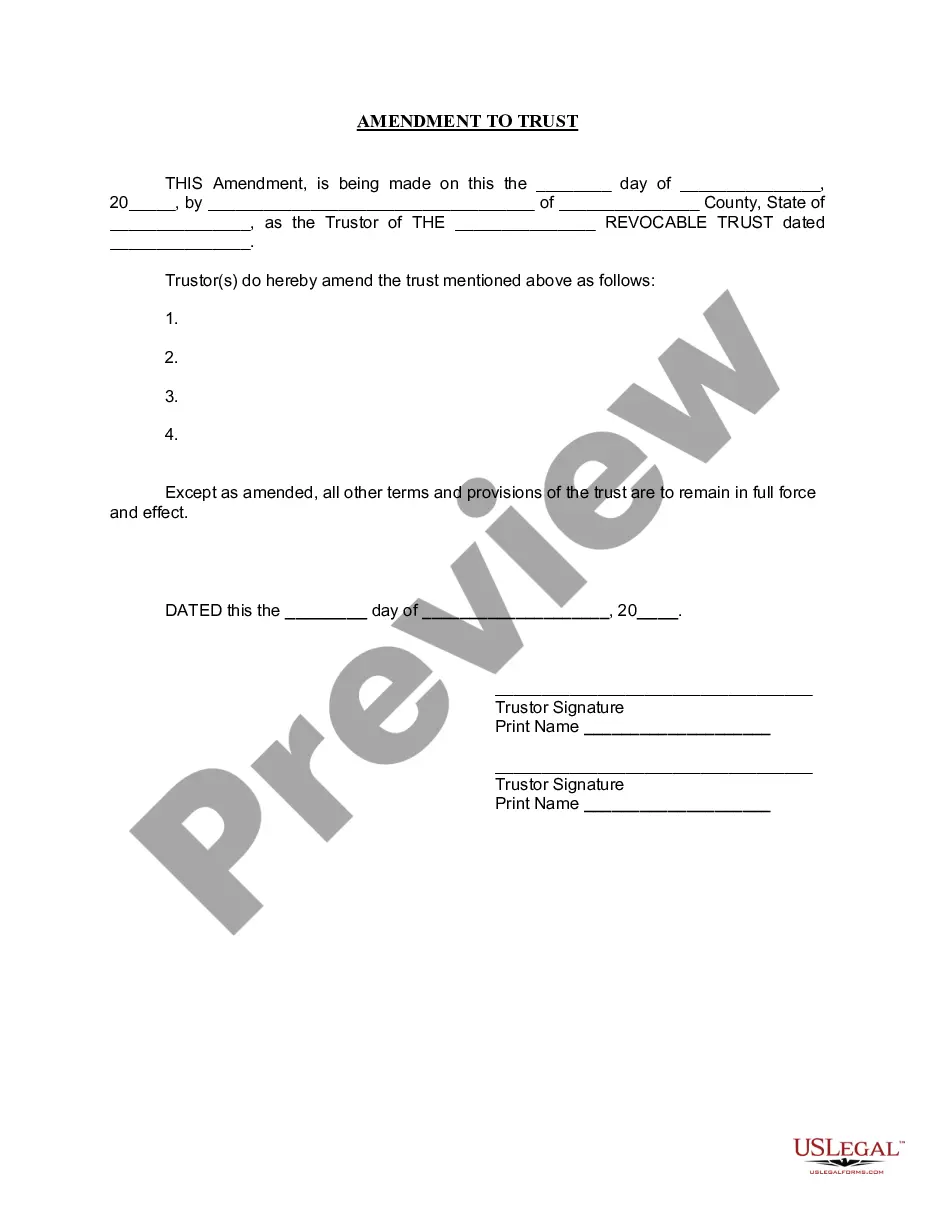

To write an amendment to a living trust, begin by clearly identifying the trust and the specific changes you wish to make. Use simple language that describes the amendments in a straightforward manner. It is essential to follow your state’s laws and include a statement that the amendment alters the existing living trust. After drafting the amendment, consider consulting a legal professional to ensure it aligns with the requirements for a living trust amendment with pour-over will.

over will is not directly part of a trust, but it works in conjunction with the trust to ensure your assets are managed according to your wishes. When you implement a living trust amendment with a pourover will, the will facilitates the transfer of any assets left out of the trust into the trust upon your death. This arrangement enhances the overall effectiveness of your estate planning, ensuring a seamless process for your beneficiaries.

Pour-over trusts do not necessarily have to be written after a will. You can create a living trust amendment with a pour-over will simultaneously, establishing both at the same time. As long as the trust is properly funded, it will have legal effect in directing remaining assets to the trust upon your passing. This strategy allows for comprehensive estate planning.

Generally, a will does not override a trust, but it can influence the distribution of assets not included in the trust. If you have a living trust amendment with a pour-over will, your will can direct assets that are outside the trust to be transferred into the trust at your death. This approach allows your estate plan to work cohesively, ensuring your wishes are honored regardless of how your assets are structured.

One common mistake parents make when setting up a trust fund is failing to properly fund the trust. If properties and assets are not transferred into the trust, they may become subject to probate. By creating a living trust amendment with a pour-over will, you can help prevent this issue, as the will can ensure that any remaining assets are directed into the trust. Proper funding and documentation are crucial to making sure your trust functions as intended.

over will serves as a safety net for any assets not already transferred into your living trust. When you create a living trust amendment with a pourover will, the will directs that any remaining assets should 'pour over' into your trust upon your passing. This mechanism ensures that your assets are managed according to the terms of the trust, simplifying the distribution process for your heirs.

A living trust does not inherently override a will, but it can affect how your assets are distributed after your death. If you create a living trust amendment with a pour-over will, the will can direct that any remaining assets not in the trust at your death pour over into the trust. This approach helps ensure that all your property is handled according to your wishes, placing flexibility and control in your hands.

A significant disadvantage of a will compared to a trust is that a will goes through probate. This legal process can be time-consuming and expensive, delaying the distribution of assets to your heirs. In contrast, a living trust amendment with pour-over will can help streamline this process and provide faster access to assets. By using a trust, you can ensure that your estate is settled more efficiently.