Certificate Of Trust Michigan Form For Nonprofit

Description

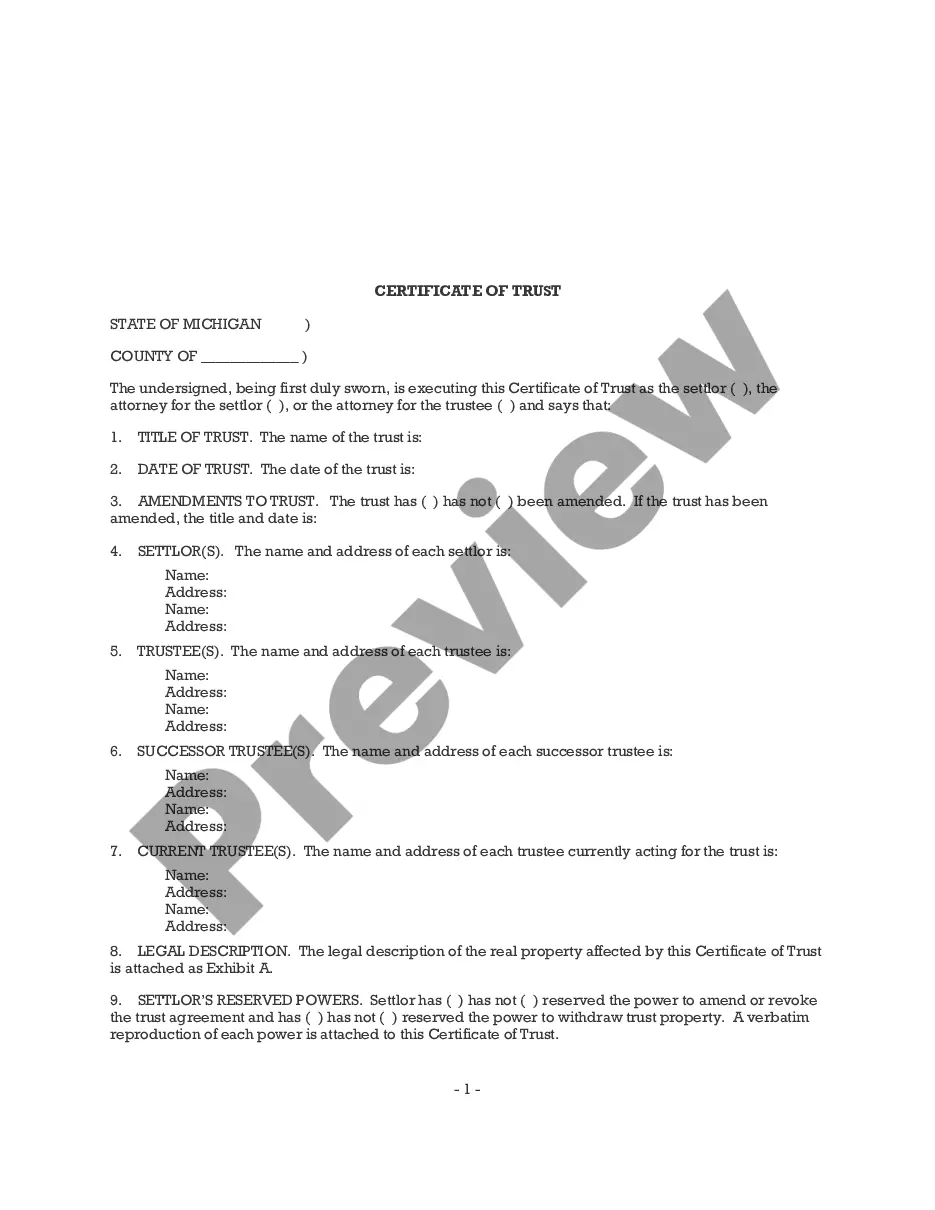

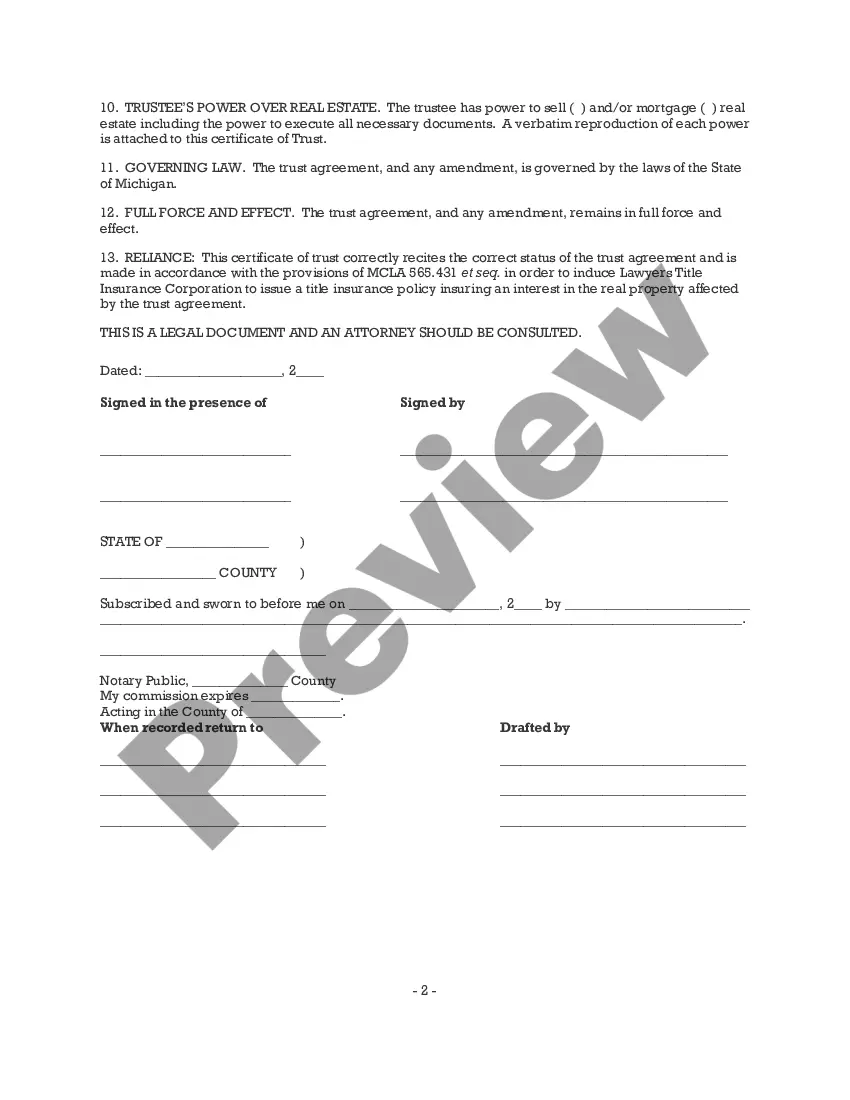

How to fill out Michigan Certificate Of Trust?

The Certificate Of Trust Michigan Form For Nonprofit you see on this page is a multi-usable legal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Certificate Of Trust Michigan Form For Nonprofit will take you only a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it suits your requirements. If it does not, make use of the search option to find the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Certificate Of Trust Michigan Form For Nonprofit (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your paperwork again. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Small nonprofits in Michigan are legible to file Form 1023-EZ, which is a Streamlined Application for Recognition of Exemption under Section 501(c)(3) of the Internal Revenue Code. It's a short form that can be found online. Further information on completing and submitting the forms may be found on the IRS website. How to Start a Nonprofit | Michigan Nonprofit Association Michigan Nonprofit Association ? resources ? how-to-start-... Michigan Nonprofit Association ? resources ? how-to-start-...

Charitable trusts offer several benefits, including tax deductions, reduced estate taxes, and the ability to make a lasting impact. It is important to consult with an experienced estate planning attorney and financial advisor before establishing a charitable trust to help ensure it is the right choice.

TRUST REGISTRATION If an individual has created a Trust, he or she may want to register it with the Probate Court. To do so, the individual must complete the Trust Registration form, PC 610 and submit it to the Probate Court along with a $25 filing fee. Trusts - Cass County Michigan Courts casscourtsmi.org ? trusts casscourtsmi.org ? trusts

How do I become tax exempt in Michigan? You will have to provide proof that your organization is Michigan non-profit. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors, making a claim for exemption from sales or use tax. Michigan Tax Exemption for Non-Profit Organizations northwestregisteredagent.com ? nonprofit northwestregisteredagent.com ? nonprofit

How to create a charitable trust Determine what assets you want to add to the trust. Remember that your donations are irrevocable. Decide on your beneficiaries and whether you want the trust income to pay them or the organization first. ... Work with a professional to draw up a trust document. How to Start a Charitable Trust in 2021 - Policygenius policygenius.com ? trusts ? how-to-start-a-c... policygenius.com ? trusts ? how-to-start-a-c...